Incremental economics paramount in oil, gas evaluations

As with any discipline, the techniques used for evaluating the economics of oil and gas investments have become progressively more sophisticated over time. The advent of computers, spreadsheets, and other software models, coupled with the advancements in uncertainty analysis methods, now allow us to make more informed decisions in less time than ever.

In spite of these advances, when most E&P economic evaluations are conducted, a simplifying assumption is made which may lead to significantly erroneous results. This assumption is based on the perspective that the existence or non-existence of other projects in the same portfolio does not affect the after-tax economics of a proposed project. In reality, however, there is a specific hierarchy that must be followed in all countries which denotes at what level (field, license, contract, country, etc.) individual fiscal terms (royalties, taxes, cost oil, profit oil, etc.) must be calculated.

This simplified assumption may be eliminated by replacing the prevalent standalone economics methodology with the incremental economics technique, which provides a more accurate picture of the after-tax incremental effect that a proposed project will have on the total company portfolio.

Consolidation principles

To understand the problems with standalone economic evaluations, it must first be understood how the after-tax economics for an entire country would be determined.

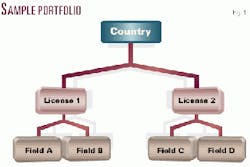

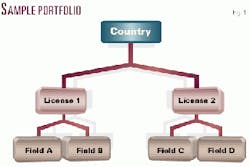

As an example, assume there is a country with four current projects that are in various stages of development and production (Fig. 1). Further, assume a set of fiscal terms (Table 1). To determine the proper forecast of the after-tax cash flows for the entire country, the following steps would be taken (Fig. 2):

- Since the fiscal terms indicate that royalties are ring-fenced around the field (i.e., calculated at the field level), the individual royalties for each field (A, B, C, and D) would be calculated based on each field's individual production rates.

- The fiscal terms also indicate that the production-sharing terms are ring-fenced around the license (i.e., calculated at the License level). So the Cost and Profit Oil would then be calculated for each of the two licenses (1, 2) based on the summed values of production, costs, and royalties (calculated in step 1) of the fields comprising each license.

- The income taxes for the entire country would then be calculated based on the summed values of cost and profit oil (from step 2), royalties (from step 1), and costs.

null

Evaluating new prospect-stand-alone methodology

Assume now that a new prospect has been generated in License 2, thus an economic evaluation is required to determine if it is economically viable.

The most typical approach to this economic evaluation is to apply all of the fiscal terms (listed in Table 1) to the new prospect. While this is certainly a straightforward approach, it completely ignores the fiscal requirements that cost-oil and profit-oil is determined at the license level and that income taxes must be calculated at the country level. Specific calculation inaccuracies are as follow:

- The profit-oil share to the company decreases as various levels of rate-of-return are reached. The fiscal terms indicate that this must be calculated based on the consolidated cash flow from all fields in that license. The stand-alone technique incorrectly calculates the profit-oil share based on the rate-of-return of the new prospect only.

- The income tax calculation is also a problem using the stand-alone method since it is based on the incorrectly calculated profit-oil and because there is no possibility of early tax losses in new prospect offsetting tax payments that might have been incurred by other projects in the license.

Incremental economics

Now that it is understood exactly how and at what level the fiscal terms may be correctly applied and the deficiencies in the stand-alone method, how can we use this knowledge to get the most accurate economic evaluation for new prospect?

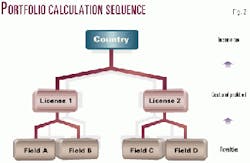

The answer is to use the incremental economics technique, which requires a three-step approach (Fig. 3) as follows:

- 1. Calculate the forecasted amounts of the after-tax cash flows during each time period for the entire country, applying the fiscal terms at the appropriate levels (field, license, and country). This calculation should include the new prospect; thus this represents the country's after-tax cash flows if the new prospect is undertaken.

- 2. Repeat step 1 and exclude the new prospect. This represents the country's after-tax cash flows if the new prospect is not undertaken.

- 3. Subtract the cash flows for each time period in step 2 from the cash flows in step 1 and calculate the economic indicators (NPV, IRR, etc.) on this increment. These results represent the true economic benefit of introducing the new prospect into the project portfolio.

Significant difference in results?

The assumption made by all those who do stand-alone economics is that there is no significant difference between the economic results generated with the stand-alone method and those derived with the incremental method. While it is true that the differences may be insignificant in some cases, it is very difficult to determine the significance subjectively.

There is so much interaction among the technical forecasts, the sliding scale rates, and ring fencing provisions that it makes it virtually impossible to tell if there is going to be a significant difference without actually running the incremental economics and comparing that with the stand-alone results. It is theoretically true that the incremental results are always as good as the stand-alone results, but often are much more accurate.

Also, please keep in mind that governments generally take 50-80% of the profits of all upstream oil and gas projects. If the economic results do not properly calculate this fiscal segment on an incremental basis, then the project results could be substantially incorrect.

Using stand-alone results with uncertainty analysis techniques

Over the last few years, there has been a large increase in the use of uncertainty analysis for E&P project evaluations.

Using decision trees and Monte Carlo simulations, more quantitative information is now available for management to assess the relative risks and rewards of undertaking a new project. However, it is of concern that this increased sophistication in uncertainty analysis is not matched by the increased sophistication of using incremental economics.

In other words, if the stand-alone NPV is used as the fundamental economic project indicator in all of these uncertainty techniques, then it certainly raises the question of the validity of the results of the uncertainty analysis.

Some preliminary research has proven that the three-step incremental economics technique may be substituted for the single-step, stand-alone technique when using Decision Trees or Monte Carlo simulation on single-project evaluations. However, a more fundamental problem emerges when trying to use optimization techniques to select multiple projects for a portfolio.

Although the details are beyond the scope of this article, suffice it to say that portfolio optimization assumes that all projects in the portfolio are fiscally independent of each other, which has already been shown to be an erroneous assumption.

Summary

The concept of incremental economics is not new to the oil and gas industry and is not hard to comprehend. To a large degree though, it has been ignored as use of decision trees, Monte Carlo simulation, portfolio optimization, and real options has taken the forefront.

It seems a bit ironic that most of the industry resources have been devoted to tools that help us manage uncertainty when very little effort has been devoted to automating the incremental economics process, which is modeling the tax laws and license terms that are known with certainty.

The author

Dennis Smith is manager of economics software for IHS Energy Group and is currently responsible for the AS$ET and GIANT software systems. In 1985, he joined Petroconsultants where as a senior economist he authored the original GIANT and ESTIMATOR economics software applications. In 1989, he was named vice president of Petroconsultants' Houston office and served in that capacity until the company merged with IHS Energy Group in 1996. He has more than 25 years' experience and holds a bachelor of business administration degree in quantitative management science from the University of Houston. E-mail: [email protected]