UK emphasis seen shifting to E&P vs. divestment

The UK upstream sector is in transition from a focus on asset divestment to an emphasis on traditional exploration and production and high-grading portfolios.

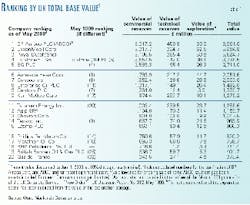

So says Wood Mackenzie Consultants Ltd., Edinburgh, in a study that ranks the top 20 UK upstream oil and gas players according to their upstream value.

After its merger with ARCO, BP Amoco PLC tops the list of those companies with operations in the UK, based on total upstream value. In fact, BP Amoco major holds 19% of the UK's total figure, or about £8.86 billion, says Wood Mackenzie.

Wood Mackenzie estimates a total base asset value for each company, calculated on the basis of 10% net present value discounted to Jan 1, 2000, and figuring in "commercial" reserves, "technical" reserves (not yet slated for development), and exploration acreage.

The second and third-ranked companies are, respectively, ExxonMobil Corp. and Royal Dutch/Shell. The ranks of all three of these companies remains unchanged vs. 1999, although the gap between them has grown. "In percentage terms, BP Amoco's portfolio is now some 56% to 60% larger thanellipseExxonMobil and Shell['s]-up from 50% to 55% in May 1999," Wood Mackenzie said.

TotalFinaElf SA and BG PLC round out the top five companies, ranking a respective fourth and fifth. In total, the top five firms account for £21.5 billion, or just shy of 56% of the total UK figure, according to Wood Mackenzie.

Significant changes

Within the top 10 companies in this year's rankings, there are a few changes that Wood Mackenzie considers "significant," when compared with 1999.

Kerr-McGee Corp. climbed to the 10th position in this year's survey after entering into the top 20 companies at this time a year ago. Kerr-McGee's position was enhanced through its acquisition of Oryx Energy Co. in fall 1998 (OGJ, Oct. 26, 1998, p. 38) and its subsequent purchase of Repsol Exploration UK.

Meanwhile, Texaco Inc. dropped from among the top 10 list-from 9th to 14th-for the first time since Wood Mackenzie began this ranking in 1989. The fall can be attributed, says the analysts, to the divestiture of two central North Sea assets: its equity in Fourth Round assets and an 100% operated stake in the Tartan, Highlander, and Petronella fields (OGJ Online, May 3, 2000).

Also continuing its climb through the rankings, all the while using what Wood Mackenzie terms its "meteoric growth-through-acquisition strategy," is Talisman Energy Inc. Talisman has effectively attained an 11th place among the ranked companies vs. its 20th place standing in 1999.

"With the inclusion of deals involving Amerada Hess (Blake), Shell (Clyde, Leven, Medwin), and Amerada Hess-BP Amoco (Halley-Fulmar), Talisman has indeed stepped into the limelight as a major force in the upstream UK sector over the past year," Wood Mackenzie said.

Reserves

According to the analyst, the top 10 companies ranked hold about 75% of the total UK continental shelf (UKCS) commercial reserve base, or about 11 billion boe.

"SignificantlyellipseTotalFinaElf now [after the merger of TotalFina and Elf] bridges the gap between the very large and the remaining medium-sized participants," Wood Mackenzie said.

The analyst pegs the UK's remaining commercial recoverable reserves at about 14.7 billion boe, which can be broken down into 7.7 million bbl of liquids and 39.8 tcf of gas.

The overall UKCS reserve mix hasn't changed since March 1999, says the analyst, and remains favorable toward oil: "ellipseBP Amoco (including ARCO) and Shell are slightly more oil-biased than the UK average (both 57%); ExxonMobil and TotalFinaElf are gas-biasedellipsehaving UK portfolios weighted 49% and 43% vs. oil, respectively."

Forecast

While acknowledging the strengthening of commodity prices-particularly those for oil-Wood Mackenzie said that it expects a level of "reticence" with regard to divesting assets, especially those already in production.

The analyst said, "As oil prices have now returned to more-favorable levels, the UK upstream sector remains in a state of transition. With new operating efficiencies to be proven, record production levels, and peak net cash flows (particularly for those companies with equity in infrastructure) many companies are enjoying a period of cash-flow harvest from the UKCS.

"However, to maintain growth in the longer term will still require either a return to traditional exploration and production activity in the UK-even under the milieu of global competition for project capital-or a determined effort to high-grade corporate portfolios via, e.g., swap deals, in the near term."