Future UKCS development depends on majors, infrastructure

Despite the maturation of the UK Continental Shelf (UKCS), there remain substantial reserve volumes yet to be developed, according to Wood Mackenzie Consultants Ltd., Edinburgh. The analyst pegs these undeveloped reserves at 7.2 billion boe, excluding analysis of the export routes in the southern gas basin (SGB).

However, certain fields holding these reserves are not likely to be commercially viable in the medium term, the analyst says. This is due to the fields' location relative to existing infrastructure or their technical complexity, or both.

"Indeed, some discoveries, such as gas finds to the west of Shetlands, are currently considered to be 'stranded reserves' as they are unlikely to be developed until gas pipeline infrastructure is emplaced in the region, which is thought unlikely in the near term," Wood Mackenzie said.

Wood Mackenzie goes on to say that, to date, the existing infrastructure in the UKCS has been instrumental in its economic development. "Its continued upkeep remains key to the level of development activity and, indeed, maintenance of production levels in the future," the analyst noted.

"Two of the key strengths of the UKCS are the infrastructure legacy and the remaining potential in existing fields," Wood Mackenzie quoted the UK Offshore Operators Association 1999 Economic Report as saying. "Through the continual application of technology, these mature field assets can yield a valuable prize probably comparable with the remaining exploration potential of the basin.

"The success of the latter is dependent on the former; the life of the infrastructure will determine the extent to which the exploration potential is captured. The industry recognizes that the license holders are the stewards of this potential and that it has a responsibility to manage the assets to maximize the value to the country. Success is also crucially dependent on government action to create the right climate of regulation and the appropriate fiscal regime," UKOOA said.

Pipeline usage, ownership

About half of the current UKCS pipeline network included in its analysis, says Wood Mackenzie, is expected to operate at less than 50% of capacity through 2000. "In total, some 46.5% of oil pipeline capacity and 47.1% of gas pipeline capacity is expected to remain unutilized through 2000.

"Indeed, under current commercial field development plans, many of the pipelines are expected to see additional declines in throughput volumes in the medium term, and this may marginalize their existence going forward. Consequently, it is the commercialization of the undeveloped reserve base of the UKCS that will ultimately decide the fate of these systems," Wood Mackenzie said.

In addition to this factor, the majority of the UK infrastructure is operated by a relatively small group of companies, the analyst says. "The pipeline systems outside of the SGB are currently operated by just 10 companies-of which nearly 60% are operated by BP Amoco PLC, Royal Dutch/Shell, and TotalFinaElf SA."

Wood Mackenzie explained, "Although substantial capital investments were required to establish the offshore infrastructure in the UK, the security of supply and relative stability of low-risk, third-party tariff income has made retaining equity in, and the operating of, pipeline infrastructure extremely attractive."

The same owners of this export infrastructure, the analyst notes, are the same owners of the remaining UKCS undeveloped reserve potential. "The 'valuable prize' that UKOOA and the government wishes to see commercialized is in the hands of these companies, and unless the government intervenes in the interim, it remains with these companies as to how this potential will be secured," said Wood Mackenzie.

Undeveloped reserves

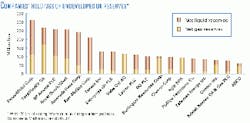

"In total," Wood Mackenzie said, "52 companies hold equity in the 3.1 billion boe of potentially viable undeveloped reserves that lie within 50 km of existing UK pipeline infrastructure.

"However, around 50% of these reserves (1.5 billion boe) are held by just 6 companies (see chart)." This group of six also owns "substantial interests" in most of the pipelines offshore, the analyst notes.

In order to better enable upstream companies to access potential undeveloped reserves from the UKCS, Wood Mackenzie suggests industry must forge a path that incorporates more mergers, acquisitions, joint ventures, and alliances; advances in technology; and better efforts at self-regulation.