Market Movement

Drop in US stocks tied to overdue transit oil?

Does the sharp decline in US oil stocks last month ultimately suggest a more bearish reflection of oil markets than a first glance would suggest?

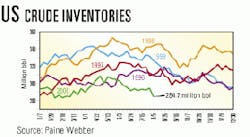

The huge drop of 9 million bbl in US oil stocks at the end of July was largely due to a decline of almost 2 million b/d in oil imports that same week, says PaineWebber (see chart). The expectation of added Middle East output also may explain why refiners drew down stocks while gasoline prices are still high.

"This oil could either be moving into floating storage or other overseas storage facilities. If this is, in fact, true, lower US oil imports could turn out to be more of a bearish factor in coming weeks and months rather than a bullish indicator," the analyst said.

"Nevertheless," PaineWebber said, "in light of the magnitude of the draw and surprise factor, we view this news as bullish for oil prices in the near term."

That near-term bullish view was sustained late last week, as further news of declining stocks helped push NYMEX crude back up to more than $30/bbl again.

Supply constraint to affect gas prices for years

Elevation of US natural gas prices results from supply constraint likely to last several years, says the top executive of a large independent gas producer.

In the US and Canada, notes Mark G. Papa, chairman and CEO of EOG Resources, producers must strain to sustain peak deliverability. And what he calls the "next big slug of supply" will be from Alaska and the Beaufort Sea, unavailable until a pipeline is in place.

Papa told an IPAA lunch meeting in Houston Aug. 9 that the inherent decline rate of US gas deliverability is increasing with time, reaching 24%/year in 1998 compared with 14%/year in 1990. That increase, he said, represents "100% of the reason" for natural gas prices in excess of $4/Mcf this year.

US production, which peaked in 1994, will be down 0.5% this year from its 1999 level, Papa said. Growth in production from Canada has been slower than expected. In contrast, US demand growth has averaged 1.5%/year for the past decade and is accelerating.

For technical and economic reasons, average production decline rates for recent additions to reserves exceed those of past additions. To keep peak deliverability from falling, operators must bring on more new production each year.

In 1999, the US lost 2.2 bcfd of peak deliverability in response to low prices. And despite zooming activity in the Gulf of Mexico, peak deliverability there has been unchanged for a decade, Papa said.

His firm estimates that operators must keep 650 rigs busy drilling for gas in order to offset production declines. With prices high and more rigs than that now drilling for gas, production this year will hold steady. But low inventories will make for a "stressed" heating season next winter. The only question, Papa said, is whether the season will be "extremely stressed or moderately stressed."

Gas from Canada isn't the whole answer to long term US supply questions, he said. Net exports by Canada are up this year, mainly because of new production from the Sable Island area off the east coast. Although deliverability from Alberta is growing, production decline rates are increasing, and export pipelines aren't full.

Papa warned producers that supply constraint won't last forever as the main influence on price. "Price elasticity works on the downside just as well," he said. "There's going to be another cycle." And he pointed to the risk of economic recession, which would slash industrial demand for gas.

Natural gas prices to remain high

US consumers are just beginning to feel the bite from rising natural gas prices.

The average wellhead gas price is expected to average $3.03/Mcf in 2000, the highest projected annual inflation-adjusted price since 1985.

Many gas utilities have begun filing requests for pass-through increases for higher gas prices with state utility commissions.

With gas storage levels down, vs. a year ago, government experts say natural gas prices could stay high until spring 2001. EIA "anticipates that prices will be high through the summer and into the winter, as gas demand growth for electric generation is projected to remain high through 2000."

null

null

null

Industry Trends

More oil firms are broadening their scope of business while burnishing their environmental credentials.

In the most recent release of its global analysis of oil and gas companies' environmental consciousness, New York-based investment firm Innovest ranked Royal Dutch/ Shell the top company for 2000, followed closely by BP (see table). Occidental and Imperial bring up the rear in the firm's ranking, which is called EcoValue 21.

The report's central findings illustrate that "the environment does matter" in terms of strong shareholder value, said Martin Whittaker, Innovest senior analyst.

In this year's survey, Innovest studied 17 of the world's largest integrated oil firms in Europe and North America, analyzing the companies' performance in a range of areas including climate change, renewables, fuel cells, natural gas, energy convergence, fuel product quality, localized emissions, and social management in international settings. Altogether, Innovest examines 40-50 companies in the E&P, R&M, and drilling and service sectors.

Innovest says the report corroborates the positive link between environmental performance and sustainable shareholder value. Companies receiving above-average environmental ratings have financially outperformed companies with below-average ratings by 10%, on average, over the past 2 years, Whittaker says.

Innovest found that environmental compliance expenditures are growing in the petroleum industry. As a whole, the industry spent $8.5 billion in this area in 1998. The largest increase in spending occurred in the R&M sector, says Innovest, as US companies spent to upgrade refineries and facilities to process gasoline with lower emissions levels and incur other environmental expenses, such as fines.

And that broader business scope is already reaping big profits for some.

Enron, for example, reported an almost 40% increase in wholesale energy volumes and continued escalation of profitability from Enron Energy Services, with new contracts totaling $3.8 billion (see related story, p. 22).

Enron's web-based transaction system registered a 92% increase in both volume and transactions from the first quarter, and its Enron Broadband Services recently cut an exclusive, first-of-its-kind contract with video rental chain Blockbuster to stream on-demand movies.

For the second quarter of 2000, Enron's earnings totaled $289 million, up from $222 million a year ago.

Government Developments

The battle continues over development off Florida.

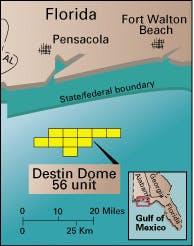

Encouraged by a favorable Supreme Court decision in a similar case in June (OGJ Online, June 27, 2000), Destin Dome gas field project partners Chevron, Con- oco, and Murphy are suing the US government for blocking development of the field, which lies 25 miles off Pensa- cola, Fla., in the eastern Gulf of Mexico (see map). The trio filed suit in a federal claims court, challenging a "Catch-22" arrangement between two US agencies that has effectively blocked "politically unpopular" plans to develop the nine Destin Dome federal leases 13 years after the field was discovered.

DOE estimates the field holds potential reserves of up to 2.6 tcf of dry gas that could help fuel Florida's growing gas market. Yet Florida now wants to ban all offshore drilling within 100 miles of its coast. In March 1998, Chevron filed an appeal with the US Secretary of Commerce seeking to override Florida's attempts to block development.

The suit alleges that EPA last year stopped processing necessary environmental permits for that project, pending a Commerce decision on Chevron's application. In June, Commerce said it would not render a decision until EPA completes the environmental permits.

The resulting gridlock is "simply another way of breaching" any "timely and fair" consideration of the companies' contractual rights while avoiding the refund of millions of dollars in bonuses and fees already collected by the government, said corporate attorneys.

Troubled over the effect fluctuating energy prices might have on the expansion of the US economy, the Interstate Oil and Gas Compact Commis- sion revealed a four-part approach to a new national energy policy.

IOGCC proposes steps to assess the cost of imported oil, increase research to ensure complete and safe development of all domestic oil and gas resources, develop tax incentives to encourage domestic E&P, and encourage public use of energy-efficient technologies.

LOOK FOR MORE POLITICAL HEAT FOR THE CLINTON ADMINISTRATION as another big Iranian project goes to a non-US firm. ENI signed a $3.8 billion buyback deal for development of the fourth and fifth phases of giant South Pars gas field. The project is expected to come under fire from the US.

The US's Iran-Libya Sanctions Act (ILSA) of 1996 created a means for the US Department of State to impose sanctions on any company that invests more than $20 million in Iran or $40 million in Libya.

So far, however, the US has not attempted to apply the act to non-US firms that have taken on projects in either of the two countries, including France's TotalFinaElf, Malaysia's Petronas, and Russia's Gazprom, which are involved in Phases II and III of the South Pars development. The EU strongly opposes ILSA and backs European companies engaged in Iran and Libya.

ENI will take a 60% stake in the South Pars IV and V project, with the remaining 40% to be held by Iran's Petro Pars.

Quick Takes

BASF Petronas Chemicals-a 60-40 joint venture of BASF and Petronas-said its acrylic monomers complex in Kuantan, Malaysia, is fully operational.The complex is the first major project to be completed at the integrated chemical site in Kuantan. The complex, which produces 160,000 tonnes/year of acrylic acid, consists of four plants: crude acrylic acid, butylacrylate, 2-ethylhexylacrylate, and glacial acrylic acid.

Also under construction are plants to make oxo alcohols, synthesis gas, phthalic anhydride, plasticizers, butanediol, and formic acid. The oxo alcohols and syngas complex is targeted for start-up in early 2001, while the butanediol complex and formic acid plants are slated for completion in 2002. The project has an estimated total expenditure of $900 million.

Topping refining news, an explosion at Indonesia's 240,000 b/d Balikpapan refinery halted production at the plant, further tightening fuel supplies in that country.

The blast occurred early last week, and the subsequent fire was extinguished after about an hour. Repairs and an investigation are under way. The blast damaged the refinery's catalytic reformer and LPG facilities. Two workers were described as "slightly injured."

In placing blame for this latest incident in a string of problems affecting Indonesia's refining industry, Mines and Energy Minister Lt. Gen. Susilo Bambang Yudhoyono and Pertamina Pres. Baihaki Hakim have pointed to the possibility of sabotage aimed at disrupting the country's fuel supply. Baihaki said he expects the refinery to resume operation in about 3 days.

In other refining news, BP signed a letter of intent with Marsulex to provide long-term environmental compliance services to BP's Whiting, Ind., refinery. Marsulex will design and build a new facility at the plant to reduce site emissions and remove spent acid from its 34,200 b/d sulfuric acid alkylation unit. The acid will be regenerated at Marsulex's regeneration plant in Toledo, Ohio. Marsulex will own the emissions facility and provide the services under a multiyear agreement. Operations at the new on-site facility are to begin in early 2002. The unit will use Marsulex's proprietary technology-also licensed by Petro-Canada and Shell Canada. The process also yields sodium bisulfite as a by-product. The spent acid regeneration service will begin later this year. Total revenue of more than $275 million is expected from the contract, two-thirds of which will be generated from the new services at Whiting, said Marsulex.

Yetagun gas field may supply LPG.

The Thai and Malaysian state oil firms plan to study the viability of building a $150 million NGL separation plant in Myanmar.

The proposed facility would extract propane and butane from gas piped from Yetagun-Myanmar's second largest gas field, located in the Gulf of Martaban-to make LPG.

PTT and Petronas are reviewing feasibility of building a plant capable of processing 250-300 MMcfd of gas with an LPG output of 200,000-300,000 tonnes/year.

The complex would be built in southern Myanmar, on the Daimensek coast in Mon state, where the 210-km offshore pipeline from Yetagun field comes ashore. A portion of the LPG will be sold domestically, and some will be exported to neighboring countries, but not to Thailand, which is self-sufficient in LPG.

Georgia asserts itself in the Caspian pipeline saga.

Progress on the Baku-Ceyhan oil line between Azerbaijan and Turkey has been stalled due to Georgia's conditions for the route, which crosses its territory.

Although participating nations signed a series of pacts at an Istanbul summit Nov. 18, they were unable to complete a host government agreement with Georgia in time. The country has since pressed a series of demands, prompting a BP official recently to call the lack of progress "frustrating." Oil industry officials have grown impatient with Georgian demands that have blocked progress on this major Caspian Sea oil export project.

Georgia has reportedly sought a 20¢/bbl tariff for the oil that will traverse its territory in the $2.4 billion line. BP says other demands related to security, environmental damage, and compensation for land have already been settled.

The fee would bring $73 million/year to Georgia when deliveries reach a peak of 1 million b/d. The country is already said to be earning 17¢/bbl for the "early oil" exported through its Black Sea port of Supsa. The 3¢ difference in rates for Baku-Ceyhan translates to only $11 million/year, an amount that could soon be dwarfed by the cost of project delays.

In other pipeline news, a crude oil pipeline spill in the Pine River in northeastern British Columbia has been fully contained, and efforts are now focusing on cleanup and long-term recovery planning. Operator Pembina Pipeline expected the line to be back in limited operation soon. Provincial officials confirmed the spill is securely contained behind a second boom 16 miles downstream of the original spill. The containment averts a threat to the water supply of the town of Chetwynd, about 60 miles downstream. The District of Chetwynd has tested water in the area and said there is no contamination. An investigation is under way into the cause of the pipeline break July 31, which released up to 6,000 bbl into the river (OGJ Online, Aug. 2, 2000). Pembina officials said earlier that the break was likely caused by a severe electrical storm and soil movement due to heavy rains. The pipeline runs from Taylor, BC, to Husky Oil's Prince George, BC, refinery.

The US Office of Pipeline Safety held a public meeting last week in Bellingham, Wash., to discuss the results of internal inspection tests on Olympic Pipe Line's 16-in. line from Ferndale to Allen, Wash. The pipeline ruptured and caught fire last June at Bellingham, killing three people (OGJ, Nov. 8, 1999, p. 27). OPS said state and local officials also will discuss at the public meeting progress in restoring Whatcom Creek, where the explosion took place, and Bellingham's agreement with Olympic. OPS said it would explain repairs and testing that must be finished before it will allow Olympic to resume operation of the 75-mile segment closed by the accident.

More Drilling rigs are on order amid high oil prices.

Diamond Offshore Drilling let contract to Keppel Fels for the upgrade of its Ocean Baroness semisubmersible drilling rig to fifth-generation capabilities for deepwater drilling.

Estimated to cost about $180 million and to take 18 months, the upgrade includes mobilization to the Singapore shipyard. The semi will leave the Gulf of Mexico by mid-September. Initial outfitting will include stability enhancements and self-contained chain-wire mooring for operation in up to 6,000 ft of water. The rig will have 6,200 tons of operating variable deck load, 15,000 psi blowout preventers, and a riser with a multiplex control system. Additional features will include a high-capacity deck crane and a significantly enlarged cellar deck area. And a 25 ft by 90 ft moon pool will provide enhanced subsea completion and development capabilities.

WYOMING PROJECTS TOP DEVELOPMENT NEWS THIS WEEK.

Questar received a nod from BLM to continue its drilling program on the Pinedale anticline of western Wyoming. Questar began constructing four drilling pads as part of a planned 8-10 well program for 2000. Questar will use four rigs in the program.

The decision allows Questar to install 700 producing well pads in the area, which covers 197,000 acres between the town of Pinedale and Jonah field, 30 miles south. Questar and affilate Wexpro hold a 60% working interest in 14,800 gross acres in the Mesa area of the Pinedale anticline. The Questar units have drilled two successful exploratory wells in the area. The wells had an average initial flow rate of 11 MMcfd of gas.

Meanwhile, Derek Resources finished drilling the Derek 2-I well on its LAK Ranch Oil Project in Weston County, Wyo. The measured length of the well was 3,210 ft. The well started vertically and then turned horizontally to enter the oil-bearing Newcastle sandstone. The well encountered good reservoir sands, similar to previous well Derek 1-P, and a slotted liner has been installed in the horizontal section. Completion of this second well finalizes the drilling of Derek's first steam-assisted gravity-drainage well pair on the property. The company is now working to complete surface facilities on the site and expects to begin production from the project soon.

MARGINAL FIELDS ACCOUNT FOR MORE NORWEGIAN OUTPUT (see special report beginning on p. 84).

Statoil's marginal Sygna field was brought to first flow through the first of two production wells tied back to the operator's workhorse Statfjord C platform 21 km south in the Norwegian North Sea.

The second well is due to come on stream before yearend, boosting production to about 40,000 b/d of oil from the field. Production from the two wells will be supported by water injection via an extended-reach well being drilled from the Statfjord North satellite. Statfjord C, to which both the Statfjord North and East satellites are tied back, will handle processing, storage, and offshore loading of produced oil totaling about 270,000 b/d once Sygna is in full production. The two wells in Sygna, estimated to contain 53.5 million bbl of recoverable oil, are likely to produce until 2014, according to Statoil, which puts total investment in Sygna at 1.4 billion kroner.

GEOPOLITICS DOMINATES EX-PLORATION NEWS THIS WEEK.

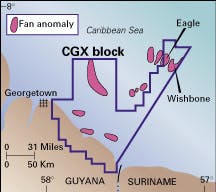

CGX Energy plans to withdraw from an exploration project in Guyana because of a boundary dispute between Guyana and Suriname (see map).

CGX was preparing June 3 to drill an oil prospect, Eagle, when personnel on Surinamese military vessels ordered R&B Falcon's C.E. Thornton jack up to leave, claiming it was in Suriname waters.

The two countries have been trying unsuccessfully to resolve a maritime boundary dispute. Guyana Pres. Bharat Jagdeo said that he will not continue talks with outgoing Suriname Pres. Jules Wijdenbosch but would talk with his likely successor, Ronald Venetiaan.

The jack up was to drill the well in 270 ft of water about 135 km offshore. The company has begun to dismantle the rig but has not ruled out returning if talks resume to end the border dispute. The firm has identified two prospects-Eagle and Wishbone-via seismic analysis. CGX acquired a 100% working interest in the 15,464 sq km Corentyne concession in and off Guyana in June 1998.

Pakistan is seeking exploration opportunities in Iraq, once UN sanctions against the latter are lifted, and will shortly set up a long-term presence in the oil-rich country.

Pakistan applied for a major oil exploration block in Iraq during a recent visit to Baghdad by Pakistan Petroleum Minister Usman Aminuddin. "We have been assured a positive response to our application for oil exploration in Iraq," said an official of the Ministry of Petroleum and Natural Resources.

Pakistan's OGDC is likely to be allotted a block in the Shiba oil field area to explore and develop, the official said, adding that Aminuddin and his Iraqi counterpart discussed in detail bilateral cooperation in the field of oil exploration while keeping within the limits of UN economic sanctions on Baghdad. Islamabad and Baghdad would continue to work within the boundaries of the UN Charter, and no violations of the curbs would be made, the official added.

In other exploration news, Phillips raised its stake in Alaska's North Slope last week with the formation of a two-part exploration alliance to explore and develop acreage with Alberta Energy and Chevron. Phillips has already completed its $965 million acquisition of ARCO's businesses in Alaska. The alliance with AEC and Chevron includes nearly 150,000 acres on the ANS and in the Beaufort Sea, and it provides for proportional ownership of seven leases containing 28,504 acres off Prudhoe Bay in the proposed McCovey Unit. Alberta Energy will earn a 33.3% interest in the area leases through a farm-out on the initial well. Phillips and Chevron each will hold a 33.3% interest in the proposed unit. The second part of the pact covers 114,262 acres in the Grizzly Gomo prospect area south of the Kuparuk River oil field. Alberta Energy will earn a 20% interest in the area, while Phillips and Chevron each will hold a 40% interest in the Grizzly Gomo area. The first wildcat could spud in the 2001-02 winter season.