Sable offshore project delivering gas, with more to come

The Sable Offshore Energy Project on the Scotian Shelf off Nova Scotia is now well under way.

Deliveries of natural gas to markets in the US Northeast and Atlantic Canada are scheduled to reach more than 500 MMcfd this fall, once pipeline laterals and development wells are completed. First gas moved through a new pipeline connection to markets in early January.

Sable perspective

Production from the first three fields in the Sable Island area are the payoff of a 2-year, $2 billion (Can.) development program by owners of the project.

It is also the first commercial gas production from the Scotian shelf, which has postulated reserves estimated at 18 tcf. Several companies are already moving out into deeper waters beyond Sable Island to test their potential.

At the end of 1997, a total of 121 exploratory wells had been drilled on the Scotian shelf, identifying 21 fields with estimated reserves of 5.8 tcf.

Six fields in the Sable Island region have reserves estimated at a combined 3 tcf, with a 10% probability of reserves exceeding 5 tcf. The fields are in shallow water similar to those in the Gulf of Mexico and can be developed using conventional technology.

A development program begun more than 2 years ago by Sable Offshore Energy Inc. (SOEI), the owner group, involved construction of three offshore platforms, two onshore processing plants, more than 186 miles of subsea pipelines, and a 34-mile onshore pipeline. Ownership interests in SOEI are Mobil Oil Canada, 50.8%; Shell Canada Ltd., 31.3%; Imperial Oil Resources Ltd., 9%; Nova Scotia Resources Ltd., 8.4%; and Mosbacher Operating Ltd., 0.5%.

Pipeline project

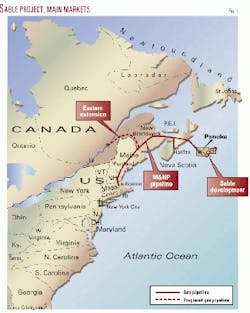

Offshore development was tied in with construction of the $1 billion Maritimes and Northeast Pipeline (M&NP) to deliver gas to Northeast markets in the US and Canada (see map). Construction of the main line was completed in October 1999, and the pipeline went into service on Dec. 31, 1999. The first gas was delivered from Sable to the M&NP line on Jan. 4. Ownership of the pipeline is Duke Energy Inc., 37.5%; Westcoast Energy Inc., 37.5%; Mobil Oil Canada, 12.5%; and Nova Scotia Power Inc., 12.5%.

The Canadian portion of the 30-in. line extends from a gas processing plant at Goldboro, NS (landfall for the offshore pipeline from Sable), 345 miles to the US border. The line has a peak day capacity of 530 MMcfd, which could be increased to 800 MMcfd with additional compression.

From the US border, the mainline extends to an interconnection with the Portland Natural Gas Transmission system near Westbrooke, Me. A section from Westbrook to Haverhill, Mass., is jointly owned by the two lines. From Haverhill, the line connects to the Tennessee Gas Pipeline Co. system at Dracut, Mass., for deliveries into other areas of Massachusetts.

SOEI says completion of the offshore and onshore facilities was compressed into a 23-month schedule compared with the industry benchmark of a 29-month schedule for similar projects, from detailed design to project completion.

Tier One of the program involved facilities and gathering lines at Thebaud, North Triumph, and Venture Fields. Onshore facilities include the Goldboro gas processing plant, with a capacity of 600 MMcfd of raw inlet gas, and a 20,000 b/d liquids processing facility at Point Tupper, NS, connected to the Goldboro plant by a 34-mile liquids pipeline.

Cost of Tier 2, a second development phase, is estimated at more than $1 billion. It will include the facilities and gathering lines for the Alma, Glenelg, and South Venture fields and will be progressively completed by 2006.

First-phase development

The first phase of offshore development involved a tight schedule of production drilling, installation of offshore platforms, and laying of subsea pipe.

The Santa Fe Galaxy 11 jack up was used beginning in April 1998 to drill 12 production wells needed for the Tier One program at Sable. Five wells were drilled at Thebaud, five at Venture, and two at North Triumph. Fabrication of the Thebaud and Venture platform jackets was contracted and completed at the MM Industra/Brown & Root JV yard in Dartmouth, NS.

Last August, the Saipem 7000, the world's largest heavy-lift semisubmersible vessel, was used to lift the natural gas processing heads from the MM Industra yards at Dartmouth, NS, to the three ofshore platforms for installation. The Thebaud central processing platform, located 6 miles west of Sable Island in about 82 ft of water, weighs more than 5,600 tonnes and stands 13 stories above the waterline. The North Triumph platform weighs 1,580 tonnes, and the total structure, including jacket, is 320 ft tall. The Thebaud platform is being used to process gas from its own wells and from North Triumph and Venture fields, which are tied into it by subsea pipeline. The gas is then shipped through 122 miles of 26-inch pipe to the onshore processing plant at Goldboro.

The Allseas Solitaire, the largest pipelay vessel in the world, completed installing 122 miles of 26-inch pipe on the ocean floor from Thebaud to the Goldboro plant in September. Pipe was laid at an average rate of 3.1 miles/day. The Allseas Trench setter trenching support and subsea installation vessel and the Digging Donald mechanical trenching machine then completed the pipe installation process.

Sable gas first flowed at the Thebaud central platform on Dec. 18 and from there to the Goldboro plant, where gas flowed through the sales meter Jan. 4 at an initial rate of 110 MMcfd. With additional development drilling this year, Sable gas throughput is expected to reach 450-530 MMcfd this fall.

Sable area exploration

With the groundbreaking Sable project up and running, companies are now fanning out from the Sable region to develop additional reserves.

Shell Canada, Mobil Canada, and Chevron Canada recently jointly acquired three exploration licenses in deep water on the continental slope beyond Sable Island.

The companies each have a one-third interest in the three licenses covering more than 1,172,000 acres in the area about 125 miles offshore. Work commitments total $94 million over the next 5 years. Seismic work is planned to determine drilling locations for exploration wells.

Shell and Mobil are also involved in a second consortium with Imperial Oil Ltd., which was awarded six exploration licenses in the Sable subbasin surrounding the current Sable production area. Mobil and Shell each have a 40% working interest in the licenses. Imperial holds the remaining 20%. The work commitment for these licenses totals about $192 million within the next 5 years.

Calgary-based PanCanadian Petroleum Ltd. late last year doubled its net land holdings off Nova Scotia.

The company and partners acquired six parcels covering more than 1,655,000 gross acres to increase its interests on the Scotian shelf and deepwater areas to more than 3,954,000 gross acres. In the past 21/2 years, the company has acquired about 2,199,000 net acres in 15 offshore exploration parcels.

PanCanadian CEO David Tuer says Offshore Nova Scotia is one of the most promising exploration regions in North America. He says the company now has a clearly established core area in the region for exploration and development. PanCanadian and partners are committed to spend $48 million over 5 years on the newly acquired parcels.

In another development, PanCanadian said it has made a potentially significant natural gas discovery underlying Panuke oil field, about 155 miles southeast of Halifax. The company drilled two exploration wells into separate zones under the oil field. The PP-well flowed gas at 55 MMcfd on a 4-day test last April, and the I-1B well tested at 52 MMcfd on a 6-day test in January. The company plans further evaluation of the reservoir, where it has a 100% working interest in the discovery. PanCanadian recently shut down production at the small Panuke oil field, which it has operated for a number of years.