Grand Banks' Jeanne d'Arc basin No. 1 hot spot for Canada's remote offshore E&D

The remote Grand Banks area off Newfoundland continues to be Canada's top offshore exploration and development hot spot, with activity still focused on oil prospects in the prolific Jeanne d'Arc basin.

The region also has substantial natural gas reserves, but most analysts put first gas deliveries 7-10 years away.

Explorationists have sunk more than 115 wells in the Grand Banks area to date and identified proven crude oil reserves of more than 2 billion bbl. The Grand Banks covers about 330,000 sq miles, with water depths mostly at 200-600 ft.

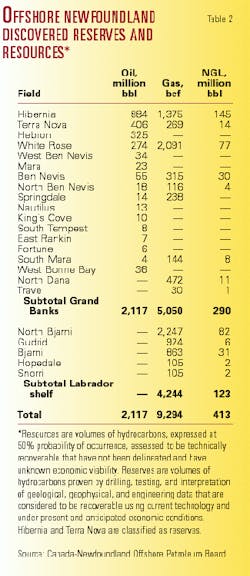

The Canada-Newfoundland Offshore Petroleum Board in May increased its estimate of discovered reserves off New foundland and Labrador to 2.1 billion bbl of crude, 9.3 tcf of natural gas, and 413 million bbl of natural gas liquids. It estimates potential recoverable oil in the Jeanne d'Arc basin and the adjacent Ridge complex at 4.6 billion bbl, with 4.09 billion bbl of that in the Jeanne d'Arc basin. Potential recoverable gas in the area is estimated at 18.8 tcf, with 12.6 tcf in the Jeanne d'Arc basin. The board says potential reserves are expressed at a 50% probability, with reserves technically recoverable but economic factors not taken into account.

Project updates

Hibernia, the first producing field in the region, which came on stream in late 1997, received approval this spring to increase production to 180,000 b/d from 150,000 b/d. Estimates of proven reserves at Hibernia were increased to 884 million bbl from 666 million. Natural gas reserves estimates for the field are estimated at 1.4 tcf, and NGL reserves are estimated at 145 million bbl.

Drilling to date in the Hibernia sands has encountered greater than expected net pay, higher permeability, and lower water saturation, indicating a higher estimate of the original oil in place. Three wells are planned this year to test the Avalon sands, the other pay horizon at Hibernia. Two will be in the originally mapped area, and another will test a possible extension.

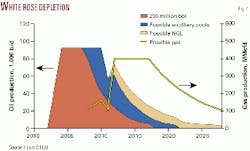

The nearby Terra Nova field, with an estimated 406 million bbl of reserves, is scheduled to begin production early in 2001. And White Rose field, with estimated reserves of 250 million bbl in the same basin, where Husky Oil Ltd. is operator, is about to undergo the permitting process for development, with a production start-up target of 2004, if it proceeds.

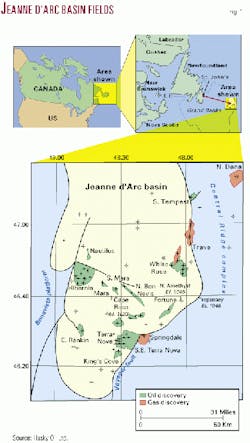

Other structures in the basin, including Hebron-Ben Nevis and Riverhead, are under exploration or appraisal and seen as potential stand-alone future developments. A number of smaller satellite fields could be tied into larger adjacent fields at a later date (Fig. 1).

Petro-Canada strategy

Petro-Canada's Gary Bruce says the Jeanne d'Arc basin is now seen as a maturing basin, where most large structures have likely been identified. Bruce is vice-president of offshore development and operations for Petro-Canada, lead partner and developer for Terra Nova.

The company has interests in 18 discoveries on the Grand Banks and is a participant in most exploration licenses in the region. It acquired a 147,000 net acre holding on the Scotia shelf and completed a farmin deal on adjacent property, giving it a total of 1.2 million acres gross and 642,000 net on the shelf.

On the Grand Banks, it acquired 653,000 net acres in the deepwater Flemish Pass basin and now has land holdings there totaling about 738,000 net acres. These add to 653,000 net acres the company already holds off Newfoundland. Petro-Canada's total East Coast land position is about 4.9 million gross acres and 1.9 million net acres. The company has withdrawn from conventional oil operations in Western Canada and now defines the East Coast as one of its core areas of operation.

Bruce says exploration is now beginning to move into other Offshore Newfoundland areas. Exploration rights are being staked in the Flemish basin, a deepwater area northeast of Hibernia and Terra Nova where water depths exceed 2,500 ft. Several companies will be shooting seismic in the area this summer. And, he says, a lot of the acreage on the Grand Banks that was originally surveyed with 2D seismic is now being reshot with 3D.

Potential, economics

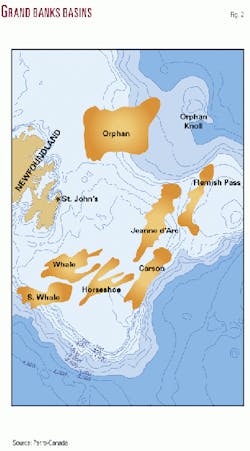

Bruce says the Grand Banks are attractive to his company and other participants, such as Mobil Oil Canada, Chevron Canada Resources, Amoco Canada Petroleum Co. Ltd., Norsk Hydro Canada Oil & Gas Inc., and Murphy Oil Co. Ltd., for a number of reasons. The reserve potential of 5 billion bbl is large and is equivalent to about 45% of the conventional oil left to be produced and found in the Western Canada Sedimentary Basin-the country's primary producing area for conventional oil and gas. Most of the other Grand Banks basins are still largely unexplored (Fig. 2).

The larger-potential targets translates to lower finding costs for this remote region. Finding costs to date in the Jeanne d'Arc basin are about $1.25 bbl, about half the cost in western Canada.

Reserves at discovered fields such as Hibernia and Terra Nova are large, with these two fields ranking fourth and seventh among conventional pools found in Canada. They are the two largest remaining pools of conventional oil in Canada today. The average pool in western Canada is now 300,000 bbl.

Recent improvements in offshore technology, such as floating production systems, have lowered development costs and made smaller reservoirs economic to develop.

The province of Newfoundland and Labrador provides a stable fiscal regime for operators and royalty levels that offer reasonable rates of return for participants.

The federal government plans to open up two new areas, the Carson and South Whale basins, for bids this fall. Ottawa has also appointed an arbitrator to resolve a boundary dispute between the provinces of Newfoundland-Labrador and Nova Scotia that has blocked exploration activity in the potentially resource rich Laurentian subbasin in the Gulf of St. Lawrence off Cape Breton.

There has been only minimal exploration activity on the west coast of Newfoundland, where PanCanadian Petroleum Ltd. and Hunt Oil Co. went elephant hunting. They drilled several wildcats with oil shows but non-commercial results.

Bruce does not discount comparisons made between the combined North Sea sectors and Canada's East Coast offshore. He notes that seven of the East Coast offshore basins are equal in areal extent to about 70% of the North Sea.

"There is substantial potential here on the East Coast, and you can get pretty excited about it," he said.

Terra Nova

The current excitement at Petro-Canada is the impending completion of the Terra Nova project in March, southeast of Hibernia, as the second Grand Banks field to be brought on stream. Petro-Canada is operator for Terra Nova with a 34% interest, including 5% recently acquired from Husky Oil Ltd. in a land swap.

The field is divided into three main blocks: the Graben, East Flank, and Far East. The company estimates reserves for the Graben and East Flank at 370 million bbl. It says there is potential for an additional 100 million bbl in the adjacent, undrilled Far East block. The first well on that block will be drilled later this year, after six wells needed for production start-up are completed.

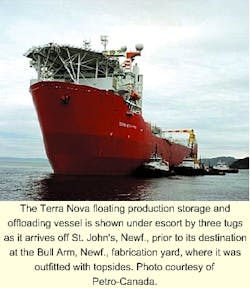

Terra Nova will use a floating production and offloading system (FPSO), which will be cheaper than the gravity-based production system used at Hibernia. It can also achieve full production more rapidly, because wells can be predrilled while the FPSO is being built. The FPSO arrived at Bull Arm, Newf., May 12, after a 57-day voyage from South Korea for the start of a hook-up and commissioning process that will take until the end of the year. Topsides modules built in Newfoundland and Scotland are being installed.

The FPSO, built at the Daewoo Shipyard in South Korea, is 18 stories high, about 300 ft long, and can store 960,000 bbl of crude. It is double-hulled, ice-reinforced, has a displacement of 196,000 tonnes, and can disconnect and maneuver under its own power. Over 10,000 tonnes of topside modules have been placed on the vessel deck. It can handle an average rate of production of 115,000 b/d, with piping capacity to handle 150,000 b/d.

The Henry Goodrich semisubmersible rig has been hired for drilling at Terra Nova, and four of six production wells required for start-up have been drilled. The rig is set to drill about 24 wells over 4 years but will be drilling for a longer period if oil is found in the Far East block.

Five of seven subsea templates have been installed in the field to provide the support structure for equipment installed on the seabed, including wellheads and manifolds. The remaining two templates will be installed in early 2001.

In May, marine operations were started at the field to install what has been described as the world's largest disconnectable riser system. The vessels Smit Pioneer and Marianos were used to install flowlines, manifolds and risers to connect production wells to the FPSO.

When the FPSO goes to the field next year, it will hook onto a spider buoy, which is essential to the flow-disconnect system. In a controlled disconnect, the spider buoy settles to midwater depth, supporting mooring chains and risers-ready for reconnection when the FPSO returns to location. A planned disconnect will take about 4 hr, but an emergency disconnect can be done in about 15 min. More than 25 miles of flexible flowlines, dynamic risers, and control umbilicals will be installed at Terra Nova. It will be the first FPSO system used in North American waters and in waters where ice is present.

White Rose

There is no final decision to proceed yet on the White Rose field development in the Jeanne d'Arc Basin close to the Hibernia and Terra Nova fields, but it is almost certain to be the third field scheduled for development on the Grand Banks.The field is located about 218 miles off Newfoundland.

Husky Oil Ltd., Calgary, is operator with a 72.5% interest, with Petro-Canada holding the balance. Husky is moving ahead with engineering design and contractor selection so that it can move quickly to the development stage of the project next year. The company is moving rapidly on White Rose plans because it wants to take advantage of the supply community and labor force that's been assembled to work on Terra Nova.

Husky is currently considering bids from several companies for an offshore production and storage vessel. The vessel is expected to have production capacity of 100,000 b/d and storage capacity of 800,000 bbl. A number of successful delineation wells have been drilled at White Rose, and one or two additional wells are to be drilled this year.

White Rose is at the top of Husky's current agenda, but the company is also one of the East Coast's most active landholders and explorers. The company began exploration there in 1982 and bought significant interests in a number of Grand Banks properties from Talisman Energy Inc. and Gulf Canada Resources when it returned in 1998 after a hiatus.

In addition to its White Rose and Terra Nova holdings, Husky has interests in 14 other discoveries and licenses in the basin. It holds a 33% net working interest in the significant discovery areas and licenses in the basin.

Husky will be drilling this year at its Cape Race exploration license, where it is operator with a 67.5% interest. Other interests in the license are Petro-Canada, 17.5%, and Norsk Hydro, 15%. The Cape Race location is about 10 miles west of the southern end of the White Rose structure. Husky will also be drilling at two other highly prospective structures this summer adjacent to White Rose, North Amethyst, and Trepassey.

James S. Blair, Husky vice-president for frontiers and international, says prospects on the Cape Race license have the potential to be combined with the Husky-operated North Ben Nevis discovery in a 100 million bbl, multipool development. He says the multipool concept is new to Canada's eastern offshore but has evolved in other harsh-environment regions, such as the North Sea.

Husky has now drilled nine wells at White Rose to define both South White Rose oil field and North White Rose oil and gas field.

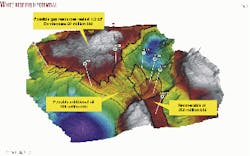

Evaluation of the southern satellite indicates proven and probable reserves of 250 million bbl, which make it commercially viable. In addition, ancillary pools have possible additional reserves of 100 million bbl. Delineation of North White Rose indicates 1.9 tcf of sales gas and 60 million bbl of condensate (Fig. 3).

Blair says Husky's long-term strategic plan for development of resources from White Rose includes current plans for the South White Rose oil pool as well as future prospects for ancillary oil pool and natural gas development. Peak oil production from South White Rose will be 75,000-110,000 b/d of 30 degrees gravity oil (Fig. 4).

Gas prospects

Blair says gas development at White Rose has not yet been determined commercially viable. Sufficient reserves have not yet been determined, and facilities to move gas from the Grand Banks to markets are not yet in place.

The Husky executive says future gas development is subject to a number of critical conditions:

- Firm contracts in place for the US market.

- Relatively high and stable gas prices.

- Firm plans approved for gas infrastructure, such as a major pipeline project connecting Grand Banks gas to the North American grid.

- The proving up of substantial gas reserves to underwrite infrastructure investment.

Blair notes that regional supply potential for gas in the Jeanne d'Arc and adjacent areas is up to 9 tcf, but these are mostly undiscovered resources.

Norm McIntyre, executive vice-president of Petro-Canada, also says Grand Banks gas development is still a long way off because of low proven reserves and no access to markets in the US. He said gas development is at least a decade away, and a pipeline is out of the question until threshhold proven reserves of gas are found.

Next hot spot

The next potential hot spot for East Coast exploration will likely be the Laurentian subbasin off Cape Breton.

Ottawa recently appointed Gerard LaForest, a retired Supreme Count justice, as head of an arbitration panel to settle a long-standing boundary dispute involving jurisdiction between Nova Scotia and Newfoundland.

The findings of the panel will be binding and are expected by mid-2001 at the latest. About 13 oil and gas companies have acquired acreage in and around the 23,168 sq mile area and are awaiting the panel's findings.

Meanwhile, Federal Resources Minister Ralph Goodale says he hopes the provinces will establish an interim agreement to allow exploration to proceed.

A series of major heavy lifts have been completed to outfit the Terra Nova floating production, storage, and offloading (FPSO) vessel-the first FPSO to be deployed in Canadian waters. The vessel will be installed in Terra Nova field in the Grand Banks area about 350 km off St. Johns, Newf.

Completing a series of 20 heavy lifts for the FPSO was Smit Transport & Heavy Lift's Asian Hercules II floating sheerlegs, shown here at the Bull Arm fabrication yard in Newfoundland.

During its 1-month job, the Asian Hercules II lifted a 285-ton tensioner connector, which was picked up from the quay and lowered partially into the FPSO's turret.

Among the more challenging lifts were those involving large-dimension modules, such as the 2,200-ton separation and high-pressure (HP) compression module, which was 45 m long, 25 m wide, and 20 m tall. Another difficult lift involved a 600-ton, 100 m flare tower.

Also lifted into position was a 1,400-ton generator and waste heat-recovery unit module, a produced water and glycol module, and a 1,857-ton separation and low-pressure compression module, all with dimensions similar to the HP compression module, says Smit.

The Smit vessel departed for Rotterdam on June 14. In early July, the Asian Hercules II left for Norway, where she will carry out lifts for the Snorre B semisubmersible production vessel.