Russian lube plants need new technologies

Upgrading Russia's existing lube-oil production facilities is the solution to the country's lube-oil crisis. Combining efforts of both Russian and international oil companies is the most effective strategy.

Russian refineries suffer from limited flexibility and lack of investment. The generally low complexities of Russian refineries limit their ability to produce high-quality, marketable products.

Also, the refineries have no choice when purchasing crude oil. They must accept whatever feedstock quality is delivered to them by a holding company or another supplier, whether it is a good crude for lubes production or not.

The troubles of the Russian oil processing industry trickle down to the production of lubricating oils, both base stock and finished oils.

There are more than 20 lube-oil manufacturing enterprises in Russia. The major producers of lube oils are 12 refineries, spread all over the country. The remaining producers either are not working as a result of economic difficulties or produce only minor volumes of lubes, using base oils purchased from Russian refineries.

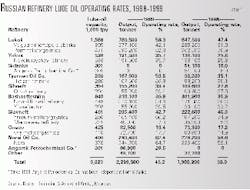

The operating rate of lube oil plants steadily fell between 1993 and 1999. Lubes output dropped by 42%-from 3.3 million tonnes (66,400 b/d) in 1993 to 1.9 million tonnes (38,200 b/d) in 1998-when on average, less than 40% of Russian lube-oil production capacity was being used.

The government intervened in 1999 to stop the decline. It forced producers to increase volumes of crude oils processed at refineries and limited exports of both oil and oil products. Thus, in 1999, Russian petroleum products output climbed by 16% to 2.3 million tonnes/year (tpy; 45,400 b/d), or to 45% operating rate (Table 1), creating a 170,000 tonnes/month oversupply problem.

Fig. 1 shows Sibneft's Omsk refinery, which increased its lube-oil facilities' usage from 28% to 39% between 1998 and 1999.

Lube plants in Russia

Productivity of some lube-oil units is much higher than others. Norsi Oil Co.'s refinery in Nizhny Novgorod at the Volga river uses about 60% of its lubes production capacity.

Despite the drastic decline of lubes output in 1998, Permnefteorgsyntez (Perm)-one of the two Lukoil refineries making lubes-is probably the best organized Russian lube-oil producer.

Upgrades that were undertaken several years ago permit the refinery to produce finished oils of acceptable market quality and to use a large portion of its lubes capacity. The Perm refinery also has a team of qualified technologists and traders who support an aggressive marketing and sales policy.

Although the upgrade repaired and modernized the Perm refinery's lube units, it did so within the constraints of existing conventional technology. Thus, although the refinery has upgraded to a larger extent than other producers, viscosity index-100 (VI-100) base stock is the best it can produce.

The second Lukoil refinery in Volgograd (on the Volga river), on the other hand, makes poor-quality lubes and is in a weak market position. It never received financial support equal to that of Perm.

Slavneft Oil Co.'s two refineries are in a similar situation to Lukoil's. The Yaroslavlnefteorgsyntez refinery, in Yaroslavl near the Volga River, one of the company's two refineries, has one of the best lube-oil capacity-use percentages in the country. Slavneft's second refinery, one of the oldest Russian refineries, is in the same city but does not receive much financial support from the parent company.

The Ryazan refinery in central Russia, belonging to Tyumen Oil Co. (TNK), is one of the fastest growing Russian oil companies. It aggressively markets its lubes.

TNK has established close business links with Texaco and carried out certain equipment upgrades so that it can produce base stock to make finished oils at Texaco specifications. This alliance makes good quality lube oils for the home market.

The first upgrade, finished in 1997, greatly increased the lubes output in 1998 despite Russia's financial crisis in August. The Ryazan refinery was the only one in Russia to increase its lubes production in 1998, when many other lubes producers cut down their activities.

In 1999, the Ryazan refinery recorded a record 70% increase in lube-oil output.

It is interesting to note that Angarsk Petrochemical Co., after becoming independent from Sidanko, unexpectedly raised lubes production by 64% in 1999.

Russian lubes market

Five companies dominate the Russian lube-oils sector, accounting for about 76% of market share (Fig. 2): Lukoil 34%, Bashneftechim 14%, Norsi Oil 11%, Slavneft 9%, and Yukos 8.5%.

Among the refineries, the biggest lubes producers are in Perm and Volgograd (Lukoil), Nizhny Novgorod (Norsi Oil), Yaroslavl (Slavneft), and Novokuibyshev (Yukos)-all in central Russia.

It is worth mentioning two Ufa refineries (part of Bashneftechim structure of Bashkorkostan, a republic in central Russia) have extensive lube-oil production facilities. Their combined lubes production capacity is 840,000 tpy (16,800 b/d), although they run at only 36% of capacity.

Russian refineries manufacture mainly diesel and industrial oils. Engine oils have a modest output, but their production is declining. The exception is Lukoil's Perm refinery; its output share of engine oils has increased from 26.5% in 1996 to more than 40% in 1999, making it the biggest engine oils producer in Russia with 157,000 tpy (3,100 b/d).

Engine oils have a 15-17% market share, diesel oils have about 40% market share, and industrial oils have more than 37% of the total lubes output.

Fatal underestimation of the importance of the quality of lube oils and the reluctance to upgrade technologies have resulted in a failure by Russian oil companies to meet the growing needs of consumers and a large loss of the domestic market.

The root of the problem is the inability of refiners to choose their crude oil and the market demand for better quality lubes.

There are few Russian crudes that meet the requirements of lubes producers. As a result, most refineries cannot produce distillates necessary to make a good base stock.

With the exception of Lukoil, local lube producers rarely sell to the domestic market. Lukoil's products are of better than average quality and are attractively packaged.

Increasing numbers of imported equipment (for example, automobiles and tractors) in Russia are increasing demand for higher quality lubricants manufactured from high VI base stock and modern additives.

Foreign producers provide most of these high quality lubes via shops, supermarkets, and gas stations. BP Amoco plc, Statoil, and Agip Petro* SpA are actively increasing their lube-oil presence at Russian gas stations.

Automobile repair and service centers use mainly imported lubes. Only companies that service Russian cars use Russian lubes; most of these prefer lubes made by Lukoil, however.

There are not many official statistics available regarding exports and imports of lube oils in Russia. No statistics at all exist for market consumption or trends in the development of the lubes market.

According to official data, Russia exports about 620,000 tpy (12,400 b/d) of lube oils, or 32% of total output, and imports about 85,000 tpy (1,700 b/d) of lubes (4.4%). Import transactions are about $88,000, and export transactions are $123,000.

Industrial oils make up the bulk of Russian exports. Smaller quantities of engine and diesel oils go to other Former Soviet Union (FSU) countries.

Countries outside the FSU import the straight-run industrial oils and use them as cheep feedstock for blending and production of various finished lubes. FSU consumers later import these finished lubes at much higher cost. On average, the exported oil price is $200/tonne and the imported price is $1,000/tonne.

Total lube-oils consumption in Russia is about 1.4 million tpy (28,000 b/d).

Technology in use

Russian lube-oils producers often use modern additives, thinking that they can make easy-selling finished lubes from any base stock. In fact, today's finished-lubes performance requirements cannot be achieved using only additives.

In Soviet times, lube producers exported only limited quantities of oils to maintain working conditions of the Soviet machinery used abroad. As it was isolated from the world market and not affected by market competitiveness, the country had no incentive to improve its lube-oil quality.

Instead of increasing quality, Russian producers increased the number of lube-oil brands, frequently duplicating existing ones. Today, the Russian lubes exports problem is even more serious because high-quality lubes are demanded from consumers and there is a significant world overproduction of high-quality base stock.

The Russian petroleum industry reorganization, based on the principle of western vertically integrated petroleum companies, has not improved lube-oil production at all. Not one Russian refinery manufacturing base stocks has carried out any serious modernization aimed at enhancing lube-oil technology.

The majority of base oils producers has replaced cap-plate vacuum columns with the packed columns manufactured by Koch-Glitsch Inc. and Sulzer Chemtech Ltd. This change allowed producers to fractionate lube raffinate into narrower lube distillates and thus improve the evaporation index.

The Orsknefteorgsyntez plant is one of those using packed vacuum columns of domestic origin. The Novokuibyshev and Yaroslavl refineries upgraded their selective solvent units and started using N-methylpyrrolidone. The Perm plant and the Yaroslavl refinery constructed new vacuum blocks (separate units installed specifically to produce oil distillates) to fractionate the raffinate into narrow oil distillates. Other plants have taken similar measures.

Despite these changes, the maximum lube-oil quality achieved in Russia is comparatively the same as the average world quality for lube oils in the mid-1970s.

Russia's standard lube-oil manufacturing is confined to the conventional extraction and crystallization methods using selective solvents. Most still fractionate the raffinate into three runs of lubes distillates, instead of the four runs practiced worldwide.

Although the Norsi Oil refinery has the capability to make a fourth run, it does not regularly make use of it, because Russian standards do not require it.

Today, even the best quality solvent-refined base stock produced in Russia, hardly conforms to API Group I stocks specification. Moreover, each refinery has its own internal base-stock quality specifications.

Another problem is that many Russian laboratories are not equipped to use international analysis methods to determine property values.

Hydrogenation processes

Countries outside of the FSU have been implementing new technologies aimed at manufacturing the next generation lubricating materials. New hydrogenation processes allow for the production of cost effective mineral oils with performance of synthetic oils.

Rapidly developing demand for higher-performance oils in the world is leading to increased use of synthetic and unconventional base stocks. This trend makes it increasingly difficult to produce oils by simply modifying additive technology with conventional solvent-refined stocks.

Severe hydrocracking technology provides a solution to stringent performance requirements and limited additives technology. Hydrocracking produces superior base stocks for most applications.

Lube hydrocracking gives the refiner more feedstock flexibility and respectable yields.

Some crude oils previously considered unsuitable for production of high quality lube oils, are successfully processed today at hydrocracking plants without sacrificing lube-oil quality. The feedstock flexibility of lube hydrocracking is of primary importance for Russia, where crude selection greatly varies and refiners have little choice.

Hydrogenation processes resolve the eternal conflict of conventional lube-oil manufacturing, that is, how to avoid the dependency of lube-oil quality upon their yields. To manufacture high VI base oils with conventional technologies, the refiner deepens the extraction by increasing the ratio of solvent to feedstock. This ratio increase inevitably results in decreased yields and overproduction of an aromatics extract (lubex) that is discharged to fuel oil.

While Russian standards provide for up to 70% of solvent raffinate output, efforts to obtain a better quality, higher VI material with conventional processes decrease the output to 50% or less.

In lube hydrocracking, on the other hand, the saturation of aromatic rings and opening of naphthenic rings allow conversion of aromatic hydrocarbons, which are harmful for VI, into paraffinic ones. Thus, hydrocracking converts undesirable components into higher VI compounds with improved characteristics (for example, improved oxidation stability).

In addition to hydrocracking, Isocracking and Isodewaxing processes developed by Chevron also increase product quality without greatly sacrificing yield. Isocracking catalysts decrease aromatics and naphthenics contents while possessing a heightened isomeric ability.

When lube distillates after an Isocracker unit are further treated in an Isodewaxing unit, super high VI base oils are produced. The oils meet API Group III stocks specifications and have operating performance approaching that of the synthetic oils.

The lube Isocracking process gives higher yields than solvent extraction, because the process converts many of the low VI components to high VI components, rather than extracting them and eliminating them from the base oils.

Chevron claims that its Isodewaxing process converts practically all normal paraffins, which decreases the pour point of lube oils, into isoparaffins, the most valuable components of lubricating oils. Conventional solvent dewaxing, on the other hand, removes normal paraffins having a VI close to 170 from the stock. In catalytic dewaxing, the normal paraffins become useful fuel components and gas.

Solutions for lube makers

As their first initial step to recover lost share in the lube-oil market, Russian petroleum companies should revise their attitudes towards lube-oil production by improving lube-oil quality.

Another solution, which would reduce Russia's dependence on lube-oil imports and Russia's own production, is to form partnerships with the world leaders in lubes technology. For example, blending agreements are profitable for Russian entrepreneurs because they will get regular sales contracts with guaranteed payments within the country.

Foreign producers will force Russian producers to manufacture maximum achievable quality oils, which will give them better technological discipline.

For "lubes majors," partnerships will decrease costs and develop market substitutes for the lubricating materials invading Russia. The Russian home market will also favor products made from alliances because the product will be high quality lube oils from the best world lube makers at reasonable prices.

Castrol Marine GmbH, for example, has successfully made marine oils for 7 years according to its proprietary specifications in Russia. It uses Russian-made stocks to meet the needs of the domestic market.

Alternative considerations

The most straightforward solution to save the Russian domestic lubes business is to upgrade facilities involved with lube-oil production.

Future lube-oil performance requirements are driven by growing market demands for improved fuel economy, lower emissions, reduced power-train wear, and improved durability of critical vehicle parts.

To enable their facilities to meet these demands, Russian lube makers need to commit to upgrading and reconstructing their lube-production technologies and units. Improvements should aim at the production of new generation lubes and meeting the growing world lubes demand.

The huge costs involved to use new technologies and processes in Russia are a myth. Many may estimate that an Isocracker would require more than $300 million in cash, that such a project would be the same as buying a new refinery, or that financing would be impossible.

Although it is not simple, costs look more reasonable and realistic after some evaluation. Here is a good example of how such a project could be developed.

Contrary to Russia, such other FSU countries as Turkmenistan or the Ukraine are looking for ways to upgrade lubes production and qualities. Azerbaijan, however, is most aggressively approaching the problem.

In Azerbaijan, there is an old Baku refinery called Azerneftiag. The plant used to be one of the largest lubes producers in the former USSR. In 1994-95, Azerneftiag commissioned two crude-distillation units, each with a 2-million tpy capacity. The two units failed to fractionate lube raffinate into narrow lube distillates because they were not designed for the change in crudes that the plant experienced.

Even some secondary processes were not able to upgrade charge from the new vacuum columns correctly, while other existing units hardly worked at all. As a result, lubes produced by the refinery did not meet minimum quality requirements and would not sell even in the home market.

Moreover, Azeri crudes are of naphthenic origin and unsuitable for high quality lubes production.

A feasibility study revealed that a retrofit of the refinery to use a modern lube production technology would make a reasonable return on investment-about 20%-within 4-5 years of implementation. Results of the feasibility study were enough to interest a consortium of international companies to invest in the project.

The study said that reconfiguring the refinery to accommodate Chevron's Isocracking and Isodewaxing technologies would produce very high VI mineral lube base oil neutrals that meet API Group II and III stocks typical properties.

The use of existing equipment minimized the project's total costs. Using vacuum gas oil as a feedstock for lube production extended the plant's flexibility and improved overall refinery economics.

In addition to very high VI lube base stocks of a new generation, a refinery revamp would produce several valuable byproducts: a high-quality naphtha, jet A-1, and a high-quality gas oil (sulfur below 0.02 wt %). All these products are badly needed in Azerbaijan and in neighboring countries as well.

The overall costs of the above project are $140-160 million, depending on the final configuration. In comparison, the upgrade of many Russian refineries would require much less investment, making a lube-oils modernization project still more attractive.

Acknowledgment

The authors thank Dr. Yakov Ruderman, director of Kortes Information & Analytical Centre, Moscow, and Prof. Eugene Khartukov, general director of the International Centre for Petroleum Business Studies, Moscow, for their support and expertise.

The authors-

Serguei A. Brezhenko is technical director of Solvalub Ltd. He has more than 20 years' experience working for Russian and international companies in the refining and petrochemical industry, lubricants production technologies, and project development. Brezhenko holds an MS in petrochemical engineering from the State Oil & Gas University, Moscow.

Vladimir M. Kachalov is a lecturer and consultant at the International Centre for Petroleum Business Studies. He has about 30 years' experience working for Russian and international companies in international crude oil trading, petroleum products, and lube oils, and projects development. Kachalov holds an MS in economics from the State Oil & Gas University, Moscow.