AGA: US natural gas prices will jump this winter

The American Gas Association has warned that US consumers could face significantly higher natural gas prices this winter.

An AGA report said the price of natural gas in the US spot and futures markets has increased significantly, and because some supplies are being purchased now and stored for winter use, prices will be higher.

The report noted several factors behind the higher prices. Low wellhead prices in 1998 and into 1999 reduced drilling for gas, said AGA. And, although rig counts are now above the levels of the same period last year, any additional supplies can't be brought on line in time to impact consumer bills this winter.

AGA said gas storage is significantly lower this year than at the same time last year but only somewhat lower than the average for the past 5 years. "All indications are that they will be up to targeted volumes by the onset of the winter."

It said US gas imports from Canada have grown over 100% in the last decade, currently accounting for about 13% of US gas consumption. Canadian imports are expected to continue to grow incrementally with US demand growth.

And AGA said US gas demand has increased at an average rate of 2.8%/year in all sectors in the last decade. It noted, "Relatively high oil prices have kept many factories and electricity generators from switching from natural gas to fuel oil."

Consumer impact

The AGA report noted weather is a paramount factor in residential gas heating bills.

"A return to normal weather [from the mild levels of the winter of 1999-2000], even if natural gas prices were unchanged from their relatively low levels last year, would increase consumers' heating bills. Consumers should expect significantly higher natural gas bills if the present increase in gas commodity prices combines with higher gas consumption due to colder [but normal] weather."

AGA said most utilities don't add any profit margin to the price they pay for each unit of gas, and the cost of gas amounts to about a third to half of a home heating bill. It said the rest of the bill is for transmission and distribution of gas, system maintenance, safety and inspection programs, customer service, metering, billing, and other costs.

It said consumers should not worry about daily changes in "spot" prices of gas. "Only a portion of all gas supplies [particularly during seasonal peaks] is purchased in the daily market. The majority of supplies are purchased under monthly, multimonth, or even multiyear contracts. Some prices in these agreements are tied to various indices, while others are fixed.

"Gas utilities use a portfolio approach for winter heating season and other gas purchases. Many companies employ a pricing strategy that includes a basket of indices from first-of-the-month to multimonth, fixed-price schedules.

"During the 1999-2000 winter heating season peak-day, companies in AGA's annual winter heating season survey indicated that over 90% of their gas purchases were made in a form other than daily spot purchases and were, therefore, not subjected directly to daily spot price volatility."

Production

AGA said that the US produces 87% of the gas it uses and imports about 13% from Canada. US gas production grew 9% from 1990 through yearend 1998 (to 18.7 tcf in 1998 from 17.2 tcf in 1990). Canadian imports grew 111% during the same period, from 1.4 tcf in 1990 to 3.1 tcf in 1998.

US Department of Energy data show gas production was down 1.1% in 1998 and down 0.3% in 1999, but in January through May of 2000, US gas output grew 0.7%.

AGA noted the Energy Information Administration has reported the average US wellhead price was below $2/Mcf for 9 months running (August 1998-April 1999), and by April 1999, rigs drilling for gas averaged only 371, while gas well completions totaled only 656 for that month (Fig. 1).

"Beginning May 1999, prices climbed above $2/Mcf and have been there since. In response to the wellhead price increase, gas exploration and production have improved dramatically," AGA said.

"By October 1999 [after about 5 months of gas prices above $2], more than 600 rigs were drilling for gas-more than a 60% increase from 5 months earlier-and have essentially remained at that level. Gas well completions also increased and have been greater than 1,000/month since October 1999 [a 30% increase]."

AGA said strong prices will encourage additional drilling, but due to a time lag between exploration and production, those supplies may not be available during the upcoming heating season.

Storage

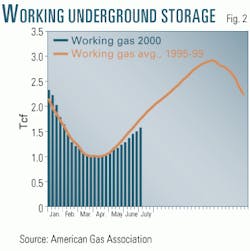

AGA said gas supplies in underground storage are only somewhat below the 5-year average for June (Fig. 2). It said working gas inventories as of June 23 were only 10% less than the 5-year average (1995-99).

It warned that a comparison of 1,567 bcf stored in June with 2,033 bcf in storage a year ago is misleading: "In 1999, storage levels in June were unusually high, due to the warmer-than-normal winter of 1998-1999 and unusually low early summer gas prices that encouraged purchases for injection. In fact, the storage level today exceeds the levels on this date in both 1996 and 1997."

AGA said working gas in storage during June exceeded the 5-year average for 10 of the first 15 weeks of 2000.

"However, early season injection rates are beginning to trail the 6-year average, according to the American Gas Storage Survey.

"It is too early to tell what impact storage injection requirements, summer electric generation load, production deliverability, and commodity prices will have on summer underground storage refill," said AGA.

In previous years, the eastern US (the most heating-load-sensitive region) has ended the winter heating season with storage as little as 9% full (April 1996) and as high as 31% full (April 1999).

"In every case and under significantly different price and demand conditions, summer injections have resulted in working gas levels that were 95-99% full by November, the traditional start of the winter heating season."