World oil demand rises despite higher prices as production struggles

World consumption of crude oil and natural gas is up, and production is struggling to keep pace with it. As usual the fundamentals of supply and demand are driving the petroleum market.

Demand for petroleum products will escalate this year in spite of rising prices. Gasoline demand will hardly be stifled as US economic expansion lives on.

US crude oil production will continue to decline, creating greater dependence on imports of crude and products. Inventories of crude oil will have a chance to build slightly by yearend as additional supply enters the market primarily from members of the Organization of Petroleum Exporting Countries (OPEC).

Since the first quarter of this year the market has reversed from favoring the depletion of crude inventories, and entered a period of mild contango, or one providing forward price incentive to build stocks.

International market

Worldwide demand for petroleum products was up during the first half of 2000 from the same period of 1999.

While demand in countries of the Organisation for Economic Cooperation & Development (OECD) remained relatively stable, demand in non-OECD Asian countries recorded gains.

According to the International Energy Agency, total worldwide demand for petroleum products increased to 75 million b/d during the first half of 2000 from 74.4 million b/d for the same period last year.

The rise in demand for petroleum products in non-OECD countries can be attributed to China and other Asian countries. These countries had a rise in demand of 600,000 b/d during the first half of 2000.

Year-on-year, first half petroleum demand in North America was unchanged at 23.5 million b/d. Demand in OECD European countries dipped by 200,000 b/d to 14.9 million b/d and in the Pacific countries moved up 50,000 b/d.

Demand in China, bolstered by greater economic strength and heightened petrochemical production, increased by 450,000 b/d to 4.9 million b/d during the first half, and demand in other non-OECD Asian countries moved up 150,000 b/d to 7.25 million b/d.

Non-OECD Europe and the countries of the Former Soviet Union had a decrease in demand of 50,000 b/d, the same as the boost in demand in Africa, Latin America, and the Middle East.

World production of crude oil and natural gas liquids increased by an average 1.75 million b/d for the first half to 75.9 million b/d.

OECD supply averaged 21.2 million b/d in the first six months of 1999. For the same period this year output was up 4.3% to 22.15 million b/d. The European countries contributed most to this lift in supply with production moving up to 7 million b/d vs. 6.65 million b/d a year earlier. Average production was up 300,000 b/d for each of North America and the Pacific countries.

OPEC oil ministers, at the March 2000 meeting in Vienna, hiked official production quotas 6.9% to 24.69 million b/d. When this increase failed to keep crude prices in a target range of $22 to $28/bbl, they imposed another 3% quota increase in June. Crude prices barely flinched at this hike as quota cheating already had production above the new limit of 25.4 million b/d.

On June 30-shortly after this forecast was completed-Saudi Arabia announced a unilateral decision to boost its crude output by another 500,000 b/d.

Total OPEC production, including natural gas liquids, edged up by an average of only 200,000 b/d for the first half to 30.05 million b/d. Most of the change was in the amount of crude supplied, as production of NGL and condensate was up only 50,000 b/d to 2.85 million b/d. OPEC crude production for the first half of this year averaged 27.2 million b/d.

Elsewhere, output from the FSU moved up the most, jumping 350,000 b/d on average for the first half of 2000.

Stock draws averaged an estimated 800,000 b/d for all of 1999.

Stocks were further run down an average 400,000 b/d during the first quarter of this year as OPEC production was excessively constrained. Subsequently, refiners were forced to replenish inventories, bidding up the price of crude. During the second quarter, stocks were replaced at a rate of 2.2 million b/d.

OGJ estimates that world stocks will continue to grow 200,000 b/d during the third quarter of 2000, then will decline 1.1 million b/d during the fourth quarter.

Worldwide outlook

A year ago the petroleum industry was hoping that an increase in worldwide demand would help to drain hefty stocks and that OPEC production restraint would hold.

This year the world is short of crude oil and OPEC must export more.

IEA projects that there will be a 1.3 million b/d increase in worldwide demand for oil this year to an average 76.2 million b/d. In the fourth quarter demand is expected to reach 78.4 million b/d, up 2 million b/d from the fourth quarter last year.

According to IEA, oil demand in OECD countries will edge up to 48.1 million b/d, an increase of 600,000 b/d from 1999. This additional demand will be equally distributed among North America, Europe, and the Pacific countries.

Demand in non-OECD countries is expected to jump 700,000 b/d from 1999 to an average of 28.1 million b/d. The most significant changes will be in Asia, continuing to recover from the 1997-98 economic crisis. Non-OECD Asian countries including China will demand 600,000 b/d more than last year, with consumption averaging 12.1 million b/d.

IEA expects total non-OPEC liquids production to average 45.9 million b/d for 2000, up from 44.6 million b/d in 1999. It expects OECD supply of 22.2 million b/d, a rise from 21.6 million b/d last year. Fourth quarter OECD supply is projected to reach 22.6 million b/d.

OPEC's new production quota of 25.4 million b/d is well below its first quarter 2000 production-26.5 million b/d of crude. As total demand builds in the second half of the year, there will be a call on OPEC to raise output further.

OGJ estimates put second quarter OPEC production at 30.8 million b/d and project second half 2000 production will rise to 30.9 million b/d.

Total OPEC production for 1999 averaged 29.4 million b/d.

Crude oil prices

World export crude oil prices for the first half of 2000 surged to an average of $26.33/bbl from $12.97/bbl in the first half of 1999 and $12.39/bbl in first half 1998. The average price in February this year was $26.94/bbl vs. $9.87/bbl for February last year. This was before OPEC's 1999 production cut.

The world export price moved up to $27.05/bbl in March 2000, and in response to OPEC raising production quotas for the first time this year, the average price in April decreased to $23.22/bbl. The average price for May jumped again to average $26.82/bbl as inventories were severely drawn down and new production was insufficient to meet demand.

On the New York Mercantile Exchange (NYMEX), the near-month futures price for light sweet crude oil averaged $26.98/bbl in January, climbed to $29.14/bbl for February, then reached $29.93/bbl for March before heading back down to average $25.58/bbl in April. Tight supplies sent the May average back up to $28.72/bbl.

For the first half of the year the NYMEX price averaged $28.61/bbl, compared with $15.24/bbl for the first half a year earlier and $15.34 for first half 1998.

The posted price for West Texas Intermediate (WTI) crude oil averaged an estimated $26.83/bbl for the first half of this year, compared with $14.08/bbl in first half 1999.

OGJ projects an average US wellhead price of $25.20/bbl for 2000. The average wellhead price for 1999 was $15.56/bbl and for 1998 was $10.87/bbl. The average wellhead price is a broader measure of all crude oil prices in the US and is typically pulled down by the low price of Alaskan crude oil.

Product prices

Just as crude oil prices are significantly higher than their year-ago levels, so are product prices.

According to the OGJ survey of self-service unleaded motor gasoline pump prices, the average price for the first half of 2000 was $1.465/gal, up from $1.065/gal over the same period last year. When all federal, state, and local taxes are excluded, the price was $1.062/gal, up from 66.6¢/gal a year earlier.

Federal, state, and local gasoline taxes averaged 40.3¢/gal for the first half of 2000, up from 39.9¢/gal over the same period a year ago.

OGJ is projecting that the US pump price for all grades of motor gasoline will average $1.54/gal for 2000, up from $1.221/gal for 1999. Previously, the peak for annual average pump price for motor gasoline was $1.353/gal in 1981.

The refiner's acquisition cost of crude is expected to be up to an average of $27.30/bbl for 2000 from $17.47/bbl for 1999.

Residential heating oil prices are expected to swell this year to $1.20/gal. The 1999 average price was 87.6¢/gal, up from 85.2¢/gal in 1998 but below the 1997 average of 98.4¢/gal.

Natural gas prices

A tight natural gas market is pushing prices to record highs.

Expectations of both continued low inventory levels through the year and a normal upcoming winter heating season drove NYMEX natural gas for December 2000 delivery to close as high as $4.62/MMbtu last month. A warmer than normal summer will minimize additions to inventories prior to winter.

With natural gas demand growth outpacing production growth, the NYMEX futures price for natural gas averaged an estimated $3.11/MMbtu for first half 2000, compared with $2.02/MMbtu in the first half last year. In June this year the NYMEX price averaged $4.30/MMbtu vs. $2.35/MMbtu in June 1999.

Spot natural gas prices averaged $2.90/MMbtu for the first half of 2000, up from $1.88/MMbtu for the first half of 1999. The average price in January was $2.28/MMbtu and by May averaged $2.99/MMbtu.

The average US wellhead price for February 2000, the latest wellhead data available, was $2.30/Mcf compared with $1.73/Mcf for February 1999 and $2.00/Mcf a year earlier.

The average annual wellhead price for natural gas peaked at $2.66/Mcf in 1984. Strong demand in 1997 sent the average annual wellhead price to a recent high of $2.32/Mcf. That year, electric utilities turned to natural gas to fill the void created when nuclear power output dropped. This is expected to be a factor driving demand for natural gas in 2000 as well.

OGJ expects that prices will continue to climb throughout 2000 and average $3.10/Mcf for the year compared with $2.07/Mcf for 1999.

US economy

The US economy has been expanding slowly but steadily during the past decade.

To rein in this economic expansion before inflation could get out of hand, the Federal Reserve Board began increasing interest rates a year ago. After imposing a string of four quarter-point raises over a period of 8 months, the Fed raised the discount rate by half a point this past May.

A sign that the torrid US economy may be starting to cool is the slight jump in the unemployment rate. The unemployment rate peaked at 7.8% in June 1993 and has since sustained a steady slide, reaching an historic low of 3.9% in April 2000. However, the rate then increased to 4.1% in May, indicating that the economy is slowing a bit.

Gross domestic product (GDP), the total amount of goods and services produced by people, businesses, governments, and property located in the US, increased 4.3% in 1998 and 4.2% in 1999.

OGJ expects that the 2000 GDP will be up 4.3% from the 1999 level. During the first quarter of this year GDP climbed 5.4%.

Industrial production is expected to increase 2.9% this year following a 2.6% rise in 1999 and a 5.4% boost in 1998.

New car and truck sales are projected to be 16.9 million units in 2000, compared with 16.8 million in 1999 and 15.4 million in 1998.

Housing starts are expected to fall to 1.61 million units this year from 1.68 million in 1999.

US energy demand

The growth rate of US energy consumption will not keep pace with the general economy, mainly due to higher oil and gas prices.

Total US energy consumption is projected to grow 1.2% following an increase of 1.4% last year. Energy consumption will reach 93.63 quadrillion btu (quads) in 2000, up from 92.5 quads in 1999 and 91.2 quads in 1998.

Since a short recession in 1990 and 1991 that led to a decline in energy consumption, there has been a steady rise in economic growth-averaging 3.1%/year-that has caused energy consumption to rise at a rate of 1.6%/year.

Energy consumption efficiency, the amount of energy consumed per dollar of GDP, has improved gradually since 1970. Measured in 1996 dollars, energy consumption efficiency in 1999 improved to 10,500 btu/$, 47% better than the 1970 level of 19,800 btu/$ of GDP.

OGJ forecasts that energy consumption per unit of GDP will decline to 10,200 btu/$ in 2000.

Energy sources

Petroleum and natural gas will dominate the energy market in 2000 with a combined share of 64.9%. The market share for these two fuels peaked in 1972 at 77.7%.

Oil energy demand is expected to increase this year by only 1% to 38.1 quads. Use of energy from oil increased 2.1% in 1999. Oil's share of the total energy consumed in the US will be 40.7%, down from 40.8% last year.

In 1998, oil comprised 40.5% of energy consumption at 36.9 quads. Oil consumption peaked in 1978 when the market share reached 48.6%.

The energy source that will show the largest increase in demand in 2000 is natural gas, which OGJ projects will jump 2.8% to 22.65 quads. This compares with an increase of just 0.5% last year when winter weather was warmer than normal.

Growth in the electric power industry is being fueled by natural gas, which will comprise 24.2% of energy demand in the US this year. This is up from a 23.8% share of the energy market in 1999.

Higher demand for utilities will also drive up demand for coal this year, though the increase will not be as much as for natural gas. Demand for coal is expected to rise 1.6% to 21.91 quads from 21.56 quads is both 1998 and 1999.

Coal's share of total energy demand will be 23.4% in 2000, rising only 0.1% from last year. In 1998 coal held 23.6% of the US energy market.

Demand for nuclear energy is projected to fall 4.3% this year to 7.4 quads. Just last year nuclear demand increased by 8.1% to 7.735 quads. The reason for this year's dip in demand is the decline in utilization rates.

Capacity utilization for nuclear power plants reached a record high of 85.5% in 1999. This topped the previous record set in 1998 at 78.2%. During 2000, planned outages at many plants for maintenance, refueling, and repairs will drive down nuclear power generation to 7.9% of the energy market compared with 8.4% in 1999.

The number of operable nuclear generating units in the US has held steady at 104 since July 1998 after peaking at 112 in 1990. As growth in nuclear power generation ceases, the power industry will turn even more toward natural gas and coal as sources for fuel.

Energy from hydroelectric and other energy sources is expected to increase 2.4% this year to 3.57 quads following a drop of 4.5% in 1999. Hydroelectric generation is highly dependent upon weather and as a result does not have potential for growth. The market share for hydroelectric and other energy sources in 2000 is projected to remain at 3.8%, the same as last year but off from 4% in 1998.

Natural gas market

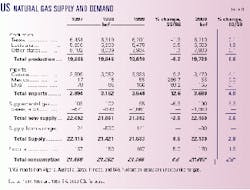

OGJ projects that demand for natural gas in the US will increase 2.8% this year to 21.96 tcf due to a return to normal weather, the strong economy, and the decrease in use of nuclear plants for electricity generation.

This substantial demand growth follows a mere 0.5% rise in natural gas demand in 1999 when the US experienced a warmer than normal winter and lower oil prices made fuel switching less attractive. The mild weather limited consumption in the residential, commercial, and industrial sectors. Total demand for natural gas in 1999 was 21.366 tcf.

Natural gas consumption has dipped in the years since it hit its recent high of 21.966 tcf in 1996, falling to 21.262 tcf in 1998. The record high for natural gas demand was set in 1972 at 22.101 tcf.

Continued economic growth and the low price of natural gas relative to crude oil drive up demand for natural gas. As the price of crude oil remains high this summer, the utility sector is switching to the use of more natural gas for electricity generation.

For the first quarter of this year, electric utilities consumed 567 bcf of natural gas compared with 529 bcf for the same period the year before. In total, electric utilities consumed 3.113 tcf of natural gas last year, down 4.45% from 3.258 tcf in 1998.

According to the Energy Information Administration (EIA), the average price of natural gas delivered to electric utilities was $2.78/tcf in 1997, $2.40/tcf in 1998, and $2.56/tcf in 1999. Meanwhile, residential consumers paid an average of $6.94/tcf of natural gas in 1997, $6.82/tcf in 1998, and $6.60/tcf in 1999.

However, natural gas futures and spot prices during the first half of this year have averaged more than 30% higher than last year.

Residential natural gas consumption was up to 4.666 tcf in 1999 from 4.52 tcf the previous year, and will be up again in 2000.

Commercial consumption also moved up in 1999 to 3.067 tcf from 2.999 tcf in 1998, but industrial use fell in 1999 to 8.653 tcf from 8.686 tcf a year earlier. Industrial sector consumption includes non-utility, gas-fired power generation.

US marketed production of natural gas is expected to rise 0.6% to 19.72 tcf in 2000. This follows a 0.2% decline in production in 1999. US natural gas production peaked in 1972 at 22.648 tcf and hit a recent low in 1986 at 16.859 tcf.

Growth in imports will slow significantly in 2000. Imports of natural gas via pipeline from Canada are expected to expand this year to 3.47 bcf, up 4.1% compared with a 9.2% increase in 1999. Pipeline imports from Mexico will be unchanged this year at 55 bcf.

LNG imports from Algeria, Australia, Qatar, Trinidad, and the United Arab Emirates will increase this year also, although not by as great a margin as last year. Total imports of LNG are expected to be 165 bcf. This compares with 85 bcf in 1998 and 160 bcf in 1999.

US petroleum demand

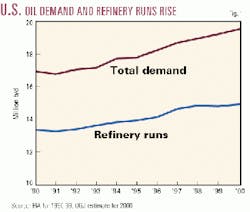

US demand for petroleum products in the first half of 2000 were up 1% from the same period last year, to an average 19.25 million b/d.

Products that showed increases in demand were motor gasoline, jet fuel, LPG and ethane, and distillate.

Demand for resid and all other petroleum products fell from the first half of last year.

OGJ forecasts that second half 2000 demand for all petroleum products will average 19.9 million b/d.

US demand for petroleum products is expected to average a record high 19.58 million b/d for the entire year, a 1% increase over 1999. This will be the 9th consecutive year of increased petroleum product consumption.

Motor gasoline demand

Demand for motor gasoline in the first half of this year was up 1.5% from a year earlier, averaging 8.318 million b/d. OGJ estimates that demand for mogas will continue to grow despite high prices. Total demand for 2000 will be 1.3% higher than in 1999.

The push on stocks of motor gasoline is driving its price up, but the strong economy and the public's desire to drive sport utility vehicles and minivans is keeping consumption strong. Growth in demand will be moderated but not stifled by higher prices this year.

More miles are being driven this year as the population grows and more cars are on the road. Further, urban sprawl adds miles to the average commute.

In 1998, the number of miles driven per vehicle averaged 11,725, up from 11,581 in 1997.

Fuel efficiency gains have slowed in recent years. In 1993 the fuel rate-the number of miles driven per gallon of fuel burned-averaged 17.4 for vans, pickup trucks, and SUVs, according to EIA. By 1998 the average had dropped to 17.1

For passenger cars, the fuel rate peaked at 21.5 in 1997 and dipped to 21.4 in 1998. When the fuel efficiency of large trucks is factored into the mix, the fuel rate for all motor vehicles has slowly but steadily improved in recent years, up to 17 in 1998 from 16.7 in 1993.

Distillate

Demand for distillate fuel oil increased more than any other petroleum product during the first half of this year, up 6.2% compared with the same period last year. The total volume of distillate demand for the first 6 months of 2000 was 3.735 million b/d.

OGJ projects that 2000 distillate demand will exceed 1999 demand by 2.4%.

Strong demand for distillate is driven by a strong economy as well as by weather conditions. The prosperous economy creates the need for more trucking, thereby increasing demand for diesel. More home heating oil will be needed should weather revert back to normal after a warmer than usual period.

The increase in demand for distillate will be tempered by attempts to be more efficient in light of higher prices. OGJ expects that distillate demand will be below 1999 levels during the third and fourth quarters of 2000, averaging 3.63 million b/d for the year.

Jet fuel

Jet fuel demand rose slightly during the first half of 2000 but is expected to swell during the remainder of the year.

Business travel is getting a boost from the strength of the general economy, as is leisure travel since more discretionary income remains to be spent.

The quest for larger profits may call for greater fuel efficiency, but more than curtailing demand, airlines commonly pass along high costs for jet fuel to the consumer.

Demand for jet fuel was up 0.1% for first half 2000 and will climb 2.6% and 2.7% in the third and fourth quarters to average an increase of 1.3% for this year as compared with last year. Average jet fuel demand is expected to hit 1.69 million b/d for 2000.

Residual fuel oil

Residual fuel oil demand has experienced a downward trend for two decades as refiners have found ways to better produce lighter products that are both more profitable and environmentally sensitive.

OGJ forecasts that demand for resid will drop 7% for all of 2000, already having plunged 14% during the first half of the year.

Fuel switching occurs in the electric utility and heavy manufacturing industries when the cost of resid rises. Natural gas has taken up the slack in demand for resid recently. According to the Bureau of Labor Statistics, resid prices were up 56% last year, while natural gas prices were up 30%. This price trend has reversed, however, and as a result demand for resid will pick up in fourth quarter 2000 as its price becomes more attractive in comparison to natural gas.

The peak for resid demand was 3.071 million b/d in 1977. This year demand is expected to average 770,000 b/d.

LPG, other products

Demand for LPG and ethane averaged 2.117 million b/d in the first half of 2000, a gain of 0.3% over the same period in 1999. For the year, LPG and ethane demand is projected at 2.2 million b/d, up 0.7% from last year's average. Demand for these products will be strongest during the third quarter of the year with a 1.2% increase over the third quarter of 1999.

Increased use of petrochemical feedstocks as a result of general economic growth has helped boost demand for LPG, which sank to 1.952 million b/d in 1998 from 2.038 million b/d in 1997, then rebounded to 2.185 million b/d in 1999.

Demand for all other petroleum products is expected to rise 0.5% for 2000, after posting a 1.2% decline during the first half of the year vs. the same period last year. This group of products includes lubes, asphalt, still gas, and petroleum coke, among others. These products are in greater demand when there is more economic activity, including increased construction activity, greater spending on highways, and more driving and industrial activity.

US petroleum supply

Although oil prices began their sharp recovery from 1998's lows before that year was through, US production has not followed suit.

For the 14th consecutive year, US petroleum and condensate production declined in 1999. Output slipped 5.2% in 1999 to average 5.925 million b/d, down from 1998 production of 6.252 million b/d.

Much of the slide in US production can be attributed to the decline in crude and condensate being produced in Alaska. For 1999, Alaskan output, which hit a high of 2.017 million b/d in 1988, averaged just over 1 million b/d, down 10.6% from the 1998 level.

During a period of higher prices, more efforts can be made to buoy production in the lower 48 where there are more secondary recovery projects and fewer environmental issues than in Alaska. Nonetheless, there will be a modest continued decline in output this year as total US production of crude and condensate falls 1.3% from last year's level to 5.85 million b/d.

During the first half of this year Alaskan production was off an average 71,000 b/d, or 6.5%, from the same period last year. Meanwhile, lower 48 production grew by 32,000 b/d for the first half of 2000 compared with 1999.

US production of natural gas liquids and other hydrocarbons increased significantly in the first half of 2000, up 11.3% to an average 2.38 million b/d.

While NGL prices have been up there has been incentive for producers to invest more effort into extract a larger volume of liquids from the existing gas supply. Since 1993 this product category has included oxygenate production from methyl tertiary butyl ether (MTBE) plants, with output tied to motor gasoline demand.

OGJ projects that since NGL prices are not expected to increase further, production of NGL and other liquids will moderate in the third and fourth quarters of the year to finish with a 3.7% gain over 1999 production and an average 2.3 million b/d for 2000.

Total liquids production for the US is projected to hold relatively steady in 2000, averaging 8.15 million b/d compared with 8.144 million b/d in 1999. Total liquids production in 2000 will be down 23.4% from the recent high of 10.636 million b/d in 1985.

Refining

Reversing a downward trend throughout the 1980s and early 1990s that drove capacity to 15.143 million b/d in 1993, operable refining capacity has since increased at a steady pace as the result of rising demand.

Capacity is expected to reach an average of 16.6 million b/d this year vs. 16.282 million b/d last year.

Increased demand for refined products, historically low refiner-held stock levels, and a shortage of new crude supplies on the market have combined to drive up refiner costs in 2000.

Refiners' acquisition cost of crude jumped to $17.47/bbl in 1999 from $12.52/bbl in 1997. OGJ projects that the average cost of crude to refiners will surge to $27.30/bbl for 2000.

Utilization rates rose in the second quarter of this year in order not only to meet demand but also to boost margins.

The start of the summer driving season and a desire to build depleted inventories pushed US refinery utilization to 94.2% in May 2000, up from 93.7% a year earlier. According to API, May gasoline production set an all-time record.

For the first 6 months of 2000, the refinery utilization rate was 91.2%.

OGJ expects that the refinery utilization rate will be 91.7% for the year 2000. This is still lower than the 1999 rate of 92.6% because more than 300,000 b/d of capacity was added between the two periods.

High utilization rates and improved margins encourage refiners to add capacity. It is expected that total refining capacity in the fourth quarter of 2000 will average 16.7 million b/d.

In 1998 the average refining utilization rate rose to 95.6%, nearly full sustainable capacity as some excess is required for maintenance downtime and contingencies.

Crude input to refineries is expected to be up 1% this year to average 14.95 million b/d. Total input to distillation units will also increase 1% to 15.23 million b/d.

Imports

Total US imports will reach record high levels in 2000 for the 5th consecutive year. Driving this trend are increased demand, depleted stocks, and decreased domestic production.

In the first half of the year, total imports rose 0.5% to 10.69 million b/d. While imports of products and unfinished oils were up 6%, imports of crude were off 0.8%. Crude inventories were already low and were drawn even lower because OPEC was exporting too little oil to meet demand.

More significant increases in imports are anticipated for both the third and fourth quarters, lifting total imports 6.2% on the year.

Third quarter crude imports will be 11.5% higher than last year, but will be 17.4% higher, at 9.66 million b/d, in the fourth quarter vs. the same period last year as refiners boost stocks to meet winter demand. For all of 2000, the US will import 6.7% more crude than during 1999, an increase of 578,000 b/d.

Crude imports dipped to a low of 4.949 million b/d in 1985 due to increased domestic production coupled with a decline in product demand, both related to sharply higher crude oil prices in the early 1980s.

No crude has been imported for the Strategic Petroleum Reserve (SPR) since 1994. Any additions have been supplied by domestic production. During 1999 the US Department of Energy took royalty in kind payments from Outer Continental Shelf leases in the Gulf of Mexico to add to the SPR.

There are currently 569 million bbl of crude in the SPR including non-US stocks held under foreign or commercial storage agreements. OGJ anticipates only minor additions to the amount of crude held in the SPR this year.

DOE authorized a 1 million bbl draw from SPR late in the second quarter to relieve a crude supply interruption to two Louisiana refineries.

Last year 54.4% of total domestic demand was met by imports. That figure is expected to climb to 57.2% this year as demand outpaces domestic production.

Saudi Arabia was the leading source of US crude imports during the first quarter of 2000, supplying 1.399 million b/d, 17.1% of the total. Canada was the second largest exporter to the US with 1.247 million b/d supplied, 15.3% of the total. Next was Mexico, which supplied 1.216 million b/d, then Venezuela with 1.147 million b/d supplied.

Because of higher prices, third quarter imports of products and unfinished oils will be 4.8% lower from 1999, but 8.9% higher for the fourth quarter due to pressures from demand. Product demand for 2000 will be 3.9% higher than for 1999.

The leading source of US products imports during the first quarter of this year was Canada at 408,000 b/d. Venezuela was second with 330,000 b/d, followed by the refineries in the Virgin Islands with 257,000 b/d and Algeria with 193,000 b/d.

During the first quarter of 2000, 44.5% of total US imports came from OPEC, an average of 4.592 million b/d.

Stocks

Total industry stocks approached minimum operating levels in 1996, when yearend stocks plunged to 941 million bbl. Following interim gains, stocks had fallen even lower to 919 million bbl at yearend 1999.

The low inventory at yearend 1999 left little room for withdrawals to meet demand in the first half of 2000. This is the force currently pressuring oil prices upward.

In 1997 and 1998 total industry stocks of crude oil and products were up sharply and became a large factor causing weakness in crude oil prices.

With OPEC limiting a quota increase to 3% at the June meeting-after a 7% increase in March 2000 failed to supply enough crude and lower prices-it is unlikely that stocks will build appreciably this year.

OGJ projects yearend 2000 stocks will total 930 million bbl.

Crude oil stocks excluding the SPR are expected to finish the year at 290 million bbl, up 6% from yearend 1999. By the end of the first half of 2000, OGJ estimates crude stocks up a bit to 300 million bbl.

Product stocks will grow 0.8% this year to settle at 640 million bbl compared with 635 million bbl last year. For the first half of 2000, product stocks were 14.1% lower versus first half 1999. Especially hard hit were stocks of distillate and residual fuel oil.

At yearend 1999 total industry stocks represented an all-time low of 47.4 days of supply at the 1999 level of domestic demand. This is drastically reduced from yearend 1998 when stocks afforded 57.6 days of forward cover.

This year's small increase in the stock level and the even smaller increase in demand will put yearend 2000 stocks at 47.5 days of supply.

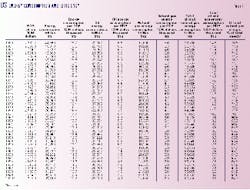

Click here to view OGJ Forecast of US supply and demandThis survey is in PDF format and will open in a new window