OGJ Newsletter

Market Movement

OPEC disarray sparks price swings

Oil prices have been seesawing wildly amid OPEC disarray. The group has been sending markets decidedly mixed signals the past few weeks, as futures prices routinely jumped or plunged by as much as $1/bbl at various times last week in response to confusion over whether another OPEC production increase was truly imminent.

After falling early last week in response to the rest of OPEC apparently following Saudi Arabia's lead in backing a 500,000 b/d production increase (see related story, p. 31), markets were startled by reports that OPEC would not, after all, proceed with an output boost because the OPEC crude-basket price had fallen below the agreed price-band trigger of $28/bbl.

But that price-barrier penetration was slight and brief. Just a day after the latter OPEC announcement was made, boosting NYMEX crude by $1.11, fresh reports were emanating from Riyadh that the Saudis were, in fact, insistent upon the production increase irrespective of what the rest of OPEC does. That sank NYMEX crude again. The resulting drop in prices also triggered some technical selling.

The August NYMEX crude contract fell 52¢ to $31.52/bbl July 19, while the September contract dropped 29¢ to $30.35/bbl. Both contracts continued to decline in after-hours trading, to $31.15/ bbl and $30.15/bbl, respectively. In London, IPE speculation over increased Saudi production resulted in nervous selling. The September Brent contract dropped 44¢ to close at $28.88/bbl.

However, traders say the market remains technically and fundamentally firm. They say additional substantial declines in futures prices are unlikely, unless there is a significant increase in oil production.

API: US gasoline supplies still tight

Although prices of gasoline in the upper Midwest have returned to normal levels, supplies remain tight across the US, API warns.

API Pres. Red Cavaney says US tax, regulatory, and lands access policies have "allowed our energy infrastructure to lag behind economic growth. The capacity that industry has now is very close to aggregate demand." For instance, Cavaney said refinery utilization is 99% on the East Coast and 98% in the Midwest. Overall, US refinery utilization is 95%.

US first half review

In the first half, says API, higher product prices contributed to the first drop in US petroleum deliveries in 5 years.

"The more-expensive crude oil imports of 8.568 million b/d declined nearly 3% compared to the first half of 1999," said API. "Still, the US remained heavily reliant on foreign oil, which amounted to 56% of domestic needs, near the all-time high of 57% set in 1998." API notes that, for the first time in 5 years, first-half US petroleum deliveries dropped about 1% vs. first half 1999. Total deliveries last month of 19.156 million b/d were 3.4% lower than in June 1999.

It says higher prices also affected June gasoline deliveries, which dropped 3.9% to 8.536 million b/d last month vs. June 1999. But the easing of transitional reformulated gasoline supply problems in the upper Midwest pushed retail prices down.

API warns, however, that actual June deliveries "may not be a reliable measure of the impact of higher prices on actual consumption, which we believe could turn out to be a bit less" than the nearly 4% June decrease.

US June deliveries of high-sulfur distillate fuel jumped 13.3% to 1.011 million b/d vs. June 1999. Total distillate deliveries in the first 6 months were 2.5% above last year.

Offshore drilling continues to gain

Offshore drilling activity is showing considerable gains, especially vs. a year ago.

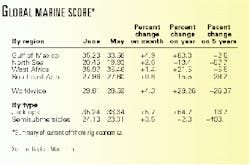

Global Marine's worldwide summary of current offshore rig economics (SCORE) was up 4.3% for June to 29.8% vs. 28.6% in May. Global Marine's SCORE compares profitability of current mobile offshore drilling rig rates with that of the 1980-81 peak of the offshore drilling cycle .

The boost in worldwide SCORE activity, says Global Marine CEO Bob Rose, was fueled by activity in the Gulf of Mexico.

The June SCORE was up 28.3% from a year ago but down 26.4% from 5 years ago (see table).

null

null

null

Industry Trends

The ability to find oil and gas supplies in a tightening market is among the chief concerns of US independent producers, says new IPAA Pres. Barry Russell. Russell said, "As energy markets tighten, we must have access to where that supply is, whether offshore or on public lands onshore. So environmental tradeoffs are one of the big things we're dealing with these days. The natural gas market is predicted to grow 30% over the next 20 years, and industry needs access to those public lands."

Industry's access to capital also is a concern, says Russell. "We believe that some selected tax incentives-the expensing of geological and geophysical costs, the expensing of delay rental payments, marginal well tax credits-would allow us to go forward and revitalize the industry.

"The oil industry is one of the nation's most important industries, in terms of driving the economy, but the industry is very vulnerable to pricing and production decisions by foreign governments. We think that a revitalization of the industry would allow it to respond to price problems and spikes in a more efficient and effective way," he said.

Russell also cites US energy security concerns: "Independents collectively produce as much oil as [the US] import[s] from Saudi Arabia. That's always a surprise to people. We try to explain to policy-makers and the public the importance of domestic oil production, yet our nation's level of dependence on imported oil keeps increasing," he warned.

Sharply increased spending by major oil firms will be a near-term boon for the oil service industry-especially offshore drilling contractors (see Mid- year Forecast, p. 74).

BP Amoco will increase E&P spending to $8 billion in 2001 from $6 billion this year. That is only the first of several similar increases by big producers that should serve as a catalyst for oil service stocks, analysts say.

The BP Amoco announcement signals a "long-anticipated ramp-up in spending following a 2-year period of cost-cutting and stagnant production by the majors," said Dain Rauscher Wessels. "It suggests a longer-term, multiyear cycle of sustained spending at increased levels."

Simmons & Co. hiked its projection of increased E&P spending to 20% from 15% previously forecast, as majors pour an extra $30 billion into worldwide drilling activity next year. "The current oil service environment is going to get a lot better. And it's going to improve relatively quickly in the next few months, perhaps the next couple of weeks," Simmons said.

Pickering says investors face their last chance to buy up key oil service stocks at a discount as those companies begin a run that will extend "over the next several years."

The newly enlarged BP Amoco group is to increase total capital spending to an average $13.5 billion/year for the next 3 years vs. $12 billion/year spent in 1997-99 by the combined predecessor firms. The focus is on projects profitable at an average oil price of $16/bbl, vs. a previous assumption of $14/bbl.

Government Developments

Will Mexico's newly elected government lead to the liberalization of its energy sector (see Watching Government, p. 36)?

Despite the slim likelihood of privatizing any part of behemoth Pemex-a source of about 30% of Mexico's national budget-once taking office as president Dec. 1, Vicente Fox Quesada should at the very least revamp the state firm's tax structure, says George Grayson, a specialist on Mexican politics.

Writing in the Houston Chronicle, Grayson said that the government should re- quire Pemex to "pay specified taxes and royalties, but allow it to retain (and use as it sees fit) that portion of its revenue not consumed by these levies."

Meanwhile, Moody's has given Pemex Project Funding Master Trust-an off-budget financing vehicle for its most important projects-a favorable rating of Baa3, reflecting Pemex's reserves base, role in Mexico's economy, and position as a leading exporter of oil to the US.

The US Senate voted early last week to create a 2 million bbl heating oil reserve in the US Northeast.

It amended the interior appropriations bill to provide for the distillate stockpile. The House has authorized creation of a permanent reserve, without appropriating funds. A House-Senate conference committee now will merge the two versions.

Pres. Clinton recently ordered DOE to establish a temporary heating oil reserve (see editorial, p. 25, and OGJ, July 17, 2000, p. 26). DOE will advertise for bids to fill that stockpile by exchanging SPR crude for distillate and tankage in the Northeast, by Nov. 1.

DOE says the reserve would be located at no more than four sites in the Northeast. It contends a 2 million bbl reserve will provide regional relief from weather-related shortages for about 10 days, the time needed for ships to bring heating oil from Gulf Coast refineries to New York harbor.

The US House Energy and Mineral Resources Subcommittee approved a resolution to cite three Project on Government Oversight (POGO) officials for contempt of Congress.

POGO Executive Director Danielle Brian, Assistant Executive Director Keith Rutter, and former Chairman Henry Banta had declined to answer the subcommittee's questions about POGO's payments of $383,600 each to two federal employees involved in oil policy.

MMS was considering oil royalty rule changes at the time of the payments, and the subcommittee questioned if the payments were a conflict of interest (OGJ, May 15, 2000, p. 31). POGO, a public advocacy group, made the payments from its share of a $1.2 million federal royalty lawsuit settlement. The House resources committee is expected to consider the contempt citation soon. If approved, it would be sent to the full House for a vote.

ALBERTA REGULATORS are to launch an expanded program to deal with the problem of orphan wells abandoned by companies no longer in existence.

The new program, to be administered by Alberta Energy and Utilities Board, will be broader and will include site reclamation and the abandonment of related facilities, such as pipelines, gas plants, batteries or compressor stations.

About 200 sites are planned for reclamation, and another 200 are being studied. Funds for the current program come from fees companies must pay before drilling. The industry has contributed $20 million (Can.) to the program since 1994 to clean up 300 improperly abandoned wells.

Quick Takes

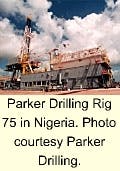

Drilling Action in Nigeria'S NIGER DELTA is taking an upward turn.

Parker Drilling says that its four drilling barges under contract in Nigeria have returned to work at full day rates. Operations in the Niger Delta were suspended in November due to civil unrest (OGJ, Nov. 8, 1999, Newsletter). Parker has retained a local firm to provide additional security for its crews and equipment under contract to Shell.

Rig 75, now on a 5-year contract, was completed last July and then mobilized to its first location but had not been able to start work due to security issues (see photo). Shell has hired this rig plus Rig 73, which is on a 3-year contract expiring in 2002, and Rig 72, which is on a 3-year contract expiring in 2001.

Parker's fourth barge rig, Rig 74, is working Chevron on a 2-year contract ending in 2001.

Elsewhere on the drilling front, Noble Drilling formed a 50-50 JV with Crosco Integrated Drilling & Well Services, a unit of Croatian state firm INA. The JV will upgrade, own, and operate the Panon, a jack up rated to 300 ft of water. Noble will manage the upgrade, marketing, and operation of the rig, while Crosco will provide key operations and technical personnel, including much of the rig crews. The rig will be upgraded from its current slot configuration to a cantilevered unit following its planned mobilization from the Mediterranean to the Persian Gulf. The rig is to be ready for work in early 2001, at which time the JV will pursue contract opportunities worldwide.

SULFER TAKES CENTER STAGE IN REFINING news this week.

Koch will soon begin production of a low-sulfur gasoline for markets served by its Corpus Christi refinery.

After investing about $28 million in the project, Koch says the new gasoline will have sulfur levels 50% lower than today's industry average. Koch will then invest more than $130 million more to achieve a 90% cut in sulfur levels in its gasoline by 2005, to meet anticipated US government requirements.

The ultralow-sulfur gasoline, with a targeted sulfur level of 150-160 ppm, is expected to be available in May 2001. According to US EPA's regulatory impact analysis, the current industry average sulfur content is 307 ppm.

The Koch refinery will supply this gasoline to the Austin, Corpus Christi, Waco, and San Antonio markets.

Meanwhile, Conoco will expand the sulfur recovery capacity of its Ponca City, Okla., refinery by 50% to reduce SO2 emissions and take advantage of less-expensive sour crude available to the refinery. Conoco will spend $22 million to install a new amine regeneration unit at the refinery. The project is a joint effort by Conoco and the adjacent Jupiter sulfur plant, owned by Tessenderlo Kerley, in which Conoco is a 50% JV partner. The Jupiter plant processes the sulfur recovered at Conoco's refinery and converts it to products for agricultural use. In recent months, Conoco has expanded its pipeline capacity to give the Ponca City plant access to less-expensive sour crude from Canada and the Gulf of Mexico. Canadian sour crude is being transported to Ponca City from Calgary via a pipeline Conoco recently converted to transport the crude.

A BIG SAUDI POLYOLEFINS EXPANSION IS IN TEST MODE.

SABIC affiliate Saudi Yanpet started up a 265,000 tonne/year HDPE unit, the first of two new units being added at its Yanbu complex.

SABIC expects a second unit of the same size to go on stream next month, bringing total Saudi Yanpet polyethylene output to about 1.5 million tonnes/year.

In other petrochemical action, Eastman Chemical selected Air Liquide America and Howe-Baker Engineers to design and construct, respectively, an air separation unit and a partial oxidation unit, comprising a partial oxidation plant, for its complex near Longview, Tex. The new plant, slated for completion in second quarter 2002, will replace Eastman's existing steam methane reformers. Air Liquide says the plant will thus reduce NOx emissions from existing plant processes by about 20%, or 900 tons/year, and be more energy-efficient.

Algerian fertilizer company Asmidal, Germany's Fritzwerder, and US-based Transammonia inked a deal to establish a JV ammonia plant in Algeria. The plant-to be built at Arzew, 450 km west of Algiers-is expected to produce about 1,850 tonnes/day of ammonia. The plant is to be operational within 3 years. The JV would have $100 million dollars in capital-50% controlled by Asmidal and 50% by its partners. Total investments for the project are estimated at $350 million. Equity in the project may be opened to Sonatrach as well as to other foreign firms.

BRAZIL WANTS FOREIGN INVESTMENT TO BOOST ITS OIL PRODUCTION.

Brazil's National Petroleum Agency (ANP) has set the bidding parameters for Petrobras's auction of 73 mature oil fields (OGJ Online, July 6, 2000).

ANP will require bidders to have at least 1 million real in net shareholders' equity, says ANP Executive Director David Zylberstajn. They also must have net shareholders' equity equal to one third of the investment or 5 million real, whichever is less.

The tender was to be published last week, and the auctions are to be held by November, says Zylberstajn Royalty rates will remain intact at 9%, unless oil output is increased from the mature fields; the royalty rate on incremental production will be set at 5%.

In other production news, Alberta Energy Co. began work on a $230 million (Can.) heavy oil thermal recovery project in northeastern Alberta. The Foster Creek project near the Primrose Air Weapons Range on the Alberta-Saskatchewan border will use steam-assisted gravity drainage to recover heavy crude. Target production is 20,000 b/d by early 2002. Twin parallel production wells will be drilled into the reservoir. A steam injection well will heat the bitumen for recovery. AEC said the project would include a $45 million, 32-mile pipeline connection.

Global Offshore International completed an expansion of Alba gas field off Equatorial Guinea in April following the installation of two platforms and four pipelines in about 250 ft of water for CMS Oil & Gas. Services included turnkey engineering, procurement, fabrication, transportation, installation, and start-up of the Alba A tripod well protector platform, Alba B four-pile production platform, three infield flowlines, and a 20-in. trunk line leading to Bioko Island. Production from the field is expected to peak at 250 MMcfd of natural gas and 20,000 b/d of associated liquids.

CHINA'S BOHAI BAY EXPLORATION CONTINUES TO SIZZLE

Texaco made an oil discovery off northeastern China on Bohai Bay Contract Area 11/19, 90 miles south of Tanggu near the Port of Tianjin.

The company said the Bozhong 25-1-8 discovery well was drilled in 57 ft of water to 7,134 ft TD and cut 115 ft of net pay at 5,500-5,700 ft. Texaco says well results indicate the presence of high-quality reservoir sands in Tertiary Minghuazhen. It holds a 100% contractor interest in the block, which covers 787,384 acres. Texaco calls the well results "encouraging" and says they will be incorporated into further studies to determine Bozhong's commercial potential. The Bozhong discovery, if deemed commercial, will enable Texaco to expand its joint developments of oil fields off China with CNOOC.

Elsewhere in the world of exploration, BHP drilled a successful appraisal of its 1998 Atlantis oil discovery in the Atwater foldbelt region of the ultradeepwater Gulf of Mexico. The well, Atlantis-2, found an oil zone in Miocene age sands, with net pay about 300 ft thick. The well is drilling ahead towards additional prospective zones deeper in the section, says BHP. Planned TD of the well is 5,670 m; water depth is 2,035 m. The find is on Green Canyon Block 743. Participants in the well are operator BHP, 44%, and BP Amoco, 56%. Atlantis is one of three BHP-BP Amoco discoveries in the vicinity; the other two are Neptune and Mad Dog.

In the latest development activity, ExxonMobil unit Mobil North Sea received permission from UK Department of Trade and Industry to begin its planned $400 million development of Skene gas-condensate field on Block 9/19 in 380 ft of water in the UK North Sea.

Skene is expected to produce up to 180 MMcfd of gas and 25,000 b/d of liquids after production begins in early 2002. Reserves are estimated at 95 million boe.

The field will be developed with a subsea manifold, to be tied back by bundled pipeline to Mobil North Sea's existing Beryl Alpha platform 9 miles away. Gas will be exported from Beryl through the SAGE pipeline to Mobil's gas processing plant at St. Fergus. Skene liquids will be comingled with Beryl crude and exported by tanker. Mobil North Sea holds a 38.22% interest in Skene. Its partners are Kerr-McGee, 33.33%; Enterprise Oil, 15.89%; Amerada Hess, 9.07%; and OMV (UK), 3.49%.

DTI also gave a go-ahead to development plans for Shell Expro's Brigantine gas fields in the southern North Sea. Shell aims to bring Brigantine-a three-field cluster estimated to hold about 280 bcf of gas reserves-into production with a pair of its low-cost Trident design platforms at a cost of £100 million. Shell expects production rates of 130 MMcfd soon after start-up next January from the Brigantine A, B, and C fields via four wells. Produced gas will be transported via a 19-km pipeline to the nearby Corvette platform and then on through existing infrastructure to the Shell-ExxonMobil gas terminal at Bacton.

TotalFinaElf unit Elf Exploration UK installed the production-utilities-quarters platform for its Elgin-Franklin project in the North Sea. The platform was installed in Elgin field, 240 km east of Aberdeen in the Central Graben area. Elgin and Franklin fields have complex, high-temperature (190° C.), high-pressure (1,100 bar) reservoirs at a subsurface depth of 5,300 m. Production of natural gas and condensate is slated to start at yearend at the fields, which have estimated reserves of 800 million boe.

Osaka Gas Co., Japan's second largest gas LDC, acquired a 10% stake in the Sunrise, Sunset, and Troubadour (collectively known as Greater Sunrise) and Evans Shoal gas-condensate fields in the Timor Sea off northwestern Australia from Woodside Petroleum and Shell Australia. Osaka Gas will pay $67.2 million for Woodside's 10% stake in Greater Sunrise Permits NT/RL2, NT/P55, ZOCA 95-19, and ZOCA 96-20. Details of the purchase of Shell's 10% in Permits NT/P47 and NT/P48 were not disclosed. Osaka Gas says that the acquisitions are part of its moves to acquire direct stakes in gas projects to feed its domestic needs and make it the first Japanese gas company to invest in development of overseas gas fields.

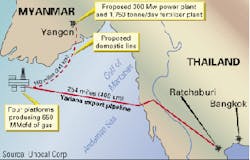

In Pipeline news, Myanmar told a three-company group to proceed with a long-delayed project to build a $200 million natural gas pipeline from Myanmar's largest hydrocarbon resource-Yadana gas field in the Gulf of Martaban-to an onshore location near the capital city of Yangon (see map).

The decision came as Myanmar's ruling junta realized that, although the price of oil used by its power plants has become prohibitive, the country has an alternative: to use cheaper, indigenous gas. However, the other elements of the plan-a consortium-owned power station and fertilizer plant-remain on hold indefinitely. Unocal confirmed that the Yadana-to-Yangon pipeline consortium, which includes TotalFinaElf and Mitsui, was recently advised by the government to go ahead with the gas pipeline project. The 20-in., 241-km gas pipeline was planned as part of the so-called "Three-in-One" project first contemplated in the mid-1990s as an element of the overall development of Yadana gas.

Turning to Caspian region pipeline concerns, Iran is planning to retool its oil infrastructure to accommodate oil swaps, including construction of a $400 million, 240-mile pipeline from the Caspian port of Neka to refineries in northern Iran and to Tehran. This pipeline is expected to transport 175,000 b/d of Caspian crude within 2 years and ultimately up to 370,000 b/d. Current export capacity at Neka is about 40,000 b/d. Tracer Petroleum signed an MOU with Iran's Rose Queshm Co. to form a partnership to handle crude oil swaps in Iran. Under the agreement, the two companies also will import refined products into Iran; acquire products, services, and equipment for NIOC; and undertake other significant business ventures in Iran on behalf of Iranian entities.