E&P spending rebound

Recent reports indicate that exploration and production spending is on the rise.

Surprised? Strong oil and gas prices are the catalysts, of course.

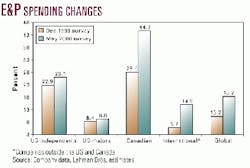

Lehman Bros.' midyear E&P spending survey shows that companies will spend more this year than they expected at the time of the firm's December survey.

Lehman surveyed 326 companies on their 2000 spending plans for worldwide E&P to gauge the industry halfway into the year and see what changes have occurred since the last yearend survey.

The results indicated that, since December 1999, nearly $6 billion has been added to this year's worldwide exploration budgets.

Also, the average oil price assumption jumped to $22.04/bbl in the May survey from $19.25/bbl in December. The average natural gas price in the budgets got a boost to $2.58/Mcf from $2.38/Mcf.

Big spending jumps

The most significant change the new survey revealed is that higher natural gas prices and increased cash flow will cause E&P outlays in Canada to rise by nearly 45% over 1999 spending vs. an increase of 28% expected in December.

Spending on E&P in the US will move up almost entirely because of independents. The 227 independent companies surveyed by Lehman Bros. plan a combined increase in their 2000 US E&P budgets of more than 26% over 1999 spending. In December's survey, these companies anticipated a 23% rise. Majors expect to spend roughly the same amount for US E&P as they reported in December.

E&P expenditures outside the US and Canada will be up considerably more than originally anticipated, gaining 14.9% over 1999 outlays compared with a gain of 5.7% expected just 6 months ago. Lehman notes that it is a group of big companies such as Texaco Inc., Petroleo Brasileiro SA, and Petroleos Mexicanos that are driving the large increases in E&P expenditures outside the US and Canada.

BP Amoco plans

The firm of Dain Rauscher Wessels (DRW) earlier this month commented on BP Amoco's plans to increase gross capital spending, with E&P spending rising to an average $8 billion/year for the next 3 years, up 33% from current levels. BP Amoco is basing its spending decisions on $16/bbl oil, expecting that prices will moderate from their current, unsustainably high prices (see Midyear Forecast, beginning on p. 74).

The firm says that the BP Amoco announcement "is significant in that it provides confirmation of long-anticipated ramp-up in spending following a 2-year period of cost-cutting and stagnant production by the majors. Furthermore, it suggests a longer-term, multiyear cycle of sustained spending at increased levels."

DRW believes that offshore production-in fact the entire offshore upstream industry-stands to gain considerably from such capital outlay increases.

"The extra spending is expected to be focused on high return projects, including gas production from Trinidad and oil production from the deepwater Gulf of Mexico. Other areas we believe will benefit from the additional spending include both North Sea production and North American gas exploration and production from both onshore and GOM shelf reserves."

DRW expects that more announcements of stepped up spending plans will follow over the next few weeks.

Drilling utilization rising

As a result of this higher level of spending, the firm anticipates that rig utilization and day rates will increase across the worldwide floating rig fleet.

"To provide some perspective, in the Gulf of Mexico, utilization for the midwater [depth] fleet currently hovers at about 58%. Worldwide, this statistic is at about 75%.

"The active deepwater fleet capable of drilling in 5,000 ft of water and greater is fully pressed at 100%. The simple and obvious key to increasing the utilization of these midwater assets is an increased E&P spend by the majors."