Taiwan poised for major shake-up in energy policy, CPC role

After a presidential election that marks a major political and economic watershed, Taiwan is poised to make major changes in its energy policy, opening up the natural gas and power markets and reducing the role of the state-owned oil and gas monopoly Chinese Petroleum Corp. (CPC).

Both initiatives are controversial policies of the previous Koumintang government of former Pres. Lee Teng-hui, and implementing them will be at least as challenging for the new administration.

Taiwan has known only one ruling party since the 1949 revolution in mainland China. The new Democratic Progressive Party (DPP) government of Pres. Chen Shue-bian has no experience governing and suffers a dearth of experienced technocrats and bureaucrats. Chen has to fill about 4,000 government positions at various levels from a very shallow DPP talent pool.

"The energy sector will be an excellent test case as to the competency of the new administration," said a senior DPP official. "If they are to really make a difference, we are going to have to push through projects that cut into CPC's and Taipower's [Taiwan Power Corp.] monopolies. It won't be popular in the bureaucracy, but it is very necessary."

The winds of change are anything but welcome within the two state companies, which, despite publicly proclaiming their allegiance to deregulation, continue to dig in their heels and show little sensitivity to market forces, local analysts say. Industry observers in the private sector and senior officials within the Ministry of Economic Affairs all say that CPC in particular must be brought into the new era kicking and squawking, attempting to hold onto its old methods of conducting business and sources of revenue every step of the way.

"It is the nature of monopolist power," says a senior privatization official at the ministry, "to try to preserve it as long as possible and by any means."

Nonetheless, the new government is clearly intent on moving forward and will be pushing the same privatization agenda. The gas industry will be deregulated and expanded to meet the requirements of an overstretched power sector. The new government hopes to more than triple Taiwan's use of natural gas by 2010, and plans are proceeding for a second LNG import terminal. Central to the new policy will be the expansion of Taiwan's gas importation and distribution infrastructure and a consequent reduction in CPC's currently dominant role, a tall order indeed.

New competition for CPC

But it is the reduction of CPC's market dominance and its eventual privatization that is the most critical issue confronting the energy sector. Under the privatization plan, a minimum of 51% of the company's stock is to be offered to the public, and a date for that offering is to be set in the second half. Already, however, a serious managerial restructuring is under way.

CPC is the dominant player in all sectors of the country's petroleum industry, including exploration, refining, storage, transportation, and marketing. Because of its monopoly position, CPC has more in common with a large government bureaucracy than with a multinational oil major of comparable size. The company is deepening its high-stakes corporate restructuring, girding for competition now that liberalization has smashed its monopoly. CPC is establishing independent divisions to take over LNG and solvents and chemicals businesses. A division for lubricants was launched in March.

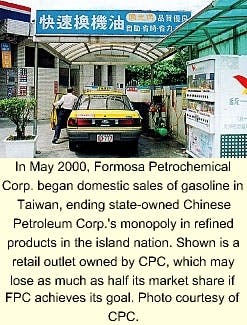

A certain amount of competition began in 1999 in the oil products sector with the completion of a refinery at Mailiao owned by Formosa Petrochemical Corp. (FPC), an arm of the private domestic petrochemical group Formosa Plastics Group. FPC intends to capture half of the country's domestic gasoline market by 2001. The first phase of throughput at its Mailao refinery began in May at 150,000 b/d. By the end of the year, the refinery will reach its full capacity of 450,000 b/d.

In addition, FPC won approval from the Ministry of Economic Affairs' Energy Commission to export diesel fuel; the first shipment of 30,000 tonnes was shipped to Japan at the end of April.

The decision by the Energy Commission, which permits FPC to export diesel fuel, kerosine, and LPG, means the company is now able to export most of its refined petroleum products except gasoline.

Another potential competitor to CPC is the Tuntex Group, which plans a refinery as part of a petrochemical complex in Tainan. The plan is on hold for the moment, however, due to environmental concerns.

Once FPC's new facility starts production, there will be an excess of refined petroleum products in Taiwan. Con- sequently, both CPC and FPC are seeking new export markets, including mainland China. Despite the lack of official ties between the two countries, there has been movement toward energy cooperation.

CPC and Beijing's state-owned China National Offshore Oil Corp. (CNOOC) signed a deal in 1996 to jointly explore a 5,939 sq mile area in the Tainan basin of the Taiwan Strait. Taipei officially ratified the deal in March 1998, and the first round of seismic surveys by the two companies was completed in October 1999. The companies' geologists have reportedly identified several structures as prospective.

CPC's problems

CPC's recent initiatives have come in the wake of a wave of criticism targeting inefficiencies and mishaps.

Noteworthy is a string of recent, large-scale industrial accidents. Former CPC Pres. Lee Shu-jeou resigned in the wake of a fatal gas pipeline explosion in Kaohsiung that killed 6 people and left another 22 seriously injured (OGJ, Sept. 22, 1997, p. 43). It was the 16th such serious accident in under 2 years and led to harsh criticism of senior CPC management in the national press and legislature.

Foreign companies seeking to do business with CPC often find it a frustrating experience. Senior managerial staff are of international caliber, but this degree of professionalism does not extend far down the line, say officials with foreign firms working with the state company. Head office personnel routinely shunt inquiries from desk to desk with claims that any matter is not within their area of responsibility. In fact, because of the recent problems faced by CPC in dealing with industrial accidents, many personnel now fear to take responsibility, the foreign executives say.

"It is generally a nightmare," said one oil industry executive. "It can take weeks to get approval to do the simplest things, and then that decision can get overturned by another official in another department."

Another dimension is added by the complexity of the company's operations. CPC operates a multibillion-dollar industry with 21,000 employees throughout Taiwan, and much of the decision-making at the working level is decentralized. Foreign companies seeking to deal with CPC are advised to approach the office of the president in the first instance and to follow up any mail or faxed advice with a telephone call immediately thereafter.

Gas deregulation

The major energy deregulation initiative currently under way involves the gas sector.

The Taiwanese gas market technically has been open since the late 1980s, but the enormous financing and long-term contracts required in that business have effectively maintained CPC's monopoly position. With energy consumption continuing to grow quickly and an increasingly powerful environmental lobby pressing for cleaner fuel usage-as well as a cut in tariffs for imports-the LNG market is poised for dramatic change.

A major private sector initiative taken to reduce CPC's dominance has focused on LNG import terminals. The government is pushing the construction of a second LNG import terminal. Significantly, CPC's participation has been largely precluded by the government, which has forbidden the state company from bidding, although it is permitted to join a consortium as a minority shareholder. Tuntex Group has proposed to build a 6 million tonne/year terminal in Taoyuan County in northern Taiwan, as well as an adjacent port and industrial harbor. Total cost for the entire development is put at $2.8 billion.

The company reached agreement in March with Australia LNG Pty. Ltd. on the supply of 4 million tonnes/year of LNG from Australia beginning in 2003. The new terminal would provide feedstock for Taipower's new gas-fired plant at Ta Tan. The new plant is already under construction, and Taipower plans to install combined-cycle gas turbine and combined-cycle steam turbine units totaling 4,250 Mw of power capacity, with the first coming on line in 2001. Full operations for the power station are scheduled for 2005 and will consume 1.88 million tonnes/year of LNG.

Final agreement will depend upon Tuntex successfully securing other customers within Taiwan. In the meantime, other foreign companies have expressed an interest in a second terminal.

ExxonMobil Corp. has proposed an offshore facility, although the government has expressed reservations due to security considerations. Presumably, these have heightened since the election of Pres. Chen and the proposal is now widely thought to be a nonstarter.

TotalFinaElf SA and Royal Dutch/Shell Group have each expressed an interest in LNG facilities, and it remains possible that one of the two could join Tuntex as a joint-venture partner. Their experience would be sorely needed, as Tuntex, a local industrial group, has absolutely no experience in the gas industry.

Although it is all but certain to go ahead, it is unclear how or when the Taiwan government will select a builder for the LNG terminal. In the meantime, Tuntex is pushing ahead with its plans and clearly has the most momentum. The company has been in discussions with Mitsubishi Corp. on construction and technology, and it has formally submitted its proposal to the Environmental Protection Administration, which is studying the environmental impact of the terminal and the port and industrial harbor. Tuntex also has discussed the project with the government of Taoyuan County, where the proposed site will be located. Before breaking ground for the terminal, companies need approval from the county government, which has its own development plans for the site.

While the second gas terminal will deal a significant blow to CPC's monopoly, the state concern will remain the dominant player in the gas sector. Taiwan's entire industry is based on its Yong An LNG terminal, near the southern city of Kaohsiung. The terminal has operated under a long-term contract with the Bontang LNG export plant in Indonesia that is operated by Pertamina. Yong An purchased 3.85 million tonnes from Bontang last year, along with another 2.25 million tonnes from Malaysia. CPC is in the process of negotiating an extension to the existing supply agreement with Indonesia and has signed a tentative accord with Malaysia's LNG Tiga project for 2 million tonnes/year.

CPC is also continuing to expand Yong An. A third expansion phase was completed last year, bringing capacity to 7.5 million tonnes/year, and plans are being drawn up for further growth, eventually bringing the facility up to 10 million tonnes/year. Yong An supplies gas to the northern section of the island via a 350-km pipeline that connects to a gas field in the northern city of Hanschu. CPC is also in the midst of building a second gas pipeline from Yong An extending offshore in the South China Sea and then onshore across the western section of the island to the north.

Power deregulation

The other major monopoly in the energy industry currently being deregulated, Taipower, is also expanding its gas activities, as are new independent power producers (IPPs), which have just started entering the market.

Companies are only allowed to propose plants fed by regasified LNG, and some existing oil-fired plants also are slated for conversion to regasified LNG. Plans call for gas-fired power to rise to around one-third of total generating capacity by 2007.

Assuming all of the projects meet their projected completion dates and promised reductions in the LNG tariff structure, LNG demand could increase from 3.84 million tonnes in 1998 to 10 million tonnes by the end of 2005, 13 million tonnes in 2010, and 16 million tonnes by 2020.

"This is the most important strategic decision regarding feedstock that has been made in this country since nuclear power was pushed back in the 1970s," said a senior executive at Taipower. "Political pressure from environmental groups has made it absolutely untenable to seriously develop any other feedstock."

Taipower has already signed agreements with CPC for 3.4 million tonnes of LNG for four of its power stations. Three of these plants-Talin, Hsinta, and Nanbu-are already on-line, while a fourth plant, Tunghsiao, is in the process of being converted from fuel oil. IPPs are also being looked at, both as a counterweight to Taipower and as a method of increasing gas use.

Privatization concerns

With CPC currently undergoing the stress of privatization, observers caution that it would be incorrect to conclude that the monopoly's position needs to be eliminated quickly.

There are too many important objectives, particularly in the gas sector, that need to be accomplished before meaningful privatization can occur. Chief among them is setting a reasonable timetable that permits enough time for end-users and producers to emerge to foster competition. A new regulatory framework also must be promulgated and approved by the federal cabinet and a wholly new regulatory body established, all of which takes time.

The costs CPC will bear are huge. Analysts in Taipei say that the liberalization of Taiwan's petroleum industry could cost CPC as much as $2 billion/year in lost sales.

An analysis conducted by CPC projects that, during the first full year after FPC begins marketing petroleum products, CPC's market share will fall to 75% for gasoline and diesel fuel, 80% for aviation fuel, 56% for LPG, and 94% for fuel oil-all products for which CPC has long held a virtual monopoly. Under the most favorable conditions, the analysis determined, revenues lost as a result of liberalization will approach $1 billion. But if the company is forced to compete with FPC through cost-cutting or similar tactics while facing additional competition from other companies that are expected to enter the market, revenue losses could rise to more than $2 billion/year.

Whatever structure is agreed upon and however long it takes to set up, CPC seems destined to never be the same. Most officials involved in the process conclude that, within 5 years, the company will be a far different organization and will be structured so that it is more sensitive to market forces, especially its gas activities.

"We won't get there overnight, but we will eventually achieve a balance where the gas sector becomes as competitive as the retail and petrochemical sectors," said an official at the Ministry of Eco- nomics. "The key is to keep the process moving and establish a new mindset that appreciates competition."