Talisman Grapples With Negative Publicity Over Its Oil Project In War-Torn Sudan

Sometimes the biggest risk for an oil company operating in a high-risk area is the attendant fallout from negative publicity associated with that operation.

That has proven to be the case for Calgary-based Talisman Energy Inc., which is operating a controversial oil field development and export project in war-torn southern Sudan.

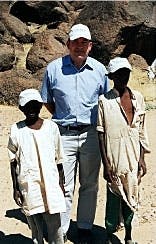

Jim Buckee, president and CEO of Talisman, in November 1999 led a group of North American market analysts and journalists on a tour of the oil field area where Talisman and partners operate, in a bid to stem a tide of criticism against the company. The exercise in risk-management and damage-control staged in mid-November was an important public relations effort in Talisman's program to reassure investors and counter growing political criticism.

Talisman's Sudan involvement began less than a year ago, when it acquired a 25% interest in the Greater Nile Oil Project (GNOP) for $267 million (Can.) with a takeover of a smaller Canadian independent, Arakis Energy Corp. Its share of investment in the project is now about $800 million. Other partners are the state oil companies of China, Malaysia, and Sudan. Talisman and partners completed a 932-mile pipeline to tidewater on the Red Sea in late August and are now producing 160,000 bo/d from several fields in southern Sudan.

Mounting criticism

During the fall of 1999, there was a growing maelstrom of criticism that oil revenues from the project are helping the Moslem government in Khartoum finance a civil war against Christian Sudanese in the south. Critics, from churches to human rights groups and US Sec. of State Madeleine Albright, have charged that the regime in Khartoum is guilty of large-scale human rights abuses, including condoning slavery and forcing relocation of villagers to clear a large region for the oil project.

The purpose of the field trip to the oil fields area was to give analysts and journalists a first-hand view of the region and to buttress statements by Talisman that: it is not aware of forced relocations, the project is successful, and its operations in Sudan are beneficial to the population.

At one point on the tour, Buckee took participants on an aerial survey of the region and pointed out the clear lines of seismic tracks placed there 24 years ago by Chevron Corp. crews and still clearly visible. If these lines are still visible, he argues, surely there would be some physical signs if villages had been forcibly evacuated for oil development. He says the area is uninhabited and often swampy. The Talisman CEO also points out that the company can hardly be accused of financing a 16-year civil war when the Khartoum government only began receiving royalties of about $20 million (US)/month in September when oil started flowing.

Repercussions

Back in Calgary, the company continues to respond to increasing political pressures and a sliding stock price, due in part at least to the campaign against its Sudan investment.

A report in November by Leonardo Franco, a special investigator for the UN Commission on Human Rights, charged that the Khartoum government used bombers, helicopters, gunships, and artillery against civilians to clear a 100-km area around the GNOP oil fields.

There have been conflicting reports from other sources about the charges of human rights abuses. Several members of Calgary's expatriate Sudanese community say villagers were forcibly moved by government forces and some people killed. But several Canadians who have lived and worked in the oil field area say reports of forced population displacement are false or at least distorted.

Talisman stock has declined more than 15% since late October and was trading at about $35 (Can.)/share in early December.

The stock took several hits after statements by Albright criticizing the company's role in Sudan. Some US shareholders have dumped their Talisman stock on ethical grounds, in response to the allegations. The Teachers Insurance and Annuity Association College Retirement Equities Fund, the world's largest pension fund, recently sold its $10.7 million holding in Talisman.

US officials are examining whether economic sanctions imposed on Sudan 2 years ago by administration of Preisdent Bill Clinton can be applied to Talisman. The White House said there would be a regulatory review after a meeting in October involving Clinton and the US Commission on International Religious Freedom, an independent body created by the US Congress to examine persecution of religious minorities around the world. Talisman trades on the New York Stock Exchange and has two US directors on its board.

Talisman said that when it got into Sudan, it hired a Washington, DC, law firm to ensure that its Sudan operations are legally and financially separate from any operations in the US. The company says it is structured to comply with US trade regulations. It has also hired independent auditors to ensure that none of the money it raises by borrowing or selling shares in the US is used for investment in Sudan.

Canada's view

Lloyd Axworthy, Canada's foreign affairs minister, has urged Talisman to take whatever action it can to help resolve the civil war in Sudan. Canada has limited diplomatic contacts with Sudan.

An investigator appointed by Axworthy left in early December for Sudan on a fact-finding mission where he was expected to talk to both Khartoum officials and leaders of the opposition Sudanese People's Liberation Army.

Axworthy says Canada is not prepared to impose sanctions against Talisman because there is still no "hard evidence" linking the company's oil operations to human rights abuses in Sudan. The foreign minister said the earlier UN report is incomplete.

"It was insufficient in the sense that it didn't deal with some of the specifics that we want examined," Axworthy said. "We have to provide sufficient corroboration. I really want to see the hard evidence. We will weigh that evidence according to our judgment."

Talisman has rejected the charges in the UN report and says the author did not personally visit areas where the alleged attacks occurred and failed to produce first-hand evidence.

Talisman said it welcomes initiatives by Axworthy to investigate the situation in Sudan and will provide all support possible to the investigator sent to Sudan by Ottawa.

"This is the type of positive engagement that we had hoped for when we entered Sudan a year ago. There is a lot of misinformation surrounding Sudan, and Talisman will respond seriously and constructively to those initiatives," Buckee said.

"Canada has a reputation as an honest broker and peacekeeper throughout the world. We believe Canada's limited diplomatic links with Sudan have hampered a true understanding of the real human tragedy, the civil war, and the tribal dynamics in the south."

Buckee said Talisman is a business, not a sovereign state, but it has already spoken with the government of Sudan about many of the issues raised by Axworthy.

Talisman initiatives

Meanwhile, Talisman has taken other initiatives in its campaign to counter political and economic risk factors.

In a letter to shareholders sent Nov. 25, the company defended its role in Sudan and noted that its share of production from Sudan will represent less than 10% of its forecast total production in 2000 of 400,000 boe/d. In addition to Sudan, Talisman has major operations in Canada, the UK North Sea, and Indonesia.

"I can assure you we have seen no indication of slavery in our area of operation and all of the people working in our project are wage earners," Buckee told shareholders.

"I would like to make it clear that Talisman is vehemently opposed to forced relocation for oil development, and I personally believe such practices are abhorrent."

Buckee says Talisman is contributing to Sudan's development in a number of ways.

The GNOP provides more than 2,000 jobs for Sudanese of all ethnic backgrounds, funds medical treatments, and is building a 60-bed hospital and medical dispensary, installing roads and water wells, and providing funding for an orphanage in Khartoum.

"Sudan has been in turmoil for many years; however, I believe that continued investment and international involvement will provide a catalyst to economic and social development. This will ultimately improve the standard of living in a country that has endured more than its share of civil war, famine, and poverty," Buckee said.

In mid-December, Talisman said its board formally adopted the International Business Code of Ethics for Canadian Business as Axworthy had urged it to do. It is not mandatory but recommends that Canadian companies doing business in other countries follow US and Canadian law.

Buckee said Talisman was pleased to adopt the code, which is in compliance with its long-standing policies of business conduct.

Analysts' views

Talisman says it has no plans to withdraw from Sudan but that sale of its share in the project is an option if it were in the interest of shareholders at some point.

If that ever came to pass, Talisman would likely gain on its Sudan investment. Most analysts who toured the oil fields filed positive reports on the potential for the company's Sudan venture.

Martin Molyneaux, research director for FirstEnergy Capital Corp., Calgary, in a follow-up report to the Sudan tour, said Talisman's project would be worth $10.50-13.50 (Can.)/share on the market. That, he said compares with an estimated $5.60/share that the company has put into its venture.

Talisman has won the approval of some hard-headed market analysts. It will continue the political and public relations battle to persuade the world that its project benefits the Sudanese population as well as its bottom line.

Talisman Energy Inc. Pres. and CEO Jim Buckee

"Sudan has been in turmoil for many years; however, I believe that continued investment and international involvement will provide a catalyst to economic and social development. This will ultimately improve the standard of living in a country that has endured more than its share of civil war, famine, and poverty."