OGJ Newsletter

Market Movement

US drivers undaunted by prices

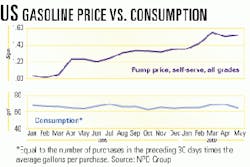

Escalating gasoline prices are not likely to deter the summertime driving patterns of US consumers, according to a study released last week by NPD Group.

US drivers, at least in the short term, do not appear to have altered gasoline consumption habits despite having to pay higher prices at the pump, says the marketing analysis firm.

"During the first 5 months of 1999, the primary driver in the typical American household made five gasoline purchases a month, consuming 13.3 gal of gasoline each time," said NPD (see chart). This level of consumption does not vary much from data collected a year ago, in spite of a 32% increase in the average price of gasoline during January through May vs. the same period in 1999.

"Surprisingly, our data show drivers don't consume less gasoline when faced with higher prices in the short term," said Larry Moore, president of automotive, petroleum, and convenience store tracking at NPD. To make up for the price hike, drivers are likely to purchase lower grades of fuel for their cars, at least in the short term, says NPD.

US Midwest gasoline prices ease

After experiencing some of the highest gasoline prices in US history last month, the Midwest is starting to feel some relief at the pump as gasoline prices decline in the area.

An unusual spike in gasoline prices last month in the upper Midwest, especially the Chicago and Milwaukee areas, has spurred calls in Washington, DC, for a federal investigation of alleged oil company collusion and price-fixing, although most analysts point to the government's own reformulated fuel rules as the main culprit in the price spike (see related story, p. 20)

During the week ended July 10, retail regular gasoline prices in the Midwest had fallen to $1.59/gal from $1.68/gal the week before. This price was about 1¢ below the nationwide average, says EIA, vs. the Chicago-Milwaukee levels of well over $2/gal in mid-June.

During the same July period, consumers on the Gulf Coast were paying the lowest prices in the US for regular gasoline, says EIA-an average of $1.53/gal. Meanwhile, West Coast consumers were paying the highest, $1.68/gal.

Reversal of market 'decoupling'

High crude prices have reversed the "decoupling" of oil and natural gas markets that the energy industry has taken for granted in recent years, says ICF Consulting Group, Fairfax, Va.

Although US demand for gas is growing, high oil prices "are, by far, the primary driver" behind the recent spike in natural gas prices above $4/Mcf, says ICF's Michael L. Godec: "Today's conventional wisdom holds that crude oil prices no longer have significant influence on natural gas prices. But this decoupling appears to have been reversed, at least for the time being."

Through much of its history, gas has been overshadowed by oil, almost never drawing a comparable price based on btu content. Customers with dual-fuel capacity were always ready to switch back to fuel oil if gas prices climbed too high or supplies fell too low.

However, other energy analysts claim that changed some years ago as North American gas came into its own, with construction of new gas-fired electric power plants. They say rising demand for gas finally decoupled rising gas prices from falling oil prices in a world then awash with crude.

For some years, North American drilling activity has been heavily weighted toward natural gas as oil markets largely languished. But the industry's perception of decoupled oil and gas prices is "either a myth, or else it only decouples when oil prices are low," said Godec. An ICF analysis of the gas market over the last 2 years, which his group is now "fine-tuning," shows that "oil and gas prices decouple when excess gas supply exists and oil prices are low," Godec said. "But today, the situation is the opposite; oil prices are high and gas supplies are tight. As a result, oil and gas prices at the burner tip are near parity and have again become coupled."

Certainly, low oil prices in 1998 and early 1999 reduced producers' cash flow and dampened drilling for both oil and gas, tightening gas supplies and helping drive up gas prices.

Tight supplies appear to be sustaining higher gas prices in the short term, notes Godec. But he claims gas deliverability concerns are short-term phenomena, because new reserves will be added as drilling picks up. "We're bullish on the potential of North American basins to deliver gas," Godec said.

And as gas supplies grow, he said, "High gas prices are not sustainable."

Industry Scoreboard

null

null

null

Industry Trends

THE SPREADING US MTBE BAN may spawn more closures of methanol capacity. Methanol producers are concerned that MTBE bans taking root in California and New York will spark future bans elsewhere in the US.

Any ban on MTBE would slash demand for methanol, that additive's key feedstock. In addition, soaring US prices for primary methanol feedstock natural gas are complicating methanol economics even further. On July 1, Methanex, the world's largest methanol producer, closed its 500,000 tonne/year methanol plant at Kitimat, BC. The shutdown follows an unsuccessful attempt to sell the plant to Acetex last year (OGJ, July 5, 1999, Newsletter). The closure, says Methanex, comes after cash losses due to very high input costs "in an increasingly competitive global methanol market."

Methanex also has opted to idle Sterling Chemicals' Texas City, Tex., methanol plant for at least 6 months because of high US natural gas prices and lingering overcapacity. Methanex has exclusive rights to output from Sterling's Texas City plant and a separate agreement with BP Amoco Chemicals to meet the latter's methanol requirements in Texas City and the Houston area.

AND concerns over us gasoline supplies will only worsen as government intrusion into refiners' operations expands with an MTBE ban, claims a New York downstream analyst.

"With regard to reformulation and oxygenation," said Poten & Partners, "the Clean Air Act virtually dictates EPA's edicts to refinery operators on how to make gasoline. The refiners' position is to get the government out of the business of telling them how to make gasoline. In their view, the government should set emission standards, leaving the task of how to make gasoline that meet these standards to the refiners.

"Looking into the future, one can sense the greater proliferation of regulations, greater bureaucratic intrusion in refinery operations, including individual states setting their own standards, as in California," P&P said.

Noting that government mandates called for the addition of oxygenates in gasoline to reduce carbon monoxide emissions, P&P notes that, due to its price and availability, MTBE is the oxygenate of choice for many refiners. In some areas in the US, such as the corn-growing Midwest, where corn-derived ethanol is used as an oxygenate, isolated local supply outages caused gasoline price spikes that far outstripped those elsewhere in the country (see related story, p. 20).

"The discovery of MTBE in American drinking water supplies has cast a shadow over the future of MTBE," P&P noted. And, despite the substance's omission by the National Institute for Environmental Health Sciences from its list of known carcinogens, an EPA group issued a report last September advocating slashing MTBE use-if not its complete removal-as a gasoline additive.

Government Developments

THE CLINTON ADMINISTRATION IS FOCUSING HARD ON ENVIRONMENTAL AND ENERGY CONCERNS.

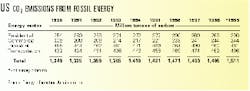

US carbon dioxide emissions from burning fossil fuels rose by 1% in 1999, reaching 1,511 million tonnes of carbon, according to preliminary estimates (see table). Although the 1% growth rate was slightly below the average annual growth rate of 1.2% during 1990-99, says EIA, it was higher than the 1998 growth rate of 0.1%. EIA's final numbers for 1999 should be available in October. The administration says CO2 emissions "are a good early indicator of the level of, and rate of change in, total US greenhouse gas emissions."

EIA says transportation-related CO2 emissions-which account for about a third of total CO2 emissions-increased 2.9% in 1999, as a healthy economy encouraged increased travel and delivery of goods. Residential emissions increased 0.4%, and commercial emissions declined by 0.4%.

Despite rapid growth of the economy, energy-related industrial CO2 emissions in 1999 increased only 0.2%, however, which EIA says may reflect below-normal growth in energy-intensive industries.

US EPA continues its war on MTBE. The agency will fund two $1 million pilot projects-in Long Island, NY, and Santa Monica, Calif.-to help clean the gasoline additive from water supplies.

The funding will accelerate cleanup at 50 MTBE-contaminated sites on Long Island. The funds for Santa Monica will be used to help the state and city clean contaminated groundwater.

The administration has urged Congress to eliminate MTBE from gasoline. Refiners use the additive to increase the oxygen content of reformulated gasoline, in line with mandates under the Clean Air Act Amendments of 1990. And EPA has begun regulatory action to control MTBE under the Toxic Substances Control Act.

The White House says Congress must draft less-restrictive criteria for use of the heating oil reserve it proposes to establish (see related story, p. 26). Without a special trigger, current law would not allow the distillate reserve to be used unless there is a national supply emergency, the same criteria as for SPR crude oil.

However, API worries about how the heating oil reserve might disrupt distillate markets and create the problem it's intended to solve.

"While we do not yet know the details of the president's proposal," it said, "we are concerned about government intervention in the marketplace and its effect on the private markets. We also have questions about possible unintended consequences of creating a regional reserve.

"There is a danger, for instance, that the requirement to fill this reserve could divert home heating oil needed to build inventories. The presence of this reserve could displace private inventory and discourage importers, and it could discourage suppliers from moving additional heating oil when a shortage occurs."

Quick Takes

MORE US REFINING CAPACITY IS CHANGING HANDS.

Ultramar Diamond Shamrock will increase its capacity by 168,000 b/d after agreeing to buy Tosco's Avon refinery at Martinez, Calif., for $650 million in cash plus a "participation" payment of as much as $150 million, to be paid over the next 8 years.

Tosco has been operating the Avon refinery at reduced runs in recent months, with two units idle. Lower returns from the refinery vs. Tosco's other plants and clean fuel regulations drove the decision to sell the plant, says Tosco.

Tosco Chairman Thomas O'Malley thinks the Avon refinery is a better fit for UDS's refinery network. "We have had our share of problems and difficulties with this refinery," he said. "I think the new owner is going to do a little bit better there."

UDS plans to increase output of clean products at Avon, including CARB gasoline and diesel, and to hike runs to about 168,000 b/d.

Elsewhere, UDS plans to construct a 50,000-bbl pressurized tank at its McKee, Tex., refinery to segregate low-sulfur gasoline blendstock. This will allow the McKee facility to produce low-sulfur gasoline, similar to CARB-spec gasoline, for sale in Phoenix, which has opted to use CARB gasoline starting in November. The project will support supply optimization between McKee and UDS's Wilmington, Calif., refinery.

In other refining news, Overseas Private Investment Corp. agreed to finance a Papua New Guinea refinery for InterOil. OPIC approved an $85 million credit facility for InterOil that, along with InterOil cash reserves, will cover the entire refinery capital budget. Final documentation may include a requirement that additional completion support be secured, in the form of cash, guarantees, or both. The Port Moresby refinery is to be completed in first half 2002.

A new private Saudi petrochemical firm, Saudi International Petrochemical Corp. let contract to Fluor Daniel for overall project management of its first petrochemical complex, to be built at Al Jubail, Saudi Arabia. The $800 million SIPC complex will produce methanol, butanediol, acetic acid, and vinyl acetate monomer.

Fluor will also provide basic engineering and front-end engineering design for the complex, which will include a common utilities unit. Work is to begin in July, with completion slated for late 2003.

Elsewhere on the petrochemical front, preliminary work is to get under way by mid-August on a $1 billion ethane cracker in India's Assam state. Reliance Assam Petrochemicals Ltd. (RAPL)-a JV of Reliance Petrochemicals and Assam Industrial Development-is moving forward with plans to build a 300,000 tonne/year olefins plant at Lepetkata, Dibrugarh. Oil India and RAPL are expected to sign a feedstock supply agreement soon, paving the way for initial survey work. The agreement, by which Oil India will supply ethane feed to RAPL for 15 years, thus far has been the major stumbling block in project negotiations.

CNOOC plans to spend 3 billion yuan this year to build an ammonia-urea plant on China's Hainan Island. Plans call for the plant to produce 450,000 tonnes/year of ammonia and 800,000 tonnes/year of urea. Construction will begin at Dongfang, Hainan, at yearend, with completion slated for late 2003. The Hainan government owns and operates a natural gas-based fertilizer plant at Dongfang that produces 300,000 tonnes/year of ammonia and 520,000 tonnes/year of urea and is supplied by gas from CNOOC and BP Amoco's Yacheng 13-1 gas field in the South China Sea.

In this week's gas processing news, Rentech entered into a nonexclusive cooperation agreement with GTL Resources and Worley Engineers to conduct a feasibility study to deploy Rentech's Fischer-Tropsch (F-T) process technology on a floating system designed to add value to low-cost offshore stranded natural gas. The study will focus on Offshore West Africa and Australia's North West Shelf, where the F-T process could be used in a project to convert gas to 10,000 b/d of synfuels. The three firms agreed to cooperate in economic feasibility studies, conceptual design, capital costs, and operating costs, together with all front-end and intermediate processing equipment, product finishing facilities, and the supporting vessel. The firms also will share responsibilities for any floating F-T plant they might develop.

In other gas processing action, a consortium led by Indian Oil Corp. (IOC) put in a bid to develop LNG import facilities and related businesses at Kakinada, Andhra Pradesh, India. IOC, Malaysia's Petronas, CMS Energy, and India's Cocanada Port want to market the regasified LNG product in Andhra Pradesh. Petronas would supply LNG from Malaysia, IOC would ship it, and Cocanada would develop the LNG terminal and ensure deepwater berthing facilities.

India has set a standard for the maximum participation of foreign firms in consortia that transport waterborne LNG shipments into the country. The government has ruled that the Indian partner in any foreign shipping consortium bidding to transport LNG for state-owned Petronet LNG must be given at least a 26% equity throughout the contract period of 25 years.

Petronet had previously announced a bidding tender for the transportation of 7.5 million tonnes/year of LNG for 25 years-purchased from Qatar's Ras Laffan LNG-on an fob basis for its planned LNG terminals at Dahej, Gujarat (2.5 million tonnes/year), and Cochin, Kerala (5 million tonnes/year).

In other tanker news, US Department of Justice and Rhode Island settled with several parties to restore Block Island Sound, hit by a 1996 oil spill. EW Holding, K-Sea Transportation, Capt. Gregory Aitken, and the West of England Ship Owners Mutual Insurance Association will pay $8 million to restore natural resources and more than $3.3 million to reimburse state and federal agencies for their costs in assessing environmental damages. The civil settlement is in addition to $8.5 million in criminal penalties imposed in 1998 on the owners of the barge responsible for the spill. During a 1996 storm, the 340-ft North Cape oil barge ran aground on Ninigret National Wildlife Refuge after the tug towing it caught fire, spilling more than 828,000 gal of home heating oil (OGJ, Jan. 29, 1996, p. 49).

The proposed Millennium pipeline faces delays.

TransCanada says completion of the proposed $1.35 billion (Can.) Millennium pipeline could be delayed for more than a year due to regulatory setbacks.

The proposed 551-mile line would carry gas from Dawn, Ont., to Westchester County, NY. FERC in May had rejected an application to build the pipeline. TransCanada wants regulators to delay hearings on the Canadian part of the line, and start-up has been postponed to a tentative date of November 2001.

In other pipeline news, J.M. Huber signed an agreement with Bighorn Gas Gathering under which Bighorn will provide gas gathering and processing services for Huber's coalbed methane production in Wyoming's Powder River basin. Bighorn will construct a $17.8 million, 56-mile, 20-in. extension of its gathering system in Sheridan County. The extension will accommodate output from about 100,000 acres under a long-term agreement. Huber is completing 150 coalbed methane wells in Sheridan County's Prairie Dog prospect area and expects to complete another 100 wells by yearend. The system is to be in service in November 2000.

MORE PIPELINE GAS-FIRED POWER CAPACITY IS ON TAP IN THE US SOUTH.

Panda Energy International and El Paso Energy affiliates signed interconnection and transportation agreements to supply the fuel needs of a 2,720-Mw power plant Panda is building in El Dorado, Ark.

Panda CEO Robert W. Carter called the agreements a "critical link" to completing what is expected to be the largest US 100%-merchant power plant-a deal involving Panda affiliates Union Power Partners and Trans-Union Interstate Pipeline, along with El Paso unit Gulf States Pipeline.

Trans-Union will build a 42-mile, 30-in. line connecting the El Dorado plant with the Gulf States Pipeline in Sharon, La. In a related move, Union Power also signed firm transportation agreements with Tennessee Gas Pipeline. FERC approval is expected by midsummer. When completed, the plant will use about 430 MMcfd of natural gas, transported by Union Power from various gas basins in Texas, Louisiana, and Oklahoma. F

Meanwhile, Midcoast Energy inked a deal to provide Calpine up to 276 MMcfd in gas transportation services for 20 years. Under the agreement, Midcoast will provide 138 MMcfd of firm transportation services to two recently announced Calpine cogeneration plants near Decatur, Ala.: the Decatur Energy Center, a 700-Mw plant at a Solutia chemical plant, and the Morgan Energy Center, a 660-Mw plant at a BP Amoco chemical plant. Midcoast will construct a 52-mile pipeline near its existing interstate system.

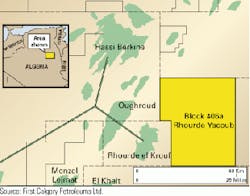

Exploration interest in Algeria's Berkine basin remains strong.

First Calgary Petroleums (FCP) signed a PSC with Sonatrach to explore a block in Algeria's Berkine basin.

Under the PSC, FCP will explore Block 406A Rhourde Yakoub. FCP is negotiating for a second block in the basin.

The firm says 800 km of existing seismic on the 970 sq km block indicate a number of prospects. The minimum work commitment in an initial, 3-year period includes reprocessing existing seismic, acquiring 200 km of 2D and 100 km of 3D seismic, and drilling two explora- tion wells at a cost of $18 million. A second period will cost an estimated $13 million and calls for 50 km of 2D seismic and two more exploration wells. The basin's geological features include two "world-class" mature source rocks; a stacked succession of porous sandstone reservoirs, folded and faulted into hydrocarbon traps; and an overlying blanket of impermeable shales and evaporites acting as a "super-seal" to oil and gas migration, says FCP.

Meanwhile, BHP committed $316 million (Aus.) toward development of five oil fields in the Rhourde Oulad Djemma (ROD) field area of Algeria's Berkine basin. Total cost of the project is $830 million (Aus.). Other interest holders are Agip and Sonatrach. The fields have total proven and probable reserves of 300 million bbl of sweet, paraffinic crude that yields good middle distillates, says BHP. They are ROD, Sif Fatima North East, Rhourde Er Rouni North, Bir Sif Fatima, and Rhourde Debdada.

SOCAR's Valekh Aleskerov says Azerbaijan's parliament approved a proposed PSA for the country's first onshore exploration contract. The 410-sq mile Padar concession is about 60 miles southwest of Baku in the Kura River basin. The deal provides for Moncrief Oil International unit Kura Valley Development to explore for and develop hydrocarbons on the concession. The US company plans to carry out a $50 million exploration program over 3 years and will drill at least three exploration wells on a prospect the state postulates as capable of holding 100 million tonnes of oil. Operator Moncrief holds 80% stake in the project, SOCAR the remainder.

In development action, Petrobras and Halliburton signed more than $2.5 billion in contracts under which the firms will jointly develop Barracuda and Caratinga oil fields in the Campos basin off Brazil. Petrobras will act as operator of the deepwater fields, but Halliburton will perform the bulk of the work under the terms of the contracts. The firms announced early this year that they were nearing a formal agreement on the Barracuda-Caratinga project (OGJ, Feb. 7, 2000, p. 31). Work is to begin this month.

THE GULF OF MEXICO WILL GET ANOTHER PRODUCTION SPAR, under a contract that Vastar Resources let to Aker Maritime, for Horn Mountain field on Mississippi Canyon Block 127.

Aker Maritime's Houston office will head up the engineering, procurement, fabrication, and delivery of the spar hull and mooring system; the hull will be built at Aker Maritime's Finland yard.

Final project sanctioning is scheduled for the fourth quarter, with delivery of the 555-ft tall spar scheduled for second quarter 2002. It will be installed in 5,400 ft of water.