OGJ Newsletter

Market Movement

'Fool's rally' in petrochemicals?

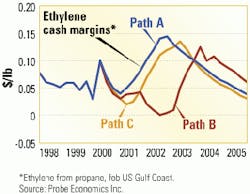

Recent petrochemical price increases could be a "fool's rally," says one analyst who expects polyolefins prices to remain flat until about 2002, when economic recovery in Asia is expected to finally take hold and demand for basic petrochemicals and polymers is forecast to catch up with capacity.

Large amounts of capacity had been built in response to healthy profits in the mid-1990s. However, the forecasts that suggested these additions were a good idea were wrong, says Fred Peterson, president of chemical industry planning, forecasting, and consulting firm Probe Economics Inc. He cited three scenarios for a post-2000 downturn, followed by recovery in 2002-03 (see chart).

"Already, ethylene, propylene, and styrene margins have shot up, and polyolefin margins are approaching peak levels," Peterson said. Five factors have pushed up petrochemical and polymer prices earlier than expected. They include the doubling of oil prices; strong US and Asian economies; low plastics prices; delayed or canceled expansions of new processing plants and lack of financing to run existing plants, especially in Asia; and the probable accumulation of inventories downstream.

Saudi report galvanizes market

Conflicting reports that Saudi Arabia may unilaterally increase its oil production by 500,000 b/d to cool sizzling oil prices have turned the market on its ear.

Oil futures prices plunged last week as traders reacted to the reports, which have suggested that typically conservative Saudi Arabia is undertaking the bold step in order to drive oil prices down to $25/bbl and keep them there.

IPE's August Brent contract dropped by $1.52 to $29.58/bbl July 4, as traders scurried to liquidate long positions accumulated during the preceding rally. IPE oil prices continued to tumble July 5, triggering technical stop-loss selling processes. In overnight trading on the Singapore Exchange, the August contract for North Sea Brent closed at $29.58/bbl July 5, down $1.52 from the day before.

An even steeper drop was registered on NYMEX, where traders usually react more strongly to OPEC-related news. The New York exchange was closed July 3-4 for the US Independence Day holiday when reports first surfaced of a proposed increase in Saudi production above the 708,000 b/d hike recently agreed to by OPEC (excluding Iraq). NYMEX crude for August delivery plunged $1.83 to close at $30.67 July 5.

However, Middle East news organizations reported that same day that Saudi Oil Minister Ali al-Naimi had contacted his counterparts in Iran and Kuwait on Tuesday to reassure them that Saudi Arabia would not unilaterally increase production.

Other reports quoted Al-Naimi as saying earlier in the week that, "if prices do not come down, the Kingdom of Saudi Arabia, in concert with the other producer countries, will increase production by 500,000 b/d very soon from now."

Saudis to go it alone?

Other crude oil exporters within and outside OPEC responded to market developments to varying degrees, suggesting a creeping erosion of the cohesiveness that OPEC and some of its non-OPEC counterparts have displayed since 1998's oil price crash, in cooperative efforts to rein production and thus revive oil prices.

OPEC's critics, particularly in the US, would contend that the exporters have done their job all too well, with oil prices staying above $30/bbl for much of the year.

Saudi Arabia is one of the price doves within OPEC and has often expressed concern about the effects of oil prices sustained above $30/bbl on the global economy-not to mention the boost it gives to competing sources of energy, including other oil supply sources. In fact, the oft-stated target of $25/bbl as an optimum price is nothing new for the Saudis. Al-Naimi has specifically cited that as an ideal price more than once since the latest oil price rollercoaster started in 1998.

What is new, however, is the what the prospect of a go-it-alone Saudi Arabia might do to future cohesiveness among OPEC members and their non-OPEC kindred spirits. While it is likely that Riyadh will undertake some fence-mending in the days to come, the very public nature of the Saudis' statement of position was a reassertion of the Saudis' incipient market power.

Other exporters react

Saudi Arabia is one of the few countries with sufficient spare capacity to boost production immediately. Most other OPEC members are already producing at maximum capacity. Only the UAE and possibly Kuwait among that group currently have significant spare production that they could bring to market. Nonmember Mexico also may have some spare production, as does Norway.

In Venezuela and Iran, officials rejected consideration of additional production increases so soon after OPEC's June decision to hike output effective July 1.

Not so Norway, whose government announced the prior week that it would lift oil production curbs, increasing output by 100,000 b/d starting July 1. Nor- wegian Oil Minister Olav Akselsen said, "There seems to be a need for oil in the market. The [Norwegian] government has resolved not to continue its production regulations into the third quarter."

Norway, which produces 3.2 million b/d, cut its oil production by 100,000 b/d in 1998 and then again in 1999, in response to the OPEC production cuts.

Venezuelan stance

Labeling current world oil prices as "fair" rather than high, Venezuelan President Hugo Chávez said July 4 his country will not increase oil production beyond the level approved by OPEC last month.

The Venezuelan leader said he held telephone conversations that day with the heads of state of Saudi Arabia, Algeria, and Nigeria regarding the need to continue "strengthening" OPEC. He said he also spoke with Vicente Fox, Mexico's new president-elect.

Last month, OPEC members agreed to increase their oil production by 708,000 b/d to a combined 25.4 million b/d in an attempt to reduce oil prices that were regularly exceeding $30/bbl. As a result, Venezuela already has boosted its output by 81,000 b/d.

Responding to reports that OPEC member states have been urged again to increase oil production to cool overheated oil prices, Chávez said, "No, no, we are not going to do that. We must strengthen OPEC." He also urged other OPEC members not to bow to international pressures to boost oil output, which he termed "blackmail."

A high-level Venezuelan mission led by Energy and Mines Minister Alí Rodríguez Araque is preparing to begin a tour of all OPEC member countries, said Chávez. The tour is designed mainly to prepare for the organization's upcoming heads of state conference, scheduled to be held in Caracas Sept. 28-29.

Industry Scoreboard

Due to a holiday in the US, data for this week's Industry Scoreboard are not available.

prices

rig

Industry Trends

IS A SHAKEOUT LOOMING IN THE GLT RACE?

Several players in the GTL arena are proposing plants too small to be profitable, Conoco says. Small plants will not be able to compete against the economies of scale that larger plants will use to their advantage in future GTL applications.

"We're afraid if we don't inject some reality into the process," said Paul J. Grimmer, manager of Conoco's natural gas refining group, "GTL will lose credibility as a viable technology."

Conoco contends GTL viability hinges on an economy of scale that calls for a minimum plant capacity of 60,000 b/d, processed from 500 MMcfd of natural gas. For a 20-year life, profitable GTL projects require fields of at least 4 tcf.

Although it has been developing its own GTL process since 1997, Conoco has no large stranded gas reserves and so will depend on others for gas supply. It plans to begin talks with public and national oil firms with large gas reserves within the next year. The company plans to build a 400 b/d pilot plant, to start up in mid-2002 and cost $40-50 million.

The syngas side will use a catalytic partial oxidation process; Conoco is developing its own catalysts. The Fischer-Tropsch process in the pilot plant will use a slurry bubble column with cobalt catalyst.

Grimmer said the company is about 4 years away from beginning engineering on a 60,000 b/d plant, which will cost about $1.2 billion, excluding gas processing costs.

Canada's Northwest is the No. 1 spot for gas exploration in that country, notably the Yukon and Northwest Territories. An Arthur Andersen annual review shows that these areas, including offshore plays, are now favored over Alberta and British Columbia, which now rank third and fourth, respectively, as being prospective for large gas finds.

Traditional areas in the Western Canadian sedimentary basin are now fairly well-explored, and companies are looking for bigger discoveries, says Arthur Andersen's Blair Kraus. There have been a number of significant gas discoveries in the Liard River area by Chevron Canada, Berkley, Ranger, and others. The region abuts the Northwest Territories' border with Alberta and British Columbia.

High natural gas prices this summer have increased interest in gas reserves and accelerated merger and acquisition activity involving companies with strong gas positions and prospects in Western Canada.

More than 60% of survey respondents expect M&A activity to increase in 2001. The value of the deals announced to date this year is more than $10 billion (Can.). The report also said most executives polled have a positive outlook about commodity prices, stock values, and the industry in general. There was a 25% response to the poll of 200 company chief executives.

Government Developments

POSSIBLE US heating oil shortages LOOM.

John Cook, EIA's petroleum division director, testified late last month to that effect before a Senate governmental affairs committee hearing on recent gasoline shortages and price spikes in the US Midwest: "Although consumers are now focusing on gasoline, EIA is concerned about winter distillate and natural gas supplies."

Cook explained that, due to high demand and low stocks, the buildup of distillate inventories is lagging. "Even with a normal inventory build during the summer and early fall, we will enter the winter with lower-than-normal stocks," he said.

Last week, Energy Sec. Bill Richardson expressed concern about low home heating oil supplies in the Northeast this winter and urged Congress to approve legislation creating a 2 million bbl heating oil stockpile.

Cook notes that natural gas prices are high this summer and may prompt industrial and utility customers to switch to distillates, further cutting inventory build. He added that gas stocks may not rise high enough to meet next winter's peak consumption.

THE REBUTTAL TO AL GORE'S ENERGY PLAN CONTINUES.

The US vice-president's energy policy proposal, unveiled in three stages in recent weeks, has come in for more criticism (OGJ, July 3, 2000, Newsletter, p. 7).

The conservative Cato Institute said Gore's energy plan is "nothing more than an elaborate repackaging of long-standing programs that have demonstrably failed to have any impact on the energy economy.

"Over the past 20 years, federal and state governments have spent more than $40 billion to subsidize renewable energy and conservation. Despite a wide array of subsidies, preferences, and mandatory purchase requirements, environmentally friendly renewable energy still constitutes only 2% of the electricity market and 0% of the transportation market."

Without mentioning the Gore program, API has offered some energy policy principles: "The oil and natural gas industry believes it is important that there be at least four essential components to a national energy policy for the 21st century. If adopted, they would enable the industry to continue to provide a reliable and affordable supply of gasoline, diesel fuel, heating oil, and natural gas to American families and businesses."

API said companies should be allowed greater access to acreage prospective for oil and gas that is currently off-limits: "We need a level playing field so we can reduce our reliance on foreign oil, currently at 55% and rising."

It said the US should lift unilateral sanctions it has imposed on certain countries.

"These sanctions are preventing American producers from drilling for oil and natural gas in some overseas oil fields. Expanded access would create a greater range of choices for American consumers."

API said the government should coordinate implementation of environmental rules and regulations. "Smoother integration of regulations might have prevented the sharply higher gasoline prices that disrupted household budgets in the Midwest this summer."

And it said the US should expedite permitting for modernizing facilities for the manufacture and delivery of gasoline, diesel fuel, natural gas, and heating oil. "Unreasonable delays in governmental approval for the construction of new pipelines or improvements to refineries slow down deliveries at a time of high demand for oil and natural gas."

Quick Takes

Oil and gas production started up from what ExxonMobil claims is the world's deepest-water drilling-production platform, part of the Hoover-Diana development project in 4,800 ft of water in the Gulf of Mexico.

The Hoover-Diana development utilizes an 83-story tall, deep-draft caisson vessel (DDCV) that is nearly 50 yards in diameter. Utilization of surface wellheads aboard the platform is also an industry first for that water depth, officials say.

Diana field, about 15 miles west of Hoover, is a subsea development that utilizes five horizontal completions tied back to the DDCV. The two fields contain estimated reserves exceeding 300 million boe.

Production began in May and is averaging 140 MMcfd of gas and 18,000 b/d of oil from five wells. The two fields are expected to produce at combined peak rates of 100,000 b/d of oil and 325 MMcfd of gas. ExxonMobil holds 66.7% interest in the $1.1 billion project, with BP Amoco 33.3%.

In other production news, McMoRan Exploration reestablished sustained production earlier this month from four wells in a field on three Eugene Island blocks in the Gulf of Mexico. Gross production from Blocks 193, 208, and 215 is averaging 1,100 b/d of oil and 600 Mcfd of natural gas. McMoRan also is evaluating several additional inactive wells in the field for potential workovers in light of strong oil and gas prices. In the second half, the company plans to drill an exploratory well on Block 193 to 17,500 ft to probe a new fault block. McMoRan is operator of and owns a 56.25% working interest and a 43.9% net revenue interest in the blocks.

CNOOC began commercial production from Qikou 17-2, an oil and gas field in the western Bohai Sea off China. The field has estimated reserves of 16.55 million tonnes of oil and is expected to produce 300,000 tonnes/year of crude over 15 years. The field-discovered in 1993 and one of three in the Bohai Sea deemed "marginal"-has been under development since 1995 at a cost of 1.3 billion yuan. Oil is being produced from four platforms linked to a terminal by a 200-km subsea pipeline. The other two fields have been producing since 1997 at a combined 500,000 tonnes/year of crude and 380,000 cu m/day of gas. CNOOC had discovered six marginal oil and gas-bearing structures in a 700 sq km area of the Bohai Sea. The six have total proven reserves of 50 million tonnes of oil and 10 billion cu m of gas.

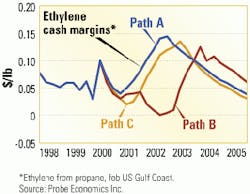

Lukoil is to move ahead with exploratory drilling plans at Yalama, a prospect in the Azeri Caspian Sea (see map), although drilling will not likely begin until 2003, due to rig delays and other factors.

Lukoil Vice-Pres. Ravil Maganov says that $185-200 million of the $212 million budgeted for the project in 2000 will be used to overhaul the company's Shelf-7 semisubmersible drilling rig-a project expected to take several years. Shelf-7 will spud the first wildcat.

Lukoil had been working the prospect with ARCO through the LukARCO joint venture. However, ARCO decided late last September, without giving a reason for doing so, that it would not proceed with work on the concession.

In other exploration action, Morocco plans an international bidding round in October for the offshore sector between Rabat and Safi. Minister of Energy and Mines Youssef Tahiri says amendments to the country's hydrocarbon regulations, make it among the most attractive E&P investment areas in the world. Changes include a reduced level of state participation in field development to a maximum of 25%; a 10-year income tax holiday; and zero royalty on initial production and thereafter royalties of 10% for crude oil (7% for deep water) and 5% for gas (3.5% in deep water).

In development news, Statoil submitted to the Norwegian Ministry of Petroleum and Energy a plan to develop and operate Glitne oil field, near Sleipner field on Block 15/5 in the Norwegian North Sea. Plans call for drilling to start Oct. 1; the field is to come on stream in the third quarter 2001. Statoil signed a letter of intent with Petroleum Geo-Services for the use of its Petrojarl 1 FPSO for Glitne. The vessel's day rate is expected to average $162,000. Glitne is estimated to contain 25 million bbl of recoverable oil and will produce for 26 months, at a projected maximum flow rate of 40,000 b/d for the first 15 months.

Triton's Ceiba-4 delineation well off Equatorial Guinea confirmed the extent of the oil pool found with the Ceiba-1, 2, and 3 wells (OGJ, July 3, 2000, Newsletter, p. 8). Ceiba-4 penetrated 269 ft of net oil-bearing pay in three zones. Ceiba-4 confirmed the field's southern extension and appears to support a deeper field oil-water contact than originally interpreted, says Triton. Located 22 miles off Equatorial Guinea on Block G, Ceiba-4 was drilled to 8,957 ft TD in 2,431 ft of water.

Singapore's largest industrial landlord and developer, Jurong Town, began its latest phase in developing Jurong Island-the city-state's petroleum and chemical megacomplex-with the award of two big reclamation contracts worth a combined $3.02 billion (US). The larger contract, valued at $2.06 billion, went to a consortium of Penta Ocean Construction, Koon Construction & Transport, Hollandsche Aanneming Mij., Dredging International, and Boskalis International. The group will reclaim 550 hectares of land for Jurong Island plus half of a 1,906-hectare parcel of land at Tuas View Extension to meet the demands for land by the growing petroleum, petrochemical, and chemical industries, plus supporting businesses. Meanwhile, another consortium-this one consisting of Hyundai Engineering, Van Oord ACZ, and Ballast Nedam Dredging-will reclaim the other half of the land at Tuas View. Its bid was estimated at more than $958 million (US). The reclamation work, which will start at the end of June, is to be completed in 65 months. A total of 14 companies were short-listed to tender for the projects.

Elsewhere in the petrochemical world, Oxy unit OxyChem signed a letter of intent with Olin to combine their chlor-alkali and related businesses in a JV Oxy says will have annual sales of $1.2 billion and save at least $60 million/year within 2 years as a result of increased efficiency. OxyChem would own 66% of the venture, and Olin 34%. To be based in Dallas, the JV would have production capacities of 4 million tons/year of chlorine, 4.1 million tons/year of caustic soda, and 425,000 tons/year of potassium hydroxide. The venture will include some of OxyChem's chlor-alkali, ethylene dichloride, potassium hydroxide, and related co-product businesses and facilities; OxyChem's interest in an Armand Products partnership in Alabama and its Carbocloro joint venture in Brazil; Olin's chlor-alkali, sodium and potassium hypochlorite, and sodium hydrosulfite businesses and facilities in the US and Brazil; and Olin's interest in the Sunbelt joint venture with Geon. The transaction is expected to be completed by the fourth quarter.

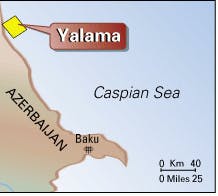

After 6 years of drilling in Sleipner West natural gas field in the Norwegian North Sea, Smedvig's West Epsilon jack up will begin work in another Norwegian field, Frøy field.

The original charter for that rig was placed with Smedvig under the Sleipner license in 1993 and was subsequently extended to the end of 2002. The West Epsilon is drilling its third well in its present series in Sleipner West. Although a fourth well might be drilled in that series, officials said it is clear that the rig's work in the field will be completed by yearend.

Sleipner West, on Norwegian North Sea Blocks 15/6 and 15/9, was discovered in 1974. Production started in August 1996.

Natural gas throughput has started up through Deepwater Holdings' new East Breaks Gathering System in the deepwater Gulf of Mexico.

This pipeline was installed in as much as 4,700 ft of water, which the company claims makes it the world's deepest gas export pipeline. Deepwater Holdings is a JV equally owned by a unit of El Paso Energy and Coastal's ANR Pipeline.

With a design capacity of more than 400 MMcfd, the 85-mile, 20-in. system is transporting gas from a DDCV platform on Alaminos Canyon Block 25 to High Island Block A-573, where it ties into Deepwater Holdings' High Island Offshore System. From there, it ties into ANR's pipeline system at West Cameron Block 167 and, ultimately, to Coastal's 1.2 bcfd Eunice, La., gas processing and fractionation plant.

The gas comes from the Hoover-Diana project on East Breaks 945, 989, 946, and 988, which is tied back subsea to the DDCV on Alaminos Canyon 25 (see related item, p. 8).

In other pipeline activity, Caspian Pipeline Consortium (CPC) awarded two more contracts, worth $1.1 million combined, to Industrial Data Systems unit IDS Engineering to supply and integrate programmable control hardware for CPC's Tengiz and Astrakhan pump stations. All equipment covered by these agreements is expected to ship prior to yearend. Under a previously announced contract, IDS Engineering has been involved in the design and programming of control equipment for CPC's five pump stations. CPC was established in 1997 to construct a crude oil pipeline connecting the oil fields in western Kazakhstan with a new terminal located on Russia's Black Sea coast. F El Paso Energy International and Unocal signed a definitive agreement with Petrobras to acquire an interest in the Pescada-Arabaiana oil and natural gas pipeline and production project in Brazil. El Paso and Unocal hold stakes in a 50-50 JV called Potiguar II SARL. Potiguar II will purchase from Petrobras 114 km of oil and gas pipeline, including 73 km of 26-in., multiphase mainline and related production facilities in northeastern Brazil. The JV also will acquire from Petrobras 22 million bbl of proved developed oil and condensate reserves and 345 bcf of gas, as well as six offshore platforms and 10 wells. The agreement covers the acquisition of an initial 79% participating interest from Petrobras in five concession areas containing five proven oil and gas reservoirs, plus an initial 35% interest in a 55,000-acre exploration block, BPOT-1. Petrobras will retain the remaining interests.

Mexico's CRE awarded Belgium's Tractebel a 12-year exclusive permit to develop the Guadalajara natural gas distribution system. The company will invest $83.6 million to develop the system, including procurement of 97 km of existing distribution assets, for which Tractebel will pay $8.13 million. Estimated development time for the system is 5 years. By then, the system will serve the Mexican municipalities of Guadalajara, Zapopan, and Tonala, distributing 257.8 MMcfd of gas mostly for use in industrial or cogeneration facilities. The pipeline system will total 2,186 km and serve more than 180,000 customers.

The government of India's Gujarat state has made clear its preferred choice among the four potential sites under consideration for LNG terminals.

The authorities are putting their weight behind Royal Dutch/Shell, which has identified Hazira as the preferred location for developing an LNG terminal and regasification complex. The other three proposed Gujarat LNG terminal sites, in various stages of progress, include Dahej, being promoted by Petronet LNG; Pipavav, with BG as the main promoter; and Maroli, which recently experienced a setback when Unocal pulled out of the proposed project.

Industry watchers have persistently maintained that there is need for only one LNG terminal in the state. The government's ambitious plan to put up a statewide gas grid has been viewed with some skepticism in these quarters. The company that launches the first terminal will have a significant advantage, the sources say.

Rounding out LNG action this week, Bahia de Bizkaia Gas (BBG) let a 203 million euro turnkey contract to SN Technigaz, a wholly owned affiliate of Bouygues Offshore, to construct an LNG import and regasification terminal in the newly expanded port of Bilbao, Spain. The contract will be carried out by a JV of SN Technigaz, 40%; Initec, 33%; and Sofregaz, 27%. Delivery of all units is expected within 36 months of administrative and legal approval of the contract (expected in the next few weeks). BBG is a Spanish gas marketing company owned equally by BP Amoco, Repsol-YPF, Iberdrola Energia, and Ente Vasco de la Energia (OGJ Online, June 23, 2000).