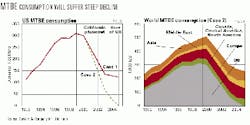

Two likely MTBE scenarios

Case 1 (50% probability):

Scenario:

California:

- Phases out MTBE by the end of 2002.

- Maintains 2.0 wt % oxygen, with ethanol at this level.

- Adjusts CARB standards appropriately.

- Makes up volume from imported iso-octane.

Rest of the US:

- Gradually reduces MTBE use in northeastern states.

- Adds ethanol to bring average oxygenates content in RFG to 2.0 wt %.

- Begins process in 2002 and completes process by 2005.

- Has no national ethanol mandate.

Rest of the world:

- MTBE use grows as refiners try to meet new aromatics standards in Europe and correct bad pollution in Asia.

- No widespread ethanol lobbies.

- Official emphasis on air quality and avoiding benzene.

Impacts:

- MTBE and ethanol uses change as shown in Table 1a. Merchant capacity for MTBE falls from 157,000 b/d to 109,000 b/d, while captive capacity is reduced by 50% to 50,000 b/d. Net imports essentially disappear.

- Captive plants in refineries are inexpensive. In most cases, the butylene can be passed on to existing or expanded alkylation plants.

- At least some of the plants using butane dehydrogenation will be forced to stop making MTBE. They have several choices:

- They can convert production to make iso-octane by polymerization of isobutylene to make iso-octene and subsequent saturation with hydrogen. This produces a high quality blendstock for gasoline.

In this case, they must obtain a guaranteed market at a price that brings satisfactory return on their investment. Joint ventures with refiners might ease this problem. - They can go a step further and install an alkylation plant. This is more expensive, but would produce a larger volume of product.

- They can find foreign markets for MTBE. At least some of them will find this route attractive, specifically in Mexico or in Europe.

- In some cases, they can divert all or part of their output to other chemicals, such as butadiene, or high-purity isobutylene by back-cracking MTBE. There is a small possibility that propylene production might prove attractive.

Plants making MTBE from propylene oxide have similar choices. Since the TBA must continue to be manufactured, they do not have the option to shut down. On the other hand, their economics is tied to propylene oxide. This gives them flexibility in setting the required product prices. It seems likely that these plants will continue to produce MTBE as long as possible, and then to convert to iso-octane as the market dictates.

Plants making MTBE via butane dehydrogenation include:

- Coastal Chem, Cheyenne, Wyo.

- Texas Petrochemicals Corp., Houston.

- Enterprise Products Co., Mount Belvieu, Tex.

- Enron EGP Fuels, La Porte, Tex.

- Valero Energy Corp., Corpus Christi, Tex.

- Global Octanes Corp., Deer Park, Tex.

The impact on the methanol industry will be severe and directly proportional to the loss in MTBE. It takes about 0.34 gal of methanol to produce 1 gal of MTBE, or 0.36 tons of methanol per ton of MTBE.

Case 2 (50% probability):

Scenario:

California:

- As in Case 1, except California waives oxygen standard.

Rest of the US:

- Completely phases out MTBE from US gasoline by 2005.

- Ethanol picks up the balance.

- Waives oxygen standard, which settles at about 1.3 wt %.

Rest of the world:

- MTBE continues to be used as in Case 1.

Impacts:

- MTBE and ethanol usages change as shown in Table 1b and Fig. 2.

- All US MTBE plants either shut down or become converted.

- Ethanol use doubles (about the same as in Case 1). The oxygen reduction is needed to keep ethanol demand from tripling.