Malaysian company more than doubles petchem complex capacity

Titan Petrochemicals Sdn. Bhd., the largest petrochemical company in Malaysia, commissioned a new 330,000 tonnes/year (tpy) ethylene unit in Pasir Gudang, Johor, Malaysia, in October 1999. The cracker can also produce 165,000 tpy of propylene (Fig. 1).

The new unit brings the capacity of the Pasir Gudang complex up to 560,000 tpy ethylene and 280,000 tpy of propylene, driving up its economies of scale.

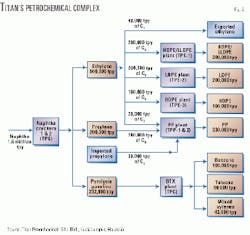

This ethylene plant was part of a larger expansion program, encompassing several polyolefin units. Most of the ethylene product is feed for Titan's polyethylene (PE) and polypropylene (PP) plants. Remaining ethylene goes to the merchant market. The PP plants take all of the propylene.

The new aromatics (BTX) complex, commissioned in January 2000, takes the pyrolysis gasoline from these naphtha crackers.

Fig. 2 shows the structure of Titan's integrated petrochemical complex. The Titan Group has three operating companies: TPC, TPE, and TPP.

TPC is responsible for the production of ethylene and propylene. TPE primarily produces low density PE (LDPE), low linear-density PE (LLDPE), and high density PE (HDPE). TPP owns and operates two PP plants.

The ownership structure of the Titan Group is composed of the Chao family (via UHI; 48.8%), PNB (via PERC; 45.5%), Sinochem (via SCP; 1.3%), and other minority shareholders (4.4%).

Petchem complex

The Titan Group is one of only two producers and suppliers of PE and PP in Malaysia. Its Pasir Gudang petrochemical complex consists of several plants:

- Two naphtha and LPG crackers with a combined capacity of 560,000 tpy of ethylene and 280,000 tpy of propylene.

- A 200,000 tpy swing HDPE and LLDPE plant.

- A 200,000 tpy LDPE plant.

- Two PP plants which produce PP homopolymers and PP copolymers. They have a combined capacity of 330,000 tpy of PP.

- A BTX plant that produces 108,000 tpy of benzene and 60,000 tpy of toluene.

- Various support facilities, including cogeneration power plants, tank farms, and warehouses.

The development of Titan's petrochemical complex consists of two phases.

In Phase I, Titan developed the first naphtha and LPG cracker, the swing HDPE and LLDPE plant, and the first PP plant on a 33-hectare site. This initial development cost about $661 million (1.65 billion Ringgit).

Phase II, initiated in late 1996 and mostly completed by early 2000, more than doubled the size and capacity of Titan's petrochemical complex. It expanded the complex beyond the Pasir Gudang Industrial Estate onto a 40-hectare site in the nearby Tanjung Langsat Industrial Estate.

At a cost of about $840 million (RM 3.2 billion), Phase II included the construction of:

- The second cracker, which has a capacity of 330,000 tpy of ethylene and 165,000 tpy of propylene.

- The 200,000 tpy LDPE plant.

- The second PP plant with a capacity of 200,000 tpy.

- A new 100,000 tpy HDPE plant.

- The BTX plant.

- Two new cogeneration power plants, which produce electricity and steam for petrochemical complexes at both Pasir Gudang and Tanjung Langsat Industrial Estates.

- New pipelines, tank farms, and warehouses.

The cogeneration plants are fueled by two sources: gas supplied via a pipeline by Petroliam Nasional Bhd. (Petronas), Malaysia's national petroleum corporation, and fuel gas and waste energy from the crackers.

Phase II is largely complete except for the HDPE plant, which will come on-line in the third quarter of 2000.

Table 1 breaks out the licensors and engineering and construction contractors for each unit.

Several new pipelines were completed in October 1999. Five 12-km underground pipelines link the Pasir Gudang and Tanjung Langsat Industrial Estate, the site of the new LDPE and HDPE plants. These allow for transportation of ethylene, propylene, butene, and natural gas (for use by the cogeneration plant).

Other new pipelines connect the petrochemical complex with the Johor Port and the tank farms.

During peak construction, there were about 5,000 construction employees on site. With the completion of the new HDPE plant, the current 1,075-personnel permanent workforce will increase by 40-50 persons.

PE and PP market

Titan produces 30 grades of PP products and 37 grades of PE products.

Malaysian consumption rates of PE and PP are growing fast. Before the 1990s, there was no domestic PE or PP production, according to Titan. In 1999, Titan sold about 86% of its PE products and about 80% of its PP products in the domestic market.

In the same year, TPC sold about 63% of its ethylene production to TPE and TPP. All of its propylene production went to TPP as feedstock for the production of PP.

In 1999, about 75% of the PE that Titan sold to the Malaysian market was processed into film; the balance was used for injection moulding and blow moulding.

With the new HDPE plant on stream, Titan will be exporting up to 50% of its polymer production.

Titan's PP products include 16 grades of homopolymers and 14 grades of random and block copolymers. The company believes it is the only producer of copolymers in Malaysia. While homopolymers have good clarity, high stiffness, good chemical and relatively high temperature resistance, they have low impact resistance. Random copolymers, in comparison, have higher clarity, greater impact resistance, and more flexibility. Block copolymers have better impact strength at lower temperatures and higher melting points than random copolymers.

In 1999, about 42% of Titan's PP sold in Malaysia was used for injection moulding. The balance was processed into film and yarn.

Tariffs and taxes

Malaysian manufacturing companies have historically benefited from tariffs on imported PE and PP. The current tariff is 15% for imports from the Association of Southeast Asian Nations (ASEAN) countries and 30% for imports from non-ASEAN countries. The intents of these tariffs were to stimulate growth in the domestic petrochemical industry and reduce Malaysia's dependence on imports.

Titan expects tariffs on ASEAN imports, however, to be lowered or eliminated by 2003. The company believes it is protected from the increased competition that lower tariffs may bring, however, because any increase in competition in the Malaysian market should be offset by tariff reductions in other ASEAN markets.

Under the Promotion of Investments Act of 1986, the government of Malaysia granted all Titan operating companies Old Pioneer status. Old Pioneer status is a 100% tax exemption on profit.

The exemption is applicable for 5 years upon commencement of commercial production. TPP and TPE have both successfully extended their 5-year Pioneer status until Dec. 31, 2001, and Nov. 30, 2003, respectively. TPC has also received a 5-year extension, due on Apr. 30, 2004.

Naphtha crackers

The first naphtha and LPG cracker, commissioned in 1994, had an initial nameplate capacity of 230,000 tpy of ethylene and 115,000 tpy of propylene. Titan commissioned the second cracker, capable of producing 330,000-tpy ethylene and 165,000 tpy of propylene in October 1999.

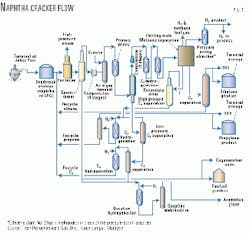

Fig. 3 shows a general flow diagram of these two ethylene plants.

Although both crackers can use a combination of naphtha and LPG for feed, in practice, the crackers use only naphtha.

Prior to the commissioning of the second cracker, Titan required 600 tpy of naphtha. Today, Titan requires 1,600 tpy of naphtha.

As there is no adjacent refinery in Pasir Gudang, Titan relies on external sources for its naphtha supply. The company has naphtha supply contracts with Saudi Arabian Oil Co., Shell International Eastern Trading Corp, Kuwait Petroleum Corp., and Marubeni International Petroleum (Singapore) Pte. Ltd.

The feasibility study for the second naphtha cracker began in the second half of 1996; construction began in February 1997. Titan chose to use two main process technologies by Stone & Webster Inc.: Ultra Selective Cracking (UCS) for the pyrolysis and quench systems and Advanced Recovery System (ARS) for cold fractionation.

The choice of ARS technology was for both convenience and performance. Titan has had good experience with the technology in its first cracker. ARS also met plant layout considerations and is easy to scale up in capacity. Furthermore, Titan was able to re-use some of the original detailed engineering from the first cracker.

Titan also chose the ARS technology for its energy efficiency:

- Reduced chilling train refrigeration load in the dephlegmator.

- Simultaneous chilling and prefractionation in the dephlegmator.

- Reduced methane content in the feed to the demethanizer.

- Reduced de-ethanizer load (C2 stream bypasses the de-ethanizer and goes directly to the ethylene fractionator).

- Dual feed-ethylene fractionator (lower reflux ratio).

- Reduced refrigeration demand (10% overall energy reduction).

BTX plant

The byproducts of the crackers are pyrolysis gasoline, gaseous fuels, fuel oils, and gaseous hydrogen.

The $41 million BTX plant, completed in January 2000, sits adjacent to the second cracker and shares common facilities with it. After the plant's commissioning, TPC diverted its 337,000 tpy pyrolysis gasoline byproduct from the export market to the new BTX plant.

The production process of the BTX plant begins when partially hydrogenated pyrolysis gasoline is piped to a splitter to remove mixed xylenes. BASF AG's Selop-F C5+ process hydrogenates the resultant product. The extractive distillation section uses Krupp Uhde's Morphylane process, to extract benzene and toluene.

Waste products are sent back to the crackers for cracking while benzene and toluene are sent to a tower for removal of solvents. The tower separates the benzene and toluene and sends them to storage facilities.

Polyethylene plants

The swing 200,000 tpy HDPE and LLDPE plant was completed in September 1993. It uses Union Carbide Corp.'s Unipol gas-phase, low pressure PE process technology.

TPE also owns and operates the new LDPE plant, which began commercial operations in November 1999. Mitsui Engineering & Shipbuilding Co. Ltd. constructed the plant using ExxonMobil Chemical Co.'s high-pressure tubular PE technology. The capital cost of the plant was about $152 million, including land costs.

The ExxonMobil technology produces a wide range of LDPE grades, including grades that can be used to produce a high clarity of film, a major market segment for LDPE in Malaysia.

Ethylene feedstock for the LDPE and the HDPE/LLDPE plants comes via pipeline from Titan's crackers or from Titan's cryogenic storage facilities adjacent to Johor Port.

For HDPE and LLDPE, butene or hexene acts as comonomers with ethylene to produce polyethylene.

The raw materials go through a purification process to remove trace impurities such as oxygen and water before they are injected into the reaction cycle for polymerization. Polymerization takes place in a fluidized-bed reactor, where a catalyst promotes reaction. The raw materials are transformed into PE powder, which is discharged from the reactor to the purge bin.

In the purge bin, the PE powder rids itself of residual ethylene. A large extruder melts and cuts the PE powder into small pellets. Titan stores the pellets in silos, from where they are packaged and labeled "Titanex" for distribution.

LDPE production involves reacting ethylene with peroxide initiators. The ethylene is pumped into a mile-long tubular reactor, which is split into five zones of increasing pressure, up to a maximum of 3,000 bar.

At each stage, the LDPE process injects peroxide initiators. At the final stage, LDPE is formed as a sticky paste. The pressure is then reduced, and degassing and chilling take place. Excess ethylene is recycled (Fig. 4). The LDPE is extracted and cut into pellets in an underwater pelletizer.

Technip Geoproduction (Malaysia) Sdn. Bhd., Kuala Lumpur, is constructing the new 100,000 tpy HDPE plant at Tanjung Langsat. The capital cost of this plant is about $75 million.

The HDPE product will be used for high quality films and high quality pipes for water and gas. Unlike the LLDPE/HDPE plant, which uses a gas phase process, the new HDPE plant will employ Mitsui Chemicals Inc.'s CX process, a low-pressure liquid slurry process.

Feedstock for the new HDPE plant will come from TPC's crackers.

Titan will market its new LDPE product under the name "Titanlene" and products from the new HDPE plant under "Titanzex."

Polypropylene

TPP owns and operates two PP plants with a combined nameplate capacity of 330,000 tpy. The first PP plant was completed in December 1991, and the second plant started commercial operation in September 1999. The second plant cost about $96 million to build.

The first plant initially had a capacity of 100,000 tpy of PP. Titan debottlenecked it in 1996 to increase the capacity to 130,000 tpy. Titan sized the second plant to consume all the propylene that would be produced by the two naphtha crackers.

Both plants use Montell's Spheripol PP process. Spheripol uses a high-yield, high-stereo-specific catalyst in a two-stage polymerization system.

The two plants share some common facilities and manpower, which lowers the initial investment cost for the new PP plant and the overall operating costs for both plants. These common facilities allow Titan to benefit from economies of scale, a wider product range, better operational efficiency, and more efficient production scheduling.

The PP plants obtain most of their propylene by pipeline from TPC; the balance is imported.

The production of PP involves reacting propylene, a liquefied gas, in the presence of a catalyst. Polymerization occurs in the loop reactors. Plastic resin, the resulting mixture of propylene and catalyst, is separated in the propylene-recovery section.

The PP is then transferred to the extrusion section, where additives are mixed with the PP by melting and mixing in an extruder. Additives modify the PP for each type of use. The molten mixture in the extruder is then blended through a die, cut, and then cooled into small pellets. Titan sells these pellets under the name "Titanpro."

Support facilities

Titan support facilities include warehouses, tank farms, and access to jetty facilities at the Johor Port.

Phase II added three new warehouses to Titan's existing two. The five warehouses store PE and PP and have a combined capacity of 56,700 tonnes.

Phase II also includes a new tank farm with five new tanks for the storage of naphtha, benzene, and toluene. Titan owned two other tank farms prior to the Phase II project: one tank farm for the storage of ethylene and propylene and one tank farm for the storage of naphtha and pyrolysis gasoline.

The storage tanks for ethylene and propylene are cryogenic. The ethylene tanks are kept at -103

Additional naphtha for the new cracker is imported via a ship through Johor Port. The naphtha is off-loaded at the port and stored in tanks until it is piped 1.5 km to the petrochemical complex.

Environmental management

Pursuant to requirements by Malaysia's Department of Environment (DOE), Titan employed contractors to prepare and submit Quantitative Risk Analysis (QRA) and Environmental Impact Assessments (EIA) studies for its petrochemical activities.

The QRA identifies hazards and quantitatively determines the risk posed to the local population.

The EIA is an assessment of the impact of new projects on the environment. In various stages, it is subject to DOE approval and public comments.

Titan has a comprehensive environmental management policy covering air and water pollution, noise pollution, disposal of gaseous, liquid, and solid wastes, and local ecology. This is achieved partly through pollution monitoring and control equipment in the plant design and partly through an emphasis on pollution management and control procedures in training provided by the licensors.

Titan's petrochemical complex contains a waste water treatment system that processes about 75 cu m/day of water. Each cracker has its own waste treatment system.

A wet air-oxidation unit treats spent caustic by oxidizing sulfites and residual hydrocarbon. Air floatation units, bio treatment facilities, and clarifier units treat spent caustic and plant waste water to Malaysia's discharge standards. Once the relevant waste material is removed from the water, the water is discharged into a nearby river.

Gaseous emissions are completely combusted in flare stacks. Drums store the scheduled wastes, which are subsequently transported to Kualiti Alam at Bukit Nenas, the only government authorized unit for treatment and disposal of hazardous wastes.

Titan regularly performs air, water, noise, and dust sampling at its petrochemical plants and submits the results to Malaysia's DOE and the Pasir Gudang local authority.

Business strategy

To maintain its position as the leading integrated petrochemicals group in Malaysia after Phase II, the Titan Group has adopted five primary business objectives:

- Expand production capacity and improve product mix. Titan plans to capture the future growth in PE and PP demand in Malaysia and Asia. Phase II of the expansion project allows Titan to produce a wider range of products and grades that will attract higher margins.

Before the completion of the LDPE plant in November 1999, imports were the only means of satisfying the domestic demand for LDPE.

The new PP facility will result in higher margins as a result of less waste production, expanded capacity, a broader product mix, and the development of higher grade products.

Titan believes its location gives it a competitive edge in pricing, timely delivery, transportation costs, and technical support.

- Continue as an efficient and low-cost producer. The company intends to maintain its position as an efficient and low cost producer by implementing projects that benefit economies of scale. For example, Phase II more than doubles the complex's capacity without the same increase in overhead costs.

- Strengthen sales and marketing activities. Titan will continue to focus on its marketing efforts to increase sales volumes in both domestic and export markets. In the domestic market, it intends to be the leader in product quality and customer service.

Price and quality mainly drive the export market, and Titan is poised to internationally compete in those two areas. It has branch offices in Hong Kong and Singapore and representative offices in Beijing, Shanghai, and Tokyo.

A new Plastic Technical Center, to be operational in the second quarter of 2000 at a cost of about RM8.6 million, will help Titan to improve its customer service and technical support and play a key role in Titan's future research and development activities. Titan plans to staff the center with about 20 technicians, who will initially focus on product development.

Finally, the marketing group is examining ways to use the Internet to market its products. Titan is a charter member of ChemConnect Inc., an on-line trading forum for chemicals.

- Use advanced and standardized technologies in its petrochemical complex. Apart from the various process technologies used in Phase II, Titan is also using Aspen Technology Inc.'s optimization software, the Asahi Engineering Co. Ltd., Tokyo, preventive maintenance system, and SAP software to run its petrochemical complex.

All the plants have AspenTech's information management system, InforPlus-21, which provides information to the data historian for future enhanced installations. Currently, Titan is implementing AspenTech's advanced controls with dynamic matrix controllers (DMC) and real-time optimization on the first cracker. Titan plans to do the same for the second cracker after implementation is complete on the first one.

AspenTech also provided training simulators for training personnel to operate the second cracker and LDPE plants. Since the second cracker's layout and equipment numbering system were nearly identical to that of the first, operators could be trained on the first unit and easily transferred to the second.

The complex uses open Yokogawa Centum CS as the platform for all the control systems. One central control center operates both crackers, the BTX plant, and cracker utility systems even though the crackers are 450 m apart.

The primary controllers for the new cracker are located in a newly constructed satellite instrument house, which connects to the central control room with a dual fiber optic cable.

- Take advantage of shareholder support. In June 1998, TPC, TPE, and TPP entered into a 10-year agreement with the Westlake Group in North America (founded by the Chao Group in 1985) for management and marketing advice and technical assistance.

Under the agreement, Westlake regularly sends experienced personnel to render assistance in project development, operations management, training, process improvement, and equipment design.