OGJ Newsletter

Market Movement

Oil prices persist above $30/bbl despite OPEC increase

Oil prices remain stubbornly above $30/bbl, despite OPEC's announcement of a 708,000 b/d production increase.

This points to two things: the driver of high gasoline prices in the US, propelled by parochial elements; and the market's perception of greater-than-expected underlying oil demand growth worldwide-especially in Asia.

While OPEC and US Republicans point to environmental considerations as the chief culprit in the US gasoline price debacle (see related stories, pp. 24 and 26), some analysts look to the prospect of high oil prices being sustained if those high-case world oil demand scenarios come to pass.

London's Centre for Global Energy Studies noted, "OPEC's output boost was meant to deal with the market's need for more oil, particularly in the US. Strong demand from Asia, however, has limited the amount of Middle East crude coming west, despite a sharp upturn in liftings. Burgeoning demand from China and India has prevented the Atlantic Basin from receiving all of the additional supplies it so urgently needs, keeping stocks low and pushing up prices for short-haul crudes in the region."

IEA now predicts that the Asian economic rebound will spur a much bigger increase in demand than had been expected. In projections worked up just before the OPEC meeting, CGES estimated that, if OPEC were to put another 500,000 b/d onto the market and IEA's high-demand projections were to materialize, then prices would settle back down to below the uppermost price-band trigger by the first quarter (see chart). But with that incremental oil and without IEA's high-demand scenario, oil prices are well on their way back down to the bottom level of OPEC's price band, when OPEC would have to start thinking about taking barrels off the market again. F

Service-supply sector rebounding

Rising demand and prices for oil and gas in the US and Canada will help the oil field service and supply sector continue its revitalization.

So said Gary R. Flaharty, director of investor relations for Baker Hughes, at a Banc of America Securities (BAS) energy conference in Houston last month.

Flaharty says seismic companies have been lagging behind other segments of the service-supply sector during the recovery. Drilling companies were the first to recover, followed by completion companies 3-6 months later.

Increased drilling activity is mostly driven by demand for gas, he says; gas-directed drilling increased more than 60% for June from a peak seen in 1997, while oil-directed drilling has risen just 45% since 1997's peak.

Industry forecasts call for gas demand to boost drilling by 43% in Canada, 40% in the US, and 19% in Latin America, says Flaharty. Drilling activity also is expected to rise by 25% in central and West Africa and by 6% in the Middle East but will remain flat in Europe and decline 4% in Asia.

Baker Hughes is forecasting that 750 rigs will be drilling in the US at yearend.

Energy stocks prospects brightening

The bullish US economy is beginning to slow, but energy stocks are finally starting to rebound.

That observation came from John K. Skeen, BAS director of portfolio strategy, at that same BAS conference. Because so many energy sector stocks are trading below the company's fiscal performance, plenty of upside remains in these stocks for profit-seeking investors, says Skeen.

Surging demand for oil and gas, the latter in particularly strong demand in the US, is giving some stocks a boost. Skeen also notes that more power plant projects are needed, as many utilities stopped building new generating capacity once they saw the approach of gas market deregulation.

The stocks of many traditional E&P companies also have potential upside of 30-50%, he says. And surging demand for oil and gas is spilling over into the drilling and oil service sectors as well, bolstering some stocks in those areas. The underlying fundamentals of the technology market also have helped service companies, many of whom are emphasizing technology as a means of reducing costs and improving efficiency. x

null

null

null

Industry Trends

OIL AND GAS consumption rose last year, even as Global energy consumption STAGNATED for the second consecutive year, growing only 0.2% in 1999 in the aftermath of Asia's economic crisis and changing fuel use patterns in China, BP Amoco reports in its annual statistical review of world energy. This increase is well below the average growth of 0.9%/year the past 10 years.

Oil consumption, however, increased by 1.6% last year, slightly faster than the 1989-99 average (see table). Also, global use of natural gas shot up 2.4%, the highest growth rate since 1996.

Asia-Pacific total energy consumption was down 2.3% last year, led by a dramatic drop of 10.7% in China-triggered largely by a whopping 16.8% drop in its coal consumption. Among Asian countries, only South Korea exceeded its average 1989-99 consumption, registering a growth rate of 9.3%.

Annual growth of total energy consumption also was below recent historic average rates in Africa and in Central and South America. Among the seven largest national economies, only the US, Italy, and Canada exceeded their 10-year average growth. US energy consumption increased by 1.6% last year, accounting for 25.8% of total world energy consumption.

While oil consumption grew in 1999, most members of OPEC voluntarily reined in their production. The group as a whole cut output 5.4% to a combined 29.3 million b/d in an effort to spur a 39% rebound in world oil prices to an average $18.25/bbl for the year.

INTEREST IN greenhouse emissions trading is on the rise.

A number of Queensland companies have joined forces to form the Queensland Emissions Trading Forum, a nonprofit organization that will provide member companies with hands-on simulated greenhouse gas emissions-trading experience in a virtual trading environment.

QETF has already begun work, and trading simulations will begin in August. The forum has been formed in response to greenhouse emissions targets proposed under the Kyoto Protocol and at a time when Australia is developing policy directions on the possible establishment of a domestic emissions-trading regime (OGJ Online, May 30, 2000). x

Government Developments

THE US Supreme Court HAS UPHELD THE SANCTITY OF FEDERAL OIL AND GAS LEASES.

The court ruled 8-1 last week that the federal government owes ExxonMobil and Marathon $156 million for voiding their leases to drill off North Carolina (see map).

The court overruled an appeals court ruling. Marathon and a unit of then-Mobil each paid more than $78 million for the leases in 1981, but Congress later passed a law requiring Interior to conduct environment- al studies before allowing exploration-which the companies alleged breached their lease contracts. API, filing a supportive brief, said the firms had acquired the tracts with the "clear expectation that they would be allowed to develop those leases."

Justice Stephen Breyer said, "The government broke its promise, repudiated the contracts, and must give the companies their money back." The appeals court had ruled that the oil firms were unable to obtain all the necessary approvals for exploration and thus were not entitled to breach-of-contract relief. x

A GORE PRESIDENCY WOULD ENSHRINE ALTERNATE ENERGY.

US presidential aspirant and Vice-Pres. Al Gore last week proposed a $75 billion program to reduce US dependence on imported oil, lower pollution, thwart purported global warming, and prevent electricity shortfalls.

For the gas industry, the plan would extend deepwater royalty relief for marginal fields in the Gulf of Mexico. That program will expire in November, unless renewed.

Gore outlined plans for tax breaks and other financial incentives for changes in energy and environmental practices. At presstime last week, he had planned to announce additional incentives, for urban mass transit and for consumers to buy more energy-efficient and environmentally sound products.

Gore outlined five energy policy goals: reduce energy use and pollution, lower dependence on imported oil, protect children against pollution threats, reduce the threat of global warming, and increase power grid reliability.

Among other incentives, Gore's proposal would extend and modify the tax credit for producing electricity from renewable and alternative sources. It would double the existing tax credits for the operating costs of wind, open and closed-loop biomass, biomass cofiring, and landfill methane power generation. The Gore program would also expand federal investment in the Small Business Innovation Research Program and the Advanced Technology Program, which give businesses incentives to develop energy-efficient and environmental technologies.

The Competitive Enterprise Institute said Gore's plan is "about government control of energy use, lower consumption, and higher prices."

CEI said, "The Clinton-Gore administration has spent 7 years working to reduce energy supplies and raise energy costs. And they got their wish with $2/gal gasoline and looming electricity shortages this summer.

"Now Gore wants to take this plan one step further by inserting government control and interference in every aspect of energy production and consumption." x

Quick Takes

Triton's success OFF EQUATORIAL GUINEA continues.

Its Ceiba-3 appraisal on Block G confirmed the primary reservoir found by the Ceiba-1 and Ceiba-2 wells and encountered a deeper, "similar-quality" oil reservoir, says Triton. Ceiba-3 cut 256 ft of net pay after being drilled to 9,695 ft TD in 2,165 ft of water. Ceiba-3 is about 1 mile northeast and 282 ft downdip of the Ceiba-1 discovery well. Plans call for Ceiba-3 to be completed this summer. A mile southwest of Ceiba-2, Triton spudded Ceiba-4 May 31 with the Sedco 700 semisubmersible rig. x

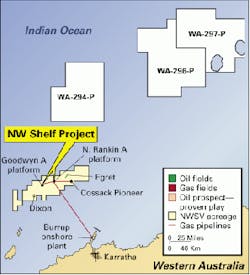

In other exploration news, PTT Exploration & Production is eyeing exploration opportunities in Viet Nam and Indonesia, as well as in Iran, where it is pursuing concessions. At the same time, PTTEP is striving to increase the proportion of oil in its gas-heavy reserves portfolio. PTTEP has already bid for Block 9-02 off southern Viet Nam. It also is finalizing plans to bid for a number of onshore oil exploration blocks in western Iran (OGJ Online, June 12, 2000). x Meanwhile, Woodside acquired BP Amoco's one-sixth share of reserves associated with the undeveloped Egret and Dixon oil discoveries in the North West Shelf venture off Western Australia (see map). In addition, Woodside will acquire BP Amoco's one-sixth share of any subsequent oil discoveries. Woodside also will provide BP Amoco with equity in three exploration permits in Australia's offshore Canning basin and cover BP Amoco's share of exploration costs of $8.5 million (Aus.) in these permits over the next 3 years. Woodside now holds 16% interests in these three permits, with BP Amoco holding 26% interests in two wells and 19% in a third well. F BHP encountered a significant oil column in its Griffin-8 appraisal well in producing Griffin field off Western Australia. This has increased the field's reserves and will boost production. The well was drilled as part of an infill program that began earlier this year with the successful Scindian-3 appraisal nearby. Griffin-8 flowed at 8,000 b/d. x BHP made a second gas discovery off Trinidad and Tobago. The Aripo-1 wildcat, about 40 km off eastern Trinidad, flowed a stabilized 21.6 MMcfd through a 44/64-in. choke after reaching a maximum flow of 46.3 MMcfd through an 80/64-in. choke. Water depth is around 30 m. The reservoir zone is similar to that in its Angostura-1 strike 4 km southwest, drilled earlier this year, says operator BHP, with 45% interest. Other interest holders are Elf 30% and Talisman 25%. F

Smedvig and Keppel Fels Shipyard plan to jointly build and market an $82.5 million self-erecting semisubmersible tender rig rated to 6,000 ft of water. Keppel will build and own the $59.5 million semisubmersible hull and Smedvig will own the $23 million topsides equipment. The rig is to be delivered by fourth quarter 2001. Keppel will market, manage, and operate the rig for 10 years. Smedvig has an option to purchase the hull during that period at a previously agreed price. F

Elsewhere on the drilling front, Pride Foramer agreed to manage rigs working off Angola owned by Ocean Rig. The agreement also covers management of units as planned by the Sonangol-Ocean Rig JV under an MOU the firms signed in February. The JV's objective is to build, own, and market rigs for ultradeepwater operations in Angola and abroad; it will be owned 51% by Ocean Rig and 49% by Sonangol.F Friede Goldman Offshore Texas (FGOT) reached an agreement with Petrodrill IV and Petrodrill V regarding contract disputes over FGOT's construction of two Amethyst-class deepwater semis for Petrodrill. The transaction, to be completed in July, was approved by the US Maritime Administration, which is providing loan guarantees for the project. The new agreement calls for the Amethyst 4 and 5 rigs to be delivered to Petrodrill on Sept. 15, 2001, and Dec. 15, 2001, respectively.

Production has begun from the first well on Jade platform in the ExxonMobil-operated Zafiro field on Block B off Equatorial Guinea. The well is flowing more than 12,000 b/d of oil. The $560 million Jade project pushes Zafiro output to more than 112,000 b/d. Eventually, the platform will contribute about 60,000 b/d to field production when Jade output peaks in 2002. ExxonMobil estimates Zafiro reserves at more than 400 million bbl of oil. There are 22 producing wells in the field, and 17 wells are to be completed from Jade in the next 18 months. Other field partners include Ocean Energy (23.75%) and Equatorial Guinea. x

Topping the rest of the week's production news, a JV of TotalFinaElf and NNPC will soon begin development of Amenam-Kpono oil field off Nigeria. TotalFinaElf pegs development costs of the 500 million bbl field at $1 billion. Production via an FSO vessel is expected by 2003. The reservoirs are at depths exceeding 3,500 m subsea. The field's production, planned for start-up in mid-2003, will be shipped through a 30-km pipeline linking the platform to the FSO at TotalFinaElf's Odudu field on Block OML 100. Output is expected to peak at 125,000 b/d of oil. x Under a revised royalty agreement covering the Hibernia offshore oil development, Newfoundland expects to receive about $100 million (Can.) in additional revenues over the next 5 years. The estimate is based on an average price of $25 (US)/bbl. The new agreement with the Hibernia ownership group will give Newfoundland about 50% more than under the original deal. The province recently approved a request from the owners to increase production by one third to 66 million bbl/year. Newfoundland asked for royalty changes to recognize a reduced payout time on the project. If production decreases, the old royalty rates will apply. The province expects to earn $28 million (Can.) in Hibernia royalties this year. F

An explosion caused by a gas leak at Kuwait's Mina Al-Ahmadi refinery on June 25 killed four people and injured 49 others, according to the Kuwaiti News Agency. The refinery was to be closed for 7-10 days for an investigation and damage assessment, says KNPC. Some units at the refinery would be out of operation for months and others for several weeks. KNPC says two 18,000 b/d gasoline units were severely damaged by the explosion and fire. A 122,000 b/d crude unit suffered major damage, while a 120,000 b/d crude unit suffered moderate damage. x

As for refining developments elsewhere, Venezuelan Pres. Hugo Ch

Nan Ya Plastics plans to spend $1.9 billion (Twn.), or about $62.3 million (US), to construct a second 100,000 tonne/year phthalic anhydride (PA) plant at Formosa Plastics Group's petrochemicals complex in central Taiwan. The plant is to begin commercial operation before yearend 2001. Nan Ya currently operates a 100,000 tonne/year PA plant at the FPG complex. F

In the week's other petrochemicals report of note, Iran's first JV contract to build a petrochemicals plant at Bandar Imam Khomeini will cost an estimated $140 million, reports the UK's Bal* Group Chairman, Vahid Alaghband. Bal* was reported 2 weeks ago to have joined the project with a 60% stake, with National Petroleum Corp. unit Amir Kabir Petrochemical 40%. The plant, in Iran's special economic zone, is expected to come on stream in 2003 and will produce 300,000 tonnes/year of LLDPE (OGJ, Feb 14, 2000, p. 34). F Sunoco and Epsilon Products have formed a JV combining Epsilon's polypropylene plant at Marcus Hook, Pa., with Sunoco Chemicals' polymer-grade propylene splitters. The polypropylene plant adjoins Sunoco's Marcus Hook refinery. The new venture will be owned by Sunoco and BAR-L, an affiliate of Washington Penn Plastic that is an owner of Epsilon. F

China has unveiled a new element in its long-term natural gas supply plan.

CNOOC intends to build a gas pipeline to move China's offshore gas to markets in eastern China and will ramp up offshore development work in order to support the pipeline. The pipeline is to be built in the next 15 years and extend from Hainan through Guangdong, Fujian, and Zhejiang provinces before terminating in Shanghai. Ultimately, China wants to build an infrastructure that would carry gas from East China and South China seas to these provinces. CNOOC hopes eventually to supply 30 billion cu m/year of gas-taking into account both domestic production and LNG imports-by 2010. x

Western Hemisphere projects dominate the rest of the week's pipeline action.

PDVSA Gas expects to sign by September a contract covering a project aimed at the expansion of the Anaco-Jose gas transmission system in eastern Venezuela that will lead to an increase of about 1 bcfd in the system's delivery capacity. The system now transports about 320 MMcfd. As envisioned, the Anaco-Jose project entails the creation of a JV to operate the transportation of gas from Anaco. PDVSA Gas said 59 private companies-38 of them Venezuelan-have already been short-listed to participate in the project tender. PDVSA Gas will set up an information center on Aug. 18 to provide technical data on the project. PDVSA Gas will retain a minority stake in the venture, which will be the first of several JV projects undertaken as the country's gas sector is opened to private investors (OGJ, Apr. 24, 2000, p. 21). F Imperial Oil and partners with natural gas reserves in Canada's Mackenzie Delta are considering an 800 MMcfd pipeline from the delta to Norman Wells, NWT, where Imperial operates an oil field. The firms are studying feasibility of shipping gas in a new line that would parallel an existing Enbridge-operated oil pipeline from Norman Wells with connections in northern Alberta. Imperial and partners hold about 6 tcf of onshore proven gas reserves in the delta fields under study. Total estimated reserves in the area are 12 tcf of gas and 1.7 billion bbl of oil. The feasibility study is to be completed in early 2001.

A downed GTL plant has resumed operations.

Shell MDS Malaysia resumed production at its gas-to-liquids plant at Bintulu 21/2 years after an explosion badly damaged its air separation unit (OGJ, Jan. 26, 1998, p. 48). The plant, which uses the Shell Middle Distillate Synthesis (SMDS) process, is now operating at its 12,000 b/d design capacity.

"Detailed investigations into the cause of the December 1997 explosion established that minute atmospheric particles stemming from forest fires during the prolonged haze period, which blanketed Borneo Island during that time, had entered and accumulated in the ASU, resulting in an explosion," said Shell. "This was unrelated to the core SMDS synthesis technology, and the decision to rebuild reflects the company's confidence in this state-of-the-art, gas-to-liquids conversion technology." x

Correction

Syntroleum Corp.'s Sweetwater project in Australia is at the design and engineering stage, not under construction, as reported incorrectly (OGJ, June 19, 2000, Newsletter, p. 8). Construction is not likely to get under way before next year, Tulsa-based Syntroleum said.