Worldwide gas processing rides industry wave into 2000

The new century began on a very upbeat note for worldwide gas processing.

Buoyed by rising world energy markets leading into 2000, Canada led the way in 1999 in increasing inlet-gas capacity and NGL production and further solidified North America as the dominant region for gas processing. US capacity and production increased last year as well.

Outside these two North American giants, additional capacities and production along with new data reflect a more accurate picture of gas processing elsewhere, especially in Latin America and the Middle East.

This growth in activity outside North America reflects the ongoing wider and more fundamental shift in trading patterns for NGL, especially LPG. Experts have been predicting this shift for some time. (See accompanying article, p. 73.)

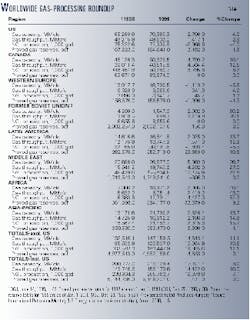

On Jan. 1, 2000, gas-plant data for the US and Canada reflected those countries' historical dominance of world activity: Combined for 1999, the two countries retained their 57% of world capacity and produced more than 48% of the world's NGL (Table 1).

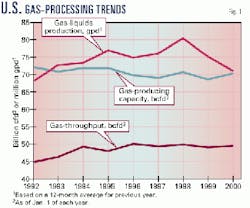

On Jan. 1, 2000, US gas-processing capacity stood at nearly 71 bcfd; throughput in 1999 averaged 49.6 bcfd; and NGL production, 72 million gpd (1.7 million b/d). Only the production figure reflects a drop from that for 1998 (Fig. 1).

At the beginning of 2000, Canadian gas-processing capacity exceeded 50.9 bcfd with an average of more than 40 bcfd going through the country's plants last year. NGL production exceeded 50 million gpd.

Canadian natural gas production has been increasing vigorously for several years in response to expanded takeaway capacity from Alberta. Growing US demand has been fueling these increases. Oil & Gas Journal has been tracking this trend (see OGJ, Mar. 13, 2000, p. 70; and the second issue of March for preceding years).

When, for a moment, Mexican figures are removed from Latin American ones and combined with its geographical North American neighbors, the dominance of that region appears even more starkly:

Combined, the three countries of North America in 1999 accounted for more than 137 million gpd (53.8%) of the world's NGL production.

Sources; the world

These gas-processing activity figures are based on Oil & Gas Journal's most recent exclusive, plant-by-plant, worldwide gas-processing survey (p. 79) and its international survey of petroleum-derived sulfur recovery (p. 115).

For Canadian figures, OGJ's report supplements operator-supplied capacity and production data with figures from the (1) Alberta Energy & Utilities Board (AEUB), (2) British Columbia Ministry of Employment & Investment's Engineering and Operations Branch, and (3) Saskatchewan Ministry of Energy & Mines.

OGJ began incorporating AEUB data in 1994 (for 1993 activity). Specific comparisons of data for 1992 and earlier years must therefore proceed carefully because of lack of response by some operators. Provincial data, nonetheless, confirm general trends indicated in data reported for those years.

Numbers for 1999 plant data for the Middle East have been adjusted to reflect fresh information about Iran. And NGL production for Saudi Arabia, the world's third largest NGL-producing country, is an aggregate published by the US Energy Information Administration.

Outside Canada and the US at the start of 1999, gas-processing capacity stood at 96.2 bcfd; throughput for 1999 averaged 68 bcfd; NGL production averaged more than 129 million gpd.

These figures all reflect increases over 1998 as the world outside Canada and the US, especially the countries of Asia-Pacific and Latin America, produce more gas and gas liquids to meet improving domestic and regional economies.

Led by Saudi Arabia, the Middle East ranks as the world's largest exporter of NGL, especially LPG. For 1999, its countries ranked behind the US and Canada for gas-processing capacity (26.8 bcfd) and accounted for 55.8 million gpd of NGL production, or more than 21% of the world's production, and surpassing Canadian production.

The reviving economies of Asia-Pacific pushed that region's gas handling capacity (21.8 bcfd) past Western Europe (nearly 19 bcfd). Latin American countries increased capacity to more than 16.8 bcfd.

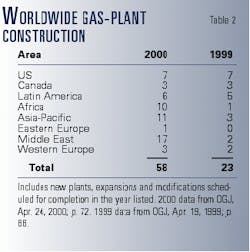

Table 2 provides a snapshot of the current state of gas plant construction in the world.

Table 3 ranks the world's major natural-gas reserves by country at the start of 2000; Table 4, the world's top natural-gas producing countries for 1999; and Table 5, the world's leading NGL producers.

In petroleum-derived sulfur recovery, Canada and the US continued to dominate the world in 1999, holding nearly 56% of processing capacity and almost 57% of actual production.

For worldwide production of sulfur derived from refining and natural gas, Canada last year accounted for more than 32% of the overall total; the US, more than 24%.

North American picture

A look at natural gas production over the last 5 years for the three countries that make up North America reveals much about the shifting patterns of gas movements and NGL production in the region.

Between 1995 and 1999, US natural gas production wavered along a narrow band, starting at 19.6 tcf in 1995 and returning to 19.6 tcf for 1999. Canadian and Mexican natural gas production, on the other hand, has risen.

In 1999, Canada produced 6.74 tcf, up steadily every year from 6.2 tcf in 1995. Mexican production has also increased yearly to 1.75 tcf in 1999 from 1.37 tcf in 1995.

A lion's share of Canadian natural-gas production flows across the southern border into US markets in California, the upper Midwest, and the Northeast. And with completion later this year of Alliance pipeline from British Columbia to south of Chicago, more of Canada's gas liquids will accompany that gas south.

While much Mexican production is aimed at satisfying demand of the several municipal gas-distribution systems under construction, some production-mainly in the north-aims at moving across the US border to meet demand in the growing US Southwest.

This stagnant US natural gas production along with major consolidations among midstream US companies (more about which later) and poor gas plant economics explain in large measure why US natural gas processing capacity grew slightly in 1999 and its gas liquids production declined.

The US in 1999, nonetheless, continued to dominate the other countries and regions in gas processing: Its inlet capacity made up nearly 33% and its NGL production more than 28.2% of the rest of the world's.

Canadian capacity last year stood at more than 23% of the world's and its NGL production, almost 20%; Mexican capacity, 2.1%, and its NGL production, 5.8%. OGJ numbers indicate that, in NGL production outside Canada and the US, Mexico ranks second only to Saudi Arabia (Table 5).

For 1999, based on OGJ's exclusive plant-by-plant survey and other published sources, more than 1,600 gas plants were operating worldwide, 581 plants in the US, 760 in Canada.

Table 2 shows a dramatic increase in planned new plants or those under construction. If petroleum prices remain at or near levels they have achieved for the first half of 2000, we will see more construction planned to handle the consequent increase in natural gas production.

State dominance

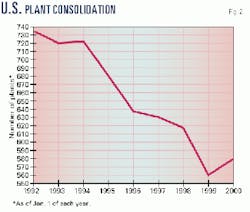

The number of gas plants operating in the US reversed a several year decline in 1999 (Fig. 2). This occurred despite ongoing consolidation and rationalization as companies have been merging, exchanging assets, and closing older, less efficient plants.

Capacity utilization in the US since 1995 has been fluctuating in a narrow band around 70%: For 1999, it was 69.9%; 1998, 70.6%; 1997, 70.7%; and 1996, 72% . In 1995, it stood at 70%.

OGJ data indicate that an historical low utilization rate, at least for the modern era of deregulated natural-gas prices, occurred in 1986: 55%.

With more than 19.1 bcfd in gas-processing capacity (up slightly from 18.6 bcfd in 1998), Louisiana continues to lead other US states, followed closely by Texas with slightly more than 16.8 bcfd. Between them, the two states hold nearly 50.8% of the nation's capacity.

In 1999, the two states produced more than half of the NGL produced in the US: Texas, nearly 43.5% and up from 41% in 1998; Louisiana, more than 17.8% and up from 15% in 1998.

The rush of new capacity that has been ongoing in Louisiana for the last few years seems to have run into the juggernaut of company mergers, consolidations, and closings. The result is fewer gas plants operating in the state in 1999.

At the end of the year, therefore, Louisiana gas-plant capacity growth had slowed, compared with a year earlier, and was up only 160 MMcfd, or less than 1%.

Gas throughput, much from offshore Gulf of Mexico production, fell, but the state's gas plants produced more than 12.9 million gpd compared with 11.7 million gpd of NGL in 1998, a growth of more than 7.7%.

Start-up occurred last year on the Neptune gas-processing plant, a 300-MMcfd, $300-million cryogenic plant near Centerville, La. It was built by then Shell Oil Co. unit Tejas Natural Gas Liquids LLC and Marathon Oil Co. to serve the Nautilus pipeline and facilities of Manta Ray Pipeline Partners LP. It was among the wholesale shifting of plants among owners in 1999 and is now owned and operated by Enterprise Gas Processing LLC

State-by-state OGJ data do not reflect operating information on NGL fractionation plants, fractionation being secondary to gas processing. The plant names and locations are listed in the accompanying plant-by-plant data table.

In Louisiana, several fractionator expansions or projects to improve efficiency have been under way or recently completed at several important plants along the Louisiana gulf coast. These plants are strung along a line from Baton Rouge on the Mississippi River in the east to Lake Charles to the southwest.

Liquids from the large gas-processing plants feed these fractionation plants. One problem has been that much of the product from these fractionation plants is pipeline-constrained for moving westward to the nation's largest petrochemical concentration around Mont Belvieu, near Houston.

Giants' deal

One of the nation's largest fractionators and handlers of NGL and chemicals took a major step last year to relieve this constraint.

In late 1999, Enterprise Products Partners LP, Houston, agreed to buy the 10-in., 263-mile Lou-Tex Pipeline from Concha Chemical Pipeline Co., an affiliate of Shell Oil Co.

The pipeline had been dedicated to moving chemical-grade propylene from Sorrento, La., to the Mont Belvieu area.

Enterprise is acquiring the system through affiliate Entell NGL Services LLC and is converting part of it to batch service to transport refinery and chemical-grade propylene, mixed NGL, and NGL products, primarily ethane, propane, normal butane, isobutane and natural gasoline. The line is also being expanded to approximately 75,000 b/d.

Enterprise said that implementation of batch service in the line along with the company's existing Louisiana pipeline assets will provide NGL and propylene customers in South Louisiana the flexibility to store and transport products to Mont Belvieu and other Gulf Coast markets through an integrated NGL transportation and storage system.

The purchase and expansion comprised the first step in the company's development of a $245 million, 160,000-b/d NGL pipeline system to connect growing supplies of NGL produced in Louisiana and Mississippi with the principal US NGL markets on the Gulf Coast.

These markets include Mont Belvieu, South Louisiana, and US southeastern states served by Dixie Pipeline.

Conversion of the Lou-Tex system is set for later this summer.

Entell NGL Services LLC was formed in early 1999 in a 50/50 joint venture between Enterprise and Tejas Natural Gas Liquids LLC, an affiliate of Shell Oil Co. Entell is a wholly owned subsidiary of Enterprise.

Enterprise, says the company, owns and operates some of the largest NGL fractionation facilities in the US, the largest isobutane complex in the US, two propylene fractionation facilities, a methyl tertiary butyl ether (MTBE) production facility, an import/export terminal of approximately 35 million bbl storage capacity, and a 750-mile network of pipelines, all along the Gulf Coast.

Elsewhere, Williams Energy Services, Tulsa, completed last month a $60-million expansion at its natural gas plant in Opal, Wyo. The project added 350 MMcfd of cryogenic capacity and 20,000 b/d of NGL extraction capacity.

Total inlet capacity at the plant is now 1 bcfd, including 735 MMcfd of cryogenic capacity, and NGL extraction capacity raised to 43,000 b/d.

A third cryogenic train was added, two existing cryogenic trains were modified, and control systems and field compression were enhanced.

Jonah field partners McMurry Oil Co., Amoco Production Co., and another Williams unit selected the Opal plant to process new volumes of natural gas from the Sublette County, Wyo., field.

Installation of the new cryogenic unit began in May 1999. Williams said the completed expansion makes the facility one of the largest NGL producers in the US.

Opal NGL can be fed into a 412-mile pipeline, completed in November 1999, tying into a Williams Rockies-region NGL pipeline system for ultimate delivery to the US Gulf Coast.

Later this year, one of the largest gas plants built in the US will begin operations in conjunction with the Alliance dense-phase pipeline from Northeast British Columbia to near Chicago.

Aux Sable Liquid Products is a $365 million, world-scale, NGL extraction and fractionation plant nearing completion approximately 50 miles southwest of Chicago. It is designed to process up to 1.6 bcfd of natural gas and initially to recover 70,000 b/d of NGL.

Installed extraction consists of two trains, each with a 175-ft demethanizer capable of processing approximately 1 bcfd of natural gas.

Installed fractionation includes: a 135-ft de-ethanizer recovering 40,000 b/d , a 125-ft depropanizer recovering 19,000 b/d, a 90-ft debutanizer and 185-ft butane splitter recovering 8,000 b/d of normal and iso-butane, and 3,000 b/d of natural gasoline.

Other installed components include: two 30,000-hp compressor units, a 300-ft flare stack, more than 1,500 ft of large-diameter multi-level pipe racks, eight large spherical storage vessels for 200,000 bbl of NGL products, rail tank car loading facilities, and product pipeline interconnects.

As of June 2000, work remaining involves primarily electrical and facility control systems to be followed by commissioning.

Elsewhere, in a major consolidation of gas processing capacity, Duke Energy Field Services Inc., Denver, announced in April 2000 that it had completed acquisition from Phillips Petroleum Co., Bartlesville, Okla., of the plants and pipelines of GPM Gas, previously the nation's largest natural gas processor and producer of NGL.

The merger is the latest in a series of major moves for DEFS. In 1999, Duke acquired Union Pacific Resources Group Inc.'s midstream gas unit and Koch Midstream's South Texas gas gathering, treating, and processing systems.

With the UPR deal, DEFS became the largest US producer of NGLs, ahead of GPM, which now folds into WEFS to form a new company that will operate 70 plants and 57,000 miles of pipelines with an estimated 17 tcf contracted gas supply.

The company operates in 11 states: including Wyoming, Colorado, Kansas, Oklahoma, New Mexico, Texas, Louisiana, Alabama, and Mississippi, and along the Gulf Coast and in northwest Alberta,

It will process about 5 bcfd of raw gas and produce nearly 16.8 million gpd of NGL, dwarfing its closest rivals: ExxonMobil, Dynegy Liquids, and BP Amoco, each of which produced in 1999 between 4.6 and 5.3 million gpd.

As part of the expanded company, DEFS also completed the acquisition of companies holding gathering and processing assets in central Oklahoma from Conoco Inc. and Mitchell Energy & Development Corp. The assets acquired lie adjacent and between DEFS' current assets, providing future integration opportunities, said the company.

DEFS purchased Conoco's interests for cash. In exchange for Mitchell's interests in the Oklahoma gathering and processing assets, DEFS transferred to Mitchell its interests in the assets of the UPR Bryan, Tex., plant, Ferguson-Burleson Co. gas-gathering system and Austin Chalk Natural Gas Marketing Services joint ventures that operate in central Texas.

Also forming part of the new company is Texas Eastern Products Pipeline Co., Houston, the general partner of TEPPCO Partners LP, which was transferred to DEFS in April.

Canadian changes

Gas-processing capacity for all Canadian plants at Jan. 1, 2000, was more than 50.9 bcfd; throughput for 1999 averaged more than 40 bcfd; NGL production, nearly 50.3 million gpd (almost 1.2 million b/d).

Canadian plant utilization in 1999 was up slightly for 1999 at 79.5%, compared with about 78% for both 1998 and 1997.

OGJ's survey and governmental data from Canada's three major producing provinces indicated that 780 plants were operating in Canada in 1999. Alberta alone had 713 plants operating last year with nearly 44.3 bcfd capacity.

Eastern Canada entered the gas-processing picture for the first time last year with completion in December of the Goldboro, Guysborough County, NS, gas plant and fractionation plant at nearby Point Tupper.

The Goldboro gas plant began processing gas on New Year's Eve. Inlet capacity is 17 million cu m/day (596 MMcfd) and residue gas on the order of 15.7 million cu m/day.

The Point Tupper fractionation plant, some 30 miles north and connected by an 8-in., 40-mile pipeline, will process 20,000 bbl (840,000 gpd) of natural gas liquids from Goldboro. It will produce 10,500 bbl of condensate, 6,250 bbl of propane, and 3,250 bbl of butane.

But the real story is on the western side of the country, in the highly concentrated plants and production in the Province of Alberta.

There, restructuring continues.

By mid-1999, it had become clear to the new TransCanada (a marriage of NOVA and TransCanada PipeLines Ltd.) that fundamental changes had to be made. With its stock value falling, the company put up for sale virtually its entire midstream assets in a divestiture valued at approximately $3 billion (US).

Included in the sale is the huge, 2.4 bcfd Cochrane plant that straddles the takeaway system to the Western US.

TCPL expects the sale of this and other assets to close this year. And with that close may well end a chapter in Canadian gas processing, as the once nearly unified Albertan industry seems destined for fragmentation.

TransCanada had also announced in early 1999 that it would get out of the US midstream market by selling its Gulf Coast facilities and its US oil marketing and trading units.

By late 1999, Coastal Field Services, Houston, had stepped in to buy four Louisiana plants, three NGL fractionation plants, 380 miles of NGL pipelines, and TCPL's marketing and trading business.

These assets significantly increase Coastal's presence in Louisiana, adding the 1,275-MMcfd Eunice plant, among others, to Coastal's only other plant in the state, the Pelican plant near Patterson.

Coastal had no fractionation capacity; now it adds the 26,000-b/d Riverside fractionator at Geismar, La., and the idle 28,000 Rayne fractionator in Acadia Parish.

Other events in Canada also reflect the shifting ownership scene.

Conoco Inc., Houston, and its wholly owned subsidiary Conoco Canada Ltd. completed purchase of Petro-Canada's NGL business.

Conoco said its acquisition of the NGL business is part of its program to upgrade its portfolio of North American gas processing and gas liquids assets.

The associated assets include an 18% nonoperating interest in the Dow's Fort Saskatchewan propane-plus fractionator at Edmonton, a 5% non-operating interest in the Rimbey Pipeline, and a 10% non-operating interest in the 1,900-mile Cochin Canada pipeline, which stretches from Edmonton through the US Upper Midwest to Sarnia, Ont.

Conoco's NGL acquisition included a 92% operating interest in Petro-Canada's 2.4 bcfd Empress gas plant near Medicine Hat, Alta.; the 580-mile Petroleum Transmission Co. pipeline from Empress to Winnipeg, Man.; six related pipeline terminals; and a storage facility. The Empress plant has an NGL production capacity of 48,000 b/d.

The deal increases Conoco's total net gas liquid production in Canada, the US, and Trinidad by 65% to 105,000 b/d and triples net processing capacity to 3.4 bcfd while reducing per-barrel overhead and operating costs by 24%, Conoco said.

Previously, Conoco sold midstream properties in Oklahoma and West Texas, and in late 1999 it acquired natural gas producing properties from Canada-based Renaissance Energy Ltd. That acquisition doubled Conoco Canada's daily gas production and increased proven gas reserves by 60%.

World developments

Among the big news in Africa last year was the advancement of projects in Nigeria, where political events have created numerous delays and at times left major projects in doubt.

Nevertheless, Nigeria LNG Ltd.'s $3.8 billion, 5.9 million tonne/year (tpy) LNG plant at Bonny, Rivers state, started production and loaded its first LNG shipment the first week in October.

The project was built by TSKJ, an engineering consortium consisting of Technip SA of France, Snamprogetti SpA of Italy, Kellogg Brown & Root of the US, and JGC Corp. of Japan. The project was launched in 1989 to make use of Nigeria's associated natural gas production, much of which is flared.

The first LNG shipment was bound for Gaz de France's Montoire terminal in the 122,000-dwt LNG Lagos.

NLNG has sales contracts with Italy's ENEL for 3.5 billion cu m/year (bcmy) of gas, Spain's Enagas SA for 1.6 bcmy, Turkey's Botas for 1.2 bcmy, and Gaz de France for 500 million cu m/year.

Contracts called for Shell Petroleum Development Co. to supply 53.33% of the plant's feed gas requirement of 26.6 million cu m/day, while Elf Aquitaine SA and Nigeria Agip Oil Co. were to account for 23.33% each.

Ownership in NLNG is Nigeria National Petroleum Corp., 49%; Shell Gas BV, 25.6%; Elf, 15%; and Agip, 10.4%.

Expansion of a third train, now under construction and targeted for 2003, will increase the LNG capacity of the Bonny plant to 8.7 million tpy. TSKJ landed the contract for the third train in a deal valued at $1.2 billion.

The third train will increase the plant's capacity by 50%, said Shell.

The project also will export approximately 1 million tpy of LPG to South America and Western Europe.

Portugal's Transgas signed a 20-year contract for an undisclosed sum to purchase 1 bcmy of LNG from NLNG. Deliveries from the third LNG train are planned to begin in fourth quarter 2002.

The new contract follows an agreement between NLNG and Transgas in 1993 for deliveries from NLNG's first two trains. With this contract, NLNG has presold all the output from its third train.

Elsewhere in Africa, Repsol-YPF SA started up the 200-MMcfd Salam gas-processing plant, part of a major gas project on the Khalda concession in Egypt's western desert. Concession partners are operator Repsol-YPF, 50%; Apache Corp., Houston, 40%; and Novus Petroleum Ltd., Sydney, 10%.

The newest phase of the project boosts gas and liquids production at Khalda to 100,000 boed from 37,000 boed. The project also includes the 100-MMcfd Tarek gas-processing plant and a 320-km spur to the trunk line at Salam.

State-owned Egyptian General Petroleum Corp. will buy 200 MMcfd of the Khalda gas; separately, Dahshur South, Cairo, will buy 50 MMcfd via a southern pipeline under construction.

Conoco and 50-50 partner Elf Aquitaine let a $160 million EPC contract to Houston-based Kvaerner ENC for the $430 million Deir Ez Zor natural gas project in Syria's eastern desert.

The contract involves construction of a two-train, 450-MMcfd gas processing complex, six compressor stations, a 100-mile gathering system, and a 150-mile trunk pipeline.

In the neighboring Middle East, Saudi Aramco last year let an EPC contract to Foster Wheeler Energy Ltd., Reading, UK, for development of a new gas-processing complex near Haradh, part of a larger gas project set to come on stream by 2004.

First-year production will produce 1.4 bcfd of gas, plus elemental sulfur and condensate.

Work also continues under a Saudi Aramco contract to JGC Corp., Yokohama, for construction of a 1.6-bcfd gas processing plant slated for completion in November 2001.

The plant is part of Saudi Aramco's $2 billion project to expand production in supergiant Ghawar oil field. Gas processed by the new plant will be used in power generation and petrochemicals production.

And, Saudi Aramco hired the Italian unit of Technip and its subsidiary TPL Arabia Ltd. to build sulfur-recovery and utilities plants at Hawiyah gas field in Saudi Arabia.

Technip said the plant, to be built 280 km south of Dhahran, will consist of three sulfur units with a capacity of 350 tonnes/day (t/d) each, with sulfur-loading facilities and related utilities.

Mechanical completion targets November 2001, with the plant due on stream in first quarter 2002. Hawiyah will deliver 1.6 bcfd of gas to the Saudi master gas system.

Also, late last year, Qatar General Petroleum Corp. let a $430 million contract to ENI unit Snamprogetti SpA and South Korea's Hyundai Engineering & Construction Co. for construction of NGL-4 at Dukhan and Masaieed, Qatar.

The project, to be completed in early 2002, will enhance recovery of ethane from Arab-D field in the Dukhan and North field gas plant in Mesaieed, to transport the NGL across the Qatar peninsula with a new pipeline and, finally, fractionate it into ethane and exportable products (propane, butane and gasoline) in the new NGL-4 plant.

With this project, QGPC will supply an additional 2.5 million t/d of ethane to the projected petrochemical complex (Q-CHEM) and the existing complex (QAPCO).

Asian LNG, terminals

LNG news was big in Asia last year as Malaysia LNG Tiga Sdn. Bhd., subsidiary of Malaysian state oil firm Petronas, awarded a $1.5 million turnkey contract by for a major expansion of its LNG complex in Bintulu, Sarawak.

The consortium, headed by Kellogg Brown & Root (KBR), will handle the project that, says KBR, will be the facility the largest of its kind in the world.

Malaysia LNG Tiga is a joint venture of Petronas, Shell Gas BV, Nippon Oil LNG (Netherlands) BV, Occidental LNG (Malaysia) Ltd., and Sarawak state. The construction consortium includes Malaysian subsidiaries of KBR and JGC Corp. and Sime Engineering Sdn. Bhd. of Malaysia.

The job calls for design, procurement, construction, and commissioning of two LNG trains and offsite facilities, which will be added to the existing six-train complex. Each train will have capacity of 3.8 million tpy, boosting total capacity of the MLNG Tiga plant to 23 tpy.

Construction will start in first quarter 2001. The first new train is scheduled for completion in fourth quarter 2002, and the second in third quarter 2003.

This is the second major expansion of the initial MLNG complex. The three-train MLNG Dua addition was completed in 1995 by a consortium headed by JGC Corp. and KBR forerunner M.W. Kellogg Co.

In the Philippines, Shell Philippines Exploration BV let contract for a multimillion EPC contract to Foster Wheeler Energy Ltd. to build an onshore gas-processing plant to be linked with the Malampaya deepwater gas development off the Philippines.

The twin-train plant, to be built in Tabangao on Luzon Island, will have capacity to process 500 MMcfd of gas. The $4.5 billion Malampaya project will include development of two deepwater fields, construction of a gas evacuation pipeline and processing plant, and 2,700 Mw of power generation capacity.

First offshore gas deliveries to the Philippines are expected to begin in October 2001.

Also in the Philippines, TotalFina SA acquired a 15% interest in Shell Gas Eastern Inc., which owns an LPG import and storage terminal at Tabangao, the Philippines.

This is the only refrigerated butane and propane storage facility in the Philippines and has a combined storage capacity of 50,000 tonnes.

Another unit of TotalFina, Total Gas & Power India, along with Hindustan Petroleum Co. Ltd., signed a shareholder agreement to develop a 50/50 LPG import terminal at Andhra Preadesh state on India's east coast.

With 60,000 tonnes of storage capacity, the terminal will reportedly be the largest of its kind in the region. It will help India meet its demand for LPG, which is expected to rise to 10 million tonnes after 2005-06 from 4.5 million tonnes in 1998.

The terminal is slated from completion in 2003.

In other storage news, Caltex Corp., the Asian joint venture of Chevron Corp. and Texaco Inc., began operation of an LPG terminal and storage tanks in south China's Guangdong province. The $100 million project was initiated in 1995, with construction started a year later at the port city of Shantou.

The project includes two 100,000-cu m underground LPG tanks for butane and propane storage. It also incorporates an LPG receiving terminal with three berths. One berth has a handling capacity of 50,000 tonnes and the other two, 5,000 tonnes each.

The terminal can accommodate a maximum LPG throughput of 2 million tpy, but during the initial operation stage, Caltex expects it to handle only 500,000 tpy.

In Thailand, Petroleum Authority of Thailand (PTT) recently announced it is considering a sixth gas-processing plant.

The project would cost an estimated $263 million. A feasibility study will be completed near yearend, said a company official, with the plant being commissioned within 4 years. Plant inlet capacity could be as high as 400 MMcfd of natural gas. The original plan for the project envisioned commissioning in 2006-07.

Initially, propane and butane from the fractionation section of the proposed gas plant are likely to be exported. Current PTT forecasts indicate the kingdom will not need additional indigenous LPG supplies until 2006-07.

The gas complex would process incremental natural gas supplies from PTT, consisting mainly gas from the Yadana and Yetagun fields in Myanmar's Gulf of Martaban.

The plant also would be integrated with PTT's gas processing complex in Rayong, where PTT operates three units with capacities of 220 MMcfd, 250 MMcfd, and 350 MMcfd. PTT also operates a 250 MMcfd gas plant in Khanom, Nakhon Si Thammarat, in southern Thailand.

Thailand's fifth gas processing complex is operated by Thai Shell Exploration & Production, a unit of the Royal Dutch/Shell Group. Thai Shell runs a small facility that separates 300 t/d of LPG from associated gas produced from Sirikit oil field in the northern province of Phitsanulok.

In Latin America, Petroleos de Venezuela SA continues development of its $450 million Accro project. Construction began in June 1999 and is set to be completed by spring 2001.

Included are NGL extraction facilities in San Joaquin and Santa Barbara, Venezuela, and NGL fractionation, storage, and refrigeration facilities in Jose. The units will process 800 MMcfd of gas and fractionate 50,000 b/d of NGL; products are allocated for export. NGL storage capacity will be about 610,000 bbl.

Sulfur recovery

Petroleum-derived sulfur production capacity worldwide remained essentially flat in 1999, contracting to slightly less than 129,000 t/d from slightly more than 129,000 t/d in 1998. This comes as no surprise given that the world is awash in unwanted sulfur.

Canada reported nearly 33,500 t/d capacity in 1998 (27.4% of the world's total); the US held more than 36,000 t/d (28.1% of the world's total).

Worldwide capacity in 1999 outside the US and Canada fell to more than 57,000 t/d from slightly more than 61,000 in 1998.

Worldwide production of petroleum-derived sulfur increased last year to slightly more than 68,000 t/d, from nearly 64,500 t/d in 1998.

Canada accounted for slightly more than 22,000 t/d; the US, for more than 16,600 mtd.