OGJ Newsletter

Market Movement

OPEC accord bullish for oil prices

As expected, OPEC has compromised between the price hawks and doves, but the outcome is more likely to be bullish rather than bearish for oil prices for the rest of the year.

OPEC last week quickly agreed to increase its oil production another 3%, or 708,000 b/d, to a total 25.4 million b/d, effective July 1. That increase apparently was a midpoint compromise between a smaller hike of 500,000 b/d, preferred by Venezuela and Iran, and a bigger bump of 900,000 b/d, which Saudi Arabia and some other members reportedly favored.

Even before the 90-min meeting June 21 of OPEC oil ministers in Vienna, analysts were saying the market had already factored in an expected increase of 500,000 b/d.

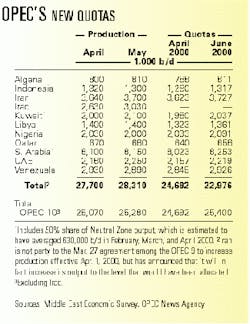

With some OPEC members already exceeding their previous production quotas by an amount close to their new quotas, the increase actually would add only 200,000 b/d to the market (see table). But if OPEC members follow their usual pattern of cheating on their quotas, the result could be an effective increase of 1 million b/d or more, say some analysts. Dain Rauscher Wessels, noting the limited production capacity of some OPEC members, thinks cheating will actually decline from the May average it pegs at 500,000 b/d to only 300,000-400,000 b/d. That will keep WTI at $25-30 during the next 2 quarters, the analyst says.

Meanwhile, oil prices continued to climb after the meeting, with NYMEX August crude closing June 21 at $31.37/bbl, up 72¢ on the day. On June 22, August Brent was fetching $29.56 in late afternoon trading in London, up 16¢ from the previous day's close, while in Singapore, Brent closed at $29.33/bbl.

Gasoline price furor

Analysts say the latest OPEC production increase will likely have little immediate impact on US gasoline prices this summer, in a market plagued by low inventories of the new reformulated gasoline (RFG) mandated for major cities by EPA (OGJ Online, June 21, 2000).

The US pump price for regular gasoline averaged $1.681/gal last week, up 5¢ from the previous week.

The FTC launched an investigation of allegations of oil company gouging in the Chicago and Milwaukee areas, where pump prices for RFG have exceeded $2/gal, compared with $1.87/gal for conventional regular.

Industry officials claim the price spike is a result of low inventories, problems with a Michigan pipeline, and the higher costs of producing and transporting RFG.

Vice-Pres. Al Gore has called for an investigation of possible price-fixing by the industry, while administration officials continue to deny that the US EPA mandate could be part of the problem, for fear of hurting Gore's presidential bid (see Government Developments, p. 7).

OPEC rebuts

In announcing the production increase, OPEC Conference Pres. Alí Rodríguez Araque, energy and mines minister of Venezuela, took a slap at various government policies that OPEC members claim are the real culprits behind rising gasoline prices in consumer nations, echoing OPEC Sec. Gen. Rilwanu Lukman, at WPC last week (OGJ Online, June 14, 2000).

Crude stock levels remain "adequate," Rodríguez said, but "legislative introduction of reformulated gasoline has resulted in supply bottlenecks" that drove up US gasoline prices. He also blamed high pump prices on market speculators in general and on domestic taxes on gasoline in Western Europe, "amounting to as much as 70% of the price to the final consumer."

As with the earlier agreements to cut production, the new accord also excludes Iraq. But changes in UN sanctions against Iraq permitted an almost 20% increase in its production following last year's OPEC cuts. Nevertheless, Iraqi officials last week urged other OPEC members not to feel pressured to boost production.

NL Bulletin

At presstime, there still was no reported settlement of a labor dispute that threatened to knock out Norway's production of about 3.2 million b/d last weekend. Norway's oil company association threatened early last week to lock out more than 2,600 offshore oil field workers by midnight June 23 if a dispute over retirement ages is not resolved.

Meantime, Olso says it will decide soon whether or not to scrap its current curb on oil output, in light of high oil prices. In recent weeks, the country's oil sector has been plagued by a series of strikes and weather damage (see related item in Quick Takes, p. 8), calling into question its ability to boost output quickly, even if a decision to do so is reached.

Industry Trends

TECHNOLOGICAL advances are expected to increase the economic gas resource base of the US Lower 48 and Canada by 250 tcf and 125 tcf, respectively, says Gas Technology Institute

GTI, the product of the merger of Institute of Gas Technology and Gas Research Institute (see story, p. 34) outlines in a new study the elements that will enable the US and Canada to expand gas supply and cut costs over the next 15 years-among them improved geologic knowledge and advances in exploration technology to help find new gas-prone areas and plays and more-efficient completion and new production technology to improve the economics of turning existing resources into reserves.

In addition, by 2015, development and exploratory drilling success rates are expected to approach 85% and 30%, respectively. Advanced bits, improved drilling fluids, better rig designs, and greatly improved operating efficiency will contribute to a decline in drilling costs onshore and offshore in all depth ranges.

"Technology has been a facilitator to allow producers to develop new gas supply niches," said GTI's John Cochener. "For example, before the mid-1980s, coalbed methane production was essentially zero. Today, it contributes 1.2 tcf annually to [US] gas production and represents 6.5% of supply. Technology has helped producers survive the 1998 slump and position themselves to produce into today's attractive $4 gas and $30 crude oil price environments."

Globalization of the natural gas industry is a positive force that can help bridge the economic chasm between the world's affluent and poor, says Texaco Chairman and CEO Peter I. Bijur.

At a World Petroleum Congress session, Bijur predicted rapid globalization of the gas industry and world economy. He said globalization is driving change at "light speed," not jet speed. It is not just another business development but equivalent to the movement of tectonic plates, he said.

World gas trade is being integrated, and nations are steadily opening their economies to competition and deregulation. Bijur said this globalization can help bring "light and literacy" and an improved quality of life to underdeveloped nations. He said the industry can benefit 1 billion people who live on $4/day or less and the 2 billion for whom electric light or internet access is a distant dream.

Bijur notes that globalization of the energy industry is considered a scourge by some. But it is, in fact, a key driver for economic and social improvement (see Journally Speaking, OGJ, June 19, 2000, p. 17). And, he stressed, it is in the best self-interest of the industry to work with governments and other agencies to ensure that globalization succeeds for all nations.

Government Developments

Deepwater activity in the Gulf of Mexico doesn't warrant additional environmental impact statements, says MMS

A new US MMS environmental study examines potential effects of E&D and production operations in the gulf's deep waters. The document is intended to be a planning tool to help shape the scope of a National Environmental Policy Act review that will be required for future deepwater work. MMS concludes that most deepwater operations are substantially the same as those in shallow water on the OCS and that no new environmental impact statement is needed.

According to the study-which evaluates current and projected deepwater activities on the OCS during 1998-2007-new discoveries are being made in progressively deeper water, leading to questions about effects on marine life, the fishing industry, water quality, air quality, and nearby communities' socioeconomic systems. The assessment sought to determine which deepwater activities are substantially the same as those on the shelf, which are substantially different, what effects the activities might have, and what mitigation measures are possible. x

HIGH GASOLINE PRICES HAVE SPARKED A POLITICAL FIRESTORM in the US.

EPA is mulling whether to waive rules requiring summertime reformulated gasoline-with its reduced volatility specifications-and allow refiners to sell conventional gasoline until prices ease.

The Clinton administration recently asked the FTC to investigate high gasoline prices in the Chicago and Milwaukee areas, and administration officials met with refiners to discuss the situation.

Vice Pres. Al Gore charged, "The big oil companies' profits have gone up 500% in the first part of this year, just at the time when these prices are going sky-high in the Midwest. I think this justifies a much broader investigation into possible collusion, price gouging, and antitrust violations."

Last week, API urged the US Office of Pipeline Safety to lift an 80% pressure limit on the Explorer Pipeline. The southern leg of Explorer's 560,000 b/d Houston-to-Chicago line has been limited to 490,000 b/d since a rupture near Greenville, Tex., in March. The northern section into Chicago has operated at the usual 350,000 b/d.

Meanwhile, DOE took the unusual step of releasing up to 1 million bbl of SPR crude to relieve a Louisiana supply problem. Conoco's Westlake refinery and Citgo's Lake Charles refinery both were unable to receive waterborne crude shipments after a commercial dry dock collapsed into the Calcasieu Ship Channel earlier this month-a problem resolved last week.

Sen. Charles Schumer (D-NY), who has been urging the administration to release SPR oil to thwart OPEC output cuts, said release of the oil to the Louisiana refineries shows that the administration "is willing to allow the government to influence the market."

In the face of an election-shortened legislative calendar, the US Senate will push this summer to approve permanent normal trade relations (PNTR) with China, and China is expected to enter the WTO later this year. Last month, the House approved PNTR in a 237-197 vote.

US businesses, facing competition from Chinese imports and wanting more access to the vast Chinese market, had pushed for approval. Opposing it were some unions, human rights activists, and environmentalists.

Last month, China agreed to open about 10% of its crude trade to foreigners under a pact with the EU for WTO membership. Under the deal, China gradually would decontrol oil, allowing foreign firms to sell oil directly to refiners and large customers vs. going through state firms. This would give private companies 20% of China's refined products import market, rising by 15%/year.

Foreign firms could sell crude to about 60 small refineries-total capacity of about 300,000 b/d-affiliated with local governments and outside control of CNPC and Sinopec. x

Quick Takes

CHINA'S OLEFINS PRODUCTION registered strong gains in the first 5 months of this year on strong demand for downstream derivatives such as polyethylene.

Production will likely be boosted further, as China recently banned polyethylene imports from South Korea. In the first 5 months of 2000, China's ethylene production rose 11.4% from the same period the previous year, reaching 1.98 million tonnes. Output in May was up 7.02% year-to-year, at 368,800 tonnes. China plans to produce 4.45 million tonnes of ethylene this year, up 10.8% from 1999 production.

IN GAS PROCESSING NEWS, Phillips has withdrawn from a gas-to-liquids joint venture with Qatar General Petroleum and Sasol.

Phillips had been participating in the GTL plant, to be built at Ras Laffan Industrial City, Qatar. QGPC and Sasol are reverting to a two-partner ownership per the original arrangement. Phillips has decided to refocus its activities in Qatar in light of the recent merger of its chemical business with that of Chevron's.

QGPC and Phillips say they will jointly explore future opportunities in Qatar. However, both companies feel that Phillips should concentrate on areas involving its core expertise and proprietary technology, such as chemicals, LNG, and E&D. QGPC and Sasol will hold interests of 51% and 49%, respectively, in the realigned GTL project. Both companies will proceed with the design and execution plans necessary for the project to enter into the front-end design and engineering phase before yearend.

ON THE REFINING FRONT, Kazakhstan's 163,000 b/d Pavlodar refinery has suspended operations temporarily, says Aleksandr Ryumkin, deputy head of the Pavlodar regional administration.

The official reason for the shutdown is maintenance, but Ryumkin claims the real cause was the conflict between the owner of the refinery, CCL Oil, and Mangistaumunaigaz. In 1999, the bulk of the refinery's assets, which has been held in concession by CCL Oil since March 1997, were transferred to Mangistaumunaigaz to repay debts.

Ryumkin notes, however, that Mangistaumunaigaz has yet to receive its property. The refinery was expected to restart June 25.

A SCANDAL HEADS UP MARKETING NEWS. Statoil and four other service station operators in Sweden are under investigation for possible illegal price fixing.

The Swedish competition authority has been looking into the practices of Norsk Hydro Olje, OK-Q8 (owned by Kuwait's national oil firm), Preem Petroleum, Svenska Shell, and Statoil Detaljhandel since December. This investigation was launched after the companies moved in November to cut down on discount schemes for corporate customers, says Statoil. "We felt that these discounts were excessive, particularly in relation to the pump prices charged to ordinary consumers," says Johnny Ohlsson, head of Statoil Detaljhandel in Sweden. "Eliminating them was intended to bring down the level of discounts and thereby maintain reduced pump prices in order to enhance our competitiveness in the market, rather than to boost profits."

In other refined products marketing developments, BP Amoco said tests of its new ultralow-sulfur diesel fuel on buses, tractor-trailer trucks, and gasoline tanker trucks showed air emissions decreased by more than 90% when teamed with catalytic exhaust filters. The test, begun by ARCO last fall before its acquisition by BP Amoco, included more than 180 urban commercial vehicles in Southern California.

SIGNS ABOUND OF AN UPTURN IN RIG DEMAND. Helmerich & Payne ordered four new land rigs and exercised an option to order four additional rigs. Since March 2000, H&P has ordered 12 new land rigs worth about $90 million. The first four rigs are expected to cost about $7.5 million each, and the last four, scheduled for delivery in fiscal year 2002, will cost about $8.25 million each. H&P expects the first new rigs to begin operations in H&P's first quarter of fiscal 2001; all should be operational by the middle of fiscal 2002. The company will use major equipment components from IRI International for all 12 rigs. x With demand for natural gas rising and its backlog of gas-related drilling, completion, and workover services growing, well service firm Key Energy Services will refurbish 50-60 workover and completion rigs and issue about 10 million shares of common stock. The firm has scheduled about $25 million worth of rig work for 2001. Key said the projects are expected significantly to improve the company's ability to serve customers in the onshore natural gas regions of the US, Argentina, and Canada, where a substantial backlog of orders already exists. F In other rig action of note, Transocean Sedco Forex received a letter from BP Amoco alleging default on a 5-year contract for the Discoverer Enterprise ultradeepwater drillship. The contractor says the letter alleged that equipment problems relating to the drillship's BOP system caused downtime. Transocean says the rig remains on contract and is standing by on location on Mississippi Canyon Block 822 in the Gulf of Mexico. The company strongly denies it is in default and is meeting with BP Amoco to resolve the matter. F The Bideford Dolphin semi resumed operation at Vigdis field in the Norwegian North Sea, and oil production of about 280,000 b/d from Snorre and Vidgdis fields is back on line, reports Norsk Hydro. Sections of three anchor lines that were damaged in hurricane-force winds June 13 have been replaced. An ROV was used to inspect all of the rig's eight anchor lines without uncovering further problems, the company says, and work is proceeding to find out the cause of the anchor problems. An independent investigative commission was established immediately after the incident to determine the cause of the problem.

US PRODUCERS MAY GET SOME HELP FROM DOE. The agency launched a program to help producers identify and quickly apply "best practices" that can keep oil fields in operation. DOE's Tulsa-based National Petroleum Technology Office is seeking proposals for projects that can demonstrate a combination of improved technologies, better data, or other actions that improve production. The Preferred Petroleum Upstream Management Practices Program, known as PUMP, has the goal of helping US operators boost output by 200,000 b/d within 5 years.

In other production news, natural gas output at the Venture platform near Sable Island off Nova Scotia was shut in after a leak was found in the fire-fighting system June 6. Production at the platform-responsible for about half of the gas output from the Sable Offshore Energy Project-will be shut down indefinitely until the system is fixed. The Thebaud and North Triumph platforms will continue with adjusted production to compensate for Venture's shut-down. The problem is in a section of fiber-reinforced plastic piping in the firewater system, which has leaked in previous tests.

AN OLD AUSTRALIAN FIND IS TARGETED FOR DEVELOPMENT. OMV Australia plans to develop Patricia and Baleen gas fields about 23 km offshore in 55 m of water in the eastern Bass Strait. First discovered by the Hudbay group in the 1980s, the fields will be developed in competition with Esso Australia's and BHP Petroleum's gas network fed by fields further south and west. Offshore processing will not be required. Gas will free-flow to an onshore plant close to the coastal town of Orbost in east Gippsland, where it will be compressed, treated, and sold into the nearly completed Eastern Gas Pipeline system to Sydney for consumers in eastern Victoria and New South Wales. Gas is expected on stream in mid-2001 via up to four subsea or minitower-supported wellheads and a pipeline to shore. F

In other development action, Talisman Energy and Summit North Sea Oil will proceed with development of the Beauly oil field in the UK North Sea. The companies will develop the field, which has estimated crude reserves of 3 million bbl, under a contract with Global Marine Integrated Services. Talisman has 60% interest in the field and Summit 40%. Beauly, formerly known as Zeta field and discovered in 1998, will be developed with a 4,000-ft horizontal extension of an existing well, with the oil moved via a subsea pipeline to the Balmoral floating production system. Production is expected to begin later this year at an initial rate of 10,000 b/d. F Samedan Oil's Ecuadorian unit EDC began drilling the Amistad 5 delineation well to test seismic anomalies in the Progreso formation in Amistad gas field off Ecuador. Amistad 5 will be drilled to 12,600 ft by the end of June, says Samedan, at which time production testing will begin. Another delineation well, Amistad 7, is also planned, at the opposite end of the structure. Amistad 6 and 8 will further delineate the field and will also serve to develop the structure.

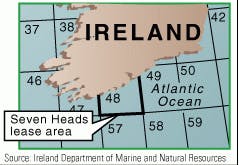

INTEREST IN OFFSHORE IRELAND EXPLORATION continues to build.

Ramco Oil & Gas was awarded a 12-month license option for the Galley Head area, which includes parts of Block 48/18, Block 48/19, and Block 48/24 in the North Celtic Sea off Ireland (see map). Ramco received the option through its partnership with Island Petroleum Developments and Sunningdale Oils (Ireland). Option interests are Ramco 60%, Island 32%, and Sunningdale 8%. Galley Head is 25 km north of Seven Heads oil and gas field, for which Ramco was granted a license option in late 1999. Two wells have been drilled on the acreage. Well 48/18-1, drilled by BP in 1985, flowed gas on test. The well is in 90 m of water about 28 km from the Irish coast-about the same distance from both Seven Heads and Kinsale Head fields.

Topping other exploration news, a consortium led by Isramco and BG spudded the Nir-1 wildcat off Israel. Nir-1 is in the Yam Ashdod Carveout, 10 miles northwest of Ashkelon, Israel, in 120 m of water. The primary objective is early Pliocene gas sands. The budget for the well is $10 million. Isramco is operator and holds 0.36244% working interest in the well. x

Petrobras Colombia has drilled a successful appraisal to its Guando find on the Boqueron Block in Colombia, reports partner CanOxy. Preliminary estimates indicate that, with waterflood support, the field could produce 280 million bbl of oil. Guando is in the Upper Magdalena basin, 70 km southwest of Bogota. Drilled to 3,529 ft TD, Guando-2 cut 485 ft of net oil pay. The well was drilled 2.3 km southwest and 730 ft downdip of the Guando-1 discovery well, which cut 506 ft of net gas pay and 510 ft of net oil pay. Guando-1 is producing 350 b/d on a long-term production test, with only the lowest 20% of the net pay zone perforated. Guando-2 will be tested, once a long-term production license has been received. Preliminary estimates indicate OOIP of at least 1.4 billion bbl of 30° gravity sweet crude, plus gas, says CanOxy. Recovery of at least 20% is expected with waterflood support for the reservoir.

REPERCUSSIONS FROM THE ERIKA SPILL continue and will likely have a profound effect on tanker travel.

France's National Assembly unanimously adopted a draft law to bolster control of tanker degassing operations in France's harbors. Degassing at sea is blamed for heavy pollution. The new law, which comes into force July 1, makes it compulsory for vessels to deposit their waste and shipment residues into existing facilities before leaving the harbor. A related new law reinforces the sanctions directed at ship captains who wash out their tanks offshore. F A joint venture of Chevron and Mitsui & Co. signed a shipbuilding contract with Japan's Kawasaki Heavy Industries for construction of two 82,200 cu m LPG carriers, with delivery expected during the last quarters of 2001 and 2002, respectively. The vessels will be placed under long-term time charter to Dynegy Global Liquids, a subsidiary of Dynegy. Operated by Chevron, the carriers will enhance Dynegy's ability to move large volumes of LPG at competitive rates. The vessels will be classified as very large gas carriers and will have a laden speed exceeding 17 knots. The vessels will be configured to trade to either Eastern or Western Hemisphere terminals. x

ROUNDING OUT TRANSPORTATION NEWS, Northern Border Pipeline reached an agreement in principle with the majority of its customers and FERC to settle its pending rate case.

Terms of the settlement are confidential until a stipulation and agreement is filed with FERC for approval. Based upon the agreement in principle, the procedural schedule in the rate case proceeding has been suspended for 60 days. Northern Border owns and operates a 1,214-mile interstate pipeline that transports nearly one fourth of all Canadian gas imported into the US. F

In other pipeline action, Tennessee Gas Pipeline plans to build a 17.5-mile, 20-in., 400 MMcfd natural gas pipeline to connect its existing system in the Gulf of Mexico to the High Island Offshore System (HIOS). Tennessee says the new link will give its customers strategic access to the deepwater gulf and other supply connected to HIOS. Access also will be provided to Vastar Resources's Grand Chenier, La., processing plant, Tennessee's 800-leg Zone L pool, interstate and intrastate pipeline interconnects, and Tennessee's marketing facilities in the gulf, as well as the Southeast and Northeast. The project involves laying pipe from HIOS, in West Cameron Block 167, to a subsea tie-in to Tennessee's existing system in WC Block 180. Incremental supplies will follow this route to Vastar's Grand Chenier plant onshore for processing. The plant has available capacity to process the entire 400 MMcfd while continuing to manage its existing throughput. Start of service is planned for Nov. 1. F Vector Pipeline construction began on the mainline portion of the 344-mile pipeline that will carry natural gas from Chicago to markets in Eastern Canada and the US Midwest, Northeast, and Mid-Atlantic regions when operations begin later this year. Mainline construction is expected to last throughout the summer. x Georgian parliamentary deputies have ratified a package of agreements for construction of the Baku-Ceyhan oil export pipeline from the Caspian Sea region to the Turkish Mediterranean coast. Georgia stands to earn up to $62.5 million in annual transit fees from oil transported through the pipeline. On May 31, the Georgian Parliament voted unanimously to ratify the contract signed by Georgia, Azerbaijan, and Turkey on construction of the Baku-Tbilisi-Ceyhan Main Export Pipeline. Despite a unanimous approval, Nino Burdjanadze, head of Parliament's international relations committee, says the contract was ratified with some conditions: If the price for the transportation of the oil is more than $2.50/bbl, Georgia retains the right to raise the tariff on oil transported through its territory. The Mil* Mejlis of Azerbaijan had ratified the contract on May 26. The Turkish Parliament has yet to vote on ratification.