Indian LNG projects boom in full swing

A boom in LNG demand and projects is taking shape in India.

Demand for natural gas, mainly from new power generation projects, fertilizer plants, and industrial users, is projected to soar in the world's second most populous nation.

Its paltry domestic output of natural gas mandates that India must import natural gas to meet it expected explosive growth in demand for the fuel. While pipeline imports might seem a logical choice, this is a problematic alternative.

Proposals to bring gas from Oman to the Gujarat coast through a subsea pipeline or from Iran to India, via Pakistan, have been floated and discussed at length. But the former faces daunting technical and economic hurdles, and given the inimical political relations between the two neighbors, no final decision is forthcoming soon on the latter.

Given the scope of India's expected demand growth and the likely long lead times and other problems associated with various pipeline options, India has settled on a comprehensive program of establishing LNG terminals around the country and expanding its domestic gas pipeline infrastructure to deliver that regasified LNG to market.

Companies including Enron Corp., Unocal Corp., ExxonMobil Corp., TotalFinaElf SA, Royal Dutch/Shell, and BG PLC have expressed interest in setting up facilities for importing and processing LNG.

At least six LNG terminals (see Fig. 1), are slated to be developed in the next 5 years; one is already under construction as part of a massive LNG-and-power project by Enron (see related articles on pp. 74 and 76). Of these, a 120 billion rupee ($3.36 billion), 2.5 million tonne/year LNG terminal at Ennore and a $1 billion, 2.5 million tonne/year LNG terminal at Mangalore, are the two privately promoted LNG projects currently under development.

In addition, according to the projections of the Ministry of Surface Transport, at least 10 LNG carriers will be needed to transport the required LNG.

The country needs an estimated $8 billion to set up such LNG terminals. Most of this could come from the private sector, if the basic pipeline infrastructure is in place. A wide spectrum of foreign companies have tried to establish a foothold in India, either in oil and gas exploration and development or in promoting an LNG terminal.

The Asian Development Bank is funding natural gas infrastructure facilities in the country to the tune of $700 million. Industry officials have suggested that, ideally, power plants could be developed along the pipeline network, to take optimum advantage of cheap, efficient, and clean regasified LNG.

Shell strategy

The burgeoning LNG market in the country is a major area of focus for Shell and Saudi Aramco, which have almost concluded negotiations with the Gujarat Maritime Board on the parameters of an LNG terminal project at Hazira on the Gujarat coast.

"With so many gas-based power projects coming up in India, selling LNG in the country would be a very good field for us to get into," said Shell Group Managing Director Jeroen Van der Veer.

The multinational also made an oil strike on an exploration block in Rajasthan earlier this year, its first in India. While the oil found was deemed nonviable on a stand-alone basis, the company is assessing the discovery and remains positive about its prospects.

However, the combine of Shell and Aramco has definitely put on hold its plans, first put forth in 1997, of entering into a joint venture with one of the Indian public sector undertakings, to set up a distribution and marketing company in India for refined products.

"Our primary interest in India has always been in the retail market, since we feel we could do a lot at the petrol pump level," said Van der Veer. However, the Indian government has not yet permitted investment in the retail sector, though we are still talking to the authorities on this subject."

Foreign oil majors are not allowed to invest in the retail sector unless they invest a minimum of 20 billion rupees ($460 million) in a refinery or produce 3 million tonnes of crude oil from an Indian oil field.

For the moment, Shell produces and sells lubricants and LPG through a joint venture with the government-owned Bharat Petroleum Corp. Ltd. It has also recently started marketing asphalt in India.

In addition, a group led by Shell proposes to set up an LNG terminal at the private port of Kakinada, in Andhra Pradesh, on India's eastern coast, to handle gas imported from Bangladesh. Shell's partners are GVK, Maytas, Ispat and the local Nagarjuna group.

"We would like to utilize the latest technology to develop a floating LNG scheme," said Shell Group Managing Director Phil Watts. "We firmly believe that the gas delivered at Kakinada can compete with coal and naphtha as fuels for power generation and also open up opportunities for downstream businesses that utilize gas."

Watts said that, in the initial phase, the consortium would be looking at the supply of 1-2 million tonnes/year of LNG. If demand increases as expected, the scheme could grow.

"The scheme is a flexible one, which can get bigger step by step," said Watts, who held extensive discussions with Andhra Pradesh Chief Minister Chandrababu Naidu and other authorities about the proposed LNG import scheme.

While claiming that LNG is the fuel of the future, Watts cautions that transportation and handling of the gas is a highly specialized business, involving huge investments for the development of the terminal port and LNG carriers.

"We are the world's largest supplier of commercial LNG, and we also happen to be one of the few major companies to have ready access to the gas," said Watts. "For example, the first shipment of LNG is being delivered to the Enron power project at Dabhol, in Maha rashtra, from a gas field in Oman, in which we own a 33% equity stake."

Although Shell has identified Andhra Pradesh and Gujarat as the key states in which it wishes to invest, Watts said the company would be pursuing business opportunities throughout the country and is keen on oil exploration in the Krishna-Godavari basin.

BP Amoco JV

Another major international player, BP Amoco PLC, plans to enter into a major joint venture with two Indian government-owned companies, Indian Oil Corp. (IOC) and Gas Authority of India Ltd. (GAIL), to supply LNG from its Middle East facilities (either Qatar or Iran) to Indian power projects.

BP Amoco plans to hold 50% of the equity stake in the proposed 40 billion rupee ($920 million) company, while the two Indian firms will take 12% each. The remaining 26% will be given to the Dehradun-based Indian Institute of Petroleum. A technical-economic feasibility report is currently under preparation, but it could take anything up to 5 years for the project to actually go on stream.

Australian combine

A combine of Australian firms promoting sales of Australian LNG hopes to soon sign a memorandum of intent with the promoters of the giant 218 billion rupee ($5 billion) petrochemicals and power complex at Gopalpur in Orissa, on India's eastern coast, to supply 5 million tonnes/year of LNG.

The Australian group is equally keen to pick up an equity stake in the complex, being promoted by the UAE's Al Manhal International Group.

At the moment, the promoters are busy roping in several strategic partners, including the state government-owned Industrial Promotion & Investment Corp. of Orissa, in an effort to implement the project by yearend 2003.

Even the public sector entities Petronet LNG Ltd. and GAIL are slated to pick up equity in the project, which will see foreign direct investment of nearly $4 billion.

"The investments will be routed through Mauritius," said Farid Arifuddin, managing director of the Delhi-based Vavasi Oil & Gas, which has been appointed to coordinate and execute the project. "The project will have a debt-equity ratio of 70:30, while in the case of the pipeline project, the ratio is likely to be 50:50."

The promoters plan to set up an LNG terminal at an estimated cost of 14.82 billion rupees ($340 million) to handle 5 million tonnes/year of LNG, which will be regasified and fired in a 2,000-Mw power plant costing 42.35 billion rupees. Alongside will be a 1.2 million tonne/year petrochemicals complex with a naphtha cracker, costing 50.82 billion rupees; a 1.2 million tonne/year urea-ammonia complex expected to cost 33.88 billion rupees; and two gas pipelines totaling 2,900 km in length and costing 76.11 billion rupees.

Australia LNG consists of BP Amoco, BHP Petroleum Pty. Ltd., Chevron Corp., Woodside Petroleum Ltd., and MiMi (a combine of Mitsui & Co. and Mitsubishi Corp.

Northeast India

There are several other LNG-related projects on tap in northeastern India.

Unocal, which had been asked by the Indian government to study prospects for oil and gas exploration in the tiny northeastern state of Tripura, concluded that, while the potential for oil in the region was extremely low, there was plenty of natural gas potential in the area.

Unocal contends that gas fields discovered in neighboring Bangladesh could be on trend with those in Tripura, where ONGC has launched a project to triple the gas production in the state from the present capacity of 1 million standard cu m/day (MMscmd).

Cairn Energy India Pte. Ltd., the Indian subsidiary of London-based Cairn Energy PLC, has proposed to ONGC that the gas found in Tripura be marketed jointly. So far, gas found in the country has been marketed only by GAIL.

Cairn also made a significant gas discovery of 0.8 in the Gulf of Khambat, on Block CB-OS/2 off Gujarat state, in mid-May this year. The discovery well found both oil and gas, and gas tested was nonassociated gas, with no evidence of carbon dioxide or contaminants. The block had been awarded 2 years earlier to a consortium of Cairn Energy India, Tata Petrodyne, and ONGC. Cairn holds a 75% interest in the find, while Tata Petrodyne has 15% and ONGC 10%.

Cairn, which operates Ravva offshore oil and gas field and plans to extend its exploration activities to the area south of Ravva, the Gulf of Cambay in Gujarat, and in Rajasthan, also has some concessions in Bangladesh.

Because it would be capital-intensive to transport Tripura gas to other parts of India through Indian territory, circumnavigating Bangladesh, both Cairn and Unocal propose to transport any gas found in Tripura to Bangladesh and to deliver the same volume of Bangladeshi gas across that country's western border with India.

However, Bangladesh has not been very positive towards either selling its surplus gas to India (see related article, p. 20) or to swap it with Tripura gas. But both multinationals claim that it is "only a matter of time before that country sees the logic of the arrangement."

Senior officials in the Petroleum Ministry have said that Unocal is expected to submit its final report to the Indian authorities by July 23. The report will contain recommendations on the subject of the Tripura gas.

Iran's bid

With Oman and Qatar actively involved in inking LNG pacts with India, it did not come as much of a surprise when Iran also offered to export natural gas to India, in an endeavor towards building long-term bilateral trade relations.

The options for moving the gas would be either via LNG exports or through a subsea pipeline between Iran and India, to the Gujarat coast.

Iran's deputy minister for gas, Mehdi Hashemi, who led a six-member delegation to India last year, had made the offer while speaking in Ahmedabad at a session with the Gujarat branch of the Confederation of Indian Industry.

"Our government has been in talks with the Indian government for the last 7 years, but these talks did not fructify earlier due to politico-economic reasons," Hashemi said.

"But Iran considers India to be one of its biggest and nearest markets. It would be in India's interests to buy gas from one source that is near and never-ending, rather than from several sources in far-off countries. In return, India could supply several commodities which Iran has to import."

Iran professes to have 16% of the world's gas reserves, sufficient to last for 500 years at the present rate of exploitation. Even if India buys 30 MMscmd of gas, it would represent just 10% of Iran's present rate of production.

Hashemi said that, while his country would have no problem supplying gas to India either through a pipeline or through LNG carriers, it would prefer the first alternative.

"A pipeline would be safer and probably 10-20% cheaper than a ship," he said. "We have been in the oil and gas business for the last 50 years and possess the technology to lay a subsea pipeline up to 1,000 m deep in the sea.

"Pakistan ought to have no objection to allowing the laying of pipelines through its territorial waters. But in case it does, the job could be executed by international players."

However, given the history of tensions between India and Pakistan, and the recent outbreak of hostilities situation between the two neighbors, it is unlikely that India would agree readily to a pipeline that comes through Pakistani territorial waters, fearing a cutoff of gas supplies in the event of new tensions. Accordingly, the Indian government favors LNG transported by ships.

E&C firms scramble

In the meantime, the slew of LNG-based projects coming up in India have spawned a scramble by foreign engineering and construction companies, which have either joined hands with their Indian subsidiaries or floated joint ventures with domestic counterparts to offer a host of services.

These range from providing technical know-how and front-end and back-end engineering to turnkey contracts.

The leading global engineering firms that have already taken the plunge include Tecnimont SPA of Italy, SN Technigaz and Buoygues Offshore of France, and Japanese E&C majors including Japan Gas Co., Chiyoda Corp., Mitsubishi Heavy Industries Ltd., Ishikawajima Harima Heavy Industries Ltd., and NKK Corp.

"There is vast potential for the LNG sector in India," said Andrea Brunetti, joint managing director of the joint venture Tecnimont ICB. "LNG will be one of our focused areas, and we will bid for all LNG projects that are coming up in the country."

Other international engineering giants that have shown keen interest in the Indian LNG sector include Bechtel Group of the US, Hanjung Corp. of South Korea, and Australia's ICF Kaiser Engineering.

Projects rundown

India's experience of handling LNG is so limited as to be almost nonexistent.

Even Shipping Corp. of India (SCI), the country's national carrier and largest shipowner with 50% of the national merchant fleet under its belt, does not yet own an LNG carrier. It is only a 20% owner in the LNG Lakshmi, which is currently being built in the Mitsui Shipyard in Japan.

Given this background, and the fact that Petronet LNG was formed less than 2 years ago, the stated plans of building as many as 14 LNG terminals in the country-a figure touted by CapEx, the project database of the Mumbai-based Centre for Monitoring Indian Economy (CMIE)-do sound a little grandiose. Petronet LNG is a state-owned holding company formed by distributing 10% equity holding to each of five government-run companies: IOC, GAIL, Hindustan Petroleum Corp. (HPCL), Bharat Petroleum Corp. (BPCL), and National Thermal Power Corp. (NTPC). The remaining 50% equity is being offered to private companies and strategic partners that have already expressed a desire to hold a stake in the new company. These include Gaz de France, Qatar's RasGas (LNG export project) consortium, ExxonMobil, and BSES (formerly Bombay Suburban Electric Supply) Ltd.

Some of these terminals, being built under the aegis of companies with deep pockets, will definitely see the light of day, but others are likely to vanish in the months to come.

The terminals that are certain to see the light of day include the ones at Dahej, in Gujarat, and Cochin, in Kerala, being put up by Petronet.

A memorandum of understanding (MOU) has been signed with the ExxonMobil-led RasGas consortium for the supply of 7.5 million tonnes/year, of which 5 million tonnes will come to Dahej, on the country's northwestern coast, and 2.5 million tonnes will be delivered to Cochin, near the country's southernmost tip.

The petroleum ministry has said that demand for gas from LNG from the power, fertilizer, industrial and domestic sectors is expected to go up phenomenally over the next 2-3 years. The government also expects the existing gap between demand and supply to widen further in the years to come.

In an effort to narrow this gap as much as possible, the government has not only backed Petronet LNG in its efforts to set up a number of LNG terminals along the country's coast, but it has also given permission to private companies to set up such terminals, to import and distribute the gas (Fig. 1).

According to the CapEx database, the aggregate investment for setting up the 14 terminals has been estimated at 350 billion rupees ($8.05 billion). These terminals together would have capacity to handle about 40 million tonnes/year of LNG.

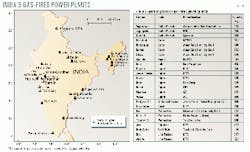

Apart from a handful of fertilizer plants, the bulk of LNG demand is expected to emanate from the number of gas-based power projects currently envisaged in the country (Fig. 2). CapEx has estimated that, at the moment, there are around 75 gas-based power projects being planned all over the country.

The progress of their implementation is exceedingly tardy. Of the 75 projects, only 19 have actually begun construction. Their implementation schedules indicate that not more than 5,000-6,000 Mw of additional power-generating capacity would be added over the next 5 years.

Given this situation, several of the LNG terminal projects being planned may become nonviable, unless project investment activity in the power sector gets going.

"Already, over the last 3 years, three projects have been put under review," said Shashikant Hegde, CMIE economist. "One of these is Petronet's Mangalore LNG project. The next couple of years might see some more of the LNG projects evaporating. Only those projects that would manage to secure funds on easy terms and succeed in hooking long-term customers, might be able to see the light of day."

The following sections are thumbnail sketches of some of the top LNG projects in India.

Petronet Dahej

The public sector firms HPCL, BPCL, IOC, and GAIL, are expected to hold 10% equity each in the new company, Petronet LNG Dahej. NTPC, a prospective customer of this terminal, has demanded a 16.33% equity stake.

Among the private sector companies, BSES has already expressed its willingness to invest in the equity.

BSES is one of the companies (the others being DCM Shriram, RPG Dholpur, and SKN Industries) that have signed MOUs with Petronet LNG Dahej, for the supply of gas for their respective projects.

Petronet Cochin

Along with the five central government companies, the Kerala state government will hold 51% of the total equity of 4.80 billion rupees in the Petronet Cochin terminal.

NTPC, one of the main customers, would hold a 16.5% stake. Among the foreign participants, Malaysia's Siasin Energy has reportedly been eyeing an equity stake in the project.

GAIL, one of the co-promoters, has sought marketing rights for the entire output of the terminal. Marketing the LNG in Kerala state might be a viable option for GAIL, because the company already has the necessary infrastructure in place.

On July 31, 1999, GAIL signed a 25-year agreement with Qatar's Ras Laffan LNG Co., for the supply of 2.5 million tonnes/year of LNG to Cochin. The project was expected to reach financial closing by the end of May, and the terminal is expected to be ready by March 2002.

Ennore

The 2.5 million tonne/year Ennore LNG terminal is being put up at a cost of 20 billion rupees and is being implemented by Dakshin Bharat Energy Consortium (DBEC), which was awarded the contract by Tamil Nadu Industrial Development Corp. in December 1998.

The consortium, incorporated in 1998, is owned by the Singapore-based CMS Energy Asia, Siemens Power Venture of Germany, Unocal, Woodside, and Grasim Industries of the Aditya Birla industrial group.

Ras Laffan LNG has been selected as the LNG supplier. As of August 1999, DBEC had short-listed four consortiums for awarding the engineering, procurement, and construction (EPC) contract: a combine of IHI-Toyo Engineering Inc. and Itochu Corp.; Larsen & Toubro's Mumbai unit, Chiyoda Corp., and Nissho Iwai Corp.; Hyundai Corp. and CoGas; and M.W. Kellogg, Japan Gas, and Marubeni.

Dabhol

Originally, the 28 billion rupee terminal was planned by Enron as part of the Dabhol power project in southern Maharashtra. However, it was subsequently split off into a separate project by the Houston-based energy multinational.

The scope of the project includes a 1.75-km jetty, storage tanks, and a regasification plant. Half of the gas supplied by the 2 million tonne/year capacity regasification plant would be used by Enron's 2,140-Mw power plant at Dabhol, and the rest would be supplied to residential consumers.

A new company named Metropolitan Gas (MetGas) has been floated by Enron for laying a related transmission pipeline and distribution infrastructure for distributing the regasified LNG in India. MOUs have also been signed with Oman LNG and Malaysia's Petronas, operators of LNG export projects in their respective countries, for the supply of LNG.

For transporting the gas, a separate company has been floated, named Greenfield Holdings, in which Mitsui OSK Lines will hold a 60% equity stake, with Enron and SCI holding 20% each. The company will own the LNG carrier, which will be dedicated to ferrying gas from Qatar to the Dabhol jetty.

The eventual capacity of the terminal is expected to be around 5 million tonnes/year. The contract to design and build the terminal was awarded to Kvaerner Constructions International of Norway, and construction is well under way.

Hazira

The Gujarat Maritime Board, in August 1997, floated tenders for building a multipurpose terminal at Hazira in Surat district.

Apart from handling 2.5 million tonnes/year of LNG, the 24 billion rupee terminal is also expected to have the capability to handle LPG, petrochemicals, cement, and iron ore.

In October 1999, Shell, in consortium with the Essar shipping and steel group of Mumbai, won the contract to build the terminal on a 30-year build-operate-transfer lease model. The other contenders at the time were a combine of Reliance Petroleum Ltd., the former Elf Aquitaine, and the then-Mobil operated Ras Laffan consortium.

Gujarat Pipavav

Gujarat Pipavav LNG Co., promoted by the Gujarat state government along with BG and Sea King Infrastructure, proposes to set up a 2.5 million tonne/year LNG terminal at Pipavav in Gujarat's Amre* district.

The confusion that prevailed over the ownership of the new company was settled near the end of 1999, when BG watered down its demand to hold a controlling 51% equity stake and settled for 25%.

The second partner, Sea King, which was to originally hold 49%, has also settled for 25%. NTPC, again one of the prospective customers of the terminal, had demanded 26% of the equity but will now be one of several financial institutions and some state government companies to whom the remaining 50% equity will be distributed.

The company has already floated a global tender for the award of the EPC contract. The project is expected to achieve financial closing by third quarter 2000. Sumitomo Bank has been appointed the lead adviser and debt arranger for the project, which is scheduled to be completed by January 2004.

Manappad

A 2.5 million tonne/year capacity Manappad terminal would be set up by Indian Gas, a subsidiary of Indian Power Project.

The terminal would cater to the needs of the 1,873-Mw power project being set up by Indian Power Project at Vembar in the Tirunelve* district of Tamil Nadu.

LNG would be supplied from the Manappad terminal to the power project site through a 120-km pipeline.

Kakinada

At last count, there were three LNG terminals being proposed at Kakinada.

The Hyderabad-based Nagarjuna group had managed to secure Hindustan Oil Exploration Co. as its co-promoter for the proposed 1 million tonne/year LNG terminal at this new intermediate port. Hardy Oil & Gas PLC of the UK was appointed technical collaborator for the project.

However, there was not much progress on the other two terminals planned at the same site. According to the most recent reports, the Mittals unit of the Ispat group has decided to go slow on its proposed 2.5 million tonne/year LNG terminal at Kakinada in the East Godavari district of Andhra Pradesh.

Acute financial constraints, plus directions from domestic financial institutions to concentrate on its steel and power projects already under way forced Ispat Energy to place the project under review for the time being.

Similarly, Tractebel Energy South Asia has not reported any major progress at its proposed 56 billion rupee LNG terminal at the same location.

Trombay

The 3 million tonne/year LNG terminal at Trombay, near Mumbai, has been promoted by Tata Electric Cos. (TEC), together with GAIL and TotalFinaElf.

The three firms are expected to hold one third each of the equity shares of the company. In all, 25.30 billion rupees would be invested in the project, which is due for completion by June 2003. A new company, India Natural Gas, has been floated by the three partners for developing the project.

Of the 3 million tonnes/year of potential LNG capacity, 1 million tonnes would be consumed by TEC power plants. A search for customers for the remaining 2 million tonnes is currently under way.

Natural gas centerpiece of new Indian energy strategy

As far as India's energy planners are concerned, natural gas (in the form of LNG) is the fuel of the future.

Given the high price India pays for imported oil and rising environmental concerns over coal use, natural gas not only becomes more attractive every day, but a strategy to import massive volumes of it as LNG is shaping up as the centerpiece of India's energy policy.

"With India's oil pool deficit soaring to new highs with each succeeding day, there would seem to be no alternative but to go in for greater quantities of [natural gas]," said energy analyst K.L.N. Rao. "And if it is not available within the country, the answer is large-scale imports."

Coal, which accounts for about 60% m of energy consumption in the country, is abundant in India. But there are problems with both the mining and transportation of coal. Coal resources are concentrated in eastern and central India, and transporting it to other parts of the country is difficult and expensive.

Accordingly, there is a push under way to reduce coal use and transportation and find alternate resources of energy in areas where no coal is available nearby. Natural gas in many instances can sharply reduce harmful emissions by backing out coal use in a number of areas-notably in the power and generation and industrial sectors-while helping to feed India's rapidly growing fertilizer and petrochemicals sectors.

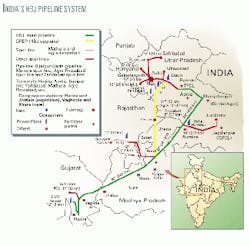

However, most of the natural gas transportation infrastructure in the country consists of the big HBJ system in northwestern and north-central India (see map, next page). So with the many proposed LNG terminals being scattered around the country (see map, p. 62), a flurry of pipeline construction will accompany the LNG boom; in fact, many of the LNG projects incorporate pipelines to deliver the regasified LNG to customers.

What is certain is that India's energy scene is about to be dramatically reshaped, and the new look will increasingly take on the trappings of a burgeoning natural gas industry.

Demand, supply

India's demand for natural gas is growing, currently at about 260 million cu m/day (MMcmd). That compares with domestic production, mainly through state-owned Oil & Natural Gas Corp. (ONGC) of only 60 MMcmd.

With indigenous supply limited, natural gas has made minimal inroads in India's energy mix. And there is little prospect that domestic production will increase significantly any time soon.

Indian demand for natural gas is projected to climb to 207.5 MMcmd by 2009-10 from 135.6 MMcmd in 1999-2000. But domestic supply is projected to remain flat during the period at only 59.5 MMcmd.

Only four petroleum provinces in the country have natural gas: the western offshore, home to the giant Bombay High fields complex; Gujarat state; the South Brahmaputra valley in Assam and Tripura states; and Andhra Pradesh state's coastal region. Most of the natural gas in the western offshore is utilized on site, except for some very low-pressure gas that is flared.

In the western offshore, associated gas production has reached a plateau and may not last long. Even with the major rehabilitation projects under way at Bombay High, oil and natural gas production there is not expected to increase substantially. The only way to increase production off western India is to mount a concerted effort to find new reserves in an area that doesn't offer much in the way of fresh prospects.

In coastal onshore and offshore Andhra Pradesh, natural gas production has yet to peak, but that level is not expected to be substantial; no giant gas accumulations have been found, and the basin features high-pressure gas at greater depths.

Although the production of natural gas from the upper Assam and Tripura regions far exceeds local demand, logistical and environmental problems make it infeasible for the gas to be transported out.

Bombay High efforts

While ONGC has little hope of significantly increasing its natural gas output at Bombay High, the state firm plans to invest around $1.5 billion over the next 3 years in its Bombay High offshore field.

The initiative to invest this amount from mid-2000 onwards has come after the 25-year-old oil field, believed to hold original oil in place totaling 1.64 billion tonnes, has been showing steadily declining output for the last 3 years.

Once the investment has been made, ultimate oil recovery at Bombay High is expected to be boosted to around 40% from 28%. The company is looking at an increase in the internal rate of return to 20% from 16%, assuming a crude oil price of $16/bbl.

"Bombay High has been going through something of a midlife crisis," said ONGC Chairman and Managing Director Bikash Chandra Bora. "We will adopt a multidisciplinary approach; use the vast geological data that we have and 3-D [seismic] surveys to give a 'facelift' to our premier oil field."

Bora noted that ONGC is preparing a feasibility report on the most cost-effective rehabilitation scheme with assistance from Gaffney, Cline & Associates. The consultants have recently submitted their recommendations, and a full report is being put together by ONGC senior personnel for board approval.

As a pilot project before the massive investment, ONGC will install an oil platform in Bombay High, at an estimated cost of 3 billion rupees. The new platform, dubbed ZA, is to use the most technologically advanced equipment. It is likely that any increased gas production resulting from the project will also be used on-site, so there is little likelihood that this project will result in a significant hike in gas output.

With similar prospects elsewhere on India's domestic gas supply scene, that means the rush is on for LNG imports.

Coming LNG transportation boom sparks squabble in Indian shipping

The prospect of a boom in Indian LNG imports has sparked a squabble among India's shipping companies, all fighting for a share of the lucrative LNG transportation market there.

The leading domestic shipping firms are lobbying against their smaller counterparts with the Ministry of Surface Transport, even as they initiate talks with foreign shipping companies for joint ventures.

The country's five largest shipowners-Shipping Corp. of India (SCI), Great Eastern Shipping Co., Essar Shipping, Pratibha Shipping, and Varun Shipping-have either already signed, or are on the verge of signing, joint ventures with foreign shipping concerns for carriage of LNG.

This follows a precondition laid down by the government: No foreign company will be permitted to transport LNG to India unless it has a JV with an Indian partner.

The three leading shipowners have submitted a plea to the ministry to restrict the qualification for the LNG business to those companies with have had an exposure to at least the LPG business.

The lobbying has drawn a storm of protest from the other serious Indian contenders to the deal, because no Indian shipping firm other than the top three has had any prior experience of moving LPG. "It is hitting below the belt," said a Mumbai-based small shipowner.

So far, partly state-owned LNG developer Petronet LNG Ltd. has short-listed 12 foreign shipowners for a 7.5 million tonne/year LNG transportation contract , which involves movement of 5 million tonnes/year to the terminal at Dahej in Gujarat and 2.5 million tonnes/year to the terminal at Cochin, in Kerala.

Prominent among the 12 are South Korea's Hyundai Corp., Japan's Mitsubishi Corp. and Mitsui OSK, Malaysia's MCIC, France's Louis Breyfus, Singapore's Osprey, and Belgium's Texmar.

Sources in New Delhi told OGJ that Petronet LNG is currently in discussions with the surface transport ministry on the subject of guidelines to be used to select a JV partner. A final decision is imminent, because the financial closing for Petronet LNG was slated for the end of May, following which the company will begin construction of the two LNG terminals.

Indian shipowners' toehold

Meanwhile, the five biggest Indian shipowners have already been approached by Indian Oil Corp. (IOC), the government-owned downstream oil major, to explore the possibility of forming a consortium for transportation of LNG. This is a clear bid to ensure that Indian vessels get some of the LNG transportation action.

So far, only SCI has been able to get a toehold in an LNG carriage deal, securing 20% ownership in a new LNG vessel, which will be 60% owned by Mitsui OSK and 20% by Enron Corp.

The vessel will be used exclusively to bring gas from the Middle East to Enron's LNG terminal at Dabhol, near Ratnagiri in southern Maharashtra, which will feed regasified LNG to an Enron group's 2,184-Mw power project nearby.

IOC is now seeking the best mix of domestic and international partners for a consortium to deliver LNG for Petronet LNG from Qatar's Ras Laffan LNG export project. An IOC official revealed that BP Amoco PLC had been approached in this regard.

As one of the co-owners of Petronet, along with other public-sector companies Gas Authority of India Ltd., Hindustan Petroleum Corp., and Bharat Petroleum Corp., IOC is keen on ensuring it does not miss out on the proposed 25-year time charter offering to three LNG carriers.

Industry sources told OGJ that only 11 of the top international shipping companies have made it to the prequalification round initiated by Petronet for transporting LNG from Qatar to the terminals at Dahej, Gujarat, and Cochin, Kerala. The companies are from South Korea, Japan, Europe, and the US. Petronet is reluctant to reveal further details until the contract is finalized.

Petronet has made it mandatory for interested companies to have experience of at least 650,000 tonnes of gas transported for each of the preceding calendar years, as well as the financial wherewithal to invest in an project of this scope.

Accordingly, the threshold limit for a participating company was equity ownership in at least one LNG tanker of 125,000 cu m capacity, along with the experience of managing and handling a vessel of this size.

Both the ministry of surface transport and domestic shipowners have raised with the petroleum ministry the issue of Indian vessels being kept out of the lucrative LNG transportation business on the grounds that they lack LNG experience. So the forthcoming policy is being anxiously awaited.

Draft policy

Two major features form the core of India's draft LNG transportation policy, which the Ministry of Surface Transport soon will present to the cabinet for approval.

The first proposal is to make it mandatory for foreign shipping companies interested in LNG shipping into India to have an Indian equity partner.

The exact equity component that each partner will hold is currently being worked out, but, in view of the huge investments required, it appears likely that the foreign partner will be permitted to have a majority equity stake in the joint venture.

"This would be the only way to ensure that Indian shipping companies acquire expertise in LNG operations, to which they have not yet been exposed," said Surface Transport Sec. R. Vasudevan.

The second major proposal is that LNG cargo being transported for or on behalf of the government should be purchased on an fob basis.

This would ensure that transportation arrangements for shipping the cargo are made by the public sector companies importing LNG into the country. It would provide cargo support to Indian vessels in this highly lucrative and specialized area of shipping.

Apart from government-owned or controlled LNG cargoes, any other LNG purchases can be made by private importers in the country on either an fob or cif basis.

Foreign-flag vessels

If foreign-flag vessels are used for carrying LNG into the country under cif contracts, the LNG buyer would need to seek permission from the Directorate-General of Shipping for in-chartering the vessel, because LNG shipments are long-term contracts involving time-charter periods of an average 10-15 years.

"At this stage, the ministry will make it clear that the in-chartering permission will be contingent upon the foreign shipping company taking an Indian shipping company as an equity partner in the entity owning the LNG vessel," Vasudevan said.

The amount of equity to be given to the Indian shipping company will be left to the discretion of individual companies negotiating the deal; no compulsory minimum component has been specified.

"The permission for in-chartering will also be conditional upon the foreign shipping company providing training to Indian officers and crew in the operation of the LNG vessel," the transport secretary added.

"Normally, LNG vessels are purchased against specific long-term contracts, like the Mitsui-Enron-SCI [contract]. Once the cargo is tied up, there is no risk for the owner of the LNG carrier, since he is guaranteed an internal rate of return.

"This would greatly help Indian companies to acquire LNG vessels, which require huge amounts of capital, with a 125,000 cu m capacity ship costing around $220 million today."

Vasudevan insists on ensuring that the long-term policy for LNG transportation will favor the country's own merchant fleet, while taking care to remain within the free-market framework dictated by the World Trade Organization.

"It does not bar foreign shipping lines from entering the Indian LNG transportation arena," said Vasudevan. "We have borrowed heavily from the eminently successful South Korean and Japanese models, so that sufficient advantage is given to Indian [LNG buyers] like ... power, and fertilizers."

LNG buyers' role

In view of the huge volume of LNG business expected and its implications on the Indian economy in times to come, the transport secretary insists it is crucial to ensure that the LNG users retain the upper hand while finalizing purchase deals.

"Strong control on the transportation network and shipping lines will considerably help the buyer," he asserted. "Buyers and sellers in the international LNG market are all well organized and have a big say in the transactions. Global giants like ExxonMobil, British Gas, and Shell not only have a major share in the production outlets but also in the distribution and transportation channels."

Vasudevan pointed out that large LNG user nations such as Japan and South Korea, which between them account for nearly 80% of the LNG trad, could ensure that the bulk of their purchases are carried on their own vessels, or on ships of their choice.

"These countries have a mechanism that guides the entire exercise to the benefit of the users and the national shipping lines," he said. "A policy platform designed to bring about similar benefits to India is essential."

While foreign lines would not be excluded from the Indian LNG transportation sector, they would be expected to join hands with Indian players who would not only have an equity stake in the enterprise but would also have a role to play in the actual operations.

"This would ensure that some sort of technology transfer would accrue in the Indian company's favor," Vasudevan explained. "The idea of the entire exercise is to ensure that Indian firms not only participate in this capital-intensive field but also get the benefit of the latest technology."

Policy status

The draft LNG shipping policy had been approved by former Surface Transport Minister Nitish Kumar, just 2 days before he was moved into the Agriculture Ministry in a cabinet reshuffle in the last week of November 1999.

At the moment, the man who took over the reins of the Surface Transport Ministry, Raj Nath Singh, has been trying his best to get the policy in front of the cabinet. At presstime, however, reports were that Singh is likely to be moved into a gubernatorial position in one of the Indian states where the Bharatiya Janata Party-led coalition government is trying to shore up a political stronghold. It is this lack of continuity that has contributed to the delays in finalizing the policy.

Vasudevan is likely then to work behind the scenes and ensure the safe passage of the LNG transportation policy through India's Parliament.

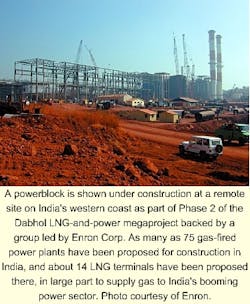

Enron tallies Dabhol success, plots new Indian gas strategy

While Enron Corp.'s ambitious Dabhol LNG-and-power project continues to attract criticism from opposition politicians in India, the project-widely seen as a litmus test for energy investment in the country-has proven itself on one key score.

Dabhol not only has eased critical power shortages in Maharashtra, the country's most advanced industrial state, but it is expected to even create a power surplus there.

Dabhol scorecard

Opposition politicians have criticized the 2,140-Mw project at Dabhol, near Ratnagiri in southern Maharashtra, claiming that Enron is charging far too much for power generated there.

But even opposition leaders can't dispute that, without Dabhol, the power situation in Maharashtra state would be as bad as it is in the country's capital, New Delhi.

Delhi suffers terribly from power shortages, especially in the summer months, when peak use causes heavy load-shedding-as much as 8 hr/day on average. Apart from the enormous loss in industrial output, the quality of life there deteriorates quickly when temperatures reach as high as 40° C.

Whether the cost of the power-which Enron insisted be designated in US dollars, because the original investment in the project was in US dollars, thus having a major bearing on the internal rate of return-is excessive or not, the fact remains that, once the project is fully commissioned, Maharashtra will be in the position of being a power-surplus state.

Enron successes

Once it resolved the initial squabbles with the local government, Enron's path has been much smoother in implementing the Dabhol project.

Enron will import 2.1 million tonnes/year of LNG from Oman LNG, its own joint venture with the sultanate of Oman. In addition, it has finalized a $165 million loan for India's first LNG carrier. The 10-year loan, struck at 325 basis points over the London Inter-bank Offer Rate (Libor), is India's first financing arrangement for an LNG ship.

"The pricing has set a benchmark for future LNG carrier financing," said Gaurav Seth, assistant director of ANZ Investment Bank, global debt origination, which was the underwriter for the loan.

"Loans contracted at 300 basis points over Libor are considered excellent, even in good days. Placing Indian paper after the Asian monetary crisis at such a fine rate is a coup of sorts."

The loan was signed between the lending institutions and a special-purpose LNG transportation company, sponsored by Japan's Mitsui OSK Lines, Enron, and the government-owned Shipping Corp. of India (SCI).

The funds will be used to own and operate a 135,000 cu m ship to transport LNG from Oman to the site of the Dabhol power project. The time charter will be a 20-year agreement dedicated to the captive supply of LNG to the plant.

The ship, to be owned 60% by Mitsui OSK, 20% by Enron and 20% by SCI, is being built by Mitsubishi Heavy Industries Shipyard in Japan. It will be called LNG Lakshmi and is expected to deliver the initial consignment of LNG by fourth quarter 2001.

The first phase of the power project, which generates 740 Mw of electricity, has been operational since May 1999; it is being fueled by naphtha until the second phase starts, after which the entire plant will be converted to LNG. The two phases would each require 2.3 million tonnes/year of LNG. Construction is well under way on the second phase (see related article, p. 76).

Enron has moved still further ahead in the LNG race by signing an agreement with Malaysian state petroleum firm Petronas for the supply of 2.6 million tonnes/year of LNG to the LNG terminal at Dabhol.

The agreement was signed in July 1999 in Kuala Lumpur between Metropolis Gas Company Pte. Ltd. (Metgas), a wholly owned Enron subsidiary, headquartered in Mumbai, and Malaysia LNG Tiga Sdn. Bhd. (MLNG Tiga), in which Petronas has a 60% equity stake.

MLNG would supply LNG to Dabhol for 20 years, and the delivery would commence around mid-2002. Metgas would market the gas not consumed by its power project to leading power, fertilizer, and industrial concerns on India's western coast.

Sanjay Bhatnagar, Enron India CEO said, "With the Petronas deal, we have been able to tie up 4.7 million tonnes/year altogether for our terminal, which will have a total capacity of 5 million tonnes/year."

Market potential

Maharashtra state is a prime target for LNG, having awarded contracts for six near-term, liquid fuel-based power projects. Apart from these, BSES (formerly Bombay Suburban Electric Supply) also plans to set up a 495-Mw, gas-based power plant at Palghar, about 100 km from Mumbai.

"Our studies reveal that Maharashtra state has a market potential of 4 million tonnes/year, while Karnataka and Goa between them could take another 2.5 million tonnes/year," said Bhatnagar. "Metgas, which was specifically set up to market LNG in India, will not lack for customers."

Enron also plans to invest 6.5 billion rupees ($150 million) into a company being created to import and market LNG in non-urban areas. Approval has already been received from the Foreign Investment Promotion Board, to float Enron Energy Marketing Ltd.

There is also a separate Enron proposal to build a gas pipeline from Qatar to India, in order to be able to supply natural gas to a host of industries in western India.

The Enron pipeline proposal has some competition from Reliance Industries, one of India's largest diversified groups, which has proposed laying a subsea gas pipeline from Iran to India to import natural gas from that country. Reliance is negotiating with some US and Canadian companies to develop the project.

Reliance is serious about tying up gas supplies from abroad, mainly the Persian Gulf, both for its own use and for supplying to bulk consumers such as the National Thermal Power Corp.