OGJ Newsletter

Market Movement

$30 oil but OPEC not budging

Oil prices remain well above $30/bbl, which is starting to boost non-OPEC oil supply and squeeze demand, yet the signs from OPEC are that it seems to be unwilling to budge on production hikes.

Higher oil prices and increased FSU exports prompted IEA to cut down its demand projections for 2000 crude oil to an average 76.2 million b/d, vs. its May estimate of 76.5 million b/d.

Despite weakening demand, oil prices remain at $30/bbl as advance purchases by refiners and tight product markets in the US pressure demand. IEA says demand for the second quarter 2000 averaged 74.4 million b/d, vs. its earlier forecast of 75.1 million b/d. Fourth quarter demand should rise to 78.4 million b/d, down 300,000 b/d from the May forecast.

IEA says it doesn't expect OPEC to agree to a production increase at the June 21 meeting in Vienna, but it does expect an "urgent need for a substantial production increase at OPEC's September meeting" fueled by strong economic growth and high crude demand as winter approaches.

Refining margins follow gasoline prices upward

US refiners, already under fire for the spike in gasoline prices, may have more explaining to do when earnings reports are unveiled.

A tight gasoline market and the rising probability of a tight distillate market for the winter heating season have prompted Banc of America Securities to raise refining margin estimates. Gasoline inventories currently stand 4.8% below seasonal norms, while distillate inventories stand 15.9% below norms.

BAS boosted its second quarter 2000 earnings per share estimates for US independent refiners by 30% to $436 million and its full-year 2000 EPS estimates by 17% to $1.64 billion.

"Owing to low gasoline supply fears, low refined product inventories, and solid demand, refining margins are averaging levels not seen since the last cyclical peak in 1997," said BAS analysts. Its 2000 earnings estimates now stand 12% above consensus, with 2001 earnings estimates 4% above consensus. BAS raised its 2001 estimates 7% to $1.35 billion.

"While we believe part of the deviation from consensus is in the market, we expect seasonally strong refining margins to last through the year and into 2001," BAS said.

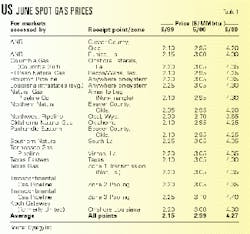

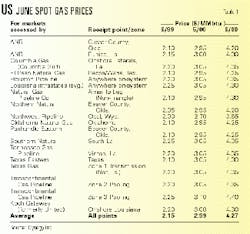

Spot gas prices to stay strong through 2001

Expect natural gas spot prices to continue a bull run after jumping sharply in the past month (see table).

Salomon Smith Barney expects gas prices to remain strong and says its earlier estimates "could prove conservative" as the US storage outlook remains grim.

Despite a recent surge in injection, current storage levels are still 25% lower than a year ago, however, and are likely to enter this winter well below 2.5 tcf. Even with the recent increase, injection rates have remained about 25% below year-ago levels.

The warmer-than-normal outlook for this summer, coupled with an active hurricane season in the Gulf of Mexico, also is keeping gas prices hot. Storms in the gulf could require platform shut-ins, potentially affecting 25% of US gas deliverability.

Salomon Smith Barney believes its $3.25/MMbtu composite spot price forecast for 2000 and 2001 to be more "conservative than aggressive."

null

null

null

Industry Trends

WILL NATURAL GAS BE THE DOMINANT ENERGY SOURCE this century? At the World Gas Conference in Nice this month, Gaz de France Chairman and CEO Pierre Gadonneix and AGA Chairman Gary Neale, both predicted a "brilliant future" for gas. Gadonneix notes that the EU gas industry faces "major upheaval" in both cost and supply challenges, while Neale bases his optimistic outlook on studies that project a continuing trend of prices remaining mostly stable despite rising consumption (see chart).

The EU market, says Neale, can be likened to what the US market was 15 years ago, although the basics are different for Europe. The EU market will grow increasingly dependent on imports after its opening, he predicts. He also suggests the EU might take lessons from the experiences of the US market, which has already taken the plunge. The arrival of US traders and marketers in Europe, poised to jump onto the newly liberalized EU market as soon as it opens Aug. 10, should drive liberalization even faster than expected, Neale believes. He sees an onslaught of "very aggressive and sophisticated" operators invading Europe's market and shaking it up as they develop trading and hedging, use LNG spot deliveries to serve the market, and undercut prices.

SPEAKING OF NEW TECHNOLOGY AND NATURAL GAS, there is an intriguing new joint venture that seeks to link marginal gas supplies with alternative fuels.

Hawks Industries and Blue Star Sustainable Technologies have formed a JV combining Hawks's natural gas resources with Blue Star's new integrated gas processing technology. Blue Star's process combines a gas-fired electrical plant with a chemical synthesis reactor to generate electrical power, clean liquid fuels, and potable water. The fuels will have application in internal combustion engines (both Otto and Diesel cycle) and are expected to have fuel-cell application for both stationary power and transportation. Over a 2-year period, the agreement calls for assessments to be made to choose among Hawks's coalbed methane reservoirs in Wyoming's Powder River basin to demonstrate the new technology, identify markets for gas-derived products, and then commence commercial production.

THE CONTROVERSIAL TOPIC OF FPSO USE IN US WATERS is getting hashed out. A government-industry panel last week testified to 20 years of successful use of FPSOs to develop offshore oil fields around the world. But despite strong recommendations that FPSOs be treated like any other permanent offshore production facilities, Coast Guard officials emphasize such vessels will be regulated as ships if MMS okays their use in US waters. This would require double hulls for FPSOs. Industry officials generally concede the need for double hulls on FPSO sides and ends in case of collisions with tankers during lightering. "But not double bottoms-that just adds unnecessarily to the total cost," one executive told OGJ. "These FPSOs are going to be almost permanently stationed in waters so deep that there's no danger of ever running aground," he said. "In the rare case when they have to come to port for inspection and maintenance, the oil should be completely offloaded."

Government Developments

CONCERNS OVER GASOLINE'S HIGH PRICES and emissions in North America command center stage this week.

Outcries over gasoline price spikes in the US Midwest have attracted notice from both EPA and DOE. In a joint letter to refiners in the region, the agencies said, "Consumers in the Chicago and Milwaukee metropolitan areas are extremely concerned about the unusually high prices of gasoline. We share those concerns. In no other areas of the country using cleaner burning reformulated gasoline have we seen increases."

DOE said regular gasoline was averaging $1.61/gal and RFG $1.84/gal in the Midwest, both the highest levels in the nation. The two agencies said refiners have told them Midwest gasoline supplies are adequate to meet demand, but "over the past week, gasoline prices have continued to climb, and there are inexplicable price differentials between RFG and conventional gasoline, especially considering the modest difference in the relative cost of producing RFG as compared to conventional gasoline."

The agencies asked BP Amoco, ExxonMobil, Phillips, Tosco, Marathon Ashland, Citgo, and Koch to meet with them at EPA headquarters in Washington to explain the higher prices. They plan a general discussion with all refiners, as well as meetings with individual refiners about their specific situations.

US EPA has entered into a consent decree with the Midwest Ozone Group (MOG) and the West Virginia Chamber of Commerce to settle a suit against it for not enforcing Clean Air Act requirements in six northeastern states. The suit seeks to force EPA to issue federal implementation plans for vehicle inspection and maintenance programs for a 15% reduction in volatile organic compounds (VOCs) and attainment demonstrations in Connecticut, Maine, Massachusetts, New Hampshire, New York, and Rhode Island.

"The consent decree provides deadlines by which EPA is required to propose and finalize federal implementation plans for ozone nonattainment areas in the Northeast states, if the conditions specified in the consent decree are not met," said David M. Flannery, counsel for the two groups. He says the order reserves a seat at the negotiating table if EPA tries to delay deadlines for issuing the plans.

Representing a wide range of business groups, including electric utilities, coal and petroleum companies, and affiliated organizations from 11 states, MOG has blasted EPA for failing to impose required vehicular emissions rules in Northeast while pursuing stationary emissions sources in the Midwest.

CANADIAN REFINERS ARE UPSET with a new position taken by Ottawa on guidelines to reduce sulfur in gasoline.

Environment Minister David Anderson says refiners must lower sulfur levels to 30 ppm by 2005. The Canadian Petroleum Producers Group says it is puzzled and concerned by Ottawa's position on the issue.

Last June, the federal government said refiners would be required to cut sulfur to 150 ppm from 350 ppm by Jan. 1, 2002, and to 30 ppm by Jan. 1, 2005. Refiners say the two-stage reduction can't be reached because of technical problems in changing refineries and costs and offered to reduce sulfur to 30 ppm by July 1, 2003, but drop the interim target. Ottawa rejected that proposal.

Some estimates place costs of refinery upgrades to meet emission targets at $1.1 billion (Can.). Imperial Oil, one of the country's largest refiners, says it is not foot-dragging but rather asking Ottawa for some flexibility in implementing the changes.

Quick Takes

Brazil still has the draw as aN exploration hot spot.

All but 2 of the 23 blocks of offer in Brazil's second bid round were licensed last week. During the round, 44 companies competed for 23 blocks-10 onshore and 13 offshore-in nine of that country's sedimentary basins (see map).

Among top bidders, a consortium of Santa Fe Snyder (operator, 45%), SK (40%), and Brazil's Construtora Norberto Odebrecht (15%) bid 12.025 million real ($6.68 million) for Block BM-C-8 in the Campos basin. Campos Block BM-C-7 received a single offer of about 4.69 million real from PanCanadian. Shell bid alone for the hotly contested Campos Block BM-C-10, offering 65.16 million real. But the big winner was state-owned Petrobras, submitting solo or with others eight winning bids.

In other exploration news this week, Conoco says Russia's investment climate could improve through President Putin's encouragement of PSAs. Earlier this month, Putin signed a law greenlighting negotiations for a PSA on giant Shtokmanovskoye gas field (OGJ, June 12, 2000, Newsletter, p. 9). Conoco is involved in two opportunities that could benefit from the changing political climate: the northern territories' Polar Lights venture and, with Gazprom subsidiary Rosshelf, the Shtokmnovskoye project. x As part of a strategy to expand overseas, Thailand's PTT E&P unit is finalizing a plan to bid for onshore blocks in western Iran. Pres. Chitrapongse Kwangsukstith led a PTTEP delegation to Tehran to register interest in participating in Iran's upcoming licensing round for western acreage, which he says offers low risks and good hydrocarbon prospects. While PTTEP is preparing a bid proposal in the next few months, Chitrapongse says Tehran is prepared to extend the bid deadline to accommodate PTTEP's participation. For now, PTTEP wants to operate and go it alone in the bidding but may join up with some multinationals already bidding for tracts in Iran's current round of licensing.

TEXAS Railroad commission passed a measure addressing abandoned oil and gas wells. The plan calls for producers to provide financial assurance, such as a bond or letter of credit, for wells remaining inactive for 2 or more years and for certain low-producing wells that are transferred between operators. The plan also calls for yearly fluid-level testing to indicate whether an inactive well is environmentally sound. The measure is expected to be approved and take effect within 60-90 days.

In other production news, Pemex began injection of nitrogen into its offshore Cantarell oil fields complex. The project is expected to increase output by 310,000 b/d. The injection program is part of Pemex's $10.5 billion effort to increase heavy crude output at Cantarell by boosting reservoir pressure, which has fallen by about 60% since production began in 1979. The project's $1 billion nitrogen supply plant was being built and isoperated by an international consortium headed by the UK's BOC Gases (OGJ, Sept. 13, 1999, p. 36). The plant's first of four 300-MMcfd trains started up June 2 but was scheduled to go on line in April. The other units are slated for start-up at 3-month intervals. F Brown & Root installed the 91,000-tonne Malampaya concrete gravity substructure off Palawan, the Philippines. Shell Philippines Exploration operates the Camago-Malampaya development project, which is due on stream in October 2001; the fields contain 4 tcf of natural gas. x Devon Energy Production is to pay $11.9 million to resolve allegations that Pennzoil, which merged into Devon Energy last year, underpaid royalties on oil it produced from leased federal and Indian land during 1988-98, the US Dept. of Justice said. The settlements bring to more than $217 million the amount the government has recovered from seven oil companies as a result of a private whistle-blower lawsuit originally filed under the False Claims Act. More cases are pending.

A MAJOR REDEVELOPMENT OF THAILAND'S LARGEST FIELD, in the Gulf of Thailand, heads this week's drilling action.

The Bongkot consortium is embarking on the Phase 3B development, which includes drilling 42 wells and installing two additional wellhead platforms. The PTTEP-led Bongkot group hired Norway's Smedvig to handle drilling, which is to begin in August and take 30 months. In addition, Hyundai Heavy Industries was commissioned to build the two wellhead platforms, slated for installation in mid-2001. PTTEP says the new development program is aimed at sustaining output from Bongkot at the current level of 550 MMcfd of gas and 14,000 b/d of condensate. Akita Drilling's board approved construction of a $13.4 million (Can.), 5,000-m capacity rig for use in the Canadian Arctic. The rig's construction is subject to completion of negotiations of a multi-year drilling contract with a "senior" oil and natural gas producer, which is expected by the end of August. Once an agreement is reached, the rig will be sold to Akita/Equtak Drilling, a 50-50 JV of Akita Drilling and Inuvialuit Development.

Topping gas processing news, the Petronas-led Malaysia LNG Tiga signed a confirmation of intent with Tokyo Gas, Toho Gas, and Osaka Gas. MLNG Tiga is to supply up to 1.6 million tonnes/year of LNG for 20 years beginning in 2004. "The price is set based on the market prices at that time," said Petronas Pres. Hassan Marican, "but based on today's market price, it's about $6 billion." The LNG will be supplied from Malaysia's third LNG train at Bintulu, Sarawak, which is slated to come on stream in late 2002. Within 2 years of start-up, it will have a capacity of 6.8 million tonnes/year.

BP Amoco signed a key letter of intent with Egypt's EGPC to build a gas processing complex on Egypt's Mediterranean coast. The complex will include a two-train NGL plant and a two-train LNG plant. Capacities were not disclosed. BP Amoco said, "The plan is to build a world-scale NGL plant to quickly supply the growing liquefied petroleum gas demand in Egypt. First production of NGLs, with delivery of LPG to the local Egyptian market, is scheduled for early 2003." The LNG plant will target Mediterranean and other markets. First deliveries are expected in 2004. On Apr. 17, BP Amoco announced a separate agreement with EGPC to construct an NGL plant on the Gulf of Suez. The company expects that plant to be operational in October 2001.

Enron North America signed a nonbinding letter of intent to invest another $20 million in equity in Syntroleum Corp.'s Sweetwater project-a 10,000 b/d Australian gas-to-liquids plant designed to convert natural gas into synthetic specialty products-now under construction. Previously, Enron had made a $1 million contribution to the project, bringing to $21 million the total invested in the plant. For its part, Syntroleum plans a public offering of 5.3 million shares of common stock and plans to use $75-95 million of the proceeds for project development and construction costs.

IN OTHER LNG NEWS, Columbia Energy Group unit Cove Point LNG completed an open season for firm LNG tanker discharging service at its Cove Point LNG terminal in Lusby, Md., officials said. The limited partnership executed binding precedent agreements with Coral LNG, El Paso Merchant Energy-Gas, and a unit of BP Amoco that fully subscribe the service offered in the open season. The new service initially will provide 4.25 bcf of storage capacity and 750 MMcfd of terminal and pipeline capacity to accommodate LNG imports by the three customers. The deal also provides for a 2.5 bcf vapor-equivalent storage capacity expansion of Cove Point.

Meanwhile, Petronet LNG is looking at a vessel cost of around $180 million for hiring on time-charter an LNG carrier from a possible combine of foreign and domestic shipping lines, to transport LNG from Qatar's RasGas to India (see special report, p. 62). No existing LNG vessel is believed to be currently available for time-charter by mid-2003, when Petronet's LNG terminals at Dahej in Gujarat and Cochin in Kerala will be ready to accept the gas. Hence, a new vessel will have to be built and dedicated to the project.

Shell Deepwater Services, acting on behalf of Equilon Pipeline and Nemo Gas Gathering, awarded J. Ray McDermott a contract to install oil and gas export pipelines for Shell's Brutus TLP project this summer in the Gulf of Mexico. McDermott will install the lines with its newly upgraded, dynamically positioned Derrick Barge 16 and will install a 20-in., 24-mile oil pipeline from ST Block 301 to GC Block 158. Also, a 20-in. natural gas pipeline will be laid about 23 miles from SS Block 332 to GC Block 158. The project also requires McDermott to install more than 15,000 ft of steel catenary risers.

Among other pipeline developments, Millennium Pipeline completed its first pipeline deliveries of crude oil from Beaumont, Tex., to connecting carriers in Longview, Tex. June nominations for the new pipeline system are to average 50,000 b/d. The 12-in., 200-mile pipeline has a design capacity of about 67,000 b/d. The system receives waterborne crude from Oil Tanking docks at Beaumont and has the potential to interconnect with other pipelines to receive crude for delivery to the Longview area. Millennium is a joint venture of Equilon Pipeline, Black Hills Milennium Pipeline, and Black Hills Energy Pipeline. F Saudi Aramco completed a key natural gas pipeline project to extend Saudi Arabia's master gas system from the eastern province to Riyadh, where it will serve a major electric power plant. The 800-km pipeline is designed mostly to accommodate gas demand in the central region, estimated at 740 MMcfd-notably Saudi Electric Co. The first shipment of gas through the pipeline began May 2, from the Shedgum gas plant to unit No. 9 of the SEC central power plant, which had been using oil as a boiler fuel. The pipeline project is part of the $2 billion, 1.5-bcfd Hawiyah gas field project and will free up crude for export. The pipeline ties the Hawiyah project, scheduled for completion in mid-2001, to the central region via the Shedgum plant. x Pemex let a $33.6 million contract to a joint venture of Horizon Offshore and Enron Offshore Services & Technology to install six pipelines in the Bay of Campeche's Cantarell fields complex. This will be the first offshore pipeline installation work for the affiliate of Enron's E&C unit, which has participated in installation of a drilling platform, four accommodation platforms, and two accommodation modules and in refurbishment of two drilling rigs, all in the Cantarell fields complex. This time, Enron's partner is Mexico City's CCC Fabricaciones y Construcciones.

In the refining sector this week, Elf Antar France let a 15-month contract to a Bureau Veritas-Ipedex consortium to develop a risk-based inspection (RBI) program for its Grandpuits refinery. Under this contract, inspection plans based on investigation of the critical nature of equipment will be developed, aiming at obtaining a 1-year postponement of shutdown for maintenance of most of the refinery units. Current regulations require internal inspection of pressure equipment at least every 5 years, but newly developed RBI techniques are expected to extend that.

Elsewhere on the refining front, Phillips intends to increase capacity at its Borger, Tex., refinery by 20,000 b/d to 145,000 b/d. The firm will initiate a debottlenecking project later this year, with completion slated for 2002. The debottlenecking project complements the S Zorb unit under construction at the facility and scheduled to start up in early 2001. S Zorb SRT is Phillips's new technology for lowering sulfur content in gasoline blending streams. The process uses a regenerative sorbent that chemically attracts sulfur and removes it from blendstocks.

Embattled Croatian state oil firm INA is cutting back its refined products output as a result of its inability to purchase adequate crude oil supplies. Its financial situation, and thus its ability to purchase crude oil, is grave, according to official Mario Dragun, but he declined to say how big the cuts will be. The firm's refining operations are profitable if Brent doesn't top $22/bbl and if the US dollar fetches no more than 8.0 kuna. Brent has risen above $30, and the dollar is worth 8.6 kuna. To assist INA, the government has allowed the firm to start raising $206.4 million from foreign banks to purchase crude oil and fuel additives. Meanwhile, a recent government decision to raise the excise duty on oil products will hike the price of gasoline by 29%, but none of the increase will go to INA. F Russia's Surgutneftegaz held meetings in London recently with potential investors to discuss building a hydrocracker at its Kirishinefteorgsintez refinery near St. Petersburg. Surgutneftegaz is seeking $600-800 million in loans for this project, to be supplied, in part, in the form of Western technology. Surgutneftegaz has drawn up tender plans and identified potential suppliers of processing technology. With the addition of a hydrocracker, the refinery's depth of conversion would increase to 75% from 50-55%, and residual fuel oil production would fall to 4 million tonnes/year from 7-8 million tonnes.

ROUNDING OUT PROCESSING NEWS this week is a Brazilian petrochemical expansion.

With its sights on reinforcing its position as Latin America's leading polypropylene producer, Polibrasil, a JV of Montell and Brazil's Suzano, plans two major PP expansions. Polibrasil will raise the capacity of the Spheripol-process PP plant it plans to construct at Capuava, Maua, in Sao Paulo state, from 240,000 tonnes/year to 300,000 tonnes. The $200 million (US) plant is scheduled to begin operations at yearend 2001.

Polibrasil also will invest $15 million to expand capacity of its Duque de Daxias plant from 180,000 tonnes/year to 240,000 tonnes by late 2001. The two expansions will increase Polibrasil's total PP capacity to 660,000 tonnes/year from its three plants.