Canadian gas completions rebound; production lags

Canada's natural gas completions are at record levels (Fig. 1), but that has not translated into production growth in the western provinces.

A concentration on shallow gas and fields that deplete quickly has led to flat production. Over the next year, increasing demand may boost gas prices.

These are some conclusions drawn by CIBC World Markets Equity Research in a recent study. These conclusions prompted it to raise gas-price forecasts for 2000 and 2001 to $3.25 (Can.)/Mcf from $2.85/Mcf.

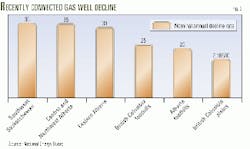

CIBC said that gas drilling has tended toward shallow gas wells during the past 3 years in the eastern region of the Western Canadian sedimentary basin (WCSB), where first-year decline rates on new wells are 30-50% (Fig. 2).

Over the past 5 years, about 50% of the gas wells drilled in Western Canada were in the shallow regions of eastern Alberta and western Saskatchewan, and fewer than 10% were drilled in the deep foothills belt.

The producer focus on shallow wells allowed them to tie in wells quickly, mitigating the effects of declining oil cash flows during the 1998-99 oil price slump. This helped producers with shallow gas inventories and low, 250-MMcfd deliverability wells, but it did little to add overall deliverability in Western Canada.

As a result, field receipts in Alberta, which account for 85% of total Western Canada deliverability, have remained flat at an average 12.3 bcfd over the past 3 years.

Deliverability, demand affect prices

With Alliance Pipeline Ltd. expected to begin shipping up to 1.325 bcfd to Chicago and points beyond in fourth quarter 2000, "Canadian producers have a lot of gas to find in order to fill this incremental takeaway capacity," CIBC said.

Producers will have to shift towards deeper wells with higher productivity to meet supply growth projections from the WCSB. Until that happens, Alberta prices should remain very strong as supplies remain tight, relative to the takeaway capacity situation of pipelines such as Alliance and Northern Border Pipeline and TransCanada PipeLine Ltd.'s expansions.

When Northern Border and TransCanada came online in late 1998, takeaway capacity increased by 1.1 bcfd. That increase has also caused the basis differential between Alberta and the US Midwest to narrow to less than transportation costs, thus boosting Alberta prices, which are 50% higher than a year ago and double the 1998 prices.

CIBC said it anticipates record gas prices in 2000 because of new demand from gas-fired electric power plants, which US Energy Information Agency (EIA) expects will increase by at least 340 bcf or about 1 bcfd.

Other factors such as the more than 8,000 Mw of nuclear capacity that is currently down and the 12,500 Mw of capacity set to go off-line this spring as plants switch gears for refueling or maintenance should bolster gas prices.

High fuel oil prices, plus high air-conditioning loads induced by the extreme heat that is forecast for this summer, will also put upward pressure on prices.

But aside from a few high-impact plays such as Fort Liard and the Foothills belt, high-impact drilling in Western Canada has been limited despite the current positive price environment. On average, well depths have declined by 10%/year the past 3 years.

With first quarter 2000 drilling activity not showing any signs of a shift toward higher-impact activity in the face of healthy commodity prices, "We do not foresee a material increase in field receipts in 2000," CIBC said.

Flat production and strong demand growth point to a limited ability to refill storage this injection season, while the outlook for end-of-winter 2001 storage levels suggest 5-year lows. CIBC also pointed out in its report that storage levels remain on the low side, compared with previous years, despite a third consecutive warm winter.

Similar US trends

A similar trend has been seen in the US industry. Year-to-year US production was flat at 51.3 bcfd in 1999, but US gas production is expected to grow 1% in 2000 and 2001. Significant production growth has been limited by low activity levels, especially in the deepwater Gulf of Mexico, because of low oil prices in 1998 and 1999 and high initial decline rates of 35-40% on new wells.

US gas production since 1987 has grown 1%/year, on average, and has been essentially flat since 1994 at 51-52 bcfd. Drilling rig activity was up in 1997 and 1998 but made little impact in adding to US production.

US demand also is outpacing supply, with the EIA projecting demand growth of 3.5% in 2000, 4.1% in 2001, and 1.8%/year through 2010. Incremental demand has been met through gas imports from Canada, where "healthy" withdrawals from Canadian storage were used to meet demand.