China's natural gas sector generating great expectations

After 2 decades of disappointing developments in China's onshore and offshore oil sectors, a good deal of the international energy community's attention has shifted to the prospects for developing China's natural gas industry.

These hopes have been fanned by the Chinese government, which forecasts in its latest 5-year plan that domestic consumption will reach 6-7 tcf by 2010.

The prospects for developing China's gas industry also seem fortified by recent deals such as BP Amoco PLC's equity investment in PetroChina Ltd., in part predicated on opportunities to participate in developing China's gas industry (OGJ, Apr. 3, 2000, p. 30).

Although the reality may well fall short of the current visions, China's gas industry will grow substantially during the next 10 years.

Remnants of state control

Until recently, natural gas was an extremely minor component of China's energy profile.

Vitally concerned with food security to feed a population of more than 1 billion, natural gas production previously was used mainly to produce fertilizer. In Sichuan Province, China's largest gas production area, over 45% of marketed production was designated for fertilizer production.

Most of the remaining gas was used in the petrochemical industry, only a small fraction was used in the residential and commercial sector, and none was used for power generation.

In terms of overall structure, the development of the gas industry continues to suffer from dictates of central planning. The industry suffers from rationing and price ceilings that bear little resemblance to China's true productive capability and costs.

Consequently, gas consumption and production have remained stunted at little more than 500-600 bcf/year for the past 20 years.

The Chinese gas industry is vertically integrated and remains under government mandate in marketing its production. For example, Sichuan Petroleum Administration, a subsidiary of China National Petroleum Corp. and the largest gas producer in China, explores for, produces, transports, and sells 244 bcf/year of natural gas.

SPA's natural gas is allocated to customers by central and provincial government mandate, with about 60% slated for fertilizer production. SPA's remaining gas production is allocated to the industrial sector-mainly petrochemicals-and to the residential sector (13%).

China's gas industry is not solely focused on producing and selling natural gas. As is the case with many other major industries in China, the gas industry also has many social "obligations"-to provide schooling, health care, and other social services, more akin to a local government than a corporation.

These services are paid for by cross-subsidies from profitable parts of the business and direct transfers from central and provincial government funds. These obligations will become increasingly onerous as the industry is exposed to greater competitive forces.

In addition, the government regulates the industry by establishing ceilings on wellhead prices, transmission tariffs, and consumer prices. Recently, the provincial and national pricing bureaus have increased price ceilings in response to rising costs, but complete price and allocation liberalization awaits major economic reform.

Overcoming barriers to supply

It is not for want of natural gas resources that China consumes so little gas. Estimates indicate China has 40 quadrillion cu ft (quads) of postulated natural gas resources.

The resource estimate for China is undoubtedly conservative. Compared with other major hydrocarbon regions of the world, China is underexplored, and, if coalbed methane and probable resources are added, China could have as much as 240 quads or more of total postulated natural gas resources.

Meanwhile, China's total gas reserves-including proven, probable, and possible-are estimated at almost 60 tcf, with proven reserves of over 37 tcf, sufficient to last 74-120 years at current consumption rates.1

China currently produces about 653 bcf/year of natural gas from four established regions-Sichuan Province, Shaanganing (the Ordos basin), Xinjiang Uygur Autonomous Region (the Tarim, Chungeer, and Caidamu basins), and Nanhai West in the South China Sea.

Sichuan Province is the largest producing area, providing 303 bcf/year of natural gas. The South China Sea is the second largest producing region, providing about 113 bcf/year to Hong Kong and Hainan Province.

China has a number of options for expanding its supply of natural gas. First, most of its domestic reserves are essentially undeveloped, with reserves to production ratios ranging from 30 years in the Northeast to 65 years in Sichuan Province and 243 years in Western China.

Second, reserves are also available to China from surrounding countries. To China's near north, in Russia, the Irkutsk basin, Krasnoyarsk, and Sakha regions contain perhaps as much as 50-60 quads of resources within transmission distance of China.

To China's west, Kazakhstan's giant Karachaganak gas field and Turkmenistan's Dauletabad field are also within potential transmission distance, with over 90 quads between them. To the far north, the Western Siberian gas fields contain over 2,000 quads of mainly untapped gas resources. Over the next 10 years, most imports of foreign gas are likely to come from Turkmenistan and Russia's giant Kovyktinskoye field in the Irkutsk basin in East Siberia.

Gas transmission: linking West and East

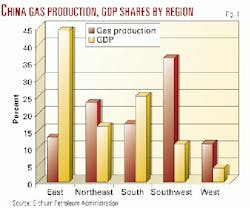

Most of China's current natural gas production is located in the Southwest (Sichuan province) and the West. Meanwhile, the areas that are experiencing the fastest economic growth are in the East and Southeast. A top priority for China's planners is to construct long-haul natural gas pipelines to serve the energy needs of these growing areas (see related story, p. 63).

Currently, China's pipeline system is regionally segmented, only connecting producing fields to nearby consumers. The first pipeline was built in Sichuan Province in 1958, followed by two trunk lines (a southern section in 1966 and a northern section in 1988) that form a Sichuan annular trunk line, with a total circumference of 5,000 km. This is China's longest gas pipeline.

The second longest pipeline is the 860-km system that ships gas from the Ordos basin to Beijing. China will probably import natural gas from Russia and the Caspian states, as well as some LNG in the southern coastal region. There are plans to build a 4,600-km pipeline from Turkmenistan to Western China that would also provide a main artery for China's domestic pipeline system. The pipeline would most likely have a capacity of 2 bcfd and carry about 600 bcf/year.

Another pipeline on the drawing board, with a capacity of 2 bcfd, would move natural gas from Russia's Irkutsk basin south to Beijing.

Bolstering gas consumption

A major obstacle to the development of a gas system in China is the development of market demand that breaks the 400-600 bcf/year mark.

Recognizing this, the Chinese government is lifting restrictions that mainly limited natural gas use to fertilizer production. In terms of developing residential, commercial, and industrial demand, China would not be starting from scratch.

Many cities already have local distribution systems that distribute manufactured town gas. This is similar to Britain in the late 1950s and early 1960s, which also had extensive town gas systems. The discovery and development of natural gas in the North Sea meant that all these systems were gradually converted to accept natural gas.

At the national level, China essentially consumed natural gas where it produced it, which makes Sichuan Province the largest consumer as well as producer in China. However, ambitious plans to construct a nationwide and international gas grid, moving gas from Sichuan province to the developing eastern economic zones, from the Tarim basin in far Western China to the populated east, and potentially from Russia, would provide the infrastructure for consumption to "take off."

China's policy towards natural gas is now changing and, with market reform, the use restrictions have been lifted. Besides rational economic reform, an important determinant that is all too often easily dismissed is China's wish to develop natural gas for its environmental advantages. China's economy is currently about 70% dependent on coal for energy, with all the attendant pollution and health problems that come with consuming coal.

Chinese gas demand forecast

The forecasts that follow on the future of Chinese gas demand are based on a number of assumptions about key economic, political, and demographic variables. These assumptions include:

- Economic growth will average 5.2%/year during 2000-10.

- Economic restructuring will continue to focus on privatization but will proceed at a cautious pace as the government seeks to minimize social instability.

- Sectoral change in China's economy will see an increased percentage of gross domestic product provided by the service sector and a decrease in share of the agriculture sector.

- Companies will increasingly focus on core activities and gradually shed social welfare responsibilities.

- Population growth will average 0.7%/year during 2000-10.

- An increasing percentage of population will be in urban areas.

- The percentage of household expenditures on consumer durables, education, recreation, and transportation will increase.

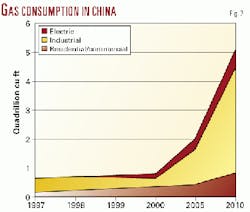

A natural gas-consumption forecast is provided by sector in the table. Considering China's climate, it is unlikely that space heating will gain the dominant position it has in Europe and the US during the next 10 years. Despite this, we still expect residential and commercial consumption to double to 830 bcf/year by 2010.

Strong economic growth and environmental initiatives could result in an eightfold increase in consumption by the industrial sector to 4 tcf by 2010. Most of the growth is expected to occur in the petrochemical and boiler heat sectors. An increase in consumption to 4 tcf/year would represent an astonishing average growth rate of 28%/year.

The electric power sector should also enjoy strong growth, assuming electric and gas deregulation and privatization remain on track. Gas consumption from power generators is expected to grow at about 17%/year, to reach almost 700 bcf by 2010.

The transportation sector is not considered in this gas consumption forecast. In terms of overall energy consumption, transportation promises to be one of the fastest-growing sectors.

Although China's government is touting and providing incentives for the use of natural gas in vehicles, the actual outcome in terms of future consumption is very uncertain on purely economic grounds.

As with the US government, China's government has promoted natural gas vehicles for specialized purposes, notably as public transportation in such cities as Chengdu and Xian. However, just as in the US, it is debatable whether natural gas vehicles, given competing transportation technologies, will find general acceptance in the population and therefore provide a source of significant consumption growth.

The forecast of China's gas consumption appears dramatic and optimistic, with annual growth rates approaching 20%.

However, at 5.2 tcf consumption by 2010, natural gas would still provide only 9% of total primary energy consumption, compared with current market shares of 24% in the US, 19% in Western Europe, and 40% in the Former Soviet Union.

In other words, the forecast could easily be increased and not stretch credulity.

Reference

- By comparison, North America possesses 10-11 years of reserves and produces 26 tcf/year; Western Europe, a major gas importer, has about 17 years of reserves and produces 14 tcf/year; and Eastern Europe and the former Soviet Union possess 83 years of reserves, producing 23 tcf/year.

The author-

David Pietz is an analyst in the Pacific Basin practice of Energy Security Analysis Inc., Wakefield, MA. With over 10 years of experience researching and writing on Chinese economic development, he works with ESAI's domestic and international clients on Chinese and Asian petroleum market analysis.

Pietz is the principle author of ESAI's recent multiclient study, Fueling China: Oil and Gas Demand to 2010. He holds a PhD in Chinese economic history from Washington University and is also an Associate in Research at Harvard University's Fairbank Center for East Asian Research.