OGJ Newsletter

Market Movement

Sustaining $30/bbl possible?

Is it possible for oil prices to be sustained above $30/bbl for much of this year?

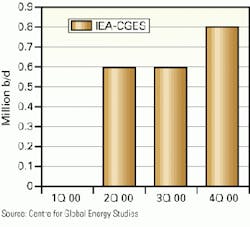

It is, if one assumes the IEA is correct in its projection that oil demand will increase by at least 1.5 million b/d this year. So says London-based think tank Centre for Global Energy Studies. But CGES differs with IEA's estimate of demand by about 500,000 b/d (see chart).

As is often the case, Iraq is a wild card. Depending on whether it chooses to sharply boost or slash exports this year-and either option depends on its relations with the US-it's anybody's guess as to whether the second half will see $30/bbl oil continue or prices drop to more manageable levels, says CGES.

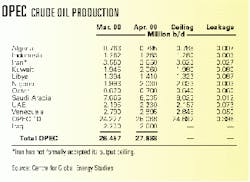

The analyst contends OPEC is unlikely to boost output at its next ministerial meeting this month, with the call on OPEC oil expected to fall 400,000 b/d of projected production.

Gasoline price role

Much of the upward pressure on oil prices comes from the extremely tight gasoline supply situation, notably in the US.

CGES contends OPEC should have hiked output at the first of the year, in order to help US refiners replenish gasoline stocks. But the high oil prices of the moment discouraged refiners from boosting runs, and utilization rates remained at 86% in the first 2 months of the year, vs. an average 91% the same time a year ago. Since then, runs have increased by 1.2 million b/d, but that's just enough to help refiners keep up with the ramp-up in gasoline demand growth.

CGES notes that, at the end of April, US gasoline inventories provided only 24 days of forward cover, 2 days less than the same time a year ago and 1 day less than the end of January: "Such low stock cover makes traders jumpy and explains the huge $17/bbl differential between reformulated New York Harbor gasoline and WTI during the first 2 weeks of May-up $10/bbl since January."

And gasoline prices are expected to trend even higher in the weeks to come. NYMEX near-month gasoline futures were hovering near record levels at presstime last week.

So US refiners have plenty of incentive to run crude flat out to maximize production of gasoline, but they need more crude to do it, which is why the market is tightening and why oil prices are so high.

Demand outlook

But CGES thinks that this gasoline-related tightness is just temporary and will ease before the end of summer.

Thereafter, the direction of oil prices is linked to the underlying consumption levels, which remains a guessing game. While IEA sees a hefty year-to-year increase in oil demand, CGES thinks it will be reined by sharply higher oil prices, citing a retail barrel that is 32% higher in the US and 28% higher in the UK. Despite a booming economy, CGES contends that oil demand in the major economies will remain flat this year, while the rest of the world will account for the 1 million b/d incremental rise it predicts.

"If our view of demand proves to be right, then OPEC's reluctance to boost output is understandable, since an increase would precipitate a price slide that would take dated Brent to less-desirable levels for OPEC by the end of 2000," CGES said.

But if IEA is right, then OPEC will come under increasing pressure to boost output by October in order to keep oil prices out of the stratosphere.

Natural gas strength

Analysts continue to ratchet up their forecasts for US natural gas as well.

Dain Rauscher Wessels Energy Group raised its US natural gas price forecast for 2000 to $3.35/Mcf from $2.85 to reflect depletion rates, higher demand, and low storage levels.

"Our new gas price forecast of $3.35 [and] $3.00 for 2000 [and] 2001, [respectively], if confirmed in actuality, would represent the strongest 2 consecutive years for gas prices ever, by a margin of roughly 20%. The best single year historically was $2.76 in 1996, and the second-best single year was $2.53 in 1997. The key reason for this stronger forecast is that some combination of domestic gas production weakness and stronger-than-expected spring demand has resulted in a subpar rate of spring inventory build-up," said a May 30 report.

A survey conducted by DRW concluded US supply is down almost 4% from this time last year. The analysts said it expects depletion levels to require more than the usual number of gas rigs working to increase deliverability.

DRW said spring gas demand may also be stronger than normal. Good oil prices have encouraged a high rate of liquids extraction, reducing the btu content of the gas. Also, start-up of new gas-fired generators has been a driver, as has been demand-switching from oil to gas when oil was $25-30/bbl and gas closer to $3/Mcf. With gas at over $4, the switching-to-gas incentive will be only slightly reduced.

In addition, the firm said, "AGA gas [storage] inventory as of May 17 was 1,218 bcf, which is approximately 24 bcf below the 5-year seasonal norm, and 414 bcf below last year. Over the last 6 weeks, inventory has increased at a rate of 4.4 bcfd as compared with a normal 8.2 bcfd build rate for this period. If a gap of this size continues in the build rate for the balance of the quarter, we estimate that AGA storage is likely to end the second quarter at approximately 1,610 bcf. This would be 190 bcf below the seasonal norm. The futures market appears to be already anticipating such an outcome.

"We see the current supply-demand tightness extending through 2001 and probably longer. The central problem is that the traditional "go to" gas supply region, the shelf of the Gulf of Mexico, has become very mature and is now facing gradual production decline. Its role will gradually be replaced with other North American supply provinces, but total supply is likely to flatten in the transition period, while demand growth will continue to grow (demand has been flat due to three near-record mild winters in a row)."

Industry Trends

THE SCRAMBLE FOR CASPIAN RESOURCES and Iran's opening of its oil sector to foreign investment are two trends that have converged.

The Iranian Majlis (Parliament) has approved a bill that gives NIOC the right to enter into buy-back contracts with foreign firms for E&D on Iran's Caspian Sea shelf. The measure may complicate the delicate balance of power in the Caspian Sea, where five littoral states disagree about territory ownership.

New drilling activity off Azerbaijan, the recent report of a supergiant discovery in the northern Caspian by Russia's Lukoil, and rumors that Offshore Kazakhstan International Operating Co. is on the verge of a huge discovery all have contributed to concerns within Iran that the country is losing out on Caspian oil and gas development. NIOC is involved with Royal Dutch/Shell, Lasmo, and Veba in the South Caspian Exploration Study.

DEPENDENCE ON MIDDLE EAST OIL, the frenzy over the Caspian notwithstanding, will continue to grow until more conventional oil is found and becomes cost-competitive, speakers told a Gulf Cooperation Council conference in Manama last month. GCC members are Kuwait, Qatar, Saudi Arabia, UAE, Oman, and Bahrain.

The investment needed for oil development for the next 25-30 years will be about $200 billion/year, says the GCC secretariat's Anwar al Abdullah. In meeting this goal, industry faces many challenges, including climate change, refining industry revitalization, renewable energy, WTO policies, globalization, oil taxes, and domestic subsidies.

Not the least of the challenges is being able to ensure that oil production capacity is adequate, he said: "This daunting task must be tackled in a climate of increasing globalization of oil and other industries, continuous cost pressures, and environmental sensitivities. These aspects should be considered in the spirit of forging partnerships with the GCC to achieve common goals."

Despite a drop in operating costs the past 2 decades, the challenges ahead are immense, contends Saudi Aramco's Sadad Ibrahim al Husseini. In recent years, demand has grown at a rate of 1.5%/year for oil, while capacity has declined 3-4%/year, he said. To try to offset this shortfall, upstream investments among 182 companies grew from $55.8 billion in 1994 to more than $102 billion in 1998.

Ultimately, the GCC, with 670 billion bbl of oil reserves and 1,970 tcf of gas reserves, will remain the cornerstone of the global energy structure, al Husseini said.

A ROADMAP FOR THE US GAS INDUSTRY is the focus of an unusual meeting of natural gas consumers and executives of producing companies, pipelines, and utilities planned July 9-10 in Colorado Springs, Colo. The goal of the by-invitation-only summit is to develop a roadmap the industry can follow to overcome challenges as US natural gas demand expands from 22 tcf/year to an anticipated 30 tcf by 2010.

The Natural Gas Council-an alliance of AGA, API, INGAA, IPAA, and NGSA-is sponsoring the Natural Gas Summit. Anadarko Energy Services Pres. Richard Sharples, NGC chairman, said, "The technology-driven economy has created reliability standards never achieved before. At the same time, the demand for natural gas in all customer sectors, including residential, industrial, and commercial, is growing significantly. To meet this demand, the natural gas industry must work with our customers to create a roadmap for the future."

Government Developments

THE CLINTON ADMINISTRATION continues to offer sops to the environmentalist lobby by throwing up roadblocks to US E&D, even as oil prices top $30/bbl and gas futures pass $4.50/MMbtu.

President Clinton last week issued an executive order to further restrict drilling in US waters. The order expands protection of coastal waters, estuaries, coastal reefs, and shorelines and directs EPA to toughen water quality standards to reduce coastal pollution.

Rep. Don Young (R-Alas.), House resources committee chairman, says Congress has either approved or is close to passing legislation that achieves most of Clinton's goals. He said Clinton "should work cooperatively with Congress on marine life and coastal protection instead of bypassing Congress and establishing a bureaucratic tidal wave of new regulations.

"Just as his national monument designations on land have created a flurry of protests, his actions with our oceans and coasts could create the same negative reactions."

VICE-PRES. AL GORE is joining the fray anew, pledging last week that, if elected president, he would never allow oil exploration on Alaska's ANWR Coastal Plain-despite a new report by EIA that estimates a mean value of 10.3 billion bbl of oil could underly the already inhabited area (see Editorial, p. 19).

Gore also promises to oppose any new oil and gas drilling off California and Florida and continue a ban on lease sales off the East and West coasts. He added that he would ban logging and road construction on 43 million acres of undeveloped national forest lands, affirming a proposal the administration made 3 weeks ago. He promised to act "to reverse the rise in global warming in a way that creates jobs."

INDUSTRY MAY GAIN SOME ENVIRONMENTAL GROUND, thanks to a US Supreme Court decision to broaden its review of EPA's 1997 smog-soot rule to consider whether the agency should have considered the rule's economic costs-a view lower courts generally have disdained.

The court previously had agreed to consider whether EPA exceeded its legal authority in drafting the reg to reduce ozone and particulate emissions (OGJ, May 24, 1999, p. 39). The rule impacts refineries, as well as other oil industry operations.

ELECTION-YEAR POLITICS IN THE US could provide an opportunity this summer for oil tax legislation in Congress. So says IPAA Chairman Jerry Jordan, noting that several pending bills would give US producers tax relief. "This is a unique opportunity to get a rifle-shot approach to tax legislation," Jordan said. "I'm not optimistic, because everybody [in Congress] is thinking about the election. But if we don't push it now, we'll have less chance in the future."

The pending bills would allow expensing of geological and geophysical costs, delay rental payments, and offer tax credits for marginal production.

IPAA's Lee Fuller says Congress and the administration are in agreement on some measures to help producers, but he is not optimistic legislation can be passed.

He noted that Senate Republicans proposed an omnibus energy bill last month, but said, "The odds are very slim Congress could act on this." Still, said Fuller, "Some scenarios could create movement" on a bill. He believes rising oil and gas prices, or shortages, could create a window of opportunity but that marginal-well tax relief faces a "sizable hurdle" due to sentiment against more tax credits.

Quick Takes

A MAJOR MIDDLE EAST GAS PIPELINE initiative has some market data to boost its prospects.

New studies show gas demand for oil field gas lift projects and for power and industrial uses will rise substantially by 2005 in Dubai, Abu Dhabi, and Oman. Dubai's overall gas demand is expected to reach 15 billion cu m in 2005, up from 8 billion cu m in 1996, according to UAE Offsets Group, backer of the Dolphin gas export project in the region. In Abu Dhabi and Oman, gas demand is expected to reach 73 billion cu m and 24 billion cu m, respectively, by 2005, vs. 36 billion cu m and 7 billion cu m in 1996.

In other pipeline news, FERC issued a final order authorizing Williams to increase capacity on its Transco pipeline system by 204,099 dekatherms/day of additional firm transportation capacity to Alabama and Georgia. The $108 million SouthCoast expansion will require about 44 miles of 48, 42, and 24-in. pipeline, as well as another 31,500 hp of compression at compressor stations in Rockford, Ala., and Newnan, Ga. Construction is to begin this summer, with service beginning Nov. 1. F Diesel fuel and other refined products throughput resumed through the newly renovated 77-mile stretch of the Cenex Harvest States Cooperatives' Cenex Pipeline near Sarpy Creek, Mont. The new segment replaces pipeline that had been in operation since 1954. The pipeline segment had been operating properly but was beginning to show wear, prompting the need for the 2-year, $13 million renovation project. The 210-mile Cenex pipeline carries 28,000 b/d of product from the Cenex refinery at Laurel, Mont., to Fargo, ND. F Pertamina plans to offer Petronas entry into a JV to develop its $800 million oil products pipeline project on Java. The offer could extend to joint work on PSCs in the Makassar Straits. x Coastal requested bids for the offshore portion of its proposed $1.6 billion, 1.1 bcfd Gulfstream Pipeline from 10 prequalified bidders. The project is a 744-mile pipeline that will carry gas from Alabama across the Gulf of Mexico to Florida. Work will include offshore assembly and installation of more than 400 miles of 36-in. pipe to transport dry, processed gas to Florida. Final environmental and routing approvals by FERC are anticipated by March 2001. F Dominion Bond Rating Service confirmed its rating on senior notes of Alliance Pipeline LP at BBB (high) with a stable trend. The high-pressure gas and liquids line from Western Canada to the Chicago area is 85% complete and on schedule for start-up in October 2000. The rating service said construction costs are close to a July 1999 control budget, and much of the risk of cost overrun has been overcome. It said 15-year take-or-pay contracts are now in place with 36 shippers. The line will have initial capacity of 1.3 bcfd.F Enterprise Products Partners let contract to Sunland Construction to build the Lou-Tex NGL Pipeline. The 12-in., 206-mile pipeline originating in Breaux Bridge, La., will connect Enterprise's NGL transportation and storage system with its Mont Belvieu, Tex., liquids complex. The pipeline will have an initial capacity of 50,000 b/d, in batch mode, for the transport of mixed NGLs and NGL products, including ethane, propane, butane, isobutane, and natural gasoline. The design will permit expansion to more than 100,000 b/d. Construction is expected to be completed by the third quarter. Whomble Co. and Bayou Pipe Coating were awarded the pipe-coating contracts. F Transwestern increased its available gas transmission capacity to California by 15% as of May 1. Previously it had held combined east-west delivery capability of 1.6 bcfd. The $12 million expansion project included the installation of a 10,000-hp motor to run a new compressor station near Gallup, NM, and the addition of gas coolers at two existing compressor stations. Work began in mid-January.

WEST AFRICAN REFINING CAPACITY is getting bigger and better.

Sonangol let contract to its new 40-60 JV with Technip, Technip Angola Ltd., for project management of construction of a new refinery in Angola (OGJ Online, May 26, 2000). Technip also will act as adviser to the Interministries Committee, headed by the petroleum minister. That committee is assessing the products market, refinery scope, investors, and financing for the proposed project.

Meanwhile, Nigerian National Petroleum Corp. let a $7.6 million contract to Comerint for turnaround maintenance on its 125,000 b/d Warri refinery. Work is to be completed within 5 months. The contract is part of a drive by NNPC to repair all its refineries, which have been plagued for years by repeated and debilitating failures (OGJ Online, Apr. 30, 2000). The plant has been out of service due to an explosion that caused major damage to the main crude oil heater. The most recent maintenance work was in 1994. Nigeria has three other refineries-60,000 b/d and 150,000 b/d plants at Port Harcourt and a 110,000 b/d plant at Kaduna. Turnaround maintenance at Port Harcourt's 60,000 b/d refinery was completed in 1999, while Nigerian firm Chrome put the 150,000 b/d plant into turnaround May 15. The revamp at Kaduna, started more than 2 years ago with an expected cost of $240 million, is yet to be completed. Nigeria plans to eventually privatize the four plants, which provide only 40% of domestic refined products supply.

In other processing news, Idemitsu Kosan shut down the crude unit at its 160,000 b/d Aichi refinery in western Japan following a fire May 24. Idemitsu says it is unclear when the refinery will start up again. The cause is under investigation. F Belarus's state oil and gas company, Belnaftokhim, is in talks with Mitsui regarding a revamp of its Novopolotsk (Naftan) refineryn. The upgrade would boost output of light petroleum products to 900,000 tonnes/year, to be sold domestically. Mitsui signed a framework contract for the $90 million project, and Belnaftokhim now is discussing financing with the Japanese firm. Belarus plans to privatize Naftan, and international energy company Itera says it would be willing to take a controlling stake in the plant in payment for Belarus gas debts. F Kellogg Brown & Root and JV partner PSI-Lurgi completed mechanical work on a new $200 million phenol and acetone plant at Theodore, Ala., for Phenolchemie. x Borealis's first Borstar-process polypropylene plant, at Schwechat, Austria, has started up. The 140 million euro, 200,000 tonne/year project was executed on schedule and under budget. Two old slurry polypropylene lines with a combined capacity of 130,000 tonnes/will be closed at the site, resulting in a net capacity increase at Schwechat of 70,000 tonnes/year to 340,000 tonnes/year. F Royal Dutch/Shell started construction on a 100,000 tonne/year propylene oxide glycol ether plant at Pernis, the Netherlands. The plant will manufacture propylene glycol monomethyl ether, dipropylene glycol monomethyl ether, and propylene glycol monoethyl ether, some of which will be esterified to form acetates. The plant should come on stream at the end of 2001. The plant is to be built next to an existing multipurpose plant producing 55,000 tonnes/year of ethylene oxide and POGE. Existing styrene monomer-propylene oxide plants in Moerdijk will supply feedstock to the Pernis plant. Those plants are operated by Basell (a 50-50 JV of Shell and BASF that produces 250,000 tonnes/year of propylene oxide and 565,000 tonnes/year of styrene monomer) and by a Shell unit that produces 200,000 tonnes/year of PO and 440,000 tonnes/year of SM.

ECUADOR IS TRUMPETING EXPLORATION SUCCESSES in its Oriente jungle region.

Ecuador is supporting Perez Companc's estimate that a recent oil discovery on Block 31 may hold 500 million bbl of reserves (OGJ Online, May 18, 2000). On test, the discovery well flowed 5,000 b/d. Three zones remain to be tested, and Perez Companc will drill two more wells on Block 31 over the next year.

Ecuador also says Cayman Oil found 55 million bbl of reserves of 28° and 33° gravity crude with the Palo Azul well, also in the Oriente. Initial production from the well, drilled in the southern portion of Block 18, is expected to be 3,600 b/d.

Elsewhere on the Latin American exploration front, Brazilian agency ANP published a list of the 44 companies it has approved for participation in the country's second open licensing round, scheduled for June 7. ANP is auctioning 23 blocks, of which 13 are offshore and 10 onshore.

Japanese explorationists have hit a hot streak off Australia.

INPEX found gas and condensate with the first wildcat on its WA-285-P block on Australia's North West Shelf. On test, the well flowed 22 MMcfd and 1,300 b/d. The 5,050 sq km block is in 90-340 of water. INPEX plans to drill two more wells on the block and hopes to begin commercial production as early as 2001. INPEX is 50% owned by Japan National Oil Corp. F Nippon Mitsubishi Oil Corp.'s JV confirmed its gas-condensate find in the Timor Sea off Australia. Nippon Oil Exploration's third appraisal on Block AC/P23 flowed 65.5 MMcfd and 1,921 b/d on test and cut 280 m of net gas pay. x Agip snagged an exploration permit in the Qaidam basin in west-central China. Agip signed a PSC with state-owned CNPC covering a 7,000 sq km area postulated to hold a natural gas resources of 250 billion cu m.

FSU DEVELOPMENT WORK tops this week's drilling-production news.

The Russian Natural Resources Ministry has approved a request for permission to resume drilling work at the Sakhalin-I project. The Sakhalin I consortium plans to begin drilling a new appraisal well, Chaivo-6, in July, ministry officials said.

The group, led by Exxon Neftegaz, is developing Arkutun-Daginskoye, Chaivo, and Odoptu fields, estimated to hold 2 billion bbl of oil, 240 million bbl of condensate, and almost 15 tcf of natural gas. Development of the fields may require more than $13 billion over their expected 42-year life. The Sakhalin I group plans to spend about $53 million this year.

The consortium had to halt appraisal drilling last year, reportedly over concerns about drilling waste disposal and other environmental issues. The partners have said, however, that time had simply run out on their drilling permit, which Russia has now renewed. The ministry is requiring the consortium to inject all of its drilling mud into the well rather than dispose of wastes at sea.

Exxon and Japan's SODECO each hold a 30% stake in the project, with other interests held by Rosneft 17% and Rosneft's Sakhalinmorneftegaz subsidiary 23%. Rosneft may sell part of its stakes to pay its debt to the consortium.

Meanwhile, Uzbekistan's Uzbekneftegaz invited investors to develop eight oil and gas fields requiring total outlays of $242 million. The fields, operated by Uzbekneftegaz, include North Shurtan, South Kyzylbairak, and Shakarbulak, which together produce 646,000 tonnes/year of oil. South Tandyrcha, Gumbulak, and Dzharkuduk fields produce 2.5 billion cu m/year of gas and 90,000 tonnes/year of condensate. Uzbekneftegaz said $25 million in investments would also be needed at Umid and South Kemachi fields in order to boost output to 100,000 tonnes/year of oil, 30,000 tonnes/year of condensate, and 2.0 billion cu m/year of gas. Also needed are a $45 million gas compressor station at Gaz* and a $20 million plant to utilize flared gas at Kokdumalak field.

Separately, Uzbekneftegaz Chairman Ibrat Zainutdinov said Uzbekistan will sell 49% of the shares of the company to foreign investors. The government will also sell stock in its other petroleum companies-Uzneftegazdobycha, Uzneftepererabotka, and Uzburneftegaz.

In other drilling-production action, NIOC has tentatively awarded ENI a buy-back contract to develop Darquain oil field, reports Middle East Economic Survey.

The estimated $500-600 million project will be the second awarded to ENI, which is already working in partnership with TotalFinaElf to develop Doroud offshore field.

Darquain, 45 km northeast of Abadan, has about 289 million bbl of oil reserves. The field's three wells were abandoned because of poor permeability. NIOC hopes to restart production, expected to plateau at 200,000 b/d, with new development and EOR projects.

ENI, along with Shell, TotalFinaElf, and Lasmo, also reportedly bid on various aspects of Iran's three-field Bangestan project, which includes Ab-Teynour, Ahwaz, and Mansouri fields. These fields have combined reserves of 5.83 billion bbl of oil, of which 690 million bbl has been produced. x Ranger Oil and its Kyle oil field partners announced first oil. In March, the UK Department of Trade and Industry gave permission for Petroleum Geo-Services to conduct a 130-day, 1.7 million bbl limited test on Well 29/2c-12z. The well began producing 19,000 b/d of oil to PGS's Petrojarl 1 FPSO on May 24. Output is expected to average 13,000 b/d. Kyle is Petrojarl 1's ninth consecutive project in 14 years; it will undergo an upgrade after the test is concluded. x Pride International reports the newbuild drillship Pride Angola, rated to 10,000 ft of water, has begun work off Angola for TotalFinaElf under a 3-year contract. Sister ship Pride Africa is currently in South Africa completing testing prior to redeployment to Elf to work off Angola for an initial term of 5 years. Both are owned and operated by a JV of Pride and Sonangol. F Statoil let contract to Coflexip Stena Offshore for abandonment of Tommeliten field, the first time that Norwegian authorities have given consent for a light well-intervention vessel to do work in a live well as an offshore installation, CSO says, and the first time such work will be undertaken by a vessel in the North Sea without the support of divers. Tommeliten was developed with six subsea trees on a single template in 73 m of water. Statoil shut in the 10-year-old field in 1998. Scope of work includes reentry of all six trees with the CSO Seawell vessel. x Saibos CML, a JV of Bouygues and Saipem, selected Enercon Engineering to perform detailed design, procurement, and construction coordination of a three-leg, three-skirt-pile, 12-slot unmanned platform with test facilities, to be installed in Espoir field in 400 ft of water off the Ivory Coast. The platform, to be operated by Ranger Oil is slated for installation in spring 2001.