Economics show CO2 EOR potential in central Kansas

Carbon dioxide (CO2) enhanced oil recovery (EOR) may be the key to recovering hundreds of millions of bbl of trapped oil from the mature fields in central Kansas.

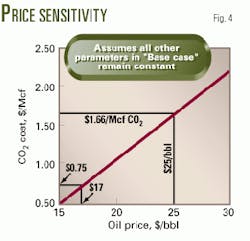

Preliminary economic analysis indicates that CO2 EOR should provide an internal rate of return (IRR) greater than 20%, before income tax, assuming oil sells for $20/bbl, CO2 costs $1/Mcf, and gross utilization is 10 Mcf of CO2/bbl of oil recovered. If the CO2 cost is reduced to $0.75/Mcf, an oil price of $17/bbl yields an IRR of 20%.

Reservoir and economic modeling indicates that IRR is most sensitive to oil price and CO2 cost.

A project requires a minimum recovery of 1,500 net bbl/acre (about 1 million net bbl/1-mile section) under a best-case scenario. Less important variables to the economics are capital costs and non-CO2 related lease operating expenses.

Central Kansas

Ten counties in the Central Kansas uplift have produced more than 2.4 billion bbl of oil (Fig. 1). This compares to the more than 6 billion bbl of oil produced from the entire state.

Most uplift production is very mature and is approaching its economic limit, leaving behind a significant amount of trapped oil. The industry with CO2 flooding may be able to recover hundreds of millions of bbl of this oil, if one assumes similar recovery factors (20-30% of primary plus secondary production) to those in the Permian basin of West Texas.

Because Kansas has no significant CO2 source, both technical and economic questions must be answered before the region's independent operators can commit reservoirs and financial resources to this recovery technology.

Many technical questions are being addressed by a US Department of Energy (DOE) sponsored miscible CO2 EOR pilot project slated to begin CO2 injection into a Lansing-Kansas City (Pennsylvanian) reservoir in central Kansas in 2001 (OGJ, Nov. 22, 1999, p. 70).

The numerous multipay fields in central Kansas, many of which were first developed in the 1930s and 1940s, are associated with the Central Kansas uplift, a large southeast trending anticlinal feature. In a major pre-Pennsylvanian uplift event, the Mississippian-age strata eroded off the crest of the structure, exposing the Cambrian-Ordovician Arbuckle group.

The Arbuckle carbonate rocks subcropping beneath the pre-Pennsylvanian erosion surface exhibit limited to extensive vuggy and karst porosity development. Blanketing Pennsylvanian strata include the Lansing-Kansas City (L-KC) group.

L-KC contains solution-gas-drive reservoirs at 2,900-3,100 ft depths that have produced about 600 million bbl in a 10-county area of central Kansas. The uppermost 50 ft of the Arbuckle group, at 3,100-3,300 ft depths, has produced about 1,600 million bbl from bottom-water-drive reservoirs.

Operators initiated successful waterfloods in the 1950s and 1960s for many L-KC fields. These floods essentially have been completed. If operators CO2-flooded all of these Central Kansas uplift fields, the potential recovery from the Arbuckle and L-KC reservoirs may be 440-660 million bbl (20-30% of primary plus secondary production).

L-KC properties

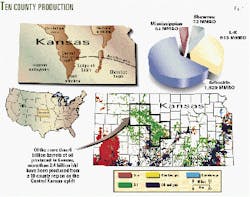

The L-KC interval consists of alternating marine carbonates and marine and nonmarine shales in cycles that have been informally classified by the letter designations A through L (Fig. 2). Within the L-KC section, nonreservoir lithofacies include shale, mudstone-wackestone, wackestone-packstone, and oomoldic grainstone with isolated oomolds.

The principal reservoir lithofacies are the vuggy oomoldic grainstones formed by early interooid cementation and subsequent meteoric water dissolution of ooids to form oomoldic or oolicastic limestones.

In general, the C and G zones are among the thickest intervals and are also the predominant reservoir intervals with net pay thickness ranging from several feet to several tens of feet. These L-KC reservoirs average 17% porosity in gross intervals and up to 25% in net pay intervals. Routine air permeabilities average 43 md in net pay intervals.

In the oomoldic grainstones, irreducible water saturation (Swi) is less than 25% and correlates with permeability.

The most critical parameter for successful CO2 flooding is the amount of oil remaining in the reservoir after waterflooding. The residual oil saturation (Sorw) must be sufficient for an economic flood.

Limited testing of L-KC oomoldic limestones indicates that Sorw averages about 30% of pore volume and decreases slightly with increasing permeability.

Economic model

A simple model aided in assessing the economics of CO2 EOR for central Kansas and the Midcontinent (see the accompanying box for the model parameters and economic model results).

The model used CO2 Prophet, a DOE freeware reservoir numerical simulation program, for determining reservoir performance, including injected and produced fluid rates, and CO2 utilization. Economic parameters such as oil price, CO2 costs, capital costs, net revenue interest, production taxes, and lease operating expenses are typical for anticipated conditions in the region and present price climate.

The economic analysis and simulation is for a 160-acre portion of a field-wide miscible CO2 flood having a standard five-spot pattern (four 40-acre, five-spot patterns in a 160-acre area). CO2 is injected into a well located in the center of each five-spot pattern. Economics generally can be scaled up to larger areas in direct proportion to size.

Reservoir properties used in the numerical simulation include porosity, permeability, relative permeability, Dykstra-Parsons heterogeneity coefficient, initial and residual fluid saturations, and thickness. The values are representative of many L-KC reservoirs and conditions in the Hall-Gurney field, the location of the DOE pilot flood.

The model held the life of the flood, 10 years, as a constant in the economic analysis. Hence, as the fluid-related parameters changed, the fluid production and injection rates also changed. Their volumes, associated costs and revenues were distributed over the same time period.

Before income tax (BFIT) internal rate of return (IRR) provides a measure of economic success that is independent of the project size. It can be easily compared with other types of investment.

Principal variables controlling the economics of CO2 flooding in the model included:

- Oil price.

- CO2 cost/net bbl of oil recovered.

- Net bbl of oil recovered/acre.

- Pre-flood capital costs.

- Non-CO2 related lease operating expense (LOE), including administration and overhead.

Where possible, the analysis normalized the variables to develop convenient reference frames.

The cost of CO2/net bbl (net revenue interest times gross bbl) incorporates all CO2 costs including the price of CO2 (base case-$1.00/Mcf), CO2 utilization (required CO2/gross bbl) and the cost to capture, compress, and reinject produced CO2 (base case-$0.30/Mcf).

The reason for the relatively high estimated cost for new CO2, as compared with the Permian basin where $0.75/Mcf is more typical, is due primarily to the distance to the most readily available source (220 miles) and the capital required to bring CO2 to central Kansas.

The analysis normalized net oil recovery to acreage, providing a measure that is convenient to upscale. Net revenue interest and production taxes are set at rates typical for central Kansas and are held constant.

CO2 Prophet predicted the base case net and gross CO2 utilization. These values are similar to those in the Permian basin. For the thinner, shale-bounded L-KC, net and gross CO2 utilization may be lower, decreasing CO2 costs.

The pilot study will provide a better quantification of utilization.

The model based preflood capital costs and LOE on the predicted costs that would be apportioned to a 160-acre portion of a field-wide flood. The analysis anticipates relatively high pre-CO2 flood capital costs to remedy problems related to poor cement jobs, inadequately plugged wells, multiple completions within a single well bore, and old casing and surface equipment.

The well bore vintage, the number of penetrations into the reservoirs (up to 60/section), and the age of the wells (up to 65 years) present challenges for containment of CO2 floods and must be addressed on a well-by-well basis.

The base case represents a best estimate for economic input parameters and is representative of central Kansas L-KC reservoirs.

The analysis holds net revenue interest and production taxes as constants, while the other parameters are not expected to vary by more than 25%. For example, CO2 delivered on a commercial scale may cost $1/Mcf, but could vary from $0.75 to $1.25/Mcf.

Sensitivity of the economics (IRR) was analyzed based on this 25% variance in the major parameters.

Economic evaluation

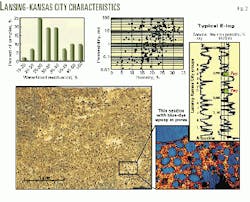

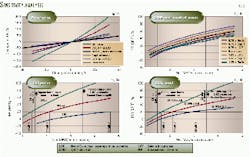

Fig. 3a illustrates that the percent change in IRR (before income tax) is most sensitive to the oil price and CO2 cost.

A 25% increase in oil price from the base case ($20-25/bbl) results in a 118% increase in IRR, and a 25% decrease in price causes a 100% decrease in IRR. The response of IRR to parameter changes is about, though not completely, linear.

Change in IRR decreases successively in response to change in the cost of CO2/net bbl of oil recovered, net bbl of oil recovered/acre, pre-flood capital costs, and non-CO2 related lease operating expense (LOE).

IRR is least sensitive to changes in LOE. A 25% decrease in LOE results in only a 20% increase in IRR and a 25% increase in LOE results in a 24% decrease in IRR.

Figs. 3b-3d illustrate the relationship between IRR and net bbl of oil recovered/acre. The figures show the influence of LOE and capital costs, oil price, and CO2 costs.

Based on Permian basin CO2 flood history, CO2 miscible floods recover about 10-15% of original oil in place or 20-30% of the primary plus secondary oil recovery. With these values and using Figs. 3b-3d, one can quickly estimate the CO2 flood recovery for a given area and evaluate the approximate IRR and influence of uncertainty on IRR.

Many Kansas independent operators consider a 20% IRR, adjusted for risk, appropriate for a new prospect. To obtain a 20% IRR, a lease exhibiting the base-case conditions, shown in the box, must produce 2,100 net bbl of oil/acre. If the oil price is $25 or $15/bbl, respectively, then recovery may decrease to 1,400 net bbl of oil/acre or must increase to 4,700 net bbl of oil/acre to maintain a 20% IRR.

Figs. 3b-3d also show the probable upper limit for L-KC oil recovery, based on L-KC reservoir properties, and the approximate lower limit possible below which economic recovery is unlikely under base-case conditions.

At a $20/bbl or greater oil price, many L-KC leases should be able to be CO2 flooded economically. At $15/bbl few L-KC reservoirs on the Central Kansas uplift can be successfully CO2 flooded, due principally to the oil recovery required for a viable economic outcome (4,700 net bbl of oil/ acre).

In the base case, the cost of new CO2 is $1.00/Mcf and total CO2 costs/net bbl of oil is $7.56. At $0.75/Mcf CO2, the total CO2 costs/net bbl is $5.82 and the oil price required for a 20% IRR is $17/bbl.

Fig. 4 shows the relationship between CO2 cost and oil price required for a 20% IRR.

Pilot project

Operators need a demonstration of the effectiveness of CO2 in a miscible pilot flood in central Kansas before substantial capital investment for CO2 pipeline construction and CO2 purchase commitments can be made.

The Hall-Gurney pilot project, a pilot funded under the DOE Reservoir Class Revisit Program (OGJ, Oct. 11, 1999, p. 38), is about 220 miles from the closest CO2 pipeline, which terminates in the Oklahoma panhandle.

Besides DOE, partners in the $5.4 million project include the University of Kansas Center for Research Inc., Lawrence, Kan.; MV Energy LLC, Wichita, Kan.; Kinder-Morgan CO2 Co. LP, Houston; and the State of Kansas.

During 2000, the plan includes reservoir characterization, numerical simulation, and drilling and coring of the main CO2-injector well for a 40-acre, six-spot pilot project. In 2001, plans include the start of injection of about 800 MMcf of CO2 at 1,300 psi. Injection is expected to last 4 years.

Present estimates indicate that 93,000 bbl of oil could be recovered from the waterflood depleted L-KC C zone.

Acknowledgments

Much of the work discussed in this article is part of a CO2 EOR feasibility study funded by the Kansas Technology Enterprise Corp., Shell CO2 Co. Ltd. (now Kinder-Morgan CO2 Co. LP), and the University of Kansas Center for Research Inc.

The Authors

Martin K. Dubois is a research geologist for the Kansas Geological Survey, Lawrence, Kan. He is a member of the technical team responsible for the DOE-funded CO2 demonstration project in central Kansas. Dubois received a BS in geophysics from Kansas State University an MS in geology from the University of Kansas.

Alan P. Byrnes is a research geologist-petrophysicist for the Kansas Geological Survey, Lawrence, Kan. He is responsible for comanagement of the CO2 demonstration project, coordination of reservoir characterization, and reservoir properties analysis. Byrnes received a BS in geology from the University of Illinois at Chicago and an MS in geophysical sciences from the University of Chicago.

Richard E. Pancake is an EOR engineer for the Tertiary Oil Recovery Project (TORP) at the University of Kansas. He is a member of the technical team that is responsible for the DOE funded CO2-demonstration project in central Kansas. Pancake received a BS in petroleum engineering and an MS in environmental engineering, both from the University of Kansas.

G. Paul Willhite is codirector of the Tertiary Oil Recovery Project at the University of Kansas where he is a professor of chemical and petroleum engineering. He is responsible for the reservoir engineering in the project and coordination of engineering. Willhite holds a BS from Iowa State University and a PhD from Northwestern University, both in chemical engineering.

Lanny G. Schoeling is senior staff reservoir engineer for Kinder-Morgan CO2 Co. LP, Houston. He is responsible for simulation and evaluation of potential CO2 candidates throughout the US. He is Kinder-Morgan's representative on the DOE-funded CO2 demonstration project team. Schoeling holds a Doctorate of Engineering, an MS in chemical engineering, and a BS in chemistry from the University of Kansas.