OGJ Newsletter

Market Movement

Offshore drilling improving but still lags

Offshore drilling activity is improving but still depressed vs. recent years.

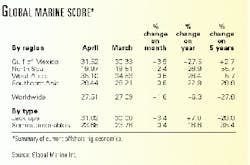

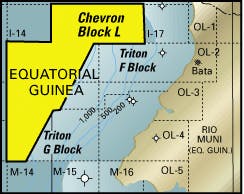

Global Marine's worldwide summary of current offshore rig economics (SCORE) was up 1.6% for April to 27.5% vs. the 27.1% recorded for March. The level of drilling rig activity is still down vs. years past, however. The April SCORE is down 6.3% from April 1999 and 27.8% vs. 5 years ago. Still, the rise reflects continued improvement in all major markets, said Global Marine CEO Bob Rose.

The SCORE system compares profitability of current mobile offshore drilling rig rates with that of the 1980-81 peak of the offshore drilling cycle.

Strong US natural gas prices and low gas storage levels should keep upward pressure on the level of drilling activity in the Gulf of Mexico, where 35% of the world's competitive offshore rigs are located, said Rose. Drilling activity in both the gulf and the North Sea rose in April vs. March, but only Gulf of Mexico activity is up vs. this time a year ago and 5 years ago (see table).

Gas markets to get tighter still

Already high US natural gas prices are expected to rise further as a result of a continued tightening in supplies.

Salomon Smith Barney has raised its full-year 2000 price forecast for US natural gas to $3.25/MMbtu from $2.78/MMbtu, as cash prices begin reacting to the "dire outlook" for gas deliverability in North America sooner than expected. And a Lehman Bros. official told IPAA that tighter supplies will push US gas prices to about $3.50/Mcf this winter.

The composite spot price for gas has averaged $2.15/MMbtu every year of the 1990s, but that has changed this year, says Salomon Smith Barney. The composite spot price is currently averaging over $3.50/MMbtu. And prices will likely keep rising, with gas demand expected to increase, especially from new power plants. In addition, gas deliverability will be off by an estimated 1 bcfd this summer vs. last.

Additional gas supplies from Canada can't be counted on either, says Salomon Smith Barney, because Canada's fundamentals and storage outlook are similar to those in the US. Adding to the concern over supplies are forecasts of a likely heavy hurricane season in the Gulf of Mexico this summer. Meanwhile, Lehman Bros.' Richard Gross predicts US gas prices will average $3.50/Mcf this winter, $3.48/Mcf in first quarter 2001, and $3.22, $3.17, and $2.90 in the subsequent respective quarters. He warns that, if prices top $4/Mcf, utilities would cancel plans for gas-fired power plants and burn coal instead.

Gross thinks higher prices will result in 800 active gas drilling rigs by 2003-04, double the level of 1994-95: "Lining up the prospects will be a tougher challenge than getting the crews and equipment."

Better oil price data ahead?

US Energy Sec. Bill Richardson says DOE will convene a conference this summer to explore how the US could improve the accuracy of world oil pricing data. Richardson says DOE needs data "that we can more effectively rely on."

EIA collects US oil market data for the government, and IEA collects some world data, but DOE desires a more comprehensive data set. An EIA official says the July meeting in Madrid would seek to improve international market data, especially better data on global crude and product stocks.

Yergin: US gasoline prices a bargain

US gasoline prices are not likely to remain high, even though prices this summer won't be the bargain they were the last two summers, says Cambridge Energy Research Associates Chairman Daniel Yergin. He told a House commerce subcommittee that rising oil prices, low gasoline stocks, strong summer driving season demand, and environmentally driven gasoline specifications are keeping pressure on pump prices.

"If the 20-year trend of falling real prices for gasoline continues-and we think it will-we don't expect these current price levels to stick. Changes in some of these factors could relieve some of the price pressure we're now seeing."

Adjusted for inflation, says CERA, US gasoline prices have dropped from a high of about $2.50/gal in 1980 to $1.16 last year. The cost per mile dropped from 17¢ to 6¢, after adjusting for inflation.

CERA says gasoline is a bargain vs. other liquid products that cost less to make: about 50% of milk's price, 40% of bottled water's, 14% of fast-food coffee's, and 8% of mouthwash's.

null

null

null

Industry Trends

ENERGY ANALYSTS ARE CONCERNED about rapidly depleting oil and gas reserves in the face of rising demand, while explorationists remain confident that new technology will continue to lower costs and find new reserves.

At a recent conference in Houston, ExxonMobil's chief geoscientist, Arthur Green, noted that new computerized exploration technology, coupled with previously military satellites, is uncovering new prospective petroleum basins on land and under water "that haven't even been named yet."

However, the last three "supergiant" field discoveries were in 1967, 1968, and 1976-well before today's technology and the biggest drilling boom ever in 1979-81, notes Matthew Simmons, president of Simmons & Co. He claims new technology also has a "dark side," in that it produces and depletes the new, smaller reservoirs faster than in the past-a view disputed by some geoscientists.

"Historically, all global forecasts of resource-constrained oil production declines have turned out to be wrong," said John H. Lichtblau. However, he acknowledged, "The concept [that] a nonrenewable resource, produced in ever-increasing quantities, will at some point reach a production ceiling cannot be dismissed." He predicts US dependence on oil imports-now about 55%, up from 44% just 5 years ago-"could well be 60% and rising" by 2005.

In the interim, Iraq may prove to be the crucial OPEC swing producer if a hostile Saddam Hussein decides to opt out of the UN oil-for-aid deal during "the tightest, most dangerous oil market we've ever been in," said Amy Jaffe, Baker Institute analyst.

AMID RISING OIL SUPPLY SECURITY CONCERNS, a Charles River Associates study finds that converting northeastern US heating oil consumers to natural gas could raise their energy costs. The Independent Fuel Terminal Operators Association commissioned the study. The Clinton administration, responding to higher heating oil prices last winter, ordered DOE to study methods to facilitate conversions from distillate to natural gas. A new energy bill also has proposed setting up a heating oil reserve in the US Northeast (OGJ, May 22, 2000, p. 26)

The study finds that the cost of such conversions would far exceed any potential benefit DOE is trying to achieve, CRA says: "Of prime importance is the fact that, for the past 10 years, households on heating oil have paid an average of $108/year less than if they had used natural gas. This trend is expected to continue."

AUTOMOTIVE FUEL CELLS will have a market share of nearly 4% in the US by 2010, at which time an estimated 608,000 fuel-cell vehicles will be on US roads. This is the conclusion of a new study by Allied Business Intelligence Inc., Oyster Bay, NY.

Fuel cells will power tens of thousands of vehicles by 2003-04. And market penetration could rise as high as 1,215,000 vehicles, or 7.6% of the total US auto market, says ABI.

"Fuel cell technology is so appealing that it will have an enormous impact across all energy marketsellipse," ABI said. "We will see dramatic changes sooner than most people think, and that will lead to early mass commercialization."

One of the major issues with automotive fuel cells is not the status of the technology, says ABI, but rather bringing down the costs with real manufacturing capacity, which no manufacturer has yet.

The firm predicts that mass production will be reached by the end of the decade, however, at which time "fuel cells will become fully price-competitive with internal combustion engines."

Government Developments

EPA HAS THE US TRANSPORTATION FUELS SECTOR squarely in its sights.

The agency last week officially proposed to eliminate virtually all sulfur from US diesel fuel-a program industry officials warn is impossible to implement by the 2006 deadline. That long-debated proposal "ellipsesets a nationwide standard that the refining industry cannot meet, for a new product that the fuel distribution system cannot provide, at a cost that American consumers cannot afford, creating a burden that the US economy cannot sustain," said Urvan Sternfels, NPRA president.

EPA's proposed rule, to be implemented this year, would require a 97% cut in diesel sulfur to a maximum 15 ppm from the current 340-500 ppm. It also imposes stricter emissions standards on diesel engines and heavy-duty diesel vehicles, thus taking a "systems" approach to reducing diesel emissions, vs. a fuel-only approach. EPA estimates the rule will increase diesel fuel prices by 3-4¢/gal and heavy-duty vehicle costs by $1,000-1,600/vehicle.

Hearings on the proposal are slated in New York, Chicago, Atlanta, Denver, and Los Angeles. NPRA officials charge EPA is carefully avoiding areas where US refining capacity is concentrated.

The pending EPA regulation also requires vehicle manufacturers to reduce emissions of soot, NOx, and nonmethane hydrocarbons from diesel truck and bus engines starting in 2007.

MEANWHILE, ANOTHER EPA RULE will get scrutinized at the highest judicial level.

The US Supreme Court has agreed to review an appeals court's decision that EPA exceeded its authority in 1997 when it issued controversial smog and soot standards. The high court will hear arguments and issue an opinion during its term that begins in October. Oil industry groups had joined the American Trucking Association in the lawsuit against the EPA rule (OGJ, May 24, 1999, p. 39). The regulation affects refineries as well as other oil industry operations. Business groups complained the rules would cost companies more than $45 billion for compliance.

The DC Court of Appeals ruled last year that EPA had failed to show that public health protection considerations justified the tougher rules and that the agency was assuming regulatory powers that Congress could not constitutionally delegate. The US Department of Justice appealed that ruling.

A POSSIBLE TIFF OVER PERSIAN GULF DRILLING between neighbors in the region has been averted.

Kuwait has welcomed a decision by Iran to stop drilling in a giant gas-condensate field in an area claimed by three countries. Saudi Arabia, Kuwait, and Iran have long sought a tripartite accord covering the area. Iran estimates reserves in Dorra gas field, in the disputed area, at 5 billion boe of gas and condensate. A few months ago, Iran began drilling in the offshore Partitioned Neutral Zone between Saudi Arabia and Kuwait (see map).

For its part, Kuwait recently signed a contract with Royal Dutch/Shell to conduct seismic surveys in its offshore area. Kuwaiti Oil Minister Sheikh Saud Nasser al-Sabah says he values Tehran's decision to stop drilling and described it as reflecting the depth of good relations between Kuwait and Iran.

Iran said it "welcomes Kuwait's readiness to hold talks with Tehran to demarcate boundaries of the continental shelf" between the two nations.

Quick Takes

DEEPWATER EXPLORATION doesn't get any hotter than it is now off West Africa.

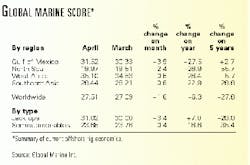

Chevron inked a 5-year, 100% PSC with Equatorial Guinea to explore the 4,250 sq km Block L in up to 2,000 m off water in the Rio Muni basin. Chevron has plans for one firm well and one contingency well and expects to spend a total of $15-20 million for drilling and seismic work under the initial exploration term. The acreage is on trend with Triton's La Ceiba strike. Chevron drilled Equatorial Guinea's first offshore well, in 1968, on the shelf in 75 m of water. It TD'd at 3,812 m in Mesozoic, where it confirmed reservoir-quality sands and found source rock. Chevron plugged the dry hole with minor shows.

Elsewhere off West Africa, BP Amoco has a third strike on the prolific Block 18 off Angola. On test, Galio-1 flowed 4,770 b/d of 34° gravity crude. Galio-1 was drilled 185 km in 1,238 m of water. Block operator BP Amoco said work to evaluate the accumulation is continuing. The previous two finds were made in 1999. Platina, drilled in 1,400 m of water, flowed 6,500 b/d of oil on test. Plutonio, drilled in 1,362 m of water, flowed 5,700 b/d of oil. TotalFinaElf reports a new deepwater discovery on Mer Trés Profonde Sud permit, 200 km southwest of Pointe Noire, Congo. Androm?de Marine-1 was drilled in 1,893 m of water, a water-depth record for Congo, says TotalFinaElf. The well cut nearly 250 m of net pay in several oil-bearing zones. On test, Androm?de Marine-1 flowed 7,000 b/d of "high-grade" oil, says TotalFinaElf. The permit was awarded in 1997 and covers more than 5,000 sq km in 1,500-3,000 m of water. TotalFinaElf holds 40% with partners Agip and ExxonMobil 30% each.

And the deepwater frenzy continues in the Gulf of Mexico as well.

Texaco and Agip have an oil discovery in the deepwater gulf with their Champlain No. 1 well. Texaco says initial results indicate the presence of high-quality reservoir sands with a total net pay of 140 ft. Champlain No. 1, drilled in 4,385 ft of water on Atwater Valley Block 63, reached 23,540 ft TD on Mar. 21. A sidetrack reached 24,989 ft TD on May 4, confirming lateral extent of the pay sands. Operator Texaco holds a 75% interest in Atwater Valley 63 and in adjacent Block 64, with Agip holding 25% in both. Texaco plans to drill five more deepwater wildcats this year. F Agip, in turn, has agreed to acquire farmouts on as many as 259 deepwater blocks held by ExxonMobil in the Gulf of Mexico. Agip can earn 25% of ExxonMobil's interest in the blocks by participating in drilling at least 12 exploration wells over the next 5 years. The agreement covers about 1.3 million net acres and, says Agip CEO Luciano Sgubini, "is the largest of its kind to date to be announced in the Gulf of Mexico's deep offshore." ExxonMobil owns 100% interest in about two thirds of the blocks and 50% interest in the remainder.

DEEPWATER GULF PRODUCTION alternatives are getting a closer look as well.

MMS plans a workshop June 7-8 in Houston to examine the successful use of FPSOs in other countries as a possible prelude to allowing their use in developing deepwater oil reserves in the Gulf of Mexico. The goal is to identify successful practices, as well as operational and regulatory issues, in the use of such vessels to produce and store crude oil in waters beyond existing offshore pipeline infrastructure. MMS also wants to identify "mitigation measures or technology needs" to address any safety concerns. It's part of an investigation promised by MMS Director Walt Rosenbusch during OTC. MMS won't establish a policy on the use of FPSO vessels in the gulf until it has more information on which to base its decision, he said. But he also warns that MMS won't permit prolonged flaring of natural gas in the gulf, including gas associated with oil produced by an FPSO. Nor will the agency allow associated gas to be reinjected, without guarantees that it eventually will be developed and produced.

Rosenbusch also is coping with requests by US producer groups to delay the June 1 implementation of its controversial oil royalty reform rule.

MMS issued the rule, 3 years in the making, on Mar. 15. IPAA and API subsequently sued to overturn the rule, but both say it would be tough to persuade a federal judge to issue an injunction to prevent the rule from taking effect.

Separately, IPAA says it is working with MMS to facilitate the federal government's taking of oil royalties in kind rather than in cash.

Burlington Resources' David Blackmon says IPAA is discussing with MMS what legislation the agency needs in its "tool kit" to simplify the bidding process, allow greater state participation, and achieve other goals. "It looks like we can mark up something that we and MMS can both live with," he said.

Back on the deepwater track, Petrobras has started up its latest deepwater platform in Brazil's Campos basin, the third of the world's major deepwater producing areas. The P-36 semisubmersible drilling-production platform produced first oil May 16 as the first permanent production system in 3 billion-bbl Roncador field, which lies in 1,500-2,000 m of water. Initial flow is 14,800 b/d, and a three-phase, $2 billion capital program will hike that to 180,000 b/d of oil and 245 MMcfd of gas. xMeantime, Petrobras is dissatisfied with progress on construction of the P-40 oil drilling-production platform semi, said Petrobras Pres. Henri Phillipe Reichstul. The platform is destined for Marlim Sul field, also in the Campos basin. Brazilian shipbuilder Maritima is responsible for constructing P-40 in Singapore under contract for Petrobras. Maritima Pres. German Efromovich says the platform will be handed over on schedule. Maritima and Petrobras are already locked in a legal dispute over the completion of two other Ametista-class drilling-production platform semis, and there were disputes over the completion of the P-36 platform at the end of last year.

THE TRANSPORTATION AND DISTRIBUTION portion of Peru's Camisea natural gas megaproject will finally see its tender take place June 22.

The tender will involve construction and operation of processing plants and pipeline facilities for the transport and distribution of natural gas and liquids from the Camisea fields, 310 miles east of Lima. The pipeline will transport Camisea gas across the Andes to Cañete or Pisco on Peru's southern coast. The first stage of the project, which involves development of the Camisea gas fields, was won Feb. 16 by a consortium led by Argentina's Pluspetrol. Estimated required investment in the transport-distribution concession is $1 billion over the life of the project.

In other midstream news, Vastar and Newfield selected units of Williams to gather, process, and transport about 75 MMcfd of natural gas from wells in Mobile Bay off Alabama. The agreements call for the Williams affiliates to gather gas produced from the Main Pass Block 264 in the Gulf of Mexico. The gas will be transported for processing at Williams's 600 MMcfd plant in Coden, Ala. Vastar and Newfield are jointly developing reserves in Mobile Bay area, where Williams recently added 350 MMcfd of transportation capacity and the Coden plant. Williams is in the process of connecting the Vastar-Newfield production facility to its gathering lines and expects to begin receiving initial volumes by the end of May. x TETCO has begun an open season, for the natural gas pipeline capacity it recently leased from Natural Gas Pipeline Co. of America in a reciprocal deal aimed at optimizing gas shipments for the two companies (OGJ, Apr. 24, 2000, p. 34). TETCO calls its program Enhanced Spectrum, while NGPL calls its HubAmerica. Enhanced Spectrum is a "low-cost alternative to new pipeline construction" for the transport of gas from Chicago to the US East Coast. TETCO's open season will end June 15. Service under Enhanced Spectrum will be available beginning Nov. 1 to coincide with the start-up of the Alliance pipeline project. F Dubai-based engineering and construction firm Dodsal has bagged a 3.5 billion rupee ($80.5 million) project to lay a high-pressure natural gas pipeline between Hazira and Dahej in India's Gujarat state. The 15-year BOOT contract is being fully financed by Industrial Credit & Investment Corp. of India. The pipeline, to be completed in 24 months, will carry gas from Oil & Natural Gas Corp.'s Hazira terminal to the Dahej facilities of Indian Petrochemicals Corp. This is the second pipeline system to be set up on the BOOT model in India. The first, built by Dodsal in 1997, transports ethylene, propylene, and naphtha between Dahej and Baroda. F Florida Gas Transmission started laying a new pipeline from Tampa to Fort Myers as part of its Phase IV expansion, which will extend its 4,700-mile transmission system by 139 miles. With an expected in-service date of May 2001, the $268 million project will add more than 38,000 hp of compression and associated facilities and will provide about 197 MMcfd of incremental firm transportation service. Seven shippers have executed 20-year firm commitments for the incremental service, net of turn-back capacity. x Texas Utilities is conducting a feasibility study for a new natural gas pipeline from Victoria to South Australia. The plan, if implemented, would end Santos' gas supply monopoly in South Australia. x Sonat filed with FERC to expand capacity on its natural gas pipeline system by 335.9 MMcfd. The South System Expansion is supported by 15-year firm transportation agreements, mainly to supply power plants, with Southern Co., South Carolina Pipeline, and LaGrange, Ga. Estimated to cost $147 million, the project includes 73 miles of pipeline loop and more than 34,000 hp of mainline compression. Service is to begin in June 2002. x Williams's gas pipeline division and Duke Energy selected Alliance Engineering to conduct detailed engineering and design of two compressor station facilities for the Buccaneer Pipeline project. Alliance will work on Buccaneer compressor station No. 1 in Mobile County, Ala., and the Anclote liquids collection facility in Pasco County, Fla. Williams and Duke are jointly financing and constructing Buccaneer, which is to start up by early 2002.

PLANS TO DOUBLE LNG PRODUCTION from the Woodside Petroleum-led North West Shelf project have intensified over the last 6 months, Chris Haynes, chief executive of the NWS JV, told the APPEA conference in Brisbane.

Haynes says negotiations with prospective Japanese buyers have "solidified," and the group is much more confident of a successful outcome than this time last year.

The JV has set itself a target of mid-2004 for delivery of an additional 3.6-4.0 million tonnes/year of LNG to Japan, taking the total shelf production to around 11 million tonnes/year. However, to meet this timetable-which includes the addition of a $3 billion (Aus.), single-train expansion of the liquefaction plant on Burrup Peninsula in Western Australia-there will need to be signed letters of intent with Japanese customers by midyear. Firm sales agreements will then need to be secured by the end of 2000.

Woodside has already ex-tended the deadlines for the project ex- pansion several times following deregulation of the Japanese power industry and lingering ef- fects of the Asian economic meltdown that prompted Japanese buyers to stall their commitments to take further LNG supplies. Initially the expansion was for two trains. Now the plan is for a staged train-by-train approach.

Haynes said Woodside had also become more innovative in its designs and had cut 20% from the design costs of the project.

Australia also commands the other gas processing news of note this week. Perth-based Wesfarmers Energy will spend $20 million (Aus.) to expand its LPG plant at Kwinana, Australia, by as much as 25%. The 60,000 tonne/year expansion would boost the plant's capacity to 300,000 tonnes/year. The plant extracts LPG from NWS natural gas brought in via the Bunbury trunkline. The expansion includes a new 5-year gas supply contract with AlintaGas to supplement the existing supply contract between the firms and an associated transport agreement with Epic Energy, which paid Western Australia $2.4 billion (Aus.) for the Bunbury trunkline 2 years ago. Clough Engineering has the engineering contract for the expansion, due on stream in January 2001.

In other processing news, Shell Chemicals let contract to Foster Wheeler for basic design and engineering of a debottlenecking of its Stanlow olefins plant at South Wirral, UK. The project will be executed under FW's existing alliance contract with Shell, which has been extended for an additional 3-year period. F BASF Sonatrach PropanChem let a turnkey contract to Lurgi for detailed engineering, procurement, and construction of a propane dehydrogenation plant, to be built at Tarragona, Spain. The JV licensed UOP's Oleflex process for the plant. UOP says the unit will produce 350,000 tonnes/year of polymer-grade propylene starting in early 2002. Sonatrach will supply the propane feedstock from Algeria; propylene will be used by BASF subsidiary Targor. F Portugal's Petrogal awarded two contracts to Technip to revamp three hydrodesulfurization units: two at its Sines refinery and one at its Porto refinery. The projects are aimed at producing gas oil that meets pending European Union sulfur standards. Total investment for the projects will be about 20 million euros. Technip is responsible for basic and detailed engineering, procurement, construction supervision, and start-up assistance. Work on the Porto unit, which will include installation of a new reactor, is due for completion in 13 months. Work on the Sines units-increasing capacity to 37,000 b/sd from 34,000 b/sd and installing new reactors, compressors, and heat exchangers-is to be completed in 16 months.