Steady growth forecast for US gas-to-liquids products

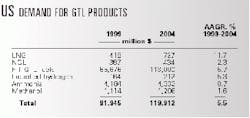

Total production of gas-to-liquids (GTL) products in the US was estimated at a value of $92 billion last year and is expected to reach nearly $120 billion by 2004, says Business Communications Co. Inc. (BCC).

That works out to a growth rate of 5.5%/year, notes the Norwalk, Conn., research analysts.

Much of this growth, says BCC, is due to recent advances in GTL technology. The Fischer-Tropsch (F-T) reaction pathway-the main element used in GTL production-has undergone several significant improvements. Among those advances are those for reactor design; product recovery; and in the production of synthesis gas, which has enabled the economic use of natural gas feedstocks.

"Therefore, the use of GTL for chemicals and energy production is envisaged to make a rapid advance in the next few years," says BCC, "as even more stringent environmental legislation is enforced."

Product breakout

The largest demand base for GTL is represented by F-T GTL fuels (see table). This category accounted for 93% of overall GTL demand in 1999, says BCC. "This market will continue to dominate the total market as new environmental legislation for clean transportation fuels come in forceellipsethereby growing at an AAGR (average annual growth rate) of 5.7% during the forecast period and hence reaching $113 billion in 2004," BCC said.

LNG leads GTL products with an AAGR of 11.7% over the forecast period, says BCC. NGL also will show an increase in demand growth, growing at an AAGR of 2.3% during 1999-2004, as gas processing volumes grow.

Demand for ammonia (NH3), meanwhile, will moderate and grow at an AAGR of 0.7% over the next 5 years after posting a 1.8% AAGR during 1996-99, says BCC. "Russia and China now have cheaper NH3-producing facilities. This will depress NH3 prices and thus slow income growth," the firm said.

Facing an AAGR slowing from 4.3% during 1996-99 to a 1.6% from 1999 through 2004, methanol is facing a growing surplus in the US, BCC notes. Demand for methanol is expected to slump with growing pressure for phase-out of methyl tertiary butyl ether in the US as a result of environmental concerns. Methanol is the principal feedstock for MTBE.

For the smallest-and nonfossil-fuel-derived-GTL product, BCC expects demand for liquefied hydrogen (LH2) to rise from a value of $164 million in 1999 to $212 million in 2004. The bulk of this demand will come from the National Aeronautics and Space Administration, which will continue to consume sizable quantities of LH2 in its ramped-up plans to construct the international space station.