OGJ Newsletter

Market Movement

Global refining sector in recovery

The global refining sector has staged a remarkable recovery this year after touching bottom a year ago.

And all signs are that a sustained recovery is in the offing for long-beleaguered refiners.

From an operations standpoint there are still some specters looming on the regulatory front, but those very hazards could, in fact, later tighten markets and thus bolster margins for the survivors

While Europe and Asia have lagged the US, refining sectors there are beginning to evince signs of a turnaround as well. It helps them that the US refining market remains strong, because the US is a net importer of refined products. And US imports are likely to continue to rise, because product de- mand growth is expected to outstrip the rate of capacity creep in the US-the latter certain to be slowed by the blizzard of new environmental strictures emanating from the Clinton administration.

US refining margins rebound

After plummeting to a 15-year low last year, US refining margins have managed a dramatic comeback.

Last year's lows were the result of product price hikes failing to keep pace with the spike in crude oil prices. It certainly didn't help that Asian refining capacity additions continued or that a European overcapacity situation persisted.

But a rebound started early this year with the jump in heating oil prices at the start of the year; a gradually tightening market in Europe, which pulled more product there; and a big bounce in US West Coast refining margins owing to a slide in imports as Asian refiners slashed runs.

In the US, first quarter refining margins were about two-thirds higher than in 1999. With crude prices still not back to their earlier stratospheric highs and low product inventories expected to persist, it is likely that robust margins will continue well in 2001.

While US refiners are scrambling to get more product out before the driving season, the already low stock levels suggest product balances will remain tight throughout the season. It is likely that this will be aggravated by the need to build heating oil stocks late in the year. While normally distillate demand is not a big factor in the US compared with gasoline demand during the summer, there is a big pull on the global distillate market because of the spike in demand for diesel in Europe, where it is a more important transportation fuel.

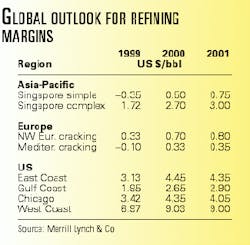

This helps set the stage for refining margins to stay close to historical average margins this year and next, when seen from a long-term standpoint (see table).

European turnaround

The turnaround in European refining margins stems from several factors that have brought European refined products stocks to the bottom of their 5-year average range. European margins temporarily rallied at the end of 1999 with the huge drawdown in stocks, but subsequent weakness in demand, owing in large part to the warm winter weather, reined product price increases to where they lagged the runup in crude oil prices.

But March proved to be the turnaround month, as a surge in gasoline demand led European refiners to run their stills at full throttle, delaying its maintenance turnaround period. As European refineries go into turnaround, that exacerbates the situation of low stock levels in the Atlantic basin and cuts the level of products exports to the US. Merrill Lynch estimates as much as 10% of European refining capacity will be off-line in the spring.

Also contributing to European margin strength is a continuing shortfall in diesel supply, which Merrill Lynch estimates currently at 100,000 b/d.

Asia-Pacific revival

The rebound in the Asia-Pacific market has been even more dramatic. According to Merrill Lynch, the Singapore simple refining margin increased from a sizable deficit of -$0.70/bbl to a hefty $3.44/bbl during the weeks ended Feb. 11 to Mar. 10. Complex margins fared even better.

Contributing factors to this improved outlook are the huge upsurge in US West Coast refining margins, cuts in refinery runs, a build-up in stocks as maintenance turnaround season begins, a regional shortfall of fuel oil owing to a steep reduction in fuel oil output as more Asia-Pacific capacity gets upgraded, and the revival in demand owing to economic recovery coupled with a slowdown in capacity build-up owing to the preceding economic slump.

Because some of these factors are temporary, it is likely downward pressure on product prices will return. But with the likelihood that crude oil prices won't spike again, margins are likely to continue to remain healthy, if not quite at the lofty levels of March. F

null

null

null

Industry Trends

THE INAPTLY NAMED LOVE BUG computer virus that crippled millions of PCs and networks worldwide last week underscores a warning about e-security issued at the Offshore Technology Conference earlier this month (see story, p. 22, and OGJ, May 8, 2000, Newsletter pp. 7-9).

A public-private partnership would be the key step in limiting risks associated with the security of critical infrastructure in the energy sector, an OTC panel concurred. The panel, including US government and industry specialists, outlined the vulnerability, risks, and solutions associated with all aspects of e-commerce, as well as the development and production of energy, company and government infrastructure, and public data.

"Tools are readily available to deliberately disrupt information services," said John Tritak, director of the Critical Infrastructure Assurance Office. "What we see are hackers, who do it simply for kicksellipse; corporate hackers...[who] do it for profits; [and] disgruntled employees, who do it for revenge. The potential for deliberate disruption has risen because of our increasing dependency on critical information infrastructures."

However, the biggest task in the short term may be getting companies-especially in the energy sector-to share information and "best practices" with agencies assigned to combat cyber-terrorism, says Paula Scalingi, director of US DOE's Office of Critical Infrastructure. She contends energy businesses should be aware that cyber-terrorism and the disruption of data delivery in other industries inevitably affect all e-business. These "infrastructure interdependencies" require energy firms to be aware of the need for vulnerability and risk assessments and real-time control mechanism technologies, Scalingi said.

COLOR major oil companies a bit greener this week.

Texaco is taking an important step into the field of environmentally friendly energy sources by purchasing a 20% stake in Energy Conversion Devices Inc. for $67.3 million. The firms will work together to develop and market ECD's solid-hydrogen storage and regenerative fuel-cell technologies. Both companies also agreed to establish JVs for continued development and commercialization of ECD's proprietary Ovonic solid-hydrogen storage and regenerative fuel cell technologies. Such technology could be the catalyst to commercializing cost-effective electric-powered vehicles, the firms say. Meanwhile, BP Amoco is buying an 18.5% share in GreenMountain.com, an energy consumer marketer, for an undisclosed amount. It hopes that by using big-company muscle in conjunction with GreenMountain, which concentrates on "green" energy products, it can extend the market for competitively priced renewable energy for end users in businesses and households across the US. The move is also aimed at boosting sales of clean energy products such as natural gas. GreenMountain, already a leading brand marketer of cleaner electricity to consumers in California, Pennsylvania, and New Jersey, sells through the internet and other media solar, wind, water, or geothermal power as well as gas. BP Amoco will also market and promote GreenMountain's solar energy offerings using BP Solarex's solar technology, products, and services.

THE OIL AND GAS SECTOR OUTLOOK remains bullish, nonetheless. US Department of Commerce says the oil and gas field machinery sector will be one of the fastest-growing areas of the US economy this year. DOC says oil machinery shipments will jump 9.1% in 2000, rebounding from a 28% drop caused by the 1998-99 oil price collapse. Exports are expected to recover 10%. It predicts average growth of 3%/year for the sector in 2000-05. That's against a backdrop of a bullish economy. DOC says more than 75% of US manufacturing industries and all major service sectors are expected to grow in 2000 and beyond.

Government Developments

MEXICO'S ENERGY SECRETARIAT plans to announce soon a new scheme to inject much-needed capital into the country's state-run petrochemical plants.

The Zedillo administration had intended to privatize the plants entirely under an earlier plan, but was hamstrung by Congress. A subsequent, much-criticized scheme to sell off only 49% of the control of the Morelos plant flopped in February 1999 due to lack of interest by foreign companies (OGJ, Mar. 1, 1999, Newsletter).

Still to be seen are any changes in the new plan, which will still be limited to a 49% stake but offer tax breaks and other incentives to lure investment of about $300 million per plant, mainly to hike ethylene output. If this plan also fails, then any new investment will have to wait until after the new government takes office in late 2000.

THE NEW VOICE OF US OIL STATES urges the feds to cede more regulatory power to the states on green issues.

New IOGCC Chairman and Alaska Gov. Tony Knowles has praised efforts by Sen. Bob Smith (R-NH) to give states more regulatory power on environmental policy and by Sen. Max Baucus (D-Mont.) for raising awareness on federal oversight. Smith believes states hold the key to solving the next century's environmental issues and that providing states flexibility to identify their own priorities and develop their own programs is essential to improving environmental protection. Baucus says federal lawmakers don't want EPA to micromanage but instead emphasize real environmental performance vs. "bean counting."

"It is encouraging that Sen. Smith and Sen. Baucus recognize successful environmental policy is not a 'one-size-fits-all' set of guidelines," Knowles said. He also encourages comparing state governments' environmental protection successes with the EPA's.

AND ANOTHER ALASKAN POLITICIAN weighs in on the heavy-handedness of federal regulators.

US Sen. Frank Murkowski (R-Alas.) recently blasted FERC for not approving the Independence natural gas pipeline project. The proposed 36-in., 1.01 bcfd line would extend 400 miles from Defiance, Ohio, to Leidy, Pa. FERC ruled in December that Williams, Coastal, and National Fuel Gas had failed to show need for the $677 million pipeline to move gas from Canada and the Midwest to the Northeast US. Last week, FERC told sponsors of the pipeline their application would be rejected unless they show within 60 days long-term supply contracts for 35% of the line's capacity.

Murkowski, chairman of the Senate energy and natural resources committee, demanded of FERC commissioners, "I will want an explanation from each of you as to why you are not doing everything you can to get this pipeline built as fast and as cheaply as possible." Noting a recent spike in US Northeast heating oil prices, he added, "[FERC]'s actions in theellipsecase seem to indicate that you really don't want this pipeline built."

Quick Takes

AN OWNER OF ARCO'S ALASKA ASSETS just a few weeks, and Phillips already has the pleasure of announcing a sizable North Slope discovery.

Granted, ARCO drilled the discovery well with partner-and new owner-BP Amoco, but Phillips gets to book the strike to its account after agreeing to buy ARCO's Alaskan assets as part of a deal to assuage the FTC over the BP Amoco-ARCO merger. The find could hold as much as 50 million bbl of oil and is within striking distance of the Alpine development and the Kuparuk River field infrastructure (see map). The Meltwater North No. 1 flowed 4,000 b/d of 37° gravity oil, and a step-out and sidetrack confirmed the northern portion of the reservoir.x In other exploration news, Conoco, Petrovietnam, and Korean National Oil Corp. inked a PSC to begin exploration of Block 16-2 near Bach Ho oil field off Viet Nam. Conoco will operate during exploration and form a joint operating company once development begins. It holds a 40% interest in the 1,114 sq mile area, where it will begin a 3D seismic survey by midyear. Conoco also has a stake in producing Rang Dong field and in Block 15-1, both off Viet Nam. x Unocal has two deepwater gas discoveries on its Ganal PSC off East Kalimantan. Its Gula and Gada discoveries could hold as much as 2-3 tcf of gas, but more drilling is needed to firm up those estimates. Unocal says the strikes confirm that the Central Delta play "contains world-class gas resources." It has drilled four consecutive discoveries in the Central Delta play fairway, with several large prospects still undrilled.

VENEZUELA'S RESUSCITATED LNG export project seems to be picking up momentum. Mitsubishi says construction is expected to start next year on the LNG plant proposed for the northern coast of Venezuela. Mitsubishi, Shell, and ExxonMobil signed a memorandum of understanding in April with PDVSA to develop the $2 billion project (OGJ, Apr. 3, 2000, p. 32). Known as the Paria North LNG project, the facility will have a production capacity of 4 million tonnes/year. Production is to begin in 2005. It will use gas from offshore fields north of the Paria Peninsula on Venezuela's East Coast. x LNG action is heating up in the US as well. Tulsa-based Williams plans to buy 100% of partnership interests in Cove Point LNG LP from Columbia Energy Group for $150 million. The partnership owns the largest LNG import terminal in the US, the Cove Point facility at Lusby, Md. Cove Point has a transmission capacity of 1 bcfd. Cove Point's 87-mile system crosses Williams's Transco system but isn't connected to it, so an interconnect is likely. Constructed in the mid-1970s for about $400 million, the Cove Point facility has operated as an LNG peak shaving facility since 1995. Cove Point LNG LP held an open season for a firm LNG tanker discharging service during Feb. 16-Mar. 16. Pending FERC approval, Cove Point LNG plans to begin the LNG discharging service by late 2001 or early 2002. x And Nigeria's LNG complex soon will get gas processing company-an LPG plant Shell Nigeria has planned near the giant LNG complex at Bonny. The country has a persistent shortfall of LPG.

EVEN AS ASIAN REFINING MARGINS are rebounding strongly this spring (see Market Movements, p. 5), throughput there continues to decline, contributing further to refined products market tightness.

Japan's refiners have slated a flurry of maintenance turnarounds: four for Idemitsu Kosan, two for Tonen plants, and two for Japan Energy.

Idemitsu Kosan's Okinawa Sekiyu Seisei affiliate slated a shutdown of its 110,000 b/d crude unit May 9-June 24 due to construction projects at secondary units in its southern Japan refinery; it also will be closed in September for additional work-the third turnaround this year for the plant. The 160,000 b/d crude unit at Idemitsu's Aichi refinery in western Japan was shut down until May 13 for work on secondary units. Idemitsu's 140,000 b/d Hokkaido refinery in northern Japan will be shut down June 12-July 12, and its 120,000 b/d Tokuyama refinery in western Japan will be closed Oct. 3-Nov. 5.

Tonen will idle the 175,000 b/d crude unit at its Kawasaki refinery near Tokyo for regular maintenance May 16-June 16. And its affiliate Kygnus Sekiyu Seisei's 80,000 b/d crude unit will be shut down for regular maintenance sometime in July.

Japan Energy shut down all units at its 100,000 b/d Chita refinery in central Japan on May 6 for a 50-day regular maintenance, with plans for a restart around June 24.

And Japan Energy plans to shut down the 110,000 b/d No. 3 crude unit at its Mizushima refinery in West Japan for a 45-day regular maintenance starting in mid-September. But it will skip a turnaround for its 90,200 b/d No. 2 crude unit at the refinery.

TOPPING PETROCHEMICAL ACTION is Sinopec's start of expansion of its Yangzi Petrochemical naphtha cracker in East China's Jiangsu province. The expansion, begun in late April and slated for completion in third quarter 2002, will raise capacity to 650,000 tonnes/year (t/y) from 400,000 t/y. Included in the project are three other expansions: polypropylene capacity to 360,000 t/y from 200,000 t/y, polyethylene to 350,000 t/y from 160,000 t/y, and butadiene to 200,000 t/y from 100,000 t/y. The 4.4 billion yuan project is being undertaken by units of ABB Lummus and Toyo Engineering. x

Elsewhere on the petrochemical front, Marubeni has withdrawn from a joint project to build a PVC plant in Baria-Vung province, Viet Nam. The remaining partners-Petronas, Petrovietnam, and Tramatsuco-have signed an amended JV accord and awarded a major contract for the plant. Under the new contract, Petrovietnam will hold 50% of Phu My Plastics & Chemicals Co. (PMPC), the JV formed in 1997 to undertake the project. Petrovietnam will hold 43%, and Tramatsuco, an entity controlled by Baria-Vung Tau province, will hold 7%. Previously, Marubeni controlled 30% of the JV. PMPC has awarded the $48.6 million engineering, procurement, construction, and commissioning contract to Samsung Engineering and appointed Petronas subsidiary OGP Technical Services the project management consultant. The plant, to be completed in 2002, will have 100,000 t/y of PVC capacity. VCM feedstock will come from the Petronas JV plant in Malaysia. PVC output will be used to meet domestic demand, displacing imports.

TRANSPORTATION CAPACITY is expanding on the Indian subcontinent.

Indian Oil Corp. has board approval to enter into a JV with India's largest private-sector shipowner, Great Eastern Shipping Co., for LNG transport. IOC went ahead with the JV despite objections of the petroleum ministry, which felt that the company should not stray from its core areas. The decision spells bad news for several other Indian shipowners trying to enter the potentially lucrative field of LNG transportation. Companies such as Essar Shipping and Varun Shipping and even state-owned carrier Shipping Corp. of India were hopeful of a tie-up with IOC, because state-owned IOC is one of four promoters of the national LNG procurement firm, Petronet LNG. IOC automatically becomes a suitor for any of nine foreign bidders that have qualified for the Petronet LNG transportation deal and that will have to form a JV with a domestic firm. Petronet has prequalified nine bidders for moving 5 million tonnes/year of LNG from Qatar's Ras Laffan LNG project for its planned LNG terminals at Dahej and Kochi. x Pakistan has launched a program to develop domestic capacity to import oil. Pakistan National Shipping Corp. (PNSC) has a green light to begin developing an oil tanker fleet. Plans call for it to acquire an tanker every 6 months until an adequate indigenous shipping capacity to import crude oil and refined products is developed to achieve an unspecified reduction in foreign exchange outlays. Pakistan now imports 8-9 million tonnes/year of crude oil.

In other transportation news, Peru and Ecuador are considering a prefeasibility study on connecting an oil pipeline in southeastern Ecuador with one in northwestern Peru. The study is to be financed through the Peru-Canada cooperation program and conducted by Canadian firms Alberta Energy, SNC Lavalin, and Agra Earth & Environmental. The project will determine feasibility of either interconnecting these trunk pipelines or directly linking oil fields near the countries' common border with spurs. Petroperu's 200,000 b/d northwest pipeline is running at a third of its capacity. One option is for Ecuador to use this excess capacity to move oil to Bayovar on Peru's northern coast for shipment to Guayaquil. F

ANOTHER DEEPWATER DEVELOPMENT is under way in the Gulf of Mexico, one that marks the entry of a new player in the gulf's deep water.

El Paso Energy Partners will install a multipurpose tension-leg platform on Ewing Bank Block 958 in the gulf. The Moses TLP, for Prince field development, will be installed in 1,500 ft of water, about 110 miles off Louisiana, and will be capable of handling up to 50,000 b/d of oil and 80 MMcfd of natural gas. Modec International LLC will construct the platform. Delivery is scheduled for April 2001, with first production expected in June 2001. In November 1999, El Paso Energy Partners transferred its interest in Prince to El Paso Production under a farmout. El Paso then announced it would suspend design and engineering work on the platform pending delineation drilling results. El Paso Production recently finished drilling the fourth successful delineation well, which cut more than 200 ft of net hydrocarbon pay. F

In other drilling-production action, BP Amoco and Petrobras let a $59 million contract to Navis ASA to use the Navis Explorer I newbuild ultradeepwater drillship to drill off Brazil and Trinidad in 2,700 m of water. The drilling program should take about 1 year. The drillship has left the Samsung Yard in South Korea for Brazil. x Texaco let a drilling contract to Precision Drilling International to drill in North Buzachi oil field in western Kazakhstan's Mangistau province. PDI will mobilize an automated slant rig, PD 709, in early June after completing rig modifications in Canada to meet contract requirements. The rig will be used to complete Phase 2 of the North Buzachi field appraisal program, requiring the drilling of vertical, directional, and horizontal wells. x BG let a £250,000 contract to UK firm Andrew Palmer & Associates for design of flowlines and associated structures for its Blake field development in the central UK North Sea. Expected to produce 40,000 b/d of crude, Blake is the largest subsea development in the UK oil and gas sector this year. Involved are a 200-tonne manifold and control system, featuring two subsea multiphase flow-measurement units, capable of controlling and connecting eight subsea wells. It will be connected to Talisman Energy's Bleo Holm FPSO, stationed in Ross field. Coflexip Stena Offshore Ltd. is main contractor for the Blake project.

EXPANSION OF PETROLEUM SECTORS in the former Soviet Union continues apace.

Lukoil's board approved a program for expansion of the oil sector in Russia's Timan-Pechora oil and gas province. In all, Lukoil will spend 134.2 billion rubles during 2001-10: 89.4 billion rubles for oil production, 13.5 billion for exploration, 7.1 billion for refining, 1.6 billion for products marketing, 15.8 billion for transportation system development, 4.4 billion for associated gas utilization, and 2.4 billion for social facilities. x The US Trade and Development Agency awarded a $600,000 grant to the Kazakhstan Ministry of Energy, Industry, and Trade for a strategic gas utilization study for the country. The study will examine Kazakh gas reserves, potential domestic uses of gas, and the domestic gas pipeline network. This study, discussed during Pres. Nursultan Nazarbayev's December 1999 meeting with US Vice-Pres. Al Gore, will assist Kazakhstan in planning for future oil and gas production and utilization.

GAS-FIRED POWER SCHEMES are proliferating worldwide, notably in areas where electric power deregulation is under way.

A unit of Calpine, San Jose, Calif., moved into Alberta's deregulated electricity market with plans for a $135 million, 250-Mw cogeneration plant in Calgary. Calpine Natural Gas plans to take a equity interest in Alberta gas reserves to supply the plant. It is also considering an expansion into Ontario and other deregulated markets. Calpine's new Calgary plant, slated for start-up in 2003, will compete with Alberta-based TransAlta, EPCOR, and Atco. Full deregulation of Alberta's power industry will begin Jan. 1, 2001. The Alberta government will hold an internet-based auction this summer to sell most of the province's electrical production for the next 20 years.

Meanwhile, Transalta won a contract to build, own, and operate the Campeche power station in Palizada, Mexico. Mexico's CRE granted an independent power producer (IPP) permit to Transalta Campeche, which will invest $200 million in the project. The 275-Mw, combined-cycle plant will have a natural gas-fired turbine that will use diesel as an alternate fuel; a steam turbine; and an electric generator. It is expected to consume about 13.5 bcf/year of natural gas. The IPP permit is effective for 28 years. The start and completion dates for the plant's construction are set for 2003. x Panda Energy plans to construct a 1,000-Mw power plant near New Florence, Mo. The company will begin building the gas-fired, combined-cycle Montgomery plant in summer 2002, with commercial operation scheduled for late 2003. The Montgomery plant is Panda's 11th power plant project and brings its total amount of electric generation capacity in development in the US to 17 Gw. x Nigerian National Petroleum Corp. and Nigerian Agip have signed an MOU to build and operate a gas-fired power generation plant. Jackson Gaius-Obaseki, NNPC group managing director, says the first phase of the project is estimated to cost $350 million and will contribute an additional 450 Mw of power to the national grid.