Coiled-tubing drilling technologies target niche markets

Coiled-tubing drilling (CTD) has been successfully used by ARCO, BP Amoco PLC, and Petroleum Development Oman (PDO) to access hard-to-reach, overlooked, and depleted reservoirs from existing wellbores.

Much of this work involves sidetrack, slim-hole, underbalanced, and through-tubing applications that provide distinct economic and operational advantages over conventional methods. Yet the industry remains reluctant to use CTD technologies: Only 1,500 CTD wells have been drilled worldwide, excluding sidetracks and extensions.

This first part of an OGJ special on coiled tubing (CT) provides information on current applications and prior developments, shedding light on the various rig types, markets, myths, and problems that may be encountered while working with CTD.

CTD rig markets

According to John Misselbrook, director of global CT services for BJ Services Co. USA, Houston, the CTD market is restricted to three well construction models:

- Vertical grassroot wells where CTD units are custom built and include efficient casing-handling capabilities.

- Hole-deepening activities that require medium-to-large standard CT units after a conventional rig has top set casing.

- Directional and horizontal work that requires specialized equipment and large customized rigs that can handle larger-diameter pipe.

For the most part, drilling contractors, other than Nabors Industries Inc. and Transocean Offshore Inc., have declined to enter the coiled-tubing drilling market. Instead, oil field service companies like Schlumberger-Dowell, BJ Services, Halliburton, and Baker Hughes Inteq have dominated CT activities.

For example, Schlumberger, which accounts for the majority of CTD work, owns four purpose-built units that are now working in Alaska, Canada, and South America. Additionally, Schlumberger operates "an assembly of CT equipment," one in South America, one in the US, and the other in the Gulf of Mexico.

From 1991 to 1998, this company led all others in terms of directional drilling activity with more than 200 directional wells totaling more than 250,000 ft and 251 nonsteered wells totaling more than 302,000 ft.

Well into the future, service companies may continue to take the lead when it comes to technological innovation. "This is mainly because CT service operators already have the infrastructure and experience in place," Misselbrook says, "and drilling contractors typically do not provide the fairly specialized technologies and bottomhole assemblies (BHAs) needed for directional work."

In the beginning

CT services began 55 years ago prior to the Allied invasion of Normandy. Initially, several 3-in. ID pipelines, long enough to cross the En glish Channel, were prefabricated from 4,000-ft sections.

The pipe was adjoined through butt welds and coiled onto 40-ft diameter spools.

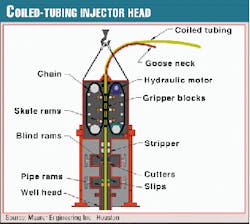

It was not until 18 years later, however, that Bowen Tools (IRI International Inc.) and the California Oil Co. developed a prototype CT workover unit with the injector head designed as a vertical, contra-rotating chain drive system built on to a string of 1.315-in. OD pipe (Fig. 1).

From the late 1960s to the mid-1980s, Brown Oil Tools, Bowen, Exxon, Uni-Flex Inc., Hydra Rig Inc., Chevron, Nowsco, and others continued to advance CT technologies. Although surface-equipment modifications improved running operations, quality issues with the manual butt-welding process and low-strength pipe resulted in numerous fishing operations that promoted an industry-wide hesitancy to use the technology.

Fortunately, new manufacturing processes and the availability of high-grade steel overcame many CT quality issues, allowing ARCO, BP Amoco, Crestar, Apache, Gulf Canada, Petro-Canada, Mobil Canada, Oryx, CUDD, Dowell, Elf Aquitaine, Plains Energy, and others to advance CTD use around the world.

The half-helix weld

"In 1983, we were continuously welding 3,000 ft sections of pipe together, and by 1987 the industry [led by Quality Tubing Inc.] had developed the bias weld [half-helix] where strips of steel were joined by cutting them at a 45° angle and welding that material together," says Mel Hightower of Maurer Engineering Inc., Houston, a CT advisor with 37 years' industry experience working for companies such as Exxon and ARCO.

This bias skelp-end welding process enhanced CT strength by spreading the heat-affected zone spirally around the tube.

Thus, no single point of the weld would touch any other point.

Accordingly, CT strength has increased. "Original CT had about a 50,000-psi yield strength, which is now up to as high as 110,000 psi. And due to the improved metallurgy and manufacturing methods, in addition to fatigue life monitoring, there are now relatively few pipe failures," he says.

A CT inspection workshop conducted by Maurer Engineering Inc., Houston, last September provided insights into the leading causes of failure. Rufus Mullins of Halliburton, for example, said over a 6-year period, corrosion (51%), overload (21%), mechanical damage (12%), and manufacturing defects (7%) were the leading causes of failure (company only).

Fortunately, improvements in inspection technologies along with increased inspection frequency, directed at wall measurements, diameter changes, longitudinal flaws, and ovality, should further reduce pipe failure incidences.

On location, software programs are also beginning to play a large role in predicting fatigue.

"Each trip on a typical CT unit crosses six bends where you're actually putting the pipe into the plastic region [permanent deformation], not simply elastic [bends with no permanent effect on pipe at this point]," Hightower says.

Thus, these programs can calculate fatigue life, providing information as to when a string should be inspected or replaced.

By 1992, common CT sizes included 23/8, 27/8, and 31/2-in. strings. And today, 23/8-in. tubing strings dominate most drilling activities, mostly because of the active CT Alaskan market.

Although manufacturers like Precision Tube Technology and Quality Tubing can produce 41/2 and 51/2-in. tubing strings, its use in the drilling industry will probably remain nonexistent. "The rate at which CT wears out is proportional to the amount of strain it experiences when bent," Misselbrook says.

"And if you have a standard size reel, but put larger pipe on it, it will simply wear our quicker."

Thus, to increase the CT life, it becomes necessary to use larger-diameter reels.

Unfortunately, there is a practical limit when it comes to transporting these large-diameter reels. "The biggest drilling strings that can be conveniently moved in most regions are 27/8 in. in diameter," he says.

ARCO's experience

In the early 1990s, ARCO, a leading pioneer in CTD, began experimenting with CTD in West Texas, Oklahoma, and Alaska. Since then, the company has drilled 132 extensions or sidetracks worldwide in Alaska (115), California (11), New Mexico (1), Texas (1), Indonesia (3), and Algeria (1).

In 1992, the company advanced CTD technologies when it developed a successful window milling system, followed by a long-term program in Prudhoe Bay that continues today.

After drilling some fairly simple wells, ARCO's first economic success began when it extended a rig sidetrack. After drilling 800 ft of directionally controlled hole, the company installed a preperforated liner and ran 31/2-in. coil for production tubing. "The well produced 4,000 bo/d for 2 years, which paid for the entire program in Alaska, up to that time" Hightower says.

Today, about a third of the wells drilled in Prudhoe Bay use CTD technology for extending existing horizontal wells or performing horizontal sidetracks.

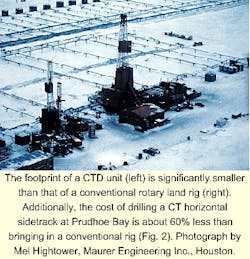

"The cost of drilling a CT sidetrack is about 40% that of bringing in a conventional rig to drill a new horizontal well (Fig. 2)," he says.

Prudhoe Bay

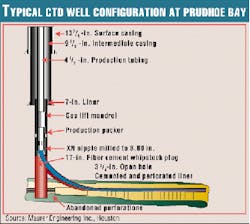

ARCO's CTD unit in Prudhoe Bay consists of two modules: a workover rig combined with a CT unit. A typical CTD well begins by working through 4 1/2 or 5 1/2-in. production tubing (Fig. 3).

Next, the operator reams through a tubing nipple, squeezes the perfs, and sidetracks off of a cement plug.

Then the operator cuts a window in the casing or liner with two to three bits, including a pilot mill, a concave window mill, and if needed, a diamond speed mill.

Finally, a polycrystalline diamond compact (PDC) bit is used to drill the horizontal section.

"All of the work is done through-tubing," Hightower says. "The whole idea is to save time, so we don't have to pull the production tubing and packer with a rig."

Directional steering systems used in the area include a tandem mud motor with bent housing, a measure-while-drilling package, gamma ray sensors, hydraulic-mechanical orienter, nonrotating joint, circulating sub, hydraulic disconnect, check valves, and coil connector.

Once the CT unit reaches TD, a 23/8-in. flush joint liner is cemented in place. Today, a typical Prudhoe Bay well consists of 1,700 ft of open hole, a true vertical depth (TVD) of 9,000 ft, and measured depths (MD) ranging from 9,000 to 15,000 ft.

As much as 3,300 ft of sidetracked open hole have been achieved with CTD. ARCO has also performed about 25 CT operations through 31/2-in. tubing. With slim-hole sizes conventionally restricted to 23/4 in., concerns of lost circulation and inefficient fluid hydraulics have led ARCO to use 3-in. bicenter bits to enlarge the hole.

Hightower says average openhole footage has more than doubled since 1995. Costs have accordingly increased from $990,000 to $1.2 million, a result of longer-reach, hard-to-drill targets. "Average post-sidetrack production has been about 1,400 b/d after the well has stabilized."

Throughout its Prudhoe Bay program, ARCO has experienced a 90% mechanical and geological success rate. "One of the drawbacks is that coil cannot be rotated," Hightower says, leading to problems with differential sticking and hard-to-fish BHAs.

Another drawback concerns the relationship between the snubbing force of the injector, the flexible nature of the CT, and bit weight. "You might apply 20,000 lb of force at the injector, but only get 1,000 lb at the bit," Hightower says.

"What happens is that as you apply weight at the surface, the coil takes on a sinusoidal shape, rapidly turning into a helical form as more weight is applied. Eventually it reaches a point where borehole contact friction forces you to stop."

The greatest measured depth CTD well Hightower is aware of is 15-16,000 ft, and some wells have achieved a TVD of 12-13,000 ft.

Other areas where ARCO has experienced success with CTD include California and Indonesia.

BP Amoco

BP Amoco PLC also uses CTD technologies in the Prudhoe Bay area horizontally to sidetrack existing wellbores, targeting overlooked reservoirs. "Taking advantage of recent 3D surveys, our geologists locate zones that haven't been depleted, then look for a poor producing well within 2,000 ft of the structure," says Rick Whitlow, drilling supervisor for BP Amoco.

Next, the company brings in a mobile Nordic CTD unit (Fig. 4), abandons the old completion, and drills the new target horizontally. An average well takes 12 days to finish including window milling, drilling, logging, and perforating.

BP Amoco also drills some inverted wells, inclined at about 110°, inside the main reservoir where there is an active gas cap, rising water, and a depleting oil column.

"First, we perforate the tail end of the well [high end of structure], then as it goes to gas, we run a bridge plug and reperforate lower in the column."

The technology has helped the company to offset declining depletion in a mature play where only 50% of the company's 800 active wells remain on line.

"An average well drilled with CT produces 2,000 bo/d, compared to 900 bo/d for existing conventional wells," says Whitlow. "And some go as high as 7,000 bo/d."

Because the zones tend to deplete quickly, however, production rates fall by as much as 50% over a 6-month period.

Advantages and disadvantages

Whitlow says CTD provides five advantages over conventional methods. First, CTD provides a safer working environment because it requires smaller crews and little rig floor work during tripping and drilling operations.

Second, the operator can perform through-tubing operations without pulling the completion equipment. Third, a 5,000-psi hydraulic pack off, located just below the injector, allows the driller to "take a kick and continue on drilling." Fourth, the unit can circulate drilling fluids while tripping.

Finally, "We can drill and complete a sidetrack for $1.1 million, whereas a rig, with through-tubing rotary-drilling capabilities, would cost $2.4 million. And a large conventional rig that does not have this ability, costs more, perhaps $4 million a well."

Whitlow says there are some drawbacks that the industry must be aware of. "Because you can't rotate and can only pull 90,000 lb, you have to be careful and not get stuck." To get around this problem, rig crews backream every 200 ft in order to clean up sloughing shales and sand ledges.

Additionally, the company, which uses about six reels a year, must replace the CT string every three to four wells, at a cost of $80,000/reel, delivered to Prudhoe Bay.

Finally, Whitlow is careful to point out that CTD has limited application and should not be used "just anywhere."

Rig design

In order to compete with conventional rotary workover and drilling rigs that have well-entrenched markets and capital-equipment investments that achieved payout years ago, companies have come up with a variety of CTD rig designs, many of which target specific niche markets that employ innovative configurations (Fig. 5).

There are currently two major classes of CTD units: hybrids and conventional CT units, says Bob Ewen, technical manager for the wellbore construction group, Baker Hughes. Whereas the hybrid rig can use both CT and jointed tubulars, conventional units must swap out with a workover or drilling rig if operations require the handling of jointed pipe.

Currently, Baker Hughes' hybrid rigs employ a self-erecting mast, a parabolic CT loop, and either a drawworks or travel-rod system for handling jointed pipe (Fig. 6).

On the other hand, conventional CTD units come in two subclasses: one targeted for land and the other for sea. Land rigs are trailer-mounted and use either a crane or a U-frame mast for injector-head support (Figs. 7 and 8). Offshore rigs on the other hand are almost always skid-mounted and use a crane to assemble a modular tower for injector head support.

Hybrids

Baker Hughes owns and operates three hybrid units known as Galileo 1, 2, and 3 (G1-3). "Basically, each unit is a modified, custom-designed workover unit," Ewen says, "with slight differences between each one."

G1, currently in Holland, was built for the land market and has drilled eight wells since it began operation at the end of 1996. This rig, which employs a sling-shot substructure, can provide up to 200,000 lb of pull and 60,000 lb of snub.

G2, a barge-based unit operating in Lake Maracaibo, Venezuela (Fig. 9), has drilled 16 wells over a 2-year period. And the last rig, G3, which targets the desert land rig market, is already on well No. 14 in Oman, having begun work last February.

Parabolic loop

G2 and G3 utilize a unique parabolic loop system with two injectors-a primary injector mounted above the wellhead and a tensioner injector located at the reel.

These units are synchronized with one another through a sophisticated software program.

Because the tubing retains residual bends in the coil, a result of being spooled on a small diameter drum, the parabolic loop between the reel and well center provides an inherent advantage over conventional reel-to-injector head tubing configurations.

"On any conventional unit, you are fighting [this residual bend] all the time, even when you are stabbing the pipe in the injector head and running it in the well." Yet with the Galileo units, this shape actually coincides with the arched configuration between the reel and injector as it forms a parabola or "natural bend in the pipe."

This design, along with integrated drilling systems such as directional drilling and underbalanced drilling packages, has allowed Baker Hughes to meet the specific needs of Pdvsa, NAM, PDO, Renaissance Energy, and ARCO.

Oman

The G3 CT unit (Fig. 10), on contract with Petroleum Development Oman (PDO), has been used to pull existing completions, drill sidetracks and extensions, and run completion tubulars. In its first 5-months of service, 3,000 m of new hole were drilled with the unit over a five-well program.

During this time, PDO completed eight openhole sidetracks and two casing exits.1

Underbalanced drilling enabled the CT unit to reach competitive penetration rates, up to 80 m/hr, and horizontal step outs exceeding 1,000 m. A light workover rig, with a 200,000-lb drawworks capacity, telescoping drill floor, and a 31/2-in power swivel, comprises the core operational package.

Manufactured by Dreco, the unit uses a support frame for a 100,000 lb-capacity injector. Five heavy-duty desert trailers are used to move the rig, reel, power plant, mud pumps, and underbalanced fluid-processing unit.

The reel uses a special 180-in. diameter drum designed for use with the parabolic loop system-in place of a conventional guide arch. The reel can hold 5,000 m of 23/8-in. electric-line CT. The rig also comes with two additional work reels: standard 23/8-in. (nonelectric line) and 13/4-in. CT.

The unit is operated from a central control cabin mounted at the rig floor where injector, reel, and mud-pump activities are controlled through a central network using a digital control system.

Yibal oil field

G3 was specifically designed to target small oil reserves in Oman from existing wellbores, using underbalanced drilling technologies, bottomhole pressure sensors, and a sophisticated fluid separation system (Fig. 11). Altogether, PDO operates over 90 fields in Oman, producing about 835,000 bo/d.1

The unit was mobilized to Oman's Yibal oil field, which produces about 25% of PDO's production, from the US in late 1998. The generic scope of the work is based on 41/2-in. through-tubing reentries.

First, drillers mill a window in the horizontal section of the 41/2-in. liner at about 1,400 m TVD. Next, they drill a 33/4-in. hole underbalanced and horizontally through the pay zone. Then the service company runs, cements, and perforates a 27/8-in. liner, followed by zonal acidization.

Underbalanced drilling

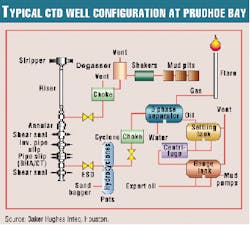

For underbalanced drilling with crude oil, the system includes settling-storage tanks, centrifuges, gauge tanks, transfer pumps, and high-pressure pumps.

The fluids-handling package consists of four main subsections and can be used for conventional drilling fluids, with returns fed to a shaker and degasser, or underbalanced drilling with crude oil and natural gas fed to a three-phase separator.

While crude oil is pumped down the coil, natural gas is also injected down the annulus of the tubing and the casing, through gas-lift mandrels, then back up the CT annulus between the completion and the coil. This essentially lightens the hydrostatic head, creating an underbalanced condition in the borehole.

The BHA, which monitors bottomhole pressures internally and externally, provides instantaneous data to the surface through the electric cable inside the CT. Thus, the operator knows exactly what pressure is being exerted on the formation at all times and can make changes to the hydraulic program accordingly.

Downstream of the BOP, returns from the well are separated into the following phases:

- Solids, knocked out by Krebs hydrocyclones.

- Gas, flared off.

- Water, sent to an evaporation pit.

- Oil, reused within the closed-loop drilling system with excess exported to a production station.

Canadian operations

Canada forms the second largest CTD market in the world, after Alaska. Since Gulf Canada drilled the first well there in 1992, operators have drilled about 170 horizontal and more than 1,000 vertical wells. The three most active areas are Alberta, southeast Sas- katchewan, and northern British Columbia.

In contrast to the Prudhoe Bay wells, where CTD drillers target discrete reservoirs using through-tubing techniques, Canadian operators typically top-set casing just into the pay zone with a conventional rotary rig. Next, they drill out the shoe, complete the build section, and drill the well horizontally and underbalanced with a CTD rig.

Brian Heikkinen, technical sales representative for Nowsco-Fracmaster, says underbalanced drilling is necessary for three reasons. First, many of the formations, such as the Jean-Marie in British Columbia, are fluid sensitive.

Second, some fields, including the Sanex in North Alberta, are pressure depleted or fractured. Finally, the presence of sour gas, found in the reservoirs of Central Alberta, presents a safety hazard. "With CT, workers remain 80 ft away from the well. There is no handling of tool joints on the rig floor."

Another distinction of the Canadian CTD market is that most operators are large independents, including Crestar, Apache, Petro-Canada, Norcen, and Burlington Resources (Po- co); whereas the Alaskan market consists mainly of major oil companies.

Development barriers

Although companies like ARCO, PDO, BP Amoco, Shell, and NAM have achieved promising results with CTD, industry-wide acceptance has yet to take place. For example, at the end of 1999, only 8-10 CTD units were actively drilling out of a potential fleet of 50-100.

Yet some specialists still question the approach the industry takes towards the development of this promising technology, feeling instead that many operators lack the patience to advance CTD applications along the learning curve.

"The reason CT programs haven't been more successful is that most companies only drill one to two wells at a time," Hightower says. "Thus, every time they restart a project, they have to relearn the CTD process all over again."

Reference

- Van Venrooy, J., et al., "Underbalanced drilling with coiled tubing in Oman," SPE paper 57571, presented at the SPE/IADC Middle East Drilling Conference, Abu Dhabi, Nov. 8-10, 1999.