Global Energy Investment Index

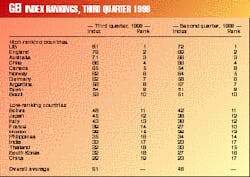

Based on growth in oil and gas production, reforms in electricity and gas markets, and the effects of those reforms on independent power production (IPP) capacity, the average Global Energy Investment (GEI) Index for the 20 countries tracked rose by 5 points during third quarter 1999 vs. second quarter.

The GEI Index was introduced last October as a tool to be used by the energy industry, finance and government leaders, energy buyers and sellers, and consultants to monitor trends in oil, gas, and electricity activities in a group of key countries that serve as a proxy for global energy activity (OGJ, Oct. 11, 1999, p. 42). This is the first in a series of quarterly reviews of changes in the GEI Index for those 20 key markets.

Movers and shakers

The GEI Index comprises three groups of indicators: 1) financial indicators; 2) energy assets and market structure data; and 3) energy volume trends.

Gains in oil and gas production and increases in private and merchant power plant activity upped the third quarter 1999 GEI score for the US to 81 from 72, and for Australia to 71 from 66 (see table). The US added 16,800 Mw to its nonutility generation capacity due to utility sell-offs, and another 1,485 Mw of new merchant plant capacity went into service during the quarter. Australia added 1,600 Mw of capacity, about 60% of which was related to capacity sell-offs.

Canada moved up to fifth in the ranking from its starting position of eighth. The change was a result of increases in oil and gas production and a rise of 56,000 b/d in domestic oil use during the quarter.

Gains in oil and gas production also helped boost the GEI Index ratings for Bolivia, China, and Mexico (Mexico's rise was due to an increase in gas production alone).

Oil and gas output gains and modest private power plant additions boosted India's score by 10 points to 33. Brazil's rose to 53 from 51 for the same reasons.

Oil consumption growth coupled with modest IPP gains in Europe and Asia increased the country rankings for France, Italy, Japan, the Philippines, and South Korea. Oil use growth and gas privatization and reforms contributed to the increased rankings for Germany, France, and South Korea.