Changing energy world shifts focus to gas

Natural gas is the fuel of the future, with new technologies on the threshold and projections that demand will double by 2010, says Richard Flury, chief executive of BP Amoco PLC's new Gas Marketing & Power unit.

Flury says one reason his company is putting new emphasis on gas is that the global power and gas economy is now worth $1.3 trillion/year, nearly twice the size of the global oil economy.

The BP Amoco executive told a recent North American natural gas outlook conference in Calgary, sponsored by Ziff Energy Group, that it is no coincidence that his company's decision to set up a separate gas and power business coincides with dramatic changes in the market itself.

Other presentations focused on:

- The role of gas supplies from the Western Canada Sedimentary Basin-including its extension into the Mackenzie Delta and Beaufort Sea areas-in meeting burgeoning North American gas demand.

- The probability that US producers will be able to rise to the challenge of a looming 30 tcf gas market.

- The possibility of Canadian gas producers meeting increased deliverability requirements resulting from the new gas export pipelines coming on-line.

New technology

Flury stresses that BP Amoco is not forgetting the potential of such alternate energy sources as fuel cells and hydrogen technologies, but the transition to that world won't be made in one leap, he noted. Gas will play a vital role in providing desired environmental improvements, and new technologies will play a crucial role in further transforming global energy markets.

A perfect example of this is combined-cycle turbines fueled by natural gas, he says.

Other gas-related technologies that could have a significant effect on the industry are:

- LNG-The industry could see LNG delivered to regasification terminals in the US at a variety of delivery points for about $2/MMbtu, competitive with pipeline gas.

- Gas-to-liquids-The GTL technology frontier is close to being breached, with many companies having a range of research and development programs in the advanced stages.

Communications and internet technologies will also play a growing role in the future. The customer will be the most powerful figure in the new energy chain, says Flury, and will have access to complete, real-time information. And companies will offer new and sophisticated service packages, including risk management.

This evolution will rapidly transfer to other areas of the world outside North America, which is currently leading the way.

The scope for mergers and acquisitions is considerable, and competition is driving innovation, he added. Gas is rapidly catching up with crude oil around the world, in terms of business priorities.

Gas as a share of BP Amoco reserves will rise to 38% when the ARCO transaction is completed, says Flury. And the company will pursue all options for moving Alaskan gas to market that are consistent with the interests of various stakeholders. The options-LNG, gas-to-liquids, and an export pipeline via Canada-are not mutually exclusive, he noted.

Western Canada resources

Brian F. MacNeill, president and CEO of Calgary-based pipeline Enbridge Inc., said oil has fueled commerce in the past 100 years, and gas will be the dominant fuel of the next century because of a unique convergence of political, economic, technical, and social developments.

If the Kyoto accord is initiated, it will force industries and consumers to switch to cleaner-burning fuels and is bound to decrease reliance on coal-fired generation, especially in the Northeast US.

There are predictions that the nonregulated electricity market in North America will grow at a rate of 35-45%/year over the next 5 years. Much of this will be related to combined-cycle, gas fueled plants, which can be built more quickly and cheaply and are safer and more efficient.

Natural gas markets are growing rapidly, but the big question is, Who will serve these markets?

The single biggest source of gas is, and will continue to be, the US Southwest, says MacNeill. But Western Canada is a major player, and Canadian producers will be the leaders in serving growth markets in eastern Canada and the Midwest US.

Western Canada producers are in the best position to supply these markets because they operate in the world's most abundant and economical gas province, says MacNeill. They have access to a growing delivery structure-second to none-and some of the lowest fixed costs of any energy supply basin in North America.

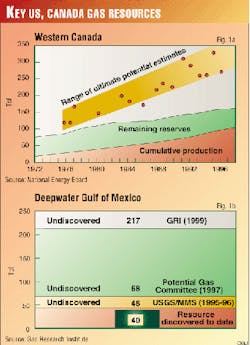

In 1996, Western Canada Sedimentary Basin (WCSB) costs averaged under 50¢/ Mcf, compared with 75¢ in most areas of Texas and Louisiana. In addition, WCSB has an estimated total gas resource of more than 200 tcf-the largest conventional resource potential of any oil and gas basin in North America (Fig. 1a).

It is still a relatively immature basin, with lower well density than basins in the Lower 48 states. To date, only 25% of estimated reserves have been exploited, compared with 45% for the continental US.

But the WCSB is not the only game in town, says MacNeill. There are several competing basins, including the Gulf of Mexico, Rocky Mountain region, Midcontinent, Mexico, and Sable Island. In addition, there is a high potential for gas off eastern Canada and in the Mackenzie Delta-Beaufort Sea area in northern Canada, which is really a frontier extension of the WCSB.

Ultimately, these regions will supply gas to North America and provide additional opportunities for producers and pipeline companies. Timing is the most important factor if WCSB producers are to capitalize fully on market potential.

It is critical that the infrastructure is in place to deliver the gas where and when it's needed as economically as possible, MacNeill noted. Without that, gas will begin to flow south-to-north and not east-to-west.

The Alliance, TransCanada Pipe- Lines, and Northern Border pipeline systems will provide efficient transport for needed North American gas supplies. The challenge may be getting sufficient supplies to fill the new pipe. If producers don't meet supply needs, they could lose market to alternative sources.

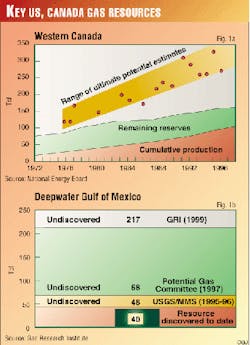

It is estimated that a 1.5% annual increase in gas drilling is needed to meet forecast demand. Drilling in the WCSB fell off in recent years because of low prices but will increase with forecast prices of about $3/MMbtu at the Henry Hub in 2000 (Fig. 2).

US supply challenge

Paul Holtberg, group manager of GRI's Baseline Center, said the challenge of meeting a forecast US demand of 30 tcf by 2015 must be put in perspective.

This represents demand growth of 0.5 tcf/year. The last time the gas industry faced a similar challenge was in the mid-1950s to mid-1970s, when it successfully addressed a 13 tcf demand increase-50% greater than the one now looming.

Holtberg says the key contributor to the outlook for increased US production will be the deepwater Gulf of Mexico.

The gulf is poised for a major increase in production, with many fields remaining to be put on line.

The onshore trend in the Lower 48 states is toward deeper drilling in South Louisiana and the Texas Gulf Coast and Permian basin areas, and these deeper reservoirs will be the silver bullet for producers onshore.

Based on first quarter 1998 data, 148 discoveries have been made in water depths of 200 m or more in the Gulf of Mexico. Of these, 48 are producing and many are underdeveloped, says Holtberg.

Discoveries to date in the deepwater gulf represent about one fifth of GRI's ultimate gas resource potential estimate of 220 tcf (Fig. 1b).

Current activity is now starting to challenge earlier estimates of total deepwater potential. Gulf start-ups have grown steadily and are expected to double in 2000.

Deepwater fields yield, on average, about six times more reserves than shallow-water fields, and shallow recovery is four times that for the average onshore gas well.

Onshore Lower 48 remains a key contributor to total US gas supply, with much of it in the West, in the Rocky Mountain, Overthrust, and San Juan basin areas. Canadian imports are important, too-particularly in the next 5-10 years, with imports expected to reach 4 tcf/year by 2005.

GRI studies indicate that producers can expect, on average, a narrow range of 13-15% return on investment, which means the exploration sector will have adequate cash flow to fund investment for a 30 tcf future.

Canada's gas supply

Ken Vollman, chairman of Canada's National Energy Board, said both the short-term and long-term outlooks for the gas industry in Canada remains favorable.

Increased activity levels are expected in 2000 and beyond, says Vollman. This winter, supply will be reasonably tight, he added, but with full storage and a normal winter, there should be no major difficulty in meeting demand.

The challenge for near-term deliverability from the WCSB is not only to increase supply but also to replace a steep decline from existing reserves. More than 50% of current production comes from wells connected since 1994. They have steeper decline rates and need to be replaced sooner.

Vollman said that, in drilling, NEB expects a gradual move away from shallower pools in the eastern area of the WCSB and toward larger prospects in the central and Foothills areas.

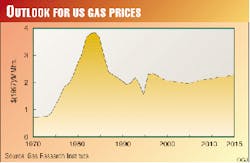

The board also expects that a "refill" period of a few years will be required following the startup of the 1.3 bcfd Alliance pipeline system in 2000. The delivery shortfall could be anywhere between zero and more than 3 bcfd. But, on balance, a gap of about 2 bcfd is expected between deliverability and takeaway capacity, says Vollman (Fig. 3).

The NEB estimates that at least 5,500 gas wells were drilled in the WCSB in 1999, and about 7,700 will be drilled in 2000, with improved cash flow justifying more than 14,000 total wells. Estimates are that only one third of the WCSB's potential has been produced so far.

NEB bases its supply outlook on two price scenarios. In Case 1, substantially improved finding rates and reduced costs will lead to more resources being available at lower costs. In Case 2, recent trends in energy supply are expected to continue, and technology will have a similar impact on costs and finding rates as it has in recent years.

In Case 2, Alberta-border prices would rise above $3/gigajoule (in nominal dollars) on a sustained basis by 2008, and by 2014 in Case 1.

In both cases, there would be an increase in conventional gas, augmented by unconventional and frontier gas supplies.

In the longer term, prospects for gas development remain favorable, says Vollman. Market deregulation has worked extremely well to ensure supplies are available when needed.