Refiners can boost profits using the conversion index

Norman E. Duncan

NED & Associates Inc.

Houston

Refiners can use conversion indices (CIs) to determine if margins will support conversion-unit projects. When the CI is higher in one refinery than another, the margin is generally also higher. Thus, CI allows for a rough comparison of relative refining margins among different refineries.

CI is the sum of the conversion capacities of a refinery divided by its crude capacity. Thus, it is the sum of catalytic cracking, hydrocracking, and coking capacities divided by crude capacity.

For any refinery, the CI can be quickly calculated using OGJ's annual refining survey (OGJ, Dec. 20, 1999, p. 45).

The easiest ways to boost refinery margins are to add or expand conversion-unit capacity and to gain greater insight to operations of existing conversion units.

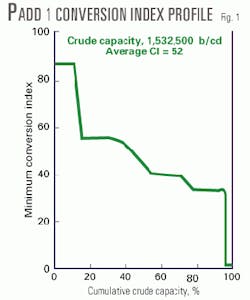

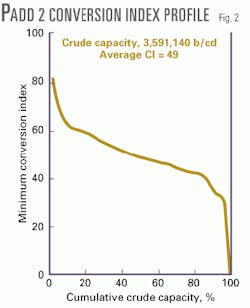

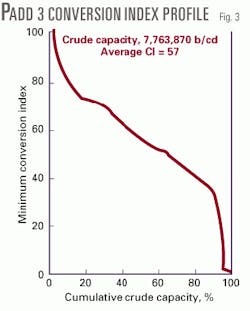

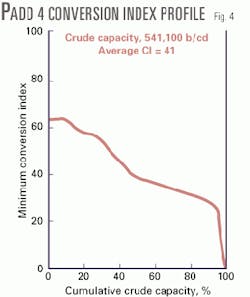

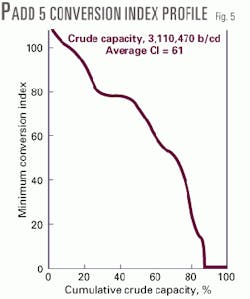

This article updates a previous one published May 4, 1992. Figs. 1-5 update conversion indices as of Jan. 1, 2000, by Petroleum Administration for Defense Districts (PADDs). Fig. 6 shows the break out of states into PADDs.

In the past 8 years, the US refining industry has shrunk by 40 refineries-from 192 to 152. In particular, smaller refineries with zero conversion have closed. Crude capacity has grown by 8%, and conversion capacity has grown by 5%. Although 5% seems small, it represents a significant addition of 460,000 b/d of new conversion capacity.

Optimizing operations

Once conversion indices have been examined, the ways to boost refinery margins are not complex. They include adding conversion capacity or running conversion units in a way to maximize return.

Implementing these concepts requires intensive manpower to look in detail at actual refinery balances, resid make, fuel-gas production, and hydrogen consumption.

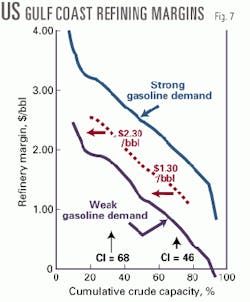

- Adding conversion capacity. Consider a PADD III refinery of 150,000 b/d with a CI of 46 and a current refinery margin of $1.30/bbl. How much better does a neighbor refiner with CI of 68 perform? Will the estimated delta margin support a conversion investment?

The first step in making a comparison is to locate both refineries on the conversion index profile. Fig. 3 shows that 70% of the crude capacity in PADD III refinery has a CI of 46 or higher. Only 32% of crude capacity has a CI of 68 or higher.

Fig. 7 is a grid of US Gulf Coast refinery margins. This graph shows that refinery margins are $1.30 at 70% cumulative crude capacity (for CI=46) and $2.30 at 32% (for CI=68). To bring 46 CI up to 68 CI might require, for example, the addition of a 33,000 b/d coker.

The gain of $1/bbl in a refinery margin would total $150,000/day, or $53 million/year. The refinery must decide if these numbers provide reasonable return for a coker investment.

While margins frequently vary, it should be noted that delta margins rarely do. The return on debottlenecking of existing conversion units can be done the same way. Such projects will usually be attractive.

- Running conversion units at maximum return. There is a fundamental rule about operations of conversion units that is not always appreciated: Once the capital investment is made, forever after, the task is to maximize return.

Maximum return is not necessarily the same as maximum throughput, however. Maximum return is maximizing value of the conversion-unit upgrades.

For a fluid catalytic cracking unit (FCCU), maximum return may be maximum coke burning capacity or maximum gas-handling capacity instead of maximum fresh-feed input. For a hydrocracker, maximum return will likely be maximizing hydrogen consumption, perhaps at maximum fresh-feed intake.

Refiners need to be careful not to express conversion unit capacity basis as a simple throughput percentage. For example, saying that an FCCU is running at 85% capacity does not give any pertinent information.

- Maximizing hydrogen consumption. Closely related to maximum conversion in any refinery is optimal hydrogen consumption. Refiners lose large amounts of money when hydrogen is released, bled, or fed to the fuel system.

For example, salvaging 1 MMscfd of hydrogen from the fuel system and adding it to a conversion system boosts refining margins about $4,500/day.

It is important that refiners make a detailed hydrogen flow sheet and balance of their refineries. Hydrogen sources are catalytic reformers as well as hydrogen plants. Hydrogen consumers are hydrotreaters and hydrocrackers.

It is desirable that every last standard cubic feet of hydrogen be used for conversion in a conversion unit. There are many inexpensive plant designs, most associated with catalytic cracking operations that can recover even low hydrogen-content streams exiting hydrotreaters.

Revamping reformers to lower pressure operations also can maximize hydrogen production.

The author-

Norman E. Duncan is the principal of NED & Associates Inc., Houston, which specializes in strategic planning for energy companies. He is retired from Shell Oil Co. where he was a planner and executive aid at senior level to Shell management in Houston and London. Duncan holds a PhD in physical chemistry from Rensselaer Polytechnic Institute, Troy, NY.