The supply of natural gasoline in Mont Belvieu is gradually being diverted from refinery feedstock and the gasoline blendstock pool to ethylene feedstock.

The new BASF-Fina cracker at Port Arthur, Tex., is expected to acquire much of this natural gasoline.

As the market for natural gasoline changes, the quality specifications of sulfur for the gas processor are diminishing in importance.

This is the conclusion of an analysis by Petral Worldwide Inc., Houston, presented to the Gas Processors Association Conference, Atlanta, in March.

In a survey by Petral, refiners said that they would not pay a premium price for natural gasoline treated to remove mercaptans. Future stricter sulfur regulations will require them to desulfurize almost all of their gasoline blendstocks, at any rate.

Natural gasoline, the liquid hydrocarbons recovered from natural gas, is primarily used as a blending agent in motor gasoline. It is also used for refinery and ethylene feedstock. Refinery motor gasoline blendstock and ethylene feedstock are the primary end-use markets for natural gasoline in Mont Belvieu.

Mont Belvieu has the largest regional natural gasoline market in the US, which makes it a major influence on market developments for natural gasoline. Refineries in the Midcontinent region, partially supplied by Mont Belvieu, are the second largest regional market for natural gasoline.

Refinery demand

Six fractionators determine the supply of Mont Belvieu natural gasoline. They belong to Coastal Corp., Dynegy Inc., Enterprise Products Co., Gulf Coast Fractionator, Koch Industries Inc., and ExxonMobil Corp.

Between 1995 and 1998, regional natural gasoline production averaged 90-100,000 b/d. In the 2000-2002 period, production is expected to be 100-110,000 b/d. The 10,000 b/d increase is a result of a butanes and pentanes mixture from a Louisiana gas plant to be sent to Mont Belvieu for processing.

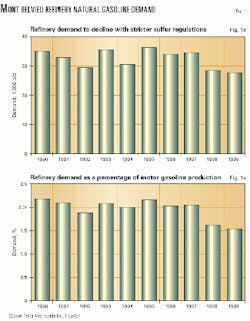

During the 1990-1997 period, refinery demand in Mont Belvieu for natural gasoline was 30-35,000 b/d, about one-third of the regional natural gasoline supply. Fig. 1 shows that not only has the absolute volume of natural-gasoline demand decreased since 1997, but the percentage used in gasoline production has also decreased.

Petral expects this downward trend to continue as refinery configurations change to accommodate reformulated gasoline complex models.

All nine refineries in the Mont Belvieu area are capable of using natural gasoline as a motor gasoline blendstock. This end use is especially attractive for those refiners with a surplus of high-octane blendstock, which blends with low-octane blendstock such as natural gasoline to make more volume.

Four of the refineries in the area have pentane isomerization (isom) units which can boost the octane in natural gasoline. Valero Energy Corp. and Crown Central Petroleum Corp. have pentane isom units, each with less than 10,000 b/d. ExxonMobil Corp.'s Beaumont, Tex., refinery has a 20,000 b/d pentane isom unit, and BP Amoco plc's Texas City refinery has a 28,000 b/d pentane isom unit.

The Midcontinent region currently receives about 15,000 b/d of natural gasoline from Mont Belvieu.

Ethylene demand

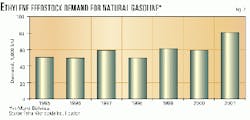

Local ethylene producers will more than pick up the demand for natural gasoline where refinery demand is expected to slack (Fig. 2).

Between 1995 and 1998, demand for natural gasoline for ethylene feedstock averaged about 50,000 b/d and consumed about 50% of Mont Belvieu's total supply. In 1999, ethylene feedstock demand jumped to 60,000 b/d.

The start-up of the BASF-Fina naphtha cracker will significantly tighten the market for natural gasoline. The cracker, to start up later this year, will likely want 20-25,000 b/d of natural gasoline. Fina's Port Arthur refinery will supply the remaining plant feedstock, 30-35,000 b/d of naphtha.

Petral expects the ethylene producers' demand for natural gasoline to be 80-85,000 b/d in 2001.

Quality survey

In 1998, Petral conducted a survey of refiners and ethylene producers to find out their practical sensitivity to the presence of mercaptans in natural gasoline.

Petral determined that ethylene producers were insensitive to both the amount of sulfur and the form of sulfur in its feeds. Ethylene producers routinely inject sulfur in various forms into feedstocks to coat the furnace-tube surfaces to minimize coking and increase plant efficiencies. They did not care if the sulfur came in the form of mercaptans or disulfides.

Although refiners are sensitive to sulfur content and the form of sulfur in the motor gasoline, as specifications for motor gasoline become tighter, refiners are becoming less sensitive to those specifications in blendstocks, like natural gasoline.

To meet 30-ppm sulfur gasoline specifications, refiners indicated in Petral's survey that they would have to desulfurize virtually all motor gasoline blendstocks. As a result of having to desulfurize blendstocks in any case, refiners are able to be flexible on the amount of mercaptans in natural gasoline.

Thus, refiners indicated that they would not pay a premium for treated natural gasoline, which reduces the margins for those operations that sweeten gasoline in Mont Belvieu.