Industry confronts challenges

Deep water complicates efforts and increases costs for developing and producing hydrocarbon accumulations.

But as significant new hydrocarbon discoveries are being made in deeper waters, the petroleum industry continues to meet the challenges posed for economically recovering these resources.

The Gulf of Mexico is the most active deepwater region in the world in terms of the number of deepwater projects. One tabulation lists 112 producing, planned, and prospective developments in the deepwater frontier.

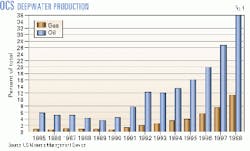

Production has steadily increased from the gulf's deepwater fields and in 1998 accounted for about 36% of the 1.2 million bo/d and 10% of the 13.8 bcfd of gas produced from the US Outer Continental Shelf portion of the Gulf of Mexico (Fig. 1).

Environmental conditions, existing infrastructure, reservoir type and size, and government regulations are some of the main variables that determine the technology needed to economically produce deepwater hydrocarbon accumulations.

Technology needs include appropriate downhole equipment as well as the wellhead, risers, production facilities, mooring for floating production facilities, connections to sales pipelines, and interconnecting flowlines, control lines, and manifolds.

Deep water

Deepwater has many different definitions. The US Mineral Management Service classifies water depths greater than 400 m (1,312 ft) as requiring deepwater technology. At this depth, traditional fixed platforms begin to be uneconomical.

Shell Exploration & Production Co. holds the record for setting a traditional fixed platform in the deepest water. Its Bullwinkle platform, in 1,353 ft of water in the Gulf of Mexico, was installed over 10 years ago.

A number of recent deepwater discoveries have been sizable and may require innovative technology to bring them on stream. The largest announced deepwater gulf discovery to date, BP Amoco PLC's Crazy Horse, is estimated to contain at least 1 billion boe of potential hydrocarbon resources.

BP Amoco had to contend with drilling in 6,000-ft water depths and through a 2,000-ft thick layer of salt overlying the reservoir to make this discovery. The salt makes detection of hydrocarbons more difficult and poses challenges to successful drilling

The Crazy Horse discovery straddles several Mississippi Canyon blocks 125 miles southeast of New Orleans. No development plans have been announced for this discovery, but the water depth for this discovery is substantially greater than the 4,800 ft in which ExxonMobil Corp. has installed its Hoover-Diana deep-draft caisson production facility."

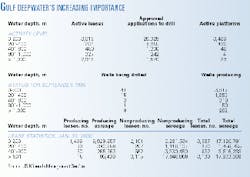

To date, only a small portion of the deepwater Gulf of Mexico has been drilled, and much acreage remains to be evaluated. Leases on the US OCS in more than 400 m of water total 21.5 million acres, vs. the 18.6 million acres in less than 400 m of water (Table 1).

Downhole equipment

In the Gulf of Mexico, most deepwater downhole well completions are conventional. Wells typically include a gravel pack and, in some cases, have produced very prolifically, flowing over 50,000 boe/d.

But new technology is starting to be run downhole in some wells.

Two recent Gulf of Mexico deepwater subsea-completed wells in the Allegheny field, operated by British-Borneo Oil & Gas PLC, included high-end intelligent or smart completions similar to that shown in Fig. 2a. These electrohydraulic-powered SCRAMS (surface-controlled reservoir analysis and management systems) from PES Inc. (a Halliburton Co. unit) provide remote flow control for each producing zone and sensors for monitoring downhole pressure and temperature.

PES systems can be configured in a variety of ways, two of which are shown in Figs. 2b and 2c.

These smart completions aim to reduce well-intervention costs, which are especially high for deepwater subsea completions, and provide a means for continual optimization of the fluid flow from the reservoirs.

Smart completions are relatively new to the industry. PES developed its initial version through a joint industry project with five operators. A North Sea completion, in September 1997, was the first downhole field test of PES's assembly. Saga Petroleum AS, now part of Norsk Hydro AS, operated the well.

PES says its initial system failed in a few months after installation in the Saga well, although the assembly still remains in the well and has not interfered with production. Its more-recent installations are operating as expected, the firm said.

Worldwide at the end of March 2000, PES's high-end smart assemblies were in 11 wells-7 platform and 4 subsea completions. Four wells included four smart assemblies per well, like that shown in Fig. 2c.

PES says that its design could handle many more than four assemblies per well, if there were a need for them. Of the 11 installations in place, 2 are in the Adriatic Sea, 7 are in the North Sea, and the other 2 are in the Gulf of Mexico. These assemblies are designed to be run in wells having either 95/8-in. casing and 51/2-in. tubing or 7-in. casing and 31/2-in. tubing.

PES aims is to design the electronics to work for 20 years at 100

The downhole electronics are the components most likely to fail from being exposed to high downhole temperatures for an extended period of time, according to PES. To lengthen the life of the electronics, one technology that PES is investigating is the use of thermoelectric coolers next to the downhole circuit boards.

PES also has installed lower-end smart systems in 34 wells, although none of these completions are in the Gulf of Mexico. These systems provide remote hydraulic downhole flow control without the electronics and the pressure and temperature sensors. These systems may eventually find a use in Gulf of Mexico wells.

To further develop and market SCRAMS, Halliburton has formed a joint venture with Shell International Exploration & Production BV. The new company, WellDynamics, will have offices in Aberdeen.

Above the mud line

Above the mud line, the industry has opted for a number for different development schemes in the Gulf of Mexico.

The Gulf of Mexico deepwater environment is one of the harshest in the world (Fig. 3). Hurricanes, loop currents, and potential development projects at great water depths are some factors that differentiate the technology required for the Gulf of Mexico from that installed in other deepwater areas.

One type of facility not yet in the Gulf of Mexico but common in other areas is the tanker-type, floating production, storage, and offloading (FPSO) vessel. These vessels may hold the key for economically developing more-marginal fields lying further away from the Gulf of Mexico infrastructure.

Produced oil would be stored in the hull of the FPSO and periodically offloaded to shuttle tankers for transport to ports in Texas and Louisiana.

MMS has an environmental impact study under way that may clarify the feasibility of FPSO installation in the gulf. The initial draft was expected to be ready by May 2000, with the final version to come in September or October 2000.

To about a 3,000-ft water depth, Gulf of Mexico operators have the possibility of using compliant towers, such as the one installed in 1,650 ft of water by Amerada Hess Corp. on its operated Baldpate field.

Another compliant tower in the Gulf of Mexico, Texaco Inc.'s Petronius-installed in 1,751 ft of water-is expected to go on stream in 2000. Production had been delayed because one production module was dropped during installation in 1999.

But most Gulf of Mexico deepwater operators have opted for one of three basic systems: TLPs; single-column floaters (deep-draft caissons or spars); or subsea completions connected to TLPs, spars, or fixed platforms in shallower water.

The Gulf of Mexico's only floating production system (FPS), which included a moored semisubmersible, Enserch Corp.'s operated Cooper field, was recently decommissioned.

While ExxonMobil's Hoover-Diana holds the Gulf of Mexico record for a production facility installed in the deepest water, the record for production from deepest water in the gulf comes from Shell's subsea Mensa development, in 5,300 ft of water, which is tied back to the shallow-water West Delta Block 143 platform by a 68-mile flowline. Mensa has been on production since 1997.

Ideally, long tie-backs to existing infrastructure or even to shore would be a solution for developing many deepwater fields with subsea completions.

With implementation of technologies such as subsea multiphase pumps or boosters, multiphase meters, compressors, and separators, the long tie-back option becomes more feasible and may eventually become a part of the schemes for developing deepwater Gulf of Mexico resources.

Several of these technologies have been installed or are being tested in other parts of the world.

The available working pressure rating of subsea systems has also increased, as seen by the deployment of the world's first 15,000-psi subsea tree, in the Gulf of Mexico's Gyrfalcon field, which lies in 880 ft of water.

Various studies have shown that the single-column floater can be designed to have large deck loads even in water depths of 10,000 ft. Oryx Energy Co. (now part of Kerr-McGee Corp.) installed the first such floating structure, Neptune, in 1,866 ft of water in the Gulf of Mexico. Two other spars have been installed in the Gulf of Mexico (BP Amoco's Genesis and ExxonMobil Corp.'s Diana-Hoover), and more are planned for both the Gulf of Mexico and other deepwater areas, such as West Africa and Brazil.

Kerr-McGee recently announced that it would be using two spars to develop the Boomvang and Nansen fields in 3,700 ft of water in the Gulf of Mexico.

With current designs, the TLP's tendon and deck weight become too heavy in water depths beyond about 5,000 ft. Mini-TLPs, with their lighter deck loads, may be practical to about 7,500-ft water depths. But the use of composite materials for risers, tendons, and decks may significantly decrease the weight of these structures, allowing them to be used in deeper water.

Reuse of floating vessels

One benefit of floating facilities, such as the TLP and single-column floater, is that they can be relocated once the initial producing field is depleted. For example, the first TLP built, Hutton, is now available for purchase and relocation.

Conoco UK Ltd. installed the Hutton TLP in 1984 in 486 ft of water in the UK sector of North Sea. Oryx became operator in 1994, and current owner Kerr-McGee plans to sell the TLP. The Hutton TLP will be available once production ceases in 2001.

Kerr-McGee indicates that, because Hutton was the first TLP built, its original design was very conservative, and the platform has survived a range of in-service environmental loads with no discernible problems. It sees the TLP as an attractive field development solution, providing accelerated development with low technical risk. Potential applications include use as a:

- TLP drilling and production facility.

- TLP in up to about 1,000 m of water.

- Catenary-moored production facility.

- Catenary-moored mobile drilling unit.

- Bottom-sitting submersible production platform.

With various mooring and foundation systems, the TLP suits a wide range of water depths and environmental conditions, and because the TLP is designed for open-ocean towing, it can be reused almost anywhere in the world, according to Kerr-McGee.

It lists some of the TLP's economic and technical advantages for other developments such as:

- Lower capital cost compared with new-build facilities.

- First oil 1-2 years before a new-build platform or FPSO.

- Reduced risk to cost and schedule.

- Fully certified with approved safety case.

- Documented maintenance and inspection history.

Kerr-McGee's experience to date indicates that a further 20 years of use could be reasonably expected and more than a 20-year life is possible, if the TLP is deployed in a more-benign environment.

Its studies show that it should be feasible to deploy the TLP in up to 900 m in the Gulf of Mexico without loss of load capacity. Deeper locations in the Gulf of Mexico would be feasible with adjustment to the TLP draft, which could be achieved by reducing weight or reducing production and drilling-riser loads-for example, fewer wells. Alternatively, additional buoyancy could be added to the TLP hull.

For more-benign locations, such as off West Africa and Brazil, Kerr-McGee believes water depths in excess of 1,000 m are feasible for the Hutton TLP.

Testing

Extensive testing is still required for most deepwater production components, because these components are mostly designed for a specific application. Even though some standardization exists, the number of installations of the same type is still not statistically sufficient to eliminate many testing requirements.

Physical testing is critical to ascertain criteria for deepwater offshore production facilities, but it can become expensive. In one planned test, the US Department of Energy and Texaco, representing the 22-company DeepStar project, built a 41/2-mile, 6-in. flow-assurance test loop at the Rocky Mountain Oilfield Testing Center (RMOTC) in Teapot Dome field near Casper, Wyo. (OGJ, Sept. 21, 1998).

DeepStar partners were interested in how and why gas hydrates and paraffins form in deepwater pipelines to create blockages in the lines. In the initial plans with DOE, DeepStar partners were to provide equipment, personnel, and funding, but no dollars would be exchanged.

According to RMOTC, about $4 million was spent on the facility, but when the estimated costs escalated to $10-16 million to finish the testing, the Deepstar partners decided to discontinue the program. One major additional cost was the compression to carry out the testing.

Currently the test loop is in place, and at this time, RMOTC is looking for companies who might want to run experiments in it.

Scale-model tests in large test tanks have been extensively used to analyze the loads experienced by floating production units. Physical tests, however, are expensive, and the methods currently used to scale up the test results are not particularly adequate for deepwater applications. So the industry is leaning more toward computational fluid dynamic models.

But additional investment is still being made for larger-model test tanks. Maritime Research Institute Netherlands (MARIN) is currently constructing a facility in the Netherlands to test offshore structures to a depth of 3,000 m.

According to Marin, a special feature of the new tank is its ability to implement current-wave interactions in a very controlled manner.

This first of three articles on overcoming deepwater technology challenges also introduces a new feature, OGJ Technology Insight, wherein OGJ editors who regularly cover certain industry segments will focus on key technological issues in their respective segments around the world.

This week, Production Editor Guntis Moritis focuses on how industry is tackling some deepwater technological challenges in the Gulf of Mexico. His subsequent articles on this topic will deal with industry's deepwater technology challenges off Brazil and West Africa.