Barite demand, prices to rebound by 2002

The demand for barite along with prices are expected to rebound by 2002 after falling in response to a decline in worldwide drilling activity spawned by low crude oil prices.

That is the conclusion of a study of global barite demand by Roskill Information Services Ltd., London.

Barite (BaSo4), with a specific gravity of 4.5, is primarily used as a weighting agent in drilling fluids, which accounts for over 85% of all barite demand. Other applications for barite include the manufacturing of barium chemicals and specialist filler uses, which together account for less than 1 million tonnes/year.

Production

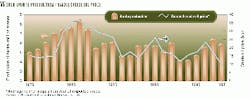

Over the past 2 decades, barite production has shown great fluctuation.

In 1981, barite production reached a record level of 8.5 million tonnes. Output declined through the mid-1980s, to less than 4.8 million tonnes/year in 1986-87. Production remained relatively stable before dropping to 4.3 million tonnes/year in 1993-94. Barite production increased during 1995-97 to 6.5 million tonnes/year, but output fell in 1998 to 6 million tonnes, showing the fallout from the financial crisis in Asia (see chart).

Of the 6 million tonnes of barite produced in 1998, China accounted for 3.3 million tonnes. The Former Soviet Union, India, Mexico, Morocco, Turkey, and the US together accounted for 26% of the total output, while the remainder was contributed by 30 other countries.

China's share of the barite market increased to 55% in 1998 from 16% in 1985. "This growth in production and market share has been set against a downward trend in barite demand and has resulted in the contraction of barite mining in other countries, most notably the US, and to a lesser extent, in the countries of the former USSR/CIS," Roskill said.

US barite production has suffered from increased competition from other, cheaper sources, primarily China and India. In 1981, US production of barite reached a peak of almost 2.6 million tonnes but in recent years has slipped to 500,000-750,000 tonnes/year.

Demand

Even though the drilling industry has yet to respond to the increase in crude oil prices that began in the latter half of 1999, improved market conditions should see a significant increase in the number of active rigs over the next 3 years, Roskill noted.

Roskill expects barite demand from drilling to undergo a similar increase, from about 5 million tonnes/year to 6 million tonnes/year by 2002.

There should also be evidence of upward price movements for barite, the consultant predicted. Prices for lump API-grade barite are expected to rise from the current depressed levels of $40-45/tonne CIF Gulf of Mexico to about $50-55/tonne.

Roskill noted that, in addition to the price of crude oil, there are a number of other factors that affect demand for barite in drilling fluids.

"The consumption of barite in water-based fluids is generally greater than for oil-based and synthetic-based fluids, because greater volumes of fluid are required to drill similar-depth wells in similar strata," it said.

New technical developments such as 3D seismic surveying have also contributed to the reduction of barite demand by providing a more accurate analysis of potential oil-bearing strata and thus reducing the number of exploratory wells drilled.