Gas the cornerstone of Venezuela's energy sector investment campaign

Natural gas forms the cornerstone of Venezuela's current efforts to attract foreign investment to its energy sector.

That is a dramatic turnabout from the situation of just a few years ago, when the government and state petroleum company Petroleos de Venezuela SA pushed for foreign investment to help the country quickly ramp up its oil production.

A change of government and of management at PDVSA has resulted in a decided shift in emphasis away from the oil initiatives (OGJ, Apr. 17, 2000, p. 25).

Venezuelan President Hugo Chávez Frias and his Energy and Mines Minister Al! Rodr!guez Araque have vowed to establish a strong natural gas industry in a country where most of the gas production currently is flared or reinjected to maintain reservoir pressure in oil fields.

Their aim is to make natural gas the foundation of a new wave of industrial development that will generate new, nonoil-dependent revenues and create thousands of new jobs in a nation that stands as a paradox: a majority of the population living in grinding poverty amid the richest oil reserves outside the Middle East.

Accomplishing this, according to the so-called Project Gas scheme, calls for development of Venezuela's 146 tcf of proven, mostly associated-gas reserves; exploration of Venezuela's vast potential nonassociated gas resources; expansion of the country's gas transmission pipeline infrastructure; implementation of new gas processing and NGL utilization projects; establishment of a national gas distribution grid; promotion of LNG-export and gas-to-liquids projects; and, consequently, implementation of power and petrochemical projects to be fed by natural gas.

Project Gas gets under way in earnest this month, when PDVSA unit PDVSA Gas unveils a tender for 10-15 gas-prospective blocks to be auctioned this summer to private foreign and domestic petroleum companies. PDVSA has estimated that these blocks could attract exploration and production investments totaling as much as $10 billion during the next 10 years.

Some analysts and prospective investors question the feasibility of such an ambitious agenda, claiming that Project Gas is more politically driven than market-driven. Their view is that interest in the gas E&P initiative will at first be reined by Venezuela's current lack of gas infrastructure and lack of potential end users-and by uncertainty over the country's volatile political climate. (Countrywide elections are slated for May 28, including a presidential race that has recently attracted a surprisingly strong opposition candidate. Political analysts in Caracas say that a Chávez defeat might also doom Project Gas.)

On the plus side, say proponents of Project Gas, is a new gas law that, at first glance, has created a promising climate for investment in the country's natural gas industry (OGJ, Apr. 10, 2000, p. 27).

In addressing concerns about infrastructure and end users, PDVSA also has undertaken these efforts:

- A tender for the first of a number of pipeline expansion projects. PDVSA Gas in February started work on a tender for a strategic partner to operate and expand the gas pipeline from the major gas producing center at Anaco to the petrochemical and industrial center at Jose on the coast at a cost of $120 million. The initial expansion would boost capacity to 800 MMcfd from the current 600 MMcfd. A second tender would involve operatorship and expansion of a gas pipeline from Barbacoas to Margarita Island at a cost of $80 million. Both pipeline project tenders are to be ready by July. Subsequent tenders are planned for the Anaco-Barquisimeto and the Anaco-Puerto Ordaz pipeline projects.

- The Pigap II high-pressure gas injection project, to be undertaken as a build-own-operate (BOO) project by a joint venture of Williams International Inc., Tulsa, and Production Operators Inc., Houston. This project entails gas compression services at 9,000 psi and subsequent reinjection, with a capacity of 1.2 bcfd and a cost of about $400 million.

- Pigap III, also a BOO project, which is being prepared for a tender. It also involves gas compression and could include the sale of the Pigap I facility, which PDVSA currently operates. Total capacity is pegged at 1 bcfd.

- Sercogas, being prepared for tender, which entails a multipackage gas compression program that would entail the sale of existing facilities and the construction, ownership, and operation of new facilities that essentially would cover all the gas compression needs of Venezuela's crude oil producing operations. Total cost of the program is put at $4 billion.

- Plans by PDVSA, Royal Dutch/ Shell, ExxonMobil Corp., and Mitsubishi Corp. to develop a $2 billion LNG project in northeastern Vene- zuela (OGJ, Apr. 3, 2000, p. 32). Project Venezuela Liquefied Natural Gas (PVLNG) will have a production capacity of about 4 million tonnes/year. The venture is a downsized version of the so-called Cristobal Colon project, which called for an investment of more than $5 billion and an estimated output capacity of as much as 6 million tonnes; it was shelved over poor economics. The new, smaller-scale PVLNG will tap gas reserves in the Gulf of Paria, off Venezuela's northeastern coast in the Caribbean Sea. It is expected to go on stream with its first exports in 2005 to markets in the Caribbean and the US East Coast.

- A proposal by Enron Corp. to build a single-train LNG export plant, with capacity of 2 million tonnes/year, at Jose. The project would cost $700 million and target the US market and possibly Puerto Rico, where Enron has an LNG receiving terminal. If construction were to get under way this year, the project could be ready for start-up of exports in 2004.

- A feasibility study of a proposed gas-to-liquids (GTL) plant at Jose. Ray- theon Engineers & Constructors is conducting the study for PDVSA Gas, which is expected to be completed and reviewed this spring. It focuses on a GTL plant with capacity of as much as 15,000 b/d. The study, expected to cost more than $300,000, is being conducted under the auspices of the US Trade and Development Agency. PDVSA Gas is considering committing as much as 4 tcf of Venezuela's natural gas reserves to a GTL project that would produce ultimately a high-ce- tane diesel fuel that it can sell or blend with parent PDVSA's low-cetane die- sel.

In addition, at least one major US company is venturing early into Venezuela's natural gas fray. Coastal Corp. unit Coastal Gas International Ventures Inc. and state utility Corp. Electricidad de Caracas CA recently signed a letter of intent to negotiate a joint bidding agreement regarding natural gas projects PDVSA will tender in Venezuela.

PDVSA Gas

PDVSA Gas has its roots in the prenationalization days of PDVSA predecessor Corp. Venezolana del Petr

The subsidiary was created in 1997 following a major restructuring of PDVSA. It was set up to manage PDVSA's natural gas business from wellhead to burnertip.

In its first 2 years, PDVSA Gas focused on transporting, distributing, and marketing natural gas to residential, commercial, and industrial consumers and on recovering NGL and marketing the gas liquids to private distributors for domestic sales and to large-scale users such as refiners and petrochemical plants, with the remainder exported.

PDVSA last year created a new Gas Division within its Oil & Gas unit, to which PDVSA Gas will report. This division is charged with developing and planning potential business opportunities along the gas value chain, including E&P, gathering, processing, transportation, industrialization, distribution, and domestic and international marketing of natural gas and its by-products.

Chief among those by-products are ethane, propane, butanes, and natural naphthas that are mostly marketed domestically-66% of total volume in 1998-as petrochemical feedstock and as LPG fuel. The remainder, mainly propane, is exported. PDVSA Gas operates installed gas processing capacity of 4.023 bcfd and recovers and fractionates 254,000 b/d of NGL.

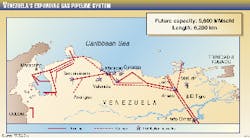

Venezuela's natural gas transmission pipeline system comprises 2,600 km of 4-36-in. pipeline with a combined total capacity of about 5.6 bcfd. About 1,500 industrial and 460,000 residential and commercial customers receive gas through a 5,000-km gas distribution system.

Because PDVSA Gas has shifted its emphasis from operations to marketing and its main goal to expansion of the natural gas business in Venezuela through partnerships along the gas value chain, the unit has created two groups internally to reflect the new business approach: an operational group consisting of Natural Gas Liquids and Methane Gas and a Business Development group focused on business with third parties.

Gas initiative

Venezuela's gas initiative centers on expanding both supply of and demand for natural gas in the country and bolstering the natural gas share in the domestic energy mix.

An earlier priority on hydroelectric power development is being scrapped because hydro now is seen as incapable of meeting Venezuela's future power needs. Hydro currently accounts for 32% of the country's primary energy consumption.

Liquid fuels account for 26% of Venezuela's energy mix, mainly as motor fuels and LPG for residential cooking. Venezuela exports sizable volumes of both.

"Given the characteristics of our primary energy matrix," said PDVSA, "the logical conclusion is to undertake a vigorous private and public investment program to meet the growing national demand for energy in the short, medium, and long term, where natural gas must play the leading role.

"With domestic liquid fuel prices rising, more infrastructure will be needed to make gas available to areas not served today, in view of the growing price differential compared with other sources of energy."

PDVSA Gas is undertaking this initiative amid projections that Vene- zuela's gas market will grow by a rate of 7%/year, reflecting a more-than-twofold increase in gas demand by 2009, and that NGL demand-currently absorbed almost entirely by a rapidly growing petrochemical sector-will continue to soar.

With that in mind, PDVSA has laid out these strategic objectives:

- To promote E&P of nonassociated gas through the participation of private-sector investment.

- To develop the Anaco gas producing complex to maximize use of Venezuelan gas resources and ensure enough supply of gas to respond to market opportunities and seasonal swings in domestic consumption.

- To seek and promote commercial uses of gas resources in fields operated by PDVSA E&P through its own efforts and through operating agreements with private companies.

- To foster new opportunities for NGLs and their optimum extraction by promoting the segregation of wet gas streams.

- To promote the horizontal and vertical expansion of the gas transmission and distribution infrastructure in Venezuela and to develop a balanced commercial portfolio in keeping with a mandate to promote a free market and the infusion of private capital.

- To develop new business opportunities to position Venezuela in the Atlantic Basin natural gas trade.

Accordingly, PDVSA Gas is seeking joint-venture partners and other cooperative arrangements in efforts to accelerate E&P for nonassociated gas; spur expansion of the gas grid, mainly domestically, but also with an eye to export opportunities; foster increases in gas processing and NGL fractionation; promote development of LNG exports; establish a presence in gas and gas by-products trading; and back development of GTL projects.

These business arrangements can include E&P operating partnerships and agreements; accords to build and/or operate facilities under ownership, lease, or transfer-of-assets schemes; partnering agreements and JVs with varying levels of participation; purchase or sale of feedstock; and investment in processing or fractionation plants or in transportation and distribution infrastructure to market gas locally or abroad.

Gas E&P

Venezuela's total gas resource is estimated at 227 tcf, of which the 146 tcf of proven reserves places the country No. 1 in Latin America and No. 7 worldwide.

Because the vast majority-91%-of Venezuela's proven natural gas reserves is associated gas, gas supply availability must depend heavily on levels of crude oil production, which, in turn, are sensitive to oil prices, Organization of Petroleum Exporting Countries quotas, and other geopolitical and market considerations.

So PDVSA Gas is charged with creating the optimum opportunity for foreign investment in exploration and production of nonassociated gas. Currently, all Venezuelan gas production is associated gas, and only a modest exploratory program has targeted nonassociated gas.

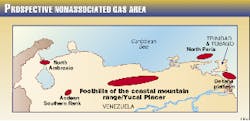

This summer's E&P tender will involve 10-15 blocks in five main areas (Fig. 2): the Deltana platform and Gulf of Paria, both in the eastern offshore; the Yucal Placer region in the coastal foothills of north-central Venezuela; and the northern Maracaibo (North Ambrosio) and Andean southern flank, both in western Venezuela. The pro- spectiveness ranges from areas that are minimally explored to areas that have infrastructure and substantial existing reserves.

The acreage involved in the first tender is expected to cover more than 12,000 sq km in about 8-12 prospective areas close to existing infrastructure and markets.

PDVSA will open a data room this month, followed by road shows in Houston, London, and other cities this spring and summer. Winning bidders will be announced in August, and final contracts are expected to be signed in October.

While natural gas may not have as strong an appeal for foreign investors as does oil in Venezuela, the terms for gas E&P are certainly more attractive. Under Venezuela's new gas law, the tax take on natural gas production is 34%, vs. 67% for oil; however, the gas royalty could go as high as 20%, vs. 16.7% for oil.

Infrastructure

Efforts to bolster Venezuela's gas infrastructure focus on expansion of the country's major gas transmission pipelines and the creation of regional local distribution grids.

PDVSA Gas expects the transmission pipeline expansions could absorb as much as $800 million-1 billion over the next 10 years (Fig. 3).

In addition to expansions of existing systems, PDVSA Gas sees opportunities for new grassroots transmission lines to areas currently being supplied mostly with other energy sources: "At the moment," it said, "the San Carlos-Margarita-Barinas and Cuman

To undertake these projects, the company envisions the creation of transportation companies through JVs in which PDVSA Gas would take a minority stake represented by an initial contribution comparable to the value of the existing business. The JV would be responsible for operating and maintaining the transportation system and then gradually expanding it with capital provided by the PDVSA Gas partner.

On the gas distribution side, the emphasis will be on expanding existing grids, especially with regard to commercial and residential users outside Caracas, Maracaibo, Puerto La Cruz, and El Tigre. Gas distribution in Venezuela is now mostly limited to the industrial zones in the largest cities along the routes of the main transmission lines: Anaco-Barquisimeto, Ana- co-Jose, and Anaco-Puerto Ordaz.

Offering significant opportunities for new local gas distribution companies (LDCs) are the cities of Maracay, Valencia, Barquisimeto, Maturin, and Puerto Ordaz.

PDVSA wants to promote the creation of LDCs that would bid for certain geographical regions (Fig. 4) and then take over operatorship of any existing distribution grids. Each LDC would then be obliged to develop its region's maximum potential, including undeveloped sectors. The LDCs would enter into supply contracts with PDVSA Gas-or later, with other producers-and sign transportation agreements with the respective transmission pipeline entities.

PDVSA Gas sees the LDC market potential being leveraged from the foundation of industrial demand in existing grids to expand into nontraditional uses of gas, such as for air conditioning.

Overall, PDVSA Gas sees a bright future for foreign investment in Venezuela's natural gas industry:

"The range of opportunities is vast and enormously attractive for experienced operators and specialized investors seeking to expand their activities on a sound footing, in a market evidently undergoing rapid expansion, where the legal and fiscal rules of the game are clear-cut and the availability of ample gas reserves is growing."