Recovery widespread for petrochemicals

The petrochemical and plastics industry "remains on the road to recovery," with a potential return to profitability in 2001 as its global surplus is absorbed, said Gary K. Adams, president of Chemical Market Associates Inc., at the firm's recent World Petrochemical Conference in Houston.

That recovery is being driven by increased demand from an expanding world economy that "can continue indefinitely" if someone doesn't mess it up, said Arved Teleki, CMAI's chief economist.

"At the dawn of a new decade and of a new century, the state of the world economy is good. The outlook for the next 5 years is excellent," Teleki said.

However, he cautioned, "Economic expansions do not die of old age. Typically, they are killed by policy mistakes."

World oil prices and government monetary policies are two primary concerns facing the petrochemical industry. Recent oil prices have been high enough and erratic enough to start damaging the world economy, Teleki said.

Because it's a big user of oil and gas as both fuel and feedstock, the petrochemical industry takes a double whammy from high energy prices and is distracted by price uncertainty, he said.

But with OPEC's recent decision to increase production, the upward cycle of oil prices has run its course and will correct this year, says Bill Sanderson, president of Purvin & Gertz. Still, he expects oil prices to remain strong beyond 2000 as long-term balances tighten.

Successful interaction of central banks, governments, and business communities effectively contained the financial panic of 1997-99. But it's not yet known if that combination can manage the current technology revolution and keep the economic expansion going long-term, Teleki said.

Meanwhile, effects of the recent monetary crises in Asia, South America, and Russia have subsided, and global economic growth of at least 3%/year is expected through 2001. By 2002, North America will be expanding more vigorously, and strong world growth will reassert itself, with all regions participating, says Teleki. "By 2003, growth of over 3.5%/year is projected, which was last seen in the late 1980s," he said.

However, Adams remains concerned about a possible relapse of Asian countries that were hit hard by the previous financial crisis. Continuing high oil prices would slow their recovery, he said.

How is the petrochemical industry faring in this economic landscape? Adams set the stage for other speakers to answer that question by describing the overall capacity situation.

Global petrochemical and plastics producers reinvested their 1994-96 earnings to add almost 30 million tonnes of production in 1997 and nearly 25 million tonnes of new capacity in 1998, he said. Adams sees the pace of capacity additions slowing to 10-12 million tonnes/year in 2002-04.

US olefins supply

The past year was a good one for ethylene producers. As a result of unplanned outages, US ethylene margins peaked at the end of 1999.

High crude oil costs, however, took their toll on ethylene production costs. Variable costs went up 6-8¢/lb in the last part of 1999. In the past week, feedstock prices have declined, however. "It looks like it's at least past its first peak," said Earl Armstrong, managing director of DeWitt & Co. Inc., Houston, at a press conference before the firm's annual World Petrochemical Review. "I guess the question is whether or not it goes down or whether it bounces and goes up again."

DeWitt expects operating rates above 95% for US steam crackers through September of this year (Fig. 1). Rates are expected to fall to 94% in October as a result of cost pressures and new capacity.

High crude prices have also negatively affected US propylene supply, which is short. "As a matter of fact," pointed out Armstrong, "it is extremely difficult to buy a pound of spot material; it's hard to find any trades-there haven't been any down in the chemical grade in months."

Although there are refinery supplies available, Armstrong explained, crude price increases have made the price of refinery alternatives so expensive that the chemicals' market envelope has not been able to catch up. "So there's not enough incentive there to move product fromellipsea distant refinery that may have been used in the past during tight supply situations to market in the Gulf Coast."

US ethylene merchant market

A key structural change in the ethylene market is the shrinking of the merchant market, said Armstrong at the DeWitt press conference. The result of this constricting merchant market is that the price of ethylene depends less on negotiation and more on logic and formula.

Armstrong estimates that 43% of the total ethylene supply was sold to merchant markets in the late 1980s. In 1990, that number increased to 29%. In the near future, only 24% of the derivatives will be supported by merchant supply, pending two chemical mergers: Dow Chemical Co. with Union Carbide Corp. and the chemicals unit of Chevron Corp. with that of Phillips Petroleum Co.

If Dow and Union Carbide merge, Armstrong believes that Dow will follow its past culture of self-sufficiency and build another ethylene plant to make up for Union Carbide's 1 billion lb shortness on ethylene. This move would remove 2% of US ethylene supply from the merchant market.

The chemicals joint venture between Chevron and Phillips will balance the two companies' ethylene supply. Chevron is about 2 billion lb short; Phillips is about 2 billion lb long. Thus, the merger will remove about 2 billion lb, or another 4%, from the merchant market.

More world capacity

In the next 3 years, a surge in capacity will come from the Middle East. The Middle East has wisely targeted its exports to Asia-primarily to China-although some of this new capacity is likely to drift to Western Europe.

Although there has been a significant amount of new Southeast Asian olefins capacity added in the past year, Rick Coles, a vice-president in DeWitt's Sydney office, pointed out that there is little new expansion on the horizon. Exxon will complete its cracker in Singapore later this year, as will Formosa Petrochemical Corp. in Mailiao, Taiwan. Beyond that, Petronas has an ethane cracker and propane dehydrogenation unit in Kertih, Malaysia, scheduled for completion in 2002.

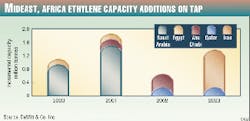

During 2000-03, the Middle East's and Egypt's ethylene capacity will increase by 5 million tonnes/year (t/y), estimates Peter Jordan, senior vice-president of DeWitt, Rowledge, UK. Saudi Arabia alone will provide another 1.5 million t/y of propylene capacity.

Fig. 2 shows incremental ethylene capacity to be added during these 4 years. Saudi Arabia's Yanpet 2, Petrokemya 3, and Kemya ethylene plants and Egyptian Petrochemical's Alexandria plant will come on stream this year. Borouge Pte. Ltd. is expected to commission its Ruwais, Abu Dhabi, unit in 2001. And Iran's National Petrochemical Co. should complete its Bandar Imam Olefins 6 and 7 units by 2004.

Both the Middle East and Asia will be competing to gain China's import market.

"There's a lot of concern about maintaining market share," said Coles at the press meeting, "and that starts to worry me, because then you wonder whether Asia's going to try and outdo the Middle East."

"The imminent expansion of Middle Eastern capacityellipseis viewed with suspicion and dismay by some established Asian producers," explained Coles during the conference. "There is a risk that the perceived dangers of Middle Eastern expansion into what are considered 'home markets' may spur an uncontrolled desire to expand Asian capacity."

Although China would like to be 75% self-sufficient, it canceled several plans for increased olefins capacity. China originally intended to expand its capacity in three phases: foreign joint ventures, large-scale expansions, and modest-scale expansions.

Of these three methods, only the modest expansion via debottlenecking of existing crackers is being done today. The slow and burdensome Chinese legal system indefinitely suspended the idea of new foreign joint-venture plants. Although large-scale expansions would have added 2.2 million t/y of capacity in China by 2002, the country found that it could not afford to debottleneck almost all of its crackers.

Thus, China was left with a modest debottlenecking project, said Coles, that consisted of expanding three of China's largest crackers:

- Yangzi Petrochemicals near Nanjing to 650,000 t/y.

- Shanghai Petrochemicals at Jinshan, Shanghai to 700,000 t/y.

- Yanshan Petrochemicals near Beijing to 600,000 t/y.

Given that only the modest expansion project will likely come to fruition, a 2.8 million lb deficit in olefins supply will occur in 2005. (Estimated demand in 2005 was based on 10%/year growth and 50% ethylene self-sufficiency.)

As Asian markets recover, countries such as Thailand and South Korea, which have been exporting 50% of their production, will divert some of these exports to their own domestic demand, thus worsening China's position. The Middle East is poised to fill this supply gap.

Although there is little Middle East product in Europe, this is already beginning to change, said Jordan. If there's not enough room for Middle Eastern products in China, they will be sent to Western Europe.

Although there is some room in Western Europe for imports, it is limited. In the future, DeWitt expects net ethylene imports for Western Europe to be about 150,000 t/y, not much different from 135,000 t/y in 1999.

DeWitt estimates propylene imports will increase from about 200,000 t/y today to 350,000 t/y in 2003.

"This is already beginning to worryellipseEuropean producers," said Jordan. "European producers are...super-conscious of their market shares."

Surprises

The two biggest surprises during the past year were South Korea's economic recovery and Russia's petrochemical production increase, says Coles.

He described South Korea's recovery as "astonishing."

In 1998, South Korea's gross domestic product declined by 5.8%, and in 1999, it grew by 12.8%.

"Korea has gone from being one of the world's worst economies to one of the world's best economies in 12 months," he said. Its recovery "has a big impact on the olefins business because in 1998, Korea was exporting some productsellipseat prices more than 50% below its manufacture on some products-polypropylene for example; PVC's another one."

Russia devalued the ruble in 1998, which boosted its economy by helping exports and clamping imports, said Jordan. Production of most Russian petrochemicals increased last year by 40%. "It doesn't mean...that the Russian petrochemical plant is in good shape, or that profitability is good," said Jordan. "Because even a 40% increase for many plants brought up operating rates to maybe 50-60%."

But that growth is still "phenomenal" for Russia, he added.