US, Canadian gas markets to remain strong

North American natural gas prices, supply, and demand should remain strong through this year, said a full spectrum of industry representatives in response to Ziff Energy Group's second annual gas industry outlook survey.

But the survey also signaled that expectations "may not all be moving in the same direction" among various segments of the industry, said Paul Ziff, chief executive of Ziff Energy, at the start of a 2-day North American Gas Strategies Conference sponsored by his firm in Houston earlier this month.

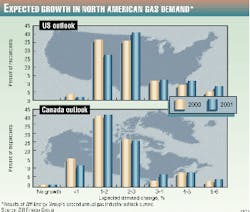

"The growth in gas production expectations outstrips the expected growth in gas demand [see chart]. This is surprising, because current NYMEX and AECO forward prices are quite high, suggesting a possible supply shortfall," Ziff Energy officials reported.

"While price expectations are higher in this survey," said the firm, "respondents are more comfortable about gas competitiveness under these price expectations than they were last year."

The 144 total respondents to the survey represented 124 companies, including 65 US and 59 Canadian firms. That's up from 79 participating companies in the initial survey last year.

"The survey is designed to provide an integrated description of the North American gas industry from wellhead to burnertip," said Ziff. Among the companies represented were producers, midstream operators, marketers, pipelines, end users, and local distribution companies.

Prices, sales

Of the 124 US and Canadian companies that responded to the energy consulting firm's survey during February and March, 54% said New York Mercantile Exchange gas futures prices should close out this year at $2.73-3.13/MMbtu, while 40% predicted yearend prices will exceed $3.13/MMbtu.

More than 90% of the respondents expect the base differential between Canadian and Gulf Coast gas to remain less than 40¢/MMbtu for the next 2 years, including one third who expect the differential to narrow to less than 20¢/MMbtu.

Industry officials don't believe high prices will blunt the competitive edge of gas in the market. More than 75% of the respondents said burnertip prices would have to exceed $3.50/MMbtu before gas loses ground to competing fuels for electric generation. That's 50¢/MMbtu higher than was predicted in last year's survey.

Almost all of the respondents expect North American gas sales will grow at least 2%/year through 2001, although producers were more conservative in their estimates than other groups, and Canadians were more bearish than US respondents.

More than half of the respondents said gas sales for electricity generation should increase an average 2-4%/year, or 200-400 bcf, to as much as 6.8 tcf in 2004.

Another 38%-including 43% of the US respondents-were even more bullish, predicting growth will exceed 4%/year. Again, producers were more conservative, with only 26% expecting a growth rate greater than 4%.

Supply, decline rates

Producers were more optimistic about the growth of gas supply than demand, with 70% of the Canadians and 54% of the US producers expecting to increase their gas output by at least 5% this year. In fact, 25% of the Canadians and 19% of the US producers said they expect to increase production by more than 15% this year.

That's despite a bimodal distribution of expected decline rates from onshore gas production, with one group of US and Canadian producers predicting declines of as much as 15% this year and another expecting declines of 20-25%. In the Gulf of Mexico, half of the offshore producers reported decline rates exceeding 25%, while the other half had decline rates of 15-25%.

Most producers expect to increase spending on gas operations by more than 5%/year through 2001, with about a third planning spending increases of more than 15%.

Those surveyed said a return to low gas prices is the most likely obstacle to increasing North American gas production by more than 10% over the next 10 years. Other potential obstacles, in order of importance, include: land access restrictions, low oil prices, sluggish demand, more stringent environmental regulations, and lack of processing and pipeline capacity.

However, inadequate gas supply was listed by respondents as the biggest potential challenge to future expansion of North American pipeline capacity. Low basis differentials and price volatility are the next two major concerns, in that order.

Canadian exports

Almost half of the respondents expect net Canadian gas exports to grow by as much as 700 MMcfd in 2001, while a third see exports increasing by as much as 900 MMcfd.

That won't be enough to fill the 1.3 bcfd capacity of the Alliance Pipeline when it comes on stream in the last quarter of this year. That pipeline will likely divert some existing gas supplies from other transportation systems in Western Canada, however.

Three fourths of the survey respondents expect Alliance to reduce NYMEX prices less than 10¢/MMbtu during its first full year of operation in 2001, while 22% expect a price decline of 10-20¢/MMbtu.

"Interestingly, Canadian respondents expect lower net export growth than US respondents do," said Ziff Energy. Canadians also expect a smaller price impact from Alliance.