PDVSA projects $53 billion in outlays for 10-year plan

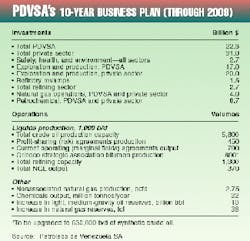

Petroleos de Venezuela SA has unveiled its latest 10-year business plan, which calls for capital outlays of over $53 billion.

The plan would almost double the Venezuelan state oil company's crude oil production and boost its exports of oil to the US.

In keeping with a mandate from the administration of Venezuelan President Hugh Chávez, the goal of the overall plan is to strengthen and enhance PDVSA's role both in the world energy market and in the economic development of Venezuela. The latter was a key point of the Chávez platform when he was running for president in 1998.

More than half the expected investment will come from the private sector, at about $31 billion (see table).

"Not only is foreign capital welcomed in our natural gas and petrochemical business, among others, but we expect to encourage strong involvement from the Venezuelan private sector as well," said PDVSA Pres. Hector Ciavaldini. "The use of private capital will have the dual benefit of increasing PDVSA's long-term profitability and the Venezuelan economy as a whole."

Production capacity

Chief among the details in PDVSA's 10-year plan is the latest target for increasing crude production capacity, which represents a scaleback from PDVSA's plans prior to Chávez's election.

Focusing on light and medium-gravity crudes, PDVSA targets a hike in production capacity to 5.8 million b/d by 2009 from the current level of 3.56 million b/d. Prior to Chávez's election, PDVSA had targeted production capacity of 6.6 million b/d by 2006.

With that earlier, more ambitious production target and a hitherto greater willingness to exceed its production quota as a member of the Organization of Petroleum Exporting Countries, Venezuela had often been at odds with some of the other key players within OPEC.

Since the Ministry of Energy and Mines under Minister Ali Rodríguez Araque took charge of oil policy-which had essentially been implemented on a de facto basis by PDVSA in the latter half of the 1990s, before the Chávez regime took office-Venezuela's star has since risen within OPEC. Rodríguez was named OPEC president at the last meeting, and the country has been instrumental in hammering out a series of production cut accords that caused oil prices to nearly triple in the past year (OGJ, Apr. 10, 2000, p. 37).

Other expansion plans

During the next 10 years, the state company also expects that it and private-sector firms will boost Venezuela's proven crude oil reserves of 76.8 billion bbl by another 10 billion bbl.

PDVSA has an especially ambitious target for production of Orimulsion, its proprietary boiler fuel consisting of extra-heavy Orinoco oil belt crude, water, and a surfactant that is meant to compete with coal in fueling power plants; production capacity is projected to jump to 20 million tonnes/year in 2009 from the current level of 5 million tonnes/year.

Also following an administration mandate, PDVSA has sharpened the focus on natural gas as a preferred area for foreign investment and as a cornerstone of efforts to diversify the economy. Development of gas resources in Venezuela will be funded mainly by private capital, the company said.

In addition to a projected 27% increase in natural gas reserves, PDVSA expects to double output of NGL and to develop gas exports totaling 1 bcfd-mainly through a new LNG export project on the Gulf of Paria (OGJ, Apr. 3, 2000, p. 32).

On the downstream side, the emphasis will increasingly be on export of finished products, especially for petrochemicals.

PDVSA plans for an increase of 200,000 b/d in total refining capacity to 1.3 million b/d. More than half of the projected $2.7 billion in outlays for this sector will be directed toward meeting more-stringent environmental requirements both domestically and in the US, PDVSA's primary export market.

The expansion of Venezuela's natural gas and refining sectors also will help PDVSA increase its production of petrochemicals. In all, the production of fertilizers, methanol, plastics, oxygenates, and aromatics will more than double.

PDVSA is placing special emphasis on the role of private capital in the expansion of its natural gas, Orimulsion, and petrochemicals businesses.

PDVSA status

PDVSA earned $24 billion in 1999, buoyed by a 20% cut in operating costs in addition to the surge in oil prices.

The state company cited as sources of the operating cuts changes in contracting practices, rationalization of operations, improvements in business processes, disposal of nonproductive assets, and optimization of its labor force. PDVSA reduced its senior management positions to 60 from 120.

PDVSA claims the sixth largest proven oil reserves in the world and the biggest reserves outside the Middle East. It ranks third in terms of refining capacity and fourth in oil production capacity.

The state company accounts for 78% of Venezuela's export revenues, 57% of fiscal revenues, and 26% of gross domestic product.

As Venezuela's largest customer, the US imports about 528 million bbl/year of crude oil and refined products-or about 14% of total US oil imports. PDVSA, in turn, has budgeted $470 million for the purchase of goods and services in the US; its investments in the US total $5 billion, including Tulsa-based Citgo Petroleum Corp., one of the biggest US refiners and the largest gasoline retailer in the US.

More than 59 foreign oil and petrochemical companies have investments in the Venezuelan oil sector.