Cost reductions yet to pull refiners out of doldrums

WORLDWIDE REVIEW-Conclusion

Weak demand for oil in spring 1998 reduced margins for the refining industry to record low levels in 1999.

This article, based on a study published by IFP in December 1999, documents the effects of the crash on industry investment. After a difficult period, investment levels for the upstream oil industry will recover in 2000. Investment in the refining sector, on the other hand, suffered in 1998 and 1999 and will remain low in 2000.

This is the third and concluding article in a series documenting the worldwide activity in the oil and gas industry in the past 2 years.

The first article covers the exploration and production sectors. The second article summarized drilling activity around the world. This article covers the refining sector in terms of its oil consumption, future investments, and the adjacent catalyst industry.

Numbers in this article do not take into account former centrally planned economy countries for which estimates of expenses and levels of activity are difficult to figure.

Economic context

The slower international economic activity recorded in 1998 in every region of the world was a direct and basic cause of the weak growth in oil consumption (+0.5 million b/d). The International Energy Agency, Paris, projects an increase of 1 million b/d demand in 1999.

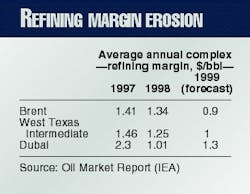

Slowed demand weighed heavily on the refining industry, particularly in Asia. Eroding refining margins, accentuated in different areas, since the start of 1998 (Table 1) illustrate the great volatility of the market, particularly evident in Europe, the US, and Singapore.

The spectacular recovery of oil prices in 1999 has aggravated the situation. Refining margins in Europe dropped by about 50% in the first half of the year.

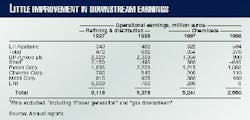

In this depressed context, it is not surprising that the financial results of the downstream sector of the big oil companies did not experience any significant improvement (+2.9%), despite the continued policies of reducing costs and gains in productivity (Table 2).

Compared with the first half of 1998, the results published by companies for the first half of 1999 were worse for the refining and distribution sector: Shell (-30%), BP-Amoco (-33%), Totalfina (now, Totalfina Elf ; -30%), Exxon (now, ExxonMobil; -70%), and Chevron (-27%).

The extent of the Asian crisis had an even greater impact on the petrochemicals sector. The overall mid-1999 results from big companies were down by 49% from 1997.

Faced with this breakdown in the economic environment, the oil industry was marked by several wide-scale mergers and acquisitions:

- The Exxon-Mobil merger, creating a world leader. This new company redefined the BP-Mobil joint venture in refining and distribution in Europe.

- The pending purchase of ARCO by BP-Amoco.

- The merger of Total and Petrofina, then the takeover bid of this group on Elf Aquitaine, which gives rise to the fourth largest group in the world.

- The continued development of independent refiners in the US (such as Ultramar Diamond Shamrock Corp., San Antonio, and Clark USA Inc., St. Louis).

- Restructuring in Japan (such as Japan Energy Corp., Showa Shell Co., Nippon Oil Co., and Mitsubishi Oil Co.).

Environmental regulations on emissions and product quality heavily influence the investment policy of refining companies. Future compliance with sulfur-reduction standards will require new or modified hydrotreating equipment in the European Union in 2005 and in the US in 2004 (OGJ, Jan. 3, 2000, p. 26).

Growth in oil consumption, which will stimulate increased investments, will remain weak, particularly in Asia, until the area's economy has recovered. India, however, has posted ambitious refining development objectives. Indian Oil Corp. Ltd. plans to double its capacity by 2005.

Finally, the plans announced by some oil companies to expand their fields of action to the production of electricity could present refineries with an economic solution to eliminate the heavy sulfur residues produced by gasification: several projects in the US, Europe, and Asia are actually under way or under discussion.

Investments in the refining industry

The Asian crisis and the average level of refining margins slowed the construction of new refineries. Overall, worldwide refining capacity only slightly increased between 1998 and 1999, from 79.9 million b/d to 80.4 million b/d.

A large part of the investments by refining companies contribute to increasing conversion capacities, revamping existing units, maintaining operations, and paying for catalyst costs. Although these costs may not directly contribute to increasing crude-distillation capacity, they maintain or improve the product quality or the product slate.

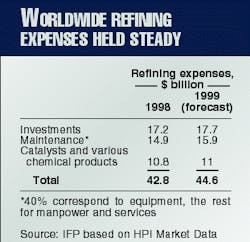

Table 3 shows that 1999 did not differ from 1998 much in terms of worldwide expenses by the refining industry.

Beyond 1999, IFP expects an increase in investments in Western Europe equivalent to 20% of the world refining capacity between 2000 and 2005. These investments will be timed with scheduled compliance with regulations on air quality (fuels and combustibles).

Initial estimates for European investments made by the various organizations range from $4 to $5 billion.

Catalyst market

In 1998, the worldwide petroleum catalyst market rose to $10.2 billion. This market consists of four major sections: refining (22%), polymers (16%), chemicals (29%), and the environment (33%, including precious metals).

About 90% of the environmental sector is made of activities linked to controlling automobile pollution. It is the most dynamic section as a result of the generalized and progressive introduction of emission controls for cars and the development of new catalyst-based technologies (for example, particle filters, de-NOx systems, etc.).

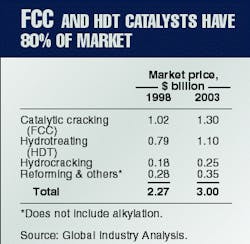

The refining catalyst market was worth more than $2.2 billion (product sales) in 1998. During 1998, competition in the refining catalyst increased among the big manufacturers. In the coming years, these manufacturers will adapt to the consequences of massive restructuring operations by oil companies.

Oil companies are outsourcing and demanding more integrated services from service companies. Also, they are reducing internal costs, a trend that puts a steady pressure on prices. The catalyst industry will restructure itself and increase its technological offer to meet the changing needs of their customers.

Fluid catalytic cracking (FCC) and hydrotreating catalysts are the leading products with 80% of the market in 1998 (Table 4). They will continue to be important commercial products, given the new constraints on the quality of gas and diesel, which will require the performance improvements in these refining units.

For hydrotreating catalysts, the market is roughly divided among Criteron Catalyst Co. (35%), Akzo Nobel (30%), Haldor-Topsøe (15%), Synetix (10%), and Procatalyse (10%). For FCC catalysts, the market consists of Grace (41%), Akzo Nobel (27%), and Engelhard (29%).

Akzo Nobel and Haldor-Topsoe are commercially very aggressive, primarily in Europe, where the 2005 standards on fuel will impose a broad-scale renewal of catalysts in place.