OPEC to boost production, correct market

Nine members of the Organization of Petroleum Exporting Countries voted at their meeting last week in Vienna to increase the group's production by 1.45 million b/d effective Apr. 1. The action returns the nine nations to the total 21.069 million b/d they were allowed to produce before they reduced output a year ago (OGJ, Mar. 29, 1999, p. 18).

Iran, the 10th OPEC member involved in the proposal, fought the export increase and did not vote for it. But it plans to increase exports anyway, to maintain market share. That would increase total OPEC output, excluding Iraq, by about 1.7 million b/d to 24.7 million b/d.

World oil prices have more than doubled from a year ago, reaching a 9-year high in March, which prompted the US to lobby OPEC nations to boost supplies.

Before the Vienna meeting, the US Energy Information Administration had said OPEC members, excluding Iraq, needed to raise output 2 million b/d to about 26 million b/d (a figure that includes current production over quota) to bring oil prices back to about $21/bbl. The International Energy Agency had estimated that 2.3 million b/d was needed to meet rising demand and return oil inventories to the average seen in much of the past decade.

US Energy Sec. Bill Richardson has praised the OPEC increase, although it is less than the US wanted.

He said, "We are anticipating additional barrels from other oil producing nations, additional leakage over the quota levels, and increased production from Iraq."

If the nine nations, plus Iran, increase output by 1.7 million b/d, and other nations add an expected 400,000 b/d or more, world supplies would be close to the levels EIA and IEA said were needed.

US President Bill Clinton said, "These increases will help sustain worldwide economic growth and provide greater balance between oil supply and demand."

But Vahan Zanoyan, president of Petroleum Finance Co., Washington, DC, said the production increase will reduce upward pressure on US oil prices but won't preclude the risk of gasoline price spikes this summer.

After the OPEC agreement, crude oil for May delivery fell to $27.09/bbl on the New York Mercantile Ex- change Mar. 28, a decline of 70¢ on the day and the lowest settling price since Jan. 13. On Mar. 29, Brent for May delivery was trading on the International Petroleum Exchange in London at $24.60/bbl, down 91¢ from Tuesday's close.

Brokers said that, overall, the market saw the OPEC move as slightly bearish. They generally expect prices to stabilize at about $25/bbl before long.

Traders also noted that, in large part, expectations of a production increase had already been factored into current futures values before the OPEC decision was handed down. Overall, they don't expect prices to fall much further as a result of the new agreement.

Agreement

Saudi Arabia brokered the OPEC agreement during a meeting in ViennaMar. 27-28. It had to persuade nations like Algeria, Libya, and Indonesia to join the agreement. These countries have little to gain from quota increases because, if higher global oil production forces prices down, they have less ability to make up for reduced oil revenues by increasing output.

OPEC Sec. Gen. Rilwanu Lukman said that, including Iran, the 10 OPEC nations may produce about 24.7 million b/d under the deal. Analysts, however, say that OPEC nations collectively have been producing 1-1.5 million b/d more than their official quotas allow and predict that this will continue, although perhaps not to the same extent.

OPEC's ministerial monitoring committee will meet again June 21 in Vienna to review the new quotas. The next regular OPEC ministerial meeting will be Sept. 10, at which time a quota for Iraq may be considered.

Saudi Arabian Oil Minister A* al-Naimi said his nation's goal at the OPEC meeting was to manage supplies so that prices for the benchmark Brent crude would remain at $20-25/bbl.

"The idea is to smooth the price gyrations and big swings. We are not going to be trigger-happy if prices go out of this range for a day or a week.

"We have taken into consideration the concerns of consumer nations. We believe that the market will be in equilibrium. We believe the supply and demand will be in balance and that inventories will be restored."

He predicted the amount of leakage will diminish as OPEC raises quotas, because there is a limit as to how much most nations can produce.

Dissent

Iran, OPEC's second-biggest producer, objected to an increase of more than 1.2 million b/d.

It argued that world demand usually falls in the second quarter, about the time the additional oil would reach the market, and thus the 1.7 million b/d production increase was unnecessarily high.

Bijan Namdar Zanganeh, Iran's oil minister, insisted, "There's no shortage of crude oil in the international market." He said, within OPEC, "Our differences are on principles and not only a few barrels. Due to the fact of no shortage in the market, any increase in the production level should be done cautiously on a step-by-step basis."

Iran also complained about US attempts to influence OPEC's deliberations.

Zanganeh said, "We gathered here to accommodate the markets. We came here to increase production, but we should have been appreciated by the consumer nations. They should have welcomed our effort without intervention."

Although Iran did not vote for the OPEC agreement, afterwards Zanganeh said, "We will not lose market share," hinting that Iran would raise its output by at least the 265,000 b/d it would have been allowed under the OPEC deal.

Non-OPEC

Three non-OPEC nations-Norway, Mexico, and Oman-that reduced output a year ago now are likely to increase it by a total of 400,000 b/d or more.

Iraq, which is in OPEC but not part of the latest deal, also plans to boost production.

Norwegian Oil and Energy Minister Olav Akselsen said Norway would decide soon whether to raise production. It has been holding about 200,000 b/d off the market, producing about 3.3 million.

Akselsen said, "The oil market has been too tight, and it will be beneficial with a certain increase in the world's oil production."

Mexican Energy Minister Luis Tellez said his nation will gradually boost oil output by 200,000-300,000 b/d. That's less than the 325,000 b/d of production Mexico took off the market under last year's joint agreement between OPEC and non-OPEC countries.

Iraqi Oil Minister Amir Rasheed said his nation would take advantage of the United Nations' recent approval of additional oil equipment imports to raise exports by 700,000 b/d to about 3.1 million b/d.

Iraq has been under UN sanctions since its 1990 invasion of Kuwait and is not included in OPEC's actions. The UN allows Iraq to sell oil so it can buy food and medicine.

The US recently agreed to a UN resolution doubling the value of oil equipment that Iraq can buy to $1.2 billion/year.

Rasheed said Iraq disagreed with any OPEC production increases, because Iraq expects world demand to fall in the second quarter.

Russia, the world's third-largest oil producer, also opposed higher OPEC output.

Russian Fuel and Energy Minister Viktor Kalyuzhny said Russia would like to see oil prices at $26-28/bbl.

The nation cut its oil exports in the second quarter of last year but said that was to meet domestic demand.

Reactions

IEA Director Robert Priddle said, "The production increase due to start Apr. 1 will not fully meet the increased demand we foresee later in the year, and it will not bring stocks up even to last year's low levels. It is, however, definitely a step in the right direction."

He also said, "We attach particular importance to OPEC's announced readiness to review the situation in June."

The European Union's executive commission praised the OPEC action. It said, "We think it's going to have a good influence on the price," and predicted that oil prices would move into the $20-25/bbl range in the next few months, possibly staying there for a few years.

In the US, Senate Energy Committee Chairman Frank Murkowski (R-Alas.) said, "The increase in OPEC's production will not result in significant price reductions to consumers." He said spot prices will fall but added that refiners still must sell the products that they made from expensive crude.

Murkowski said the OPEC deal only ensures about 500,000 b/d of additional production, taking into account excess production over the pre-meeting quotas, while world demand has increased 1.5 million in the past year.

Rep. Benjamin Gilman (R-NY), chairman of the House International Relations Committee, said 1.7 million b/d was "too little, too late to rebuild inventories to make any difference for American consumers over the coming months."

He said the amount was less than half the 4.32 million b/d of oil removed from production in the last 2 years.

The House recently passed Gilman's bill reasserting the president's authority to cut US aid and arms sales to OPEC and nations that fix oil prices.

Leakage

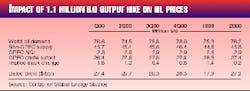

The Centre for Global Energy Studies, London, said the net effect of the Vienna meeting will be to increase OPEC's total production by 1.7 million b/d, on paper (Table 1). "Given that OPEC members are already overproducing by at least 1 million b/d, this 1.7 million b/d `paper' increase would translate to a rise of 770,000 b/d in actual production, were OPEC's members to stick rigidly to their new quotas.

"As in the past, compliance is unlikely to be absolute, and some `leakage' can be expected. However, the lack of spare capacity among OPEC's members will limit the extent of this overproduction. Overproduction will add a further 300,000-400,000 b/d to OPEC output, yielding an actual increase in OPEC output of around 1.1 million b/d," predicted CGES.

CGES said an output increase of 1.1 million b/d from the beginning of April will not significantly reduce oil prices, although it should prevent them from returning to $30/bbl.

"Unless revised in June, the agreed increase is expected to leave the price of dated Brent between $26 and $27/bbl, on average, in the second and third quarters of 2000 (Table 2)."

CGES says Iraq is a key uncertainty. It assumes Iraq's oil output will rise 100,000 b/d in the second quarter to 2.5 million b/d, another 150,000 b/d in the third quarter, and 100,000 b/d more in the fourth quarter.

"However, Iraq has claimed that it will be able to pump an additional 700,000 b/d in 2 months' time. This statement may have been made in an attempt to confuse the deliberations at OPEC's Vienna meeting, to limit the output increase and keep prices high.

"Even if Iraq's output increase were to materialize, it would have little impact on the market in the second quarter, since the increase would not be felt until toward the end of the quarter. Later in the year, it would help to dampen prices, reducing the fourth quarter average price by $3.50/bbl."