Application of new technologies led to substantial commercial reserve additions during 1990-97 on the Northwest Europe continental shelf, and further additions are possible.

Exploration and development projects in which new technologies were used also resulted in health, safety, environmental (HSE), energy security, employment, national security, and other economic benefits.

More than two-thirds of the total reserves gain of 12.4 billion bbl of oil equivalent resulted from fields whose development would not have been commercial without technological advances, a study showed.

The study participants have a minimum expectation that technological progress can "create" a further 7 billion boe by 2005 and a possible 12 billion boe thereafter.

It was clear that reserves gains usually resulted from positive interaction from a number of different, novel technological inputs-technology clusters. The economics of new developments also depends greatly on the continued existence of mature fields, without whose infrastructure satellite discoveries may remain uneconomic.

Gains in drilling (38%), seismic (23%), and floating production systems technologies (10%) were the most helpful. The gains were achieved in parallel with improvements in many areas of HSE protection despite an overall decline in research and development spending, the study found.

About 1.3 billion boe of the reserves gains could reasonably be credited to projects that received European Union funds. The study concluded that continued investment of EU funds into research is desirable because it promotes employment, export revenue generation, downward pressure on oil prices, and environmental benefits.

The study was performed during January 1997-November 1999. Participating were: AEA Technology PLC of the UK, Prof. G.L. Chierici of Ireland, Cie. Generale de Geophysique of France, Marine & Energy Consulting Gmbh of Denmark, and study manager Smith Rea Energy Associates Ltd., Canterbury, England.

The report's conclusions concurred with those of recent independent studies by Institut Francaise du Petrole and the UK Oil & Gas Industry Task Force.

Additions, technologies

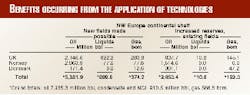

Reserves were added in existing and newly-developed fields on the continental shelves of the UK, Norway, and Denmark (Table 1).

The study included analysis of 170 fields off the UK, 55 off Norway, and 17 off Denmark. The breakdown of reserves added is 8.84 billion bbl of oil and other liquids and 3.56 billion boe of gas.

The proponents considered the effects of cost-cutting initiatives as well as seven technology classes (Table 2): subsea, drilling, improved oil recovery, platform, seismic, floating production systems, and other technologies.

Gains attributable to seismic, drilling, and floating production technology improvements accounted for 70.2% of total gains, almost 10 times the 7.4% gain identified for cost-saving measures.

"In the light of the prominence given by the industry to institutionalized cost saving initiatives, this finding was surprising," the proponents concluded. They attributed the contribution from cost reduction, less than 8%, to the fact that costs have been on an overall downward trend since the 1980 oil price peak.

The gain of 12.4 billion boe of reserves cannot be laid to "reserves drift" or "reserves growth," the tendency for reserves estimates for producing fields to increase with time due to initial underestimation.

Examination of a large number of statistical series showed that reserves gains had generally occurred in parallel with improvements in HSE protection. That work included the Netherlands.

A separate, in-depth matrix survey of 46 projects initiated during 1990-97 preceded the main study. In it the four contractors determined that exploration, the reservoir, and the well had by far the most important positive results (see chart).

Sufficiency of R&D levels

Another part of the study raises the prospect that the "stock" of technological developments now in hand might not be sufficient to maintain the previous rate of progress in adding to reserves.

World upstream R&D spending surged following OPEC-induced price rises of 1973-81, but Smith Rea estimated that such outlays by oil operating and supply companies declined about 3%/year during 1990-97. A compound increase for the service and supply sector of 2.5%/year could not compensate for a 5.7%/year decline in oil company spending.

Institutionalized cost-reduction initiatives may have damaged the information flows and processes on which successful R&D programs must be based, the study indicated.

Financial contributions from EU research, technological development and demonstration (RTD) programs evolved during the period from an initial concentration on marine and enhanced oil recovery related issues towards closer alignment with the recent reserves generation pattern, the analysis indicates.

The payoffs

Added reserves and production are what reveal the true value of technology advances. Only the producer can know when cost or time savings bring forth extra resources, and he has little direct incentive to research or publicize such figures.

Nevertheless, the study established beyond doubt that specific EU-funded projects had contributed to technical advancement and increased reserves and production. Other benefits of the additional production are job creation, export revenue generation, and downward pressure on world oil prices. The hydrocarbon sector of the European Economic Area may employ almost 500,000 people, most working for contractors and service/supply firms.

A high proportion of the companies involved in the supply sector are small and medium-sized enterprises (SMEs) towards which EU funding is increasingly oriented. These SMEs, rather than operators or major contractors, offer the EU its main opportunity to generate employment and export revenues. Continued funding would help SMEs compete internationally with the much larger US industry.

The participants recommended that future EU funding center on SMEs and the following areas: zero-emission E&P including gas-to-liquids technology; health/safety relating to higher incidence of accidents among contractor personnel; small pool strategy; reservoir characterization and management; and deepwater E&P.