Greece's Hellenic Petroleum shifts E&P focus abroad while shrinking its upstream role domestically

Greece's Hellenic Petroleum SA (HP) is refocusing its upstream strategy by farming out more of its domestic acreage and expanding its international portfolio in selected regions.

The state-owned company is Greece's largest industrial and commercial group.

HP's director of corporate planning, Dinos Panas, told OGJ that the company will develop exploration and production operations over the next 5 years by reducing its domestic acreage via farmout and expanding internationally into areas of competitive advantage.

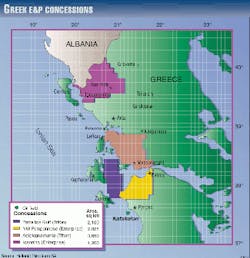

HP enjoys exclusive rights for exploration and production over 54,000 sq km of Greece. It has established its first concessions, covering 12,000 sq km of onshore and offshore areas in western Greece.

Greece merged its disparate state energy interests under the single entity of HP in June 1998. Since then, HP has acquired the Mamidakis-owned companies of Greece and OKTA, a company that owns a refinery in the former Yugoslavian republic of Macedonia.

Greek activity

Two consortia have been created to participate in four license areas created from these concessions. Britain's Enterprise Oil PLC, with a stake of 40%; Union Texas Petroleum Holdings (a unit of ARCO), 28%; and Hungary's MOL, 20%, hold the Northwest Peloponnesos and Ioannina areas. Triton Oil Corp. operates license areas in the Gulf of Patraikos and Aitoloakarnania areas (see map, p. 30). HP has a 12% stake in all license areas, making it both lessor and partner.

The four concessions have been under license since 1997. Seismic surveying in the Northwest Peloponnesos area is complete, and the data are being analyzed. As operator, Enterprise Oil says the consortium is nearing a final decision on where to drill, and, if all goes well, work will start by mid-2000.

Meanwhile, seismic surveys continue on Enterprise's northern Ioannina block. A second seismic acquisition program was completed there in September 1999; the first survey on the block was completed in 1998.

In addition, the Ioannina exploration activities include the acquisition of microearthquake data for the application of passive tomography to explore the mountainous area's subsurface. Enterprise geophysicist Eleni Karegeorgi explained that this is the first time this method has been used at such an early stage of exploration. The area is seismically active, and 13,000 micro-earthquake arrivals were recorded over a 10-month period. The job was contracted out to the University of Patras, and Enterprise is now evaluating the data; processing and interpretation are expected to be complete by fall 2000.

Western Greece is considered a high-risk area insofar as there have been no commercial discoveries there. However, the presence of proven oil and gas reserves in the adjacent mountains of southern Albania and a similar geological picture across the Adriatic in southern Italy-where Enterprise has encountered some success-are instilling some cautious optimism among Greek explorationists. And there is talk of a second round of licensing in Greece this year.

Meanwhile, HP has withdrawn from its participation in the idled state-owned Prinos field in the northern Aegean Sea. The field, which had met only 2% of Greece's crude needs, was shut in following the 1998 crude oil price drop but is now likely to resume operation following an agreement between Eurotechniki and workers laid off by the North Aegean Petroleum Corp., the former owner of Prinos.

The new company, to be named Kavala Oil, will have a staff of 249 workers from Prinos's previous workforce. Eurotechniki will take a 67% stake in the company, with the rest owned by the workers. The municipality of Kavala, the nearby port, holds an option for 5% of the stock taken from the workers' 33% stake.

The government and Kavala Oil SA late last year signed a 5-year contract granting the company a concession to Prinos oil field.

The agreement was signed in the presence of Development Minister Evangelos Venizelos.

Under the terms of the contract, Kavala Oil will have to sell all its oil from the Prinos field to HP at market prices. Prinos field's remaining proven reserves are estimated at 8 million bbl, and its production capacity is about 6,500-7,000 b/d.

Foreign activity

A new overseas investment strategy is beginning to bear fruit for HP.

Elias Conophagos, director of new ventures within the company's hydrocarbons exploration and exploitation division, told OGJ that the state-owned entity had adopted an inward-looking approach in the past despite proposals from within to expand overseas and form alliances with foreign operators: "But when the upstream sector merged with the downstream, two philosophies needed to merge, as well, and we really had to start from the beginning.

"Two main axes were formed: First, to attract business inside Greece, such as HP's participation in the foreign consortia that are exploiting the concessions in western Greece; the second axis is to develop opportunities abroad," said Conophagos.

HP has focused on certain strategic areas-namely the Mediterranean Sea region, the Middle East, the Balkans, the Caspian Sea region, and Russia. But Conophagos made it clear that his company's ambitions are limited in the short term at least.

"We are interested in Libya and Iran, for example, but we don't want to operate at this stage. We want to participate as a partner and improve our experience," he said.

"Later, we shall decide whether to change direction or not. We want to be involved in the development and/or the production of existing fields and also look atellipsesupplyellipseto our refineries. We import 50% of our needs from Iran, for example-up to 100,000 b/d-so if we go into partnership with a European or American partner in Iran, the opportunity of buy-back contracts will be an advantage to us. But for the time being, we intend to participate in existing fields only, without risk or costs other than production."

HP imports up to 5 million tonnes/ year from Iran and about 1 million tonnes/year or more from Libya; Romania accounts for the bulk of the remainder. Total Greek oil demand is about 350,000-400,000 b/d, of which HP supplies around 220,000 b/d.

"We have good commercial relationships with all three countries," said Panas, "and we are exploring some production projects there as a first step upstream [abroad]."

Opportunities are also being explored in Libya, where HP is looking to participate in both an existing field and an exploration project. Conophagos is hopeful that an agreement will be concluded soon in Libya and during the first 4 months of 2000 in Iran following the March general elections there.

Meanwhile, opportunities are also being pursued in Yemen and the UAE. But Conophagos says they have learned to be patient in these countries, acknowledging a series of delays in getting agreements signed.

In the Balkans, HP is looking to Romania and particularly at the Petrom assets that are now on the market. Again, HP is aiming at participation with European or American partners where they can benefit from others' experience. Also he said, "People don't know us, so we have to prove ourselves to be good partners." Like other prospective foreign investors in that country, he also recognizes a need for revisions to Romania's petroleum laws.

While the company has a provisional budget of $200 million for such investments, if "a very good opportunity came up, the budget would be increased so as not to lose it," Conophagos said, indicating that the Petrom investment would be such an exception. "It would be a strategic investment offer and would need to be for at least 35% of their shares."

The Caspian region is also under scrutiny. Canophagos believes that if, in spite of the cost, the proposed oil export pipeline from Baku, Azerbiajan, to Ceyhan, Turkey, proceeds and if Turkish transit fees are kept to a reasonable level, then it will provide a further strong incentive for HP to seek out suitable investments in the region (see related story, p. 28).

Elsewhere, talks with Russia's Lukoil that led to the signing of a memorandum of understanding for an upstream project in that country have not advanced and are unlikely to, says Panas.

Elias Conophagos

Hellenic Petroleum SA

director of new E&P ventures

We want to be involved in the development and/or the production of existing fields and also look at supply to our refineries. We import 50% of our needs from Iran, for example-up to 100,000 b/d-so if we go into partnership with a European or American partner in Iran, the opportunity of buy-back contracts will be an advantage to us. But for the time being, we intend to participate in existing fields only, without risk or costs other than production.