EOR weathers low oil prices

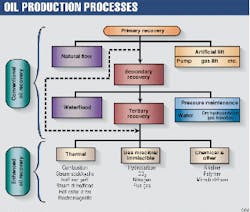

Oil & Gas Journal's exclusive biennial enhanced oil recovery (EOR) survey indicates that EOR processes have weathered the low oil price environment of the last 2 years and at the beginning of 2000 still contribute significant oil production in both the US and elsewhere.

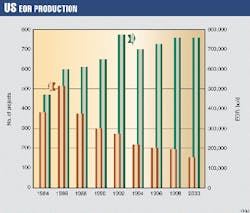

EOR's contribution to US oil production is 748,000 b/d (Fig. 1 and Tables 1 and 2), about the same 12% of US production as in the prior 1998 survey.

Other countries with significant EOR production at the beginning of 2000 are as follows:

- Venezuela-370,000 b/d (cold production of Orinoco heavy bitumen adds another 130,000 b/d).

- Canada-200,000 b/d (mining of heavy bitumen adds another 200,000 b/d).

- Indonesia-300,000 b/d.

- China-280,000 b/d (estimate based on various sources, not tabulated in this survey).

- Others-200,000 b/d (estimate based on various sources, not tabulated in this survey).

Tables A through I list the survey responses.

As seen in Table H, the large jump in Venezuelan EOR production, compared to the prior survey, is the result of three hydrocarbon miscible injection projects in the Carito Central, Carito Oeste, and Furrial fields.

These projects, started between December 1996 and August 1998, produce 166,000 bo/d that Petroleos de Venezuela (PDVSA) attributes to the EOR process. Venezuela's steam projects contribute another 200,000 bo/d to the EOR total.

Other new projects listed in the survey include seven polymer floods, two in China and five in Wyoming. The Table Mountain and Cottonwood Creek are imbibition chemical floods. Trout Pond, Stewart Lease, West Fiddler, and Daqing are in-depth colloidal dispersion gel floods.

The polymer and chemical supplier, Tiorco Inc., Englewood, Colo., provided the data on these projects.

Low prices

Both 1998 and 1999 were marked by an oil price collapse that lasted until mid-1999.

As an example, Berry Petroleum Co., Taft, Calif., saw its heavy oil price at an historic low of $6.50/bbl at the beginning of 1999. But by November 1999, the price had risen as high as $20.75/bbl, before ending the year at $19.75/bbl, about triple its Jan. 1, 1999, level. Kern River heavy oil price was up again, to $25/bbl at the beginning of March 2000.

Other heavy oil producers, such as the Petroleum Co. of Trinidad & Tobago Ltd. (Petrotrin), said it took stringent measures for cost control and management of its steamfloods. Petrotrin's steamflooding operations are high cost, largely as a result of having to purchase gas for steam generation. Therefore, it curtailed steam injection in several of the marginal projects and shut down nine steam generators.

In Canada, low oil prices forced the suspension of a number of either planned or active heavy oil projects.

Canada has also seen the number of hydrocarbon miscible projects decrease. One operator attributes this to the high cost of injection compared to the low oil prices of the last few years, as well as to the relatively good gas liquids prices.

Changes

Many ongoing EOR projects have continued through the low-price environment, although a significant number have different operators or are in the process of being sold.

In California, Aera Energy LLC, Bakersfield, (a joint venture of ExxonMobil Corp. and Shell Oil Co.) acquired the interest in the steamfloods operated by ARCO's Western subsidiary. Aera now also operates the Belridge, Coalinga, and Lost Hills properties previously handled by Texaco Inc. and its Kern River properties have now been combined with Texaco's operations.

A major change in ownership occured when Occidental Petroleum Corp. purchased BP-Amoco plc and Shell Oil Co.'s Permian basin joint venture Altura Energy Ltd., Houston, which is the major operator of carbon dioxide (CO2) floods in the area.

The main supplier of CO2 to the Permian basin, Shell CO2 Co. Ltd. (a partnership owned 80% by Shell CO2 Co. and 20% by Kinder Morgan Energy Partners LP, Houston), is also up for sale. The transaction were pending at the time of this writing.

A number of smaller properties have also changed hands, some several times. For instance, JP Oil Co., Lafayette, La., acquired the Little Creek field CO2 in Mississippi from Shell Oil. Since then, it has sold the projects to Denbury Oil Co., Dallas.

In another case, Devon Energy Corp., Oklahoma City, acquired the Sacroc Unit CO2 flood in its merger with PennzEnergy Co. Houston. At the time of this writing, Devon plans to sell Sacroc.

In Canada, major oil companies such as BP-Amoco and Shell no longer operate EOR projects. But Shell does hold interest in a new $3.5 billion (Can.) tar sands mining and upgrading project operated by Albian Sands Energy Inc., Calgary, a joint venture of 60% Shell Canada Ltd., 20% Chevron Canada Resources Ltd., and 20% Western Oil Sands LP). It also remains the operator of a heavy oil steam project in Peace River.

EOR potential

Even with the uncertainty caused by the collapse in oil prices prior to mid-1999, operators still see EOR processes as opportunities for increasing recovery factors from known oil accumulations. Table A lists field-wide and pilot projects planned to start between 2000 and 2001.

PDVSA is taking major steps in improving medium and light oil recovery with EOR processes. Of its 10 planned projects listed in Table A, 9 involve its integrated field laboratory concept (see box). Its Santa Barbara hydrocarbon miscible project is its only project that is field wide.

Optimism about the future of EOR processes is also expressed by CO2 vendors and pipeliners. Chuck Fox, vice-president of operations and technology for Shell CO2 Co. Ltd., sees more CO2 sales coming down the line. He indicates that at present his company is working on about six CO2 sales deals.

He says sales from southwest Colorado's McElmo dome, the largest CO2 source field supplying the Permian basin, have recovered to more level rates from the "take-and-pay" rates seen in 1999. CO2 sales had fallen to less than 700 MMscfd in 1999 from a high of nearly 1 bcfd in 1998.

Sales now average about 800 MMscfd, and Fox indicates that additional drilling is likely in McElmo dome to increase deliverability.

Outside of the Permian basin, Fox believes that fields in Oklahoma and the Morrow sands of Kansas have significant potential for CO2 floods. ExxonMobil Corp.'s Postle CO2 flood, in the Oklahoma panhandle, is an example of Morrow potential.

Wyoming is another area that might see additional CO2 flood development. PetroSource Corp., Houston, expects to break ground this year for a CO2 pipeline from LaBarge, Wyo., to the Powder River fields in Wyoming. The ExxonMobil LaBarge gas plant produces about 250 MMscfd of CO2. According to PetroSource, Shell CO2 Co. Ltd. is also a participant in the pipeline.

PetroSource is also involved in Ridgeway Arizona Oil Corp.'s attempts to market the estimated 21 tcf of CO2 discovered on the border of New Mexico and Arizona, near St. Johns, Ariz.

Don Riggs, Ridgeway's vice-president of operations, sees the California market in the next few years to be huge. He says potential buyers include Chevron Corp.'s and Aera Energy's Lost Hills oil reserves in diatomite formations as well as Occidental Petroleum Corp.'s Elk Hills field, all in Kern County, Calif.

Transporting CO2 from St. Johns to Kern County would require a 500-mile pipeline.

To begin producing some of its CO2, Ridgeway has announced that it has nearly completed a small plant, near St. Johns, to supply about 2 MMscf of CO2 to the food industry.

Heavy oil activity in Canada is continuing. The Alberta Energy & Utilities Board, in mid-February, approved PanCanadian Resources' plans for steam-assisted gravity drainage (SAGD) for the Christina Lake thermal project. When fully operational in 2009, the project aims to produce between 50,000 and 70,000 b/d. PanCanadian plans to drill up to 700 horizontal wells.

Estimates are that heavy oil production in Alberta could reach 1.5 million b/d by 2010. This production includes surface mining operations and will require a $25.4 billion (Can.) investment.

Other activities

Two alternatives that do not require in situ injection of steam for producing heavy oil and bitumen are surface mining operations and cold production with horizontal wells.

In Canada, both of the existing surface mining operations, Syncrude Canada Ltd. and Suncor Energy Inc., have expansion plans in the Athabasca tar sands of Alberta. Syncrude expects production to be 82 million bbl/year in 2000, and with its new Aurora Mine project, production could increase to 258,000 b/d by 2004 and 312,000 b/d in 2005.

Suncor's $2.2 billion (Can.) project aims to increase plant capacity to 130,000 b/d by 2001 and then to 210,000 b/d in 2002 from the current 85,000 b/d.

Two new planned mining projects for the Athabasca tar sands include the previously mentioned Albian Sands Energy Inc. and ExxonMobil's Kearl Oil project.

Albian Sands Energy's venture aims for bitumen production of 155,000 b/d by late 2002. The main components of the project include a $1.8 billion Muskeg River mine and a $1.7 billion upgrader to be constructed next to Shell's Scotford refinery north of Fort Saskatchewan, Alta.

The $3.1 billion (Can.) Kearl Oil project could be producing 160,000 b/d by 2005.

Horizontal wells have allowed heavy oil to be produced economically with cold production, without in situ steam injection. Two major cold-production projects have started production in the Orinoco tar sand belt in Venezuela.

One is Petrozuata CA, a strategic association between Conoco Inc. (50.1%) and PDVSA (49.9%) that produces about 93,500 b/d of 9° API gravity crude. Its target is to reach 125,000 b/d by the time its crude upgrader is completed, later this year, at Jose, on Venezuela's northern coast.

The other project currently on production is Cerro Negro (41.67% ExxonMobil Corp., 41.65 % PDVSA, and 1.66% Veba Oel AG). It produces 60,000 b/d of diluted crude and plans to reach a plateau of 140,000 b/d in 2001.

Two other ventures, Sincor (47% TotalFina, 38% PDVSA, and 15% Statoil), Petrolera Ameriven in Hamaca (40% Phillips Petroleum Co., 30% PDVSA, and 30% Texaco Inc.) will start production later in 2000 and 2001, respectively.

Total production from these four ventures, once all reach their proposed plateau rates, will be 650,000 b/d of 8-9° API oil in the early 2000s.

The PT Caltex Indonesia-operated Duri field on Sumatra Island still remains the world's largest steam flood, and Pemex Exploraci

Published articles indicate that China has about 120 EOR projects producing about 280,000 bo/d. Some of these are listed in Table H.

Improving oil-recovery factors in Venezuela

Petroleos de Venezuela SA (PDVSA) provided the following discussion on its strategy for improving oil recovery factors from its fields in Venezuela.

As PDVSA's oil resources approach maturity, it has become clear to PDVSA that improving recovery will demand the earliest use of many proven and new technologies in an integrated manner that is tailored to solve specific regional problems.

For more than 4 decades, it has injected water and gas to exploit its condensate, light, and medium oil fields. To date, the expected recovery factors for water and gas injection projects are about 29 and 44% of the original oil in place, respectively.

PDVSA's improved oil recovery (IOR) programs, in the last 10 years, have focused on improving well conformance and productivity as well as oil recoveries by different processes. These programs have been conducted by PDVSA E&P in coordination with PDVSA Intevep, consultants, research centers, and universities.

The most common IOR methods in Venezuela during the last 5 years, especially in waterflooded reservoirs at Lake Maracaibo, have been crosslinked polymer gels and microbial treatments at oil producing wells.

To a lesser extent, it has field tested stable heavy oil-based emulsions for near-wellbore water blocking in injection wells. Also, PDVSA is developing or evaluating gelling foams or polymer foams for blocking or conforming gas flow.

Regarding oil recovery processes, PDVSA has completed many screening studies based on available information, worldwide IOR demonstration and experimental field experience, and analytical and numerical simulations.

These studies show that water alternating gas (WAG) and alkali-surfactant-polymer (ASP) flooding present the most promising enhanced oil recovery potential for a large number of Venezuelan reservoirs.

Nitrogen injection is also an emerging and important alternative for replacing hydrocarbon gas injection in many existing projects and new developments.

The integrated field laboratory (IFL) philosophy is one of PDVSA,s main corporate strategies designed to evaluate those recovery methods.

The key point in the IFLs is to select a relatively small area of a field that is representative of a type of accumulation in Venezuela. The basic consideration is that all the technologies, processes, and exploitation strategies evaluated in the IFL can be applied without major modifications to the entire accumulation.

Since 1998, PDVSA has initiated nine field laboratories that include one microbial, two ASP floods, one nitrogen injection, two hydrocarbon miscible WAGs, two immiscible WAG injection schemes in light oil waterflooded reservoirs, and one continuous steam injection and steam-assisted gravity drainage (SAGD) project.

PDVSA plans to start at least four pilot projects in 2000. These include one steam and three hydrocarbon miscible WAGs. In 2001, its plans are to initiate a miscible WAG, two ASP floods, one microbial injection project, and two nitrogen-injection projects.

PDVSA's IOR program scope for the future has been expanded to include many other IOR techniques in medium and light oils, such as nitrogen (from air separation) and CO2 (from petrochemical byproducts) flooding, foams and emulsion technologies, and steam injection.

Basic research on nonconventional methods such as vibroseismic and microwave, among others, are also being considered. These programs target short, medium, and long-term gains in recovery.

Finally, PDVSA believes the next 10 years will be technically very challenging in Venezuela. It expects that international collaboration spanning the oil industry and research community, improved contractor-service company and contractor-supplier relationships, effective use of technologies, and prudent planning and execution of IOR projects will be critical for implementing IOR under varied economic conditions.