Worldwide drilling activity shrank by 25% in 1999

WORLDWIDE REVIEW-2

As with other upstream industries, the worldwide drilling industry suffered from the crude price crash of spring 1998.

The crash forced operators to lower their capital expenditures in 1999, and that consequently caused a drop in the service activities equal to 20% in geophysics, 25% in drilling, and 30-45% in the construction of offshore equipment.

In parallel, oil companies initiated unprecedented mergers and acquisitions to reduce costs and increase profitability. Mergers among service companies, which started 10 years ago to expand technological and geographical coverage, will continue in the months to come, namely in the fragmented sectors of drilling and offshore construction.

This article, based on a study by IFP in December 1999, documents the effects of the crash on drilling investment. This is the second in a series of three articles documenting the worldwide activity in the oil and gas industry in the past 2 years.

The first article covered the exploration and production sectors. The concluding article will cover the refining sector.

Numbers in this article do not take into account former centrally planned economy countries for which estimates of expenses and levels of activity are difficult to figure.

Worldwide drilling activity

North America dominates drilling activity throughout the world. In fact, excluding China and the former Soviet Union, the US and Canada were responsible for 80-85% of world activity in the past decade.

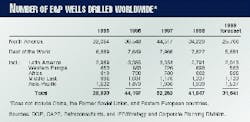

Table 1 shows the number of drilled wells by geographic sector. After a good deal of activity in 1997, the number of wells drilled in the world suddenly dropped by 20% in 1998, settling at 41,847 wells.

This drop resulted from slower activity in North America, Central America, and South America. Western Europe and Asia-Pacific maintained their levels of drilling, while Africa and the Middle East registered a slight rise.

In 1997, the drilling industry registered a 40% increase in activity over 1996, worth $17.5 billion. The market had another positive period in 1998 with a 14% rise, for combined onshore and offshore sectors.

Onshore, the business volume remained relatively stable in 1998, about $6 billion.

The American market is the largest onshore market in the world. After a good performance in the first half of 1998, it fell short in the second half.

Offshore activity is more evenly spread throughout the geographical areas, and rental contracts for offshore drilling rigs are for longer periods than for onshore. Thus, despite a smaller demand for jack ups in the Gulf of Mexico, the offshore drilling market grew by 19% in 1998 because of the steady need for rigs in deepwater.

Onshore, contractors saw their sales drop by an average of 33%. Sales in offshore operations dropped about 20%; the jack up segment in offshore continues to be particularly affected.

In 1999, the drilling market (onshore and offshore) shrank by 25%, to settle to $15 billion (total of 31,641 drilled wells). Again, the falling situation is a result of drops in both activity and prices.

Worldwide rig utilization

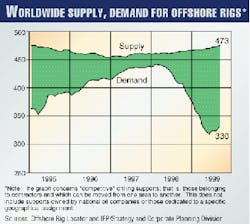

The average utilization rate of the world offshore drilling fleet decreased from 95% in 1997 to 90% in 1998, namely as a result of less activity in the US.

With an oversupply of equipment, rig day rates fell sharply in the middle of 1998 to reach an average of $93,000/day in December for semisubmersibles and $72,000/day for jack ups in the North Sea (respectively, $81,000/day and $23,000/day in the Gulf of Mexico).

Only deepwater drillships came out ahead, with rates close to $200,000/day.

In the first half of 1999, utilization rates of drilling platforms continued to fall in every region. Day rates again dropped sharply, especially in the North Sea where prices fell close to the levels noted in the Gulf of Mexico.

Prices stabilized, however, in July. Slight recoveries occurred in demand for offshore equipment in the Gulf of Mexico, West Africa, and Southeast Asia. Only the North Sea is still on a downward trend.

Utilization rates for offshore activity for the North Sea, Gulf of Mexico, and the rest of the world appear in Fig. 1. Fig. 2 shows worldwide supply and demand for offshore drilling rigs.

Since it takes 2-3 years to build a rig, construction of structures that were initiated before the fall of crude prices continued after the fall. IFP recorded 44 units under construction in mid-1999, of which 23 were to have been completed by the end of 1999, 18 in 2000, and only 3 in 2001. Of these new rigs, 85% are meant for deepwater service (drillships and semisubmersibles).

Globally, the wave of manufacturing and conversion experienced by the drilling industry helped contractors renovate and fill out their fleets. The arrival of this new equipment on the market should not cause much of an increase in the rig supply. In fact, as a result of the removal of some rigs, the supply will only increase by 3% between 1995 and 2000.

Therefore, the offshore drilling market will become balanced in the short or mid-term.

In the past 3 years, the drilling sector experienced several mergers:

- Sonat Offshore with Transocean, Houston.

- Falcon Drilling with Reading & Bates, Houston.

- Pride Petroleum with Forasol-Foramer, Velizy-Villacoublay, France.

- Diamond Offshore with Arethusa Offshore, Houston.

- R&B Falcon with Cliffs Drilling, Houston.

The merger between Transocean Offshore and Sedco Forex Offshore at the end of 1999 created a company in Houston that holds more than 15% of the world market and controls close to 25% of the total international fleet of deepwater drilling equipment. More mergers of this type will occur in the following months.

North America

Drilling activity in North America is highly influenced by the appeal of deepwater Gulf of Mexico and the price of natural gas.

In North America, the number of drilled wells dropped by 23% in 1998 to 34,220 wells.

Forecasts for 1999 were not optimistic. The number of wells drilled will have reached 25,760, representing a 25% drop over the previous year.

In the US, since 1996, 60-70% of the drilling equipment has been assigned to gas prospecting. Historically dependent on the price of crude, activity now largely depends on the gas spot market.

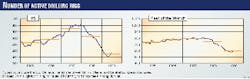

Between Jan. 1, 1998, and Jan. 1, 1999, the number of active rigs fell by 41%. On a yearly average, the number of active rigs rose to 829 in 1998, which is higher than 779 units in 1996, and only a 12% drop compared with the decade's highest level in 1997 of 944 units (Fig. 3).

The setback in activity was in line with the West Texas Intermediate crude-oil price: -30%.

For natural gas, the average value of the rig count in 1998 remained stable compared with 1997, while the wellhead price (Henry, La., hub) fell by 16%. In December 1998, the number of rigs operating on the fields dropped to less than 500.

This was the first sign of alarm for the natural gas supply, since American experts estimated that 500-550 rigs are needed to maintain production at its actual level. At the time, this fact had no impact on the price of gas given that stocks were very high.

In first half 1999, the volume of active rigs fell by 40% to 539 units from the year before. In April 1999, drilling activity took off again, however, as the price of crude rose.

The small amount of gas prospecting done these past few months signifies that American gas production is slowing as a result of depletion. Lower winter stocks in 1999 compared to the same period in 1998 should stimulate the search for more gas fields.

For 1999, the volume of active drilling rigs stayed at 580, down 30%. The number of wells drilled reached 18,060, a 25% drop over 1998 despite an improvement in the second half of 1999.

In Canada, the 1998 situation was more severe than in the US. The number of wells drilled in Canada decreased by 60% in 1 year, down to 10,137 wells. These wells were onshore, and 58% of them were on promising gas targets (compared with only 37% in 1997); they represent 30% of total drilling in North America.

The number of active drilling rigs dropped by 30% to settle at 256. This drop was mainly caused by the cancellation of development projects for heavy oil fields. The lower price of gas was also influential, since Canada is a major supplier to the US.

In 1999, the volume of wells drilled in Canada should have continued to drop by 25% and settled at 7,700.

North Sea

The North Sea holds 80% of the drilling activity in Europe. In 1998, the number of wells fell to 535, a 7% fall compared with 1997. This situation eased the market for the offshore drilling rigs. Day rates fell by about 25% for semisubmersibles and jack ups.

This change was influenced by two factors:

- Competition from other oil regions, namely those where production costs are lower.

- Crash in the price of oil, which led operators to concentrate on development rather than exploration. In fact, only 108 exploration and evaluation wells were drilled in 1998, compared with 179 the previous year. This 40% drop occurred in the UK, Norway, and The Netherlands and threatens the renewal of reserves, thus the oil future of the area.

In 1999, the drilling volume should shrink even more-to 444 wells, a 17% fall compared to 1998. The rise in prices happened too late to have a significant impact on 1999.

In the UK, the number of wells stood at 296 in 1998, a 7% fall compared with the previous year, including 58 in exploration and evaluation.

In 1999, drilling activity should have dropped another 22% and reached 230 wells, including 30-40 in exploration and evaluation.

Aware of these problems, the British government, in September 1998, stopped the project aimed at applying tougher taxes on the production of hydrocarbons. The country thus remains one of the most attractive offshore areas in the world.

In addition, the British government is considering restarting exploration, using such measures as the abolition of taxes on oil revenues, a modification of corporate income tax, or even the payment of charges. The only decision made thus far concerns the exoneration of capital gains on the sales of oil and gas assets.

Norway had a hard year in 1998. The number of wells drilled fell by 10% compared to 1997 and stood at 160, including 28 in exploration and evaluation.

For 1999, another drop of 6% is expected, down to 150 wells.

During the 16th production licensing round in the North Sea of Norway in 1999, only 19 out of 33 blocks were allocated April 1999.

Norway is having some difficult times. It suffered a decrease in upstream investment, costs are high compared with other producing areas, and local policy depends on nationalism and conservatism.

In May 1999, the government proposed several reforms to the Parliament to support exploration and production:

- Progressive elimination of the 8-16% tax for the eight fields put into production before the abolition of this tax in 1986.

- Allocation of $13.5 million for technical development.

- Drafting of 5-year plans for the licensing round.

- Readjustment of the government's share in Norwegian fields. This share will no longer be mandatory in new operations where there are few reserves, or will be limited to 25%.

A project concerning the allocation of licenses will be presented to the Parliament in spring 2000. Until now, the government has opposed new participants in exploration and production. To restart investments, however, Norway might reorganize the Norwegian oil industry and offer a larger opening on the private sector.

In The Netherlands, drilling activity remained stable in 1998 with 62 wells. On the other hand, the exploration and evaluation share went from 45 to 27%.

In 1999, the drilling market will have shrunk by 30%, with only 43 wells.

Central and South America

After 4 years of growth, the number of wells drilled on the South American continent fell 17% in 1998. In 1999, this trend will have worsened to a drop of 27%.

In 1998, drilling activity dropped steadily. Those worst hit were Argentina (-30%), Trinidad and Tobago (-35%), Peru (-25%), and Venezuela (-30%).

Mexico (+36%), Bolivia (+95%), and Brazil (+3.5%) resisted this downward trend because they were involved in heavy investment programs which were not changed by the oil crisis in 1998.

All of the countries in the area experienced a drop in the number of wells drilled in 1999 except Bolivia. The level of activity in Argentina, Brazil, and Venezuela represent more than 80% of the drilling in the Central and South America.

In Brazil, the drilling activity grew slightly in 1998 (+3%), but it will drop by 9% in 1999. Despite a low price environment, deep offshore remains the priority of Petrobas, which after having put the Roncador field into production (1,853 m), is getting ready to produce in the 2,000-3,000 m water depth.

The national company had plans to drill six exploration wells at 2,700 m in 1999.

The Petrobras monopoly in exploration-production ended in 1999 with the first licensing round. This first round was unsuccessful because none of the onshore areas received an offer.

But it confirmed the interest of foreign operators for deepwater prospects in the basins of Santos and Campos. Opening up this mining field will stimulate the future development of great depths.

Enthusiasm should be moderated, however, because the financial crisis that befell the country in 1998 affected its economic growth (-1% in 1999) and thus its demand for energy.

In Venezuela, the number of wells drilled will have shrunk by about 30% in 1999. PDVSA was particularly affected by the crash in oil prices and consequently lowered its production growth objectives.

The state-owned company is facing a large reduction in its earnings as well as the loss of control of its production, following the Venezuelan government's commitments to respect OPEC quotas.

As for natural gas, in August 1999, the government announced the application of new legislative provisions allowing the private sector, either domestic or foreign, to have access to the big fields for exploration, production, or transportation.

The development of the gas sector will require about $10 billion in investments over the next 10 years.

In Argentina, the number of wells drilled could drop by 30% in 1999. In the past 3 years, this country registered a decrease of more than 60% in activity. This situation is the result of a drop in the exploration by new players, who appeared after the privatization of YPF and acquired the mining rights for periods of 25 years with no obligation to drill.

Africa

The drilling market continued its rise initiated in 1995, mainly on account of the activity in North and West Africa, whose share comes close to 80%.

The number of wells drilled in 1998 reached a record level for the decade with 862 wells, an 11% increase over 1997 and a 70% increase since 1994. The offshore drilling volume remained stable, about 40%.

The number of active rigs remained at the same level as in 1997 with 98 units.

Some of the major development projects on the African continent slowed during first half 1999 following decline in the price of crude. The drilling volume should therefore drop by a third in 1999 to reach 585 wells.

In North Africa, Egypt and Algeria accounted for 35% of the drilling work carried out for the entire African continent in 1998. Some 301 wells were drilled in 1998, an 8% rise over 1997. In fact, the two nations remain very active in exploration. Drilling activity should drastically drop in 1999, however, with only 217 wells, 28% less than in 1998.

In Egypt, several significant natural gas discoveries have been made, namely in the Nile Delta and in the Western Desert of the country. These discoveries will help increase gas production in the near future.

The number of wells drilled and active rigs in Egypt in 1998 grew by 12% over the previous year. There were 195 wells and 24 rigs, 35% of which were offshore rigs.

In April 1999, the government launched a licensing round for production. With the majors abandoning the country, smaller companies may soon take the lead.

Algeria launched a program in 1996 to increase national production, which included the drilling of 300 exploration wells before 2000. The political conflicts did not alter these objectives, and the number of wells drilled remained stable between 1997 and 1998, with only 106 onshore wells. The volume of active rigs dropped by 23% during the same period and stood at 23 units in 1998.

In Libya, the lifting of economic sanctions imposed by the UN will enable the country to develop its hydrocarbons. Despite the presence of sanctions against American countries dealing with this country, the government is talking about allocating new exploration blocks.

In West Africa, 1998 was another prolific year for the upstream sector, despite the low barrel price and political conflicts. Exploration activity is still strong; more than 2 billion bbl were discovered. Of special note are the fields of Rosa, Kissanje, and Lirio. For the sixth consecutive year, discoveries surpassed production.

The Gulf of Guinea concentrated 43% of the drilling efforts in Africa with 372 wells in 1998, compared with 335 the previous year. In exploration, 48 wells were drilled, half of which are in Angola. In deepwater, the Gulf of Guinea recorded 16 exploration and evaluation wells.

In Nigeria, the election of a new president opened up possibilities. This government announced a series of measures to clean up the oil sector.

The first action consisted in canceling the exploration permits allocated this year without calling for tenders, by the outgoing military regime. The licenses were put up for auction and redistributed in a more transparent way.

The year of 1999 should mark the end of turmoil in West Africa: 259 wells are expected, which is 30% less than in 1998. One of the measurable effects is the excess amount of drilling supports that keep increasing.

Middle East

For the fourth consecutive year, drilling activity in the Middle East has risen (+13% in 1998). A 19% fall is expected, however, in 1999.

Dependent on oil revenues, the countries in this region have seen a breakdown in their financial situation, and their investment capacity has decreased.

In parallel, in May 1999, members of OPEC committed to new production quotas to help redress oil prices. This decision put off some extension programs for their crude-extraction capacities.

Some countries are opening up their upstream sectors to foreign operators to access capital and new technologies. Iran has been doing this since 1995, and discussions are also under way in Kuwait and Saudi Arabia.

The members of OPEC are also looking at natural gas, whose production is not limited. This source of energy could very well become a priority for them.

Asia-Pacific, excluding China

Although Southeast Asia was severely affected by a serious financial crisis in 1997 and 1998, it had stable drilling activity levels in 1997 and 1998: 1,939 wells in 1998 compared with 1,930 in 1997.

In 1999, a 20% drop in activity is expected as a result of several factors:

- Lower oil prices.

- Negative economic growth in 1998 and low growth in 1999, which limits the area energy needs, and thus the development of gas projects.

- Unstable political climate in Indonesia.

Countries such as India, Australia, Indonesia, and Malaysia are trying to draw foreign capital by offering new exploration and production licenses or by arranging their tax systems.

All countries in the region will post a significant drop in the number of wells drilled in 1999: namely Indonesia (-28%), Australia (-17%), Malaysia (-26%), and Pakistan (-31%).