Ekho deep test is spud amid San Joaquin Valley uncertainty

Members of Project Ekho have spudded what is billed as the first of three wells to test deep gas potential in California's San Joaquin Valley.

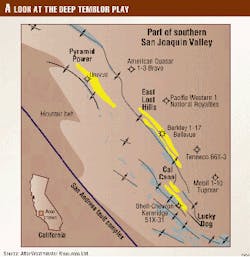

Tri-Valley Oil & Gas Co., Bakersfield, had drilled past 11,000 ft by mid-February at the 1 Ekho in Kern County towards a projected 19,500 ft. The drill site is 40 miles northwest of Bakersfield.

The well is the first of three that are to evaluate a large structurally controlled stratigraphic trap that was identified geologically and confirmed by a seismic survey.

The target: Temblor sandstones, a thick package of Middle and Lower Miocene sands and shales and several shallower objectives.

Canadian independents are paying a large share of drilling costs estimated at $10-12 million/well to earn interests in Kern County acreage.

Commercial aspects of this play remain uncertain as operators drill additional wells and prepare even more prospects.

East Lost Hills

As drilling starts at Ekho, the outlook remains unclear for the 1998 well 10 miles to the west that started this exciting and costly play.

The Elk Point/Bellevue Resources 1 Bellevue, in 17-26s-21e, at East Lost Hills blew out Nov. 23, 1998, and flowed for six months at unmeasured rates. Estimates of the flow rate fell across a wide range, and the well raised hopes about the basin's deep sediments (OGJ, Apr. 12, 1999, p. 75).

Now operated by Berkley Petroleum Corp., Calgary, it initially flowed light oil, condensate, natural gas, and water, and later produced steam judged to have been flashed from water hotter than the calculated temperature of the Temblor zone. Heavy mud and cement were pumped down a relief well to kill the flow in late May 1999.

The relief well, 1-17R Bellevue, was plugged back to 10,600 ft, sidetracked, and redrilled to 17,428 ft, encountering nearly 200 ft of Temblor and pressures as high as 15,000 psi. It flowed gas at rates of 1.3-5.0 MMcfd plus condensate and water in December 1999 from the uppermost Temblor unit.

Uncemented liner in the 1-17R makes stimulation efforts difficult. Berkley said in late January that partners would review options to sidetrack and redrill the Temblor or drill a new well from surface.

Meanwhile, Berkley's first offset, in 6-26s-21e, in late January was at 18,237 ft, about 1,000 ft into Temblor. It had penetrated four separate sand units with about 720 ft of net sand, and the company reported "steadily increasing gas shows."

Drilling continued toward 20,000 ft, and Berkley was to spud two more wells by midyear.

Further tantalizing participants is the new wells' proximity to several earlier deep tests, including the 31X-10 and 66X-3 wells, both of which flowed light oil for a short time in the 1970s. Drilling and completion technologies are available now to surmount many of the mechanical problems that plagued the earlier wells.

One operator, Ivanhoe Energy Inc., Calgary, points out that the well that blew out was only history's fifth to test Temblor at these depths. Ivanhoe also points out that Temblor properties can be very favorable. Net sand can reach 85%, porosity 6-16%, and permeabilities 300 md.

More prospects

Another group called Greater San Joaquin venture, comprised largely of Canadian independents, is under way with a series of prospects in the area.

Berkley said the first, its 1 Cal Canal, penetrated 1,230 ft of Temblor with 775 ft of net sand. TD is 18,100 ft.

The completion attempt induced noncommercial hydrocarbon flow rates from an initial 10 ft of perforations in Lower McDonald. Several other zones were to be tested in Temblor and McDonald.

"Partners have decided to defer further completion or deepening of the existing well bore until information regarding reservoir quality and performance is obtained from on-going drilling efforts" in the basin, Berkley said.

Cal Canal lies 10 miles south of East Lost Hills. The venture participants have their eyes on the Lucky Dog Prospect beneath South Belridge oil field and the Pyramid Power prospect 20 miles northwest of East Lost Hills.

Investment enthusiasm seems mixed about the basin's deep prospects. Stocks of companies involved in failed wells generally trade lower. On the other hand, Ivanhoe raised $14 million (US) in January and February 2000 to fund its deep work in the basin, where it holds interests in about 300,000 acres, although $5 million of that came from company officials.