Worldwide refining capacity creeps upward, most growth in Asia-Pacific

Refining crude-distillation capacity has grown to 81.5 million b/cd during 1999, a 1.5% increase. OGJ previously reported 80.3 million b/cd worldwide capacity in Jan. 1, 1999 (OGJ, Dec. 21, 1998, p. 41).

The most significant regional changes occurred in Asia-Pacific, Western Europe, the Middle East, North America, and South America.

Asia-Pacific was responsible for about 870,000 b/cd additional world refining capacity. India alone contributed more than 700,000 b/cd. North America added about 160,000 b/cd to worldwide capacity, most of which came from the US.

Western Europe experienced about a 140,000 b/cd decline in crude-distillation capacity.

South America added about 180,000 b/cd of crude-distillation capacity, mostly via upgrades in The Netherlands Antilles and Venezuela.

New and shutdowns

This year's survey reports eight new refineries. Four refineries closed this year.

India led the world this year in new refining capacity. The country added three new grassroots refineries to its 1.1 million b/d capacity. Following are the new Indian refineries:

- Reliance Petroleum Ltd.'s Jamnagar refinery, 360,000 b/cd. Eventually, Reliance plans to expand this capacity to 800,000 b/d. This is the first refinery in India to be fully owned by a private-sector company.

- Indian Oil Corp.'s Panipat refinery, 120,000 b/cd.

- Numaligarh Refinery Ltd.'s Assam refinery, 60,000 b/cd.

Other new refineries are:

- Emirates National Oil Co.'s Jebel Ali, Dubai, UAE, condensate refinery, 120,000 b/d.

- China National Petroleum Corp.'s El-Gily, Sudan, refinery, 50,000 b/cd.

- Concorp's Khartoum, Sudan, refinery, 10,000 b/cd.

- Yukos Oil Co.'s Strezhevoy, Russia, refinery, 4,400 b/d.

- Narli Petroleum Refining Industry & Commerce Inc.'s Narli, Turkey, refinery, 2,800 b/cd.

Four refineries shut down this year are:

- Shell U.K. Ltd., Shell Haven, UK, 92,000 b/cd capacity, December 1999.

- Mitsubishi Oil Co. Ltd., Kawasaki, Japan, 75,000 b/cd capacity, September 1999.

- Ultramar Diamond Shamrock, Alma, Mich., 51,000 b/cd capacity, October 1999.

- Showa Shell Sekiyu KK, Niigata, Japan, 40,000 b/cd capacity, March 1999.

Formosa Petrochemical Co. postponed its yearend plan to commission Phase I of its grassroots 450,000 b/cd plant at Mailiao, Taiwan. Phase I calls for 150,000 b/cd of distillation capacity. The company plans a trial run of 100,000 b/d in January 2000 (OGJ, Oct. 25, 1999, p. 39).

With two refinery closures this past year, Royal Dutch/Shell continues to divest as it looks for a buyer for its 45,000 b/cd refinery in Lutong, Malaysia (OGJ, July 12, 1999, p. 29) and evaluates the future of its 85,000 b/cd Clyde, Australia, refinery.

Changed ownerships

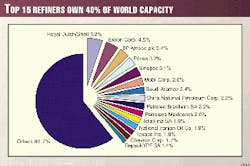

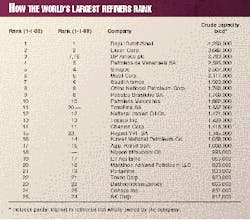

Fig. 1 (at right) shows that the top 15 refiners own about 40% of world refining capacity. This pie chart uses data from Table 1 (below right), which lists companies with the most refining capacity in the world.

Since 1998's survey, six refiners made significant jumps in the list as a result of mergers.

Although not reflected in the survey, figures, and tables, because these data were compiled before US Federal Trade Commission (FTC) approval, the largest change in ownership this year occurred on Nov. 30, 1999, when Exxon Corp. and Mobil Corp. combined to form Exxon Mobil Corp.

After fulfillment of merger terms, Exxon Mobil will own 44 worldwide refineries, a refining capacity of 5.4 million b/cd. This number knocks Royal Dutch/Shell from its longstanding record as the world's largest refiner.

The European Commission requires Mobil to sell its 30% interest in its European refining-marketing venture with BP Amoco (OGJ, Oct. 25, 1999, p. 22). The FTC requires Exxon to divest its Benicia, Calif., refinery.

The merger of British Petroleum Co. plc and Amoco Corp. brought BP Amoco plc to third on the list, behind Royal Dutch/Shell and Exxon.

The BP and Amoco merger did not affect 1997 BP and Mobil downstream consolidations in Europe.

As a result of its merger with Petrofina, TotalFina SA, formerly Total SA, moved from 20th place to 11th. Repsol Petroleo SA, with its takeover of Argentina's YPF SA in June, moved up 8 places, below Chevron Corp. Repsol officially changed its name to Repsol-YPF SA in July (OGJ, July 12, 1999, p. 2).

TotalFina and Elf Aquitaine SA, after a battle to takeover one another, agreed to combine into one company in September 1999 (OGJ, Sept. 20, 1999, p. 30). Approval from the European Commission is not expected until February 2000 (OGJ, Nov. 1, 1999, p. 32).

Rumors are that once merged, the new company will purchase Compania Espa

Finally, Nippon Mitsubishi Oil, not previously on the list, made it this year because Nippon Petroleum Refining Co.'s assets were combined with those of Mitsubishi Oil Co. Ltd.

Nippon Mitsubishi is discussing plans to form a joint venture with Cosmo Oil Co. Ltd. (OGJ, Oct. 18, 1999, p. 3). If this happens in 2000, the company will own more than 1.6 million b/cd of refining capacity.

Table 2 lists the world's largest refining plants with more than 400,000 b/cd. Although some company names have changed and there has been a slight rearrangement in rank, the top 15 refineries remain the same as ranked a year ago by OGJ.

BP Amoco's intent to merge with ARCO is pending FTC approval. If approved, BP Amoco would gain about 500,000 b/cd of refining capacity, all on the west coast.

Regional distillation changes

From a regional perspective, Asia-Pacific experienced the most capacity growth. Despite reports of weak margins and lower demand, the area increased its refining capacity by about 870,000 b/cd, or 4.6%.

Western Europe had a net decrease in refining capacity of about 140,000 b/cd. This mainly was a result of the closure of Shell U.K. Ltd.'s Shell Haven refinery and a large capacity scale down in the Raffineria di Milazzo SpA's Milazzo, Messina, Italy, refinery.

Refining capacity in the Middle East increased by 170,000 b/cd. Most of this can be accounted for by the new Dubai refinery.

In South America and the Caribbean, capacity increased by almost 180,000 b/cd. Petroleos de Venezuela (Pdvsa) refineries in Venezuela and Refineria Isla Curazao SA's refinery in The Netherlands Antilles are responsible for about two-thirds of the increase. Small debottlenecks in existing refineries account for the remaining increases.

By itself, the US accounted for a minor increase in worldwide capacity, only 120,000 b/cd. The largest reported capacity increases in the US occurred in Williams Alaska Petroleum Inc.'s Alaska refinery and Exxon Co. USA's Texas refinery. Williams increased its North Pole refinery by 80,000 b/cd, and Exxon increased its Baytown refinery by 40,000 b/cd.

Capacities in Eastern Europe, Africa, and Canada remained steady.

Table 3 summarizes crude-distillation and other processing capacities from this year's survey by region. No significant changes were reported this year.

Table 4 summarizes crude-distillation capacities of the top refiners located in the US and Western Europe. The top three refiners in the world (Table 1) consistently show up near the top of these lists also.

In the US, Royal Dutch/

Shell's refining assets are allocated mainly between Equilon Enterprises LLC and Motiva Enterprises LLC.

Processing changes

A comparison of processing capacities in this year's survey and the past year's survey in the US, the European Union (EU), and Asia-Pacific reveals interesting facts. For comparison purposes with previous years, countries included in the EU are Belgium, Denmark, France, Germany, Greece, Ireland, Italy, The Netherlands, Portugal, Spain, and the UK.

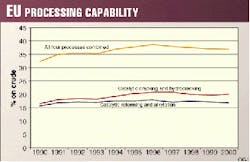

Comparing 1998's survey and this year's survey, there are significant percentage changes in oxygenates capacity in the EU and in Asia-Pacific. The EU experienced a 23% decrease in oxygenates capacity, mostly accounted for by Bayernoil, which reported a 7,675 b/cd decrease. In Spain, Petronor SA reduced oxygenates capacity at its Somorrostro Vizcaya refinery from 5,132 b/cd to 1,564 b/cd.

A look at future capacities reported in the biannual construction survey (OGJ, Oct. 11, 1999, p. 65) shows that Asia-Pacific will continue to be the highest growth area for refining.

Planned crude-distillation capacity projects will increase Asia-Pacific capacity by only 100,000 b/cd by yearend 2000, but OGJ surveys predict an increase of 773,000 b/cd of capacity between yearend 2000 and yearend 2001.

Expected US and EU crude-distillation increases by yearend 2000 and yearend 2001 are small.

With low-sulfur motor-fuel specifications looming in the US and Europe, several companies have announced planned increases in hydrodesulfurization capacities to make low-sulfur fuels in the near future. Some of these projects are as follows:

- Conoco Ltd. plans to commission a gasoline desulfurization unit in January 2000 and a diesel desulfurization unit in summer 2001 at its Humber refinery, South Killingholme, UK (OGJ, Oct. 4, 1999, p. 47).

- Phillips Petroleum Co. plans to start up a 6,000 b/d semicommercial gasoline desulfurization unit at its Borger, Tex., refinery in early 2001 (OGJ, Nov. 1, 1999, p. 46).

- Irish Refining Co. will build a new gasoline hydrotreater and isomerization unit at its Whitegate, Ireland, refinery. The company expects to complete the project in early 2000 (OGJ, Aug. 30, 1999, p. 48).

Processing capability

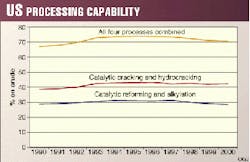

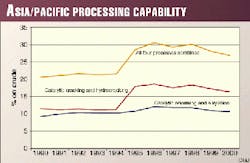

Figs. 2-4 show the processing capabilities of the US, EU, and Asia-Pacific.

Processing capabilities are defined as conversion capacities (catalytic cracking and hydrocracking) and fuels-producing processes (catalytic reforming and alkylation) divided by crude-distillation capacity ("% on crude").

Consistent with having very complex refineries, the US has higher conversion capacities than the other two regions. In every category this year, conversion capacity dipped downwards slightly. Fig. 4 (at right)

Both reforming and alkylation capacity decreased in the US. Combined with increased distillation capacity, the fuels-producing capabilities decreased.

The dip in Asia/Pacific processing capabilities is largely a result of the increase in distillation capacity.

Although Fig. 3 (at right) suggests a sudden increase in Asia/Pacific refining capacity in 1995, this is a reflection of updated capacity information, not a large increase in capacity.