Options to produce deepwater oil, gas to proliferate

In the next millennium, the petroleum industry will be have the opportunity to select from among a number of concepts for developing deepwater fields. Decisions on which technology to implement will be based on its cost-effectiveness as well as the field's location, size, and water depths.

Various subsea and floating production concepts offer a number of choices for implementing an economically viable project (Fig. 1).

Likewise, downhole development economics can be improved by increasing the production per well with such technology applications as multilateral wells, smart completions, and other technologies that are also being designed for nondeepwater environments.

Deepwater development

Deepwater fields lie in both harsh environments, such as off Norway, and more benign locations, such as off West Africa.

Currently, most deepwater developments are in less than 3,000 ft of water. But the next millennium should see industry moving into significantly deeper water. Some estimates indicate 90% of the world's undiscovered offshore hydrocarbon reserves lie in water deeper than 3,000 ft. Petróleo Brasileiro S.A. (Petrobras) has estimated that 23% of Brazil's reserves are in 3,000-6,000 ft of water and 50% of its undiscovered reserves will be found in the same water depths.

Deepwater fields are potentially very prolific. For example, one well on Shell Offshore Inc. Gulf of Mexico Ursa tension leg platform (TLP), installed in 3,800 ft of water, produces at a rate of more than 50,000 boe/d.

Petrobras holds the current record for producing from the deepest water. In a long-term test, its subsea completed well in the Roncador field, in the Campos basin off Brazil, produces from a 6,086-ft water depth to the dynamically positioned Seillean floating production, storage, offloading (FPSO) vessel.

As water-depth increases, so do the costs and risks associated with production systems. Increased water depth intensifies the potential for sea conditions to damage floating structures, risers, moorings, and subsea installations.

The two options for developing fields beyond a 3,000-ft water depth, are either to install a floating structure or have subsea installations tied back to shallow water or land-based facilities. Floating structures either can handle wells completed with dry trees or be connected to subsea installations. Floating production structures also have the advantage of being able to relocate to new fields, once the fields in which they have been deployed are depleted.

In water shallower than 3,000 ft, but still in deepwater, industry has the option of installing compliant towers, such as Amerada Hess's Gulf of Mexico Baldpate, in 1,650 ft of water.

A 1,353-ft depth is the deepest water in which a conventional fixed platform has been installed, Shell Offshore Inc.'s Gulf of Mexico Bullwinkle platform.

Floater options

The basic floating structures include TLPs, converted or new-build tankers as FPSOs or barges, semisubmersible production units, and spar towers.

TLPs and spars are the most popular designs for dry-tree deepwater floating production systems, although other variations are possibilities. Dry surface trees can significantly lower operating costs of deepwater production compared with subsea wet trees because the surface trees allow wells to be readily accessible and easily maintained. Tankers, barges, and semisubmersibles typically involve only subsea completed wells.

Both the TLP and spar options are well-proven, but are sensitive to water depth, topsides payload, environment, number of risers, fabrication, and installation methods.

Most current TLP designs tend to reach their economic limits in water depths less than 5,000 ft, although some studies with composite materials indicate that it may be possible to install TLPs in over 10,000 ft of water.

For smaller deepwater fields, the next millennium is likely to see more mini-TLPs. such as the one installed by British-Borneo Petroleum Syndicate PLC on its Morphlet field in the Gulf of Mexico. Also, Unocal Makassar Ltd. recently announced plans to install mini-wellhead TLPs in its deepwater West Seno oil field development in the Kutei basin, off East Kalimantan, Indonesia.

Included in Unocal's plans is a single floating production unit (FPU) for processing the production stream. Union expects plateau rates of 60,000 bo/d and 150 MMcfd of gas from this first deepwater development in Indonesian waters.

The spar tower, which is the other dry-tree option, is thought to be economical in water depths of 10,000 ft or more without significant modifications. It can be configured in various ways from production-only to any combination of production, workover, drilling, and storage-of which the last was one of its first applications.

Current concepts in spar designs may be more cost-effective than the three spar production facilities installed to date. These concepts include: drilling spars for water depths over 8,000 ft; split-tree production riser systems for spars that extend their feasible water depths; and the truss spar, which is lighter and therefore more cost-effective.

Mooring floating production systems can become expensive and complicated as water depth increases. To reduce costs and loads on floating vessels, the industry is testing such material such as polyester ropes, which have already been installed off Brazil.

Another concept being developed is a hybrid mooring and riser system that combines steel catenary risers (SCRs) connected to a subsea buoy with a potential restoring-force capability. The subsea buoy, positioned just below the wave zone, provides an interface that connects all mooring and riser components. This system would replace spread mooring in deepwater, in benign environments such as offshore West Africa.

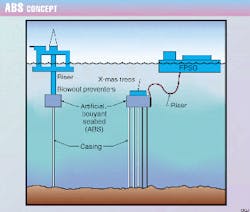

Atlantis Deepwater Technology AS has proposed another concept (Fig. 2) that lifts the wellhead away for the mudline and creates an artificial, buoyant seabed (ABS), about 600-1,000 ft below the sea level. Atlantis expects that drilling and production with this system will be similar to that in shallower water.

Subsea completions

Although dry tree operations are possible from TLPs and spar-type structures, the other floating facilities require subsea completed wells.

The next millennium is likely to see a continuation of industry's aim to standardize subsea installations, but because technology is still being developed and improved, the standard elements are bound to change over time, and therefore substantial engineering design will still be required for any given project.

Most subsea completions are still being done in shallower water, but deepwater is an area where subsea completions may be the only practical alternative.

The next millennium should see the expanded use of such enhanced subsea features as subsea separators, multiphase pumps, multiphase meters, and pressure boosters. Artificial lift in wells is also starting to be included in subsea completions.

Some other subsea equipment under development or in the concept stage that might see widespread use in the next millennium includes:

- Traditional gravity-type separators placed subsea.

- Water-injection pump modules.

- Pump modules for liquid hydrocarbon pressure boosting.

- Multiphase pump modules.

- Hydroclones.

- Gas compressor modules.

- Water separation with water reinjection.

- Cyclone-based sand cleaning with solids discharged to sea.

- Hydrocarbon-water separation with water polishing and discharge to sea.

- Gas separation and compression.

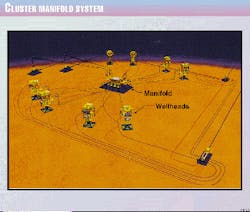

Subsea cluster development is a trend that will probably continue in the next millennium. Clusters offer flexibility for phased field development and typically incorporate a subsea manifold with single well or multiwell clusters tied into it. Fig. 3 shows Shell's cluster concept.

The Author

Shell's Pattarozzi: Ultradeepwater to pose offshore industry's key challenge in 21st century

THE ULTRADEEPWATER FRONtier will pose the offshore petroleum industry's key technological challenge in the coming century, according an executive instrumental in breaking down the industry's deepwater technology barriers.

Rich Pattarozzi, president of Shell Offshore Inc., New Orleans, offered his views on technology for producing Gulf of Mexico deepwater discoveries in the first decade of the next millennium. Pattarozzi, instrumental in all of Shell's Gulf of Mexico deepwater ventures, has announced his retirement from Shell at yearend 1999.

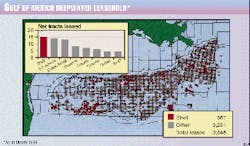

He expects the main change, during the next decade, will be industry's drive to develop the ultradeep water that starts around 5,000-6,000 ft. The industry has leased much acreage in 5,000-10,000-ft waters (see figure) and therefore activity is bound to be intense in these water depths.

BP-Amoco PLC has already announced sizable discoveries in 6,000 ft of water and these, he believes, might possibly be developed in the next 5 years, although he is not certain about how fast the industry is capable of developing and proving out cost-effective technology for producing from these water depths. He says, "for these ultradeep waters, most companies have evaluated drilling feasibility but have not done much work on developing production systems that deal with such challenges as the higher pressures encountered and the additional mechanical complications.

Production technology options

He sees such structures as tension-leg platforms (TLPs) having a maximum 4,000-5,000-ft water depth limit, partly because of tendon pressure limitations. Beyond that depth, the two main options are the spar-type structures with their dry surface trees or floating production facilities tied to subsea completed wells.

Pattarozzi believes floating production, storage, offloading vessels (FPSOs) are a possibility for the Gulf of Mexico, but that depends on the environmental evaluation being done by the US Minerals Management Service. But he also contends that pipelines extending to floating production systems are more likely in the gulf because, the technical problems of laying pipe in deepwater are not insurmountable, although costs are high.

Such technologies as gas-to-liquids floaters have potential in the gulf and elsewhere, once the technology is perfected, he noted.

Other technologies, he indicated might influence the cost of deepwater systems are alternative materials such as composites and other substitutes for steel that are being tested by a number of companies to verify the materials' cost advantages and to determine if they have the required strength.

Pattarozzi described Shell's subsea completion strategy as including an alliance with FMC Energy Systems to design modular subsea systems that are standardized but can be reconfigured for different applications. Such systems will produce the Angus, Macaroni, and Europa subsea developments. He noted recovery factors in subsea developments are not necessarily less than in wells completed to surface facilities.

In these applications, Shell uses conventional subsea trees, although he noted horizontal trees have possibilities, and the choice among trees tends to be on an individual company basis.

He believes systems such as subsea separators, pumps, and the like have potential in the Gulf of Mexico as industry moves into deeper water and further from existing infrastructure. But, he noted, existing infrastructure is relatively close to the current deepwater activity and these subsea systems do not have a particular use there at this time.

Patarrozzi also expects most downhole well completions will remain mainly conventional and that, to date, measures designed to eliminate hydrates and paraffin have been effective. He described the typical deepwater completion as needing sand control, being frac-packed, and often having horizontal laterals. Artificial lift and secondary recovery are possibilities for these wells, although he noted that, for Shell's Auger TLP development, plans were made for water injection, but the reservoir's natural water drive turned out to be very strong.

As far as servicing deepwater subsea wells, he says some work on Shell's Mensa subsea installations has been done off workboats, but other options include various types of intervention vessels with remote-operated vehicles (ROVs), specialized vessels, or drilling rigs. He expects special workover rigs possibly will be built as more wells are completed in deep water.

He noted industry still has a wait-and-see attitude regarding increased spending, although prices have jumped to over $20/bbl from the extremely low levels of just a few months ago.