Exploration frontiers for new century determined by technology, politics

Daniel Yergin, in his great book The Prize, described the 20th century as "the century of oil," arguing that petroleum has been a fundamental driver in the industrial, commercial, and political evolution of our society, especially during the 50 years or so following World War II.

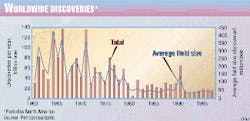

Throughout this period, our industry has supplied the "hydrocarbon society" with the low-cost oil and gas that it has demanded and has continued to find new sources of supply to replace, and in fact outstrip, continually rising annual production (Fig. 1). This relentless search for new supplies has continued throughout the highs and lows of oil prices, but before we look ahead to the next century, let's look at some of the trends apparent from the last few decades of this century.

Annual discoveries have declined steadily since the middle of the century, from, on average, 70 billion boe/year in the 1960s, when the industry had access to exploration in the Middle East, to 20 billion boe/year so far in the 1990s. This decline in total discoveries is also mirrored by a decline in the average field size of those discoveries, from over 200 million boe per discovery in the 1960s to less than 50 million boe in the 1990s (Fig. 2). In the last 50 years, 1998 was the only year the industry did not find a billion-barrel discovery.

So, are we becoming less successful as explorers?

It is clear that, in terms of volumes discovered, we are less successful-reserves per exploration well is down from about 30 million boe/well in the 1960s and 1970s to about 10 million boe/well today. However, in terms of success rate, the industry has progressively improved it's "strike rate" from about 1 in 10 in the 1960s to 1 in 5 today (Fig. 3). This improved efficiency is certainly driven in part by improved seismic, especially in the offshore, but it is also driven by the more rigorous application of know-how and business processes-we don't drill as many "dumb holes" as we used to.

Despite the decreasing trend in new discoveries, reserves-to-production ratios have remained relatively constant over the last few years, and worldwide reserve levels continue to rise. This reflects another underlying trend: We are becoming more successful at "exploring" for more reserves within existing discoveries through improved recovery techniques and better field management.

So, at the end of the 20th century, we can paint a picture of an industry becoming ever more efficient in exploiting existing reserves and discovering new pools but chasing a dwindling prize that is becoming more difficult to find in the volumes we have been used to in the past. Moving into the 21st century, what will be the challenges that face the industry's explorers?

Exploration challenges

Rather than attempt to predict the hot new plays of the next century, we can look at our business through a number of different lenses.

New frontiers for explorers in the next century can be thought of in terms of new politics, new technology, new markets, and new products:

- New politics.

Politics has always been a key driver in shaping the industry. It was politics in the 1950s and 1960s that created the Organization of Petroleum Exporting Countries and drove the international industry out of the Middle East, Venezuela, and Mexico, forcing us to pursue riskier plays in more-hostile environments such as the North Sea and Alaska. It was also politics that, at the end of the 1980s, opened new doors to the international industry by providing access to the former Soviet Union, where low-risk basins such as the Caspian could begin to be explored.

Looking forward to the next century, politics will continue to shape our future. We see two trends.

First, Russia will eventually become a more stable and attractive place for the international industry to invest. The FSU contains 6% of the world's existing oil reserves and 40% of its gas. Most of the basins have been tested thoroughly, but there is also no doubt that new technology and new ideas, underpinned by investment in export infrastructure, will unlock further reserves, both within existing discoveries and in new plays.

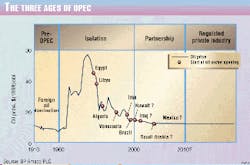

The second trend is in the changing nature of OPEC. OPEC, which was founded in 1960, has gone through a history that can be thought of in two parts: first, a period of isolation following the expropriation of assets and the expulsion of most of the majors from the majority of OPEC countries; and second, a period of partnership, starting with Venezuela, Algeria, and others inviting the international industry back to participate alongside the national oil companies in the early 1980s (Fig. 4).

This period of re-engagement is continuing, with Iran, Kuwait, and, most recently, Saudi Arabia indicating their willingness to offer some opportunities for foreign oil company involvement.

Looking forward into the next century, we see this phase transitioning to a third phase, with the international industry managing increasingly more of OPEC's production under various types of service contracts based on incentives.

- New technology.

Technology has also been, and will continue to be, a key driver. The key breakthrough of the last 2 decades of this century has been our ability to explore and produce in deep water beyond the shelf break.

The industry ventured into deep water (>500 m) in the mid-1970s, but it wasn't until the mid-1980s that significant success was achieved in the deep waters of the Campos basin off Brazil and the Gulf of Mexico. Since then, success rates and volumes discovered have improved significantly, with 20% of the world's oil discoveries and 6% of the world's gas finds made in deep water during the last decade.

Moving into the next century, our ability to operate in water depths greater than 3,000 m will continue to improve, opening new opportunities. The passive margins of the Atlantic and the Tertiary delta systems around the world are likely to continue to be the most productive areas.

This advance into deep water has been made possible in part through improvements in seismic imaging, which have been truly spectacular, such that 3D seismic can be used under favorable conditions. Improvements in seismic acquisition and processing will continue to drive down exploration risk and finding costs.

Advances in seismic and well engineering come together in the deep water, where the availability of modern, high-quality seismic data is beginning to give us hope of predicting drilling problems ahead of the bit. A step-change in drilling costs is perhaps the most coveted prize for the industry as we move into the next century.

We see the key impact of technology being a continued reduction of costs that allows smaller accumulations to be tested and commercialized, rather than any "silver bullet' that will enable us to dramatically improve the success rate of the exploration process. This will allow us to pursue smaller pools as exploration or infill drilling targets, primarily within established plays and basins.

- New markets.

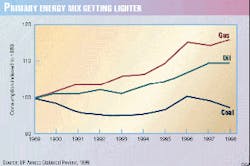

Markets have not been high on the industry's agenda during most of the 20th century, with oil being our primary product and the oil markets working effectively to match supply with demand efficiently. However, the world's energy demands are changing, with growth in gas demand now outstripping oil (6%/year vs. 2%/year) and consumers insisting on cleaner fuels with lower emissions (Fig. 5).

Matching gas supplies to markets more efficiently will be perhaps the key challenge for the industry in the early part of the next century. The focus here will be driving down transportation costs, first through continuing to lower pipeline and liquefaction costs but second, and perhaps more important, through transforming gas into more easily transportable energy. This transformation will be achieved either by gas-to-liquids technology (see related article by George Couvaras) or by converting gas to power and delivering "gas by wire." Stranded gas resources worldwide currently amount to over 1,000 tcf, and these will be a key focus for the industry.

It is also clear that, as customers, we are all becoming more demanding and sophisticated in the way we purchase energy. We demand competitive prices, but we also seek flexibility in energy supply, delivered in an environmentally friendly way, with high levels of customer support. This is going to force the hydrocarbon industry to move further along the road toward becoming an energy industry.

- New products.

Products will become more diversified as the trend towards lighter hydrocarbons accelerates. There will increasingly be a premium for lighter, low-sulfur crudes that will start to impact our exploration strategies. Already in the Middle East, producers are investing in exploration for lighter crudes at the expense of developing existing heavier, sour supplies.

We have addressed the world's preference for gas already, but outside North America, the industry is still largely driven by oil exploration. That is changing, and in the last couple of years, for the first time, oil and gas volumes discovered are approximately equal.

But this trend will go further. We expect to see gas exploration overtaking oil exploration. The implications are deeper, hotter wells and perhaps a focus on active margins and foldbelts, especially proximal to the world's most rapidly growing energy markets of the Far East and southern Asia.

This trend will also encourage a movement to unconventional gas exploration-involving tight reservoirs and coalbeds, for example-which is already well-established in the Lower 48 of the US but largely unknown elsewhere. Hydrates, too, may become a target for the future.

Our ability to exploit all of these more-exotic gas resources will depend on our ability to drive down costs such that the cost of supply associated with them becomes competitive with that of other, more-conventional energy sources.

Oil shales and ultraheavy oil deposits constitute at least twice as much again as the 1 trillion boe of the worlds known conventional hydrocarbon deposits. What role will they play in a world with a preference for lighter hydrocarbons?

The conventional methods of exploiting these resources no longer seems acceptable on environmental grounds, but technology offers some potential solutions. Conversion to synthetic crudes by refining with hydrogen seems to offer an environmentally acceptable solution in areas such as Alaska, where there are abundant supplies of gas adjacent to heavy oil resources. However, it is difficult to imagine a future in which we will actively explore for new heavy oil resources.

Summary

Exploration in the next century will be driven by the world's continuing need for low-cost hydrocarbons, but as we have suggested, our increasing preference for environmentally friendly sources of energy will present some new challenges to our business.

Where this takes us, geographically, remains to be seen, but the trends would seem to indicate a continuing focus on the world's proven provinces, with the emphasis on improved efficiency of exploitation of existing trends, a further focus on deep water, and a new relationship with the "old oil" of the Middle East and the FSU.

Perhaps the most predictable trend, however, is towards ever lower cost of supply. The international industry must compete with OPEC on a cost basis if it is to continue to prosper, and that means driving down the cost of supply to less than $5/boe, even in high-cost areas like deepwater West Africa and the West of Shetlands. This will be the greatest challenge of the next century.

The Author

Anthony B. Hayward is group vice-president and a member of the executive committee of BP Amoco Exploration in London. He joined the former British Petroleum Co. PLC in 1982 and held a series of technical and commercial positions in BP Exploration in London, Aberdeen, France, China, and Glasgow. In 1990, he became executive assistant to John Browne, who was then BP Exploration chief executive. In 1992, he became exploration manager in Colombia, and in 1995, he became president of BP Exploration Venezuela and associate president for the BP Group in Venezuela. He returned to London in 1997 as a director of BP Exploration and assumed his current role in January 1999. A geologist by training, he has a PhD from the University of Edinburgh.